Introduction

Terms of trade are an important measure of economic performance. It refers to the ratio of export prices to import prices. If reflects the capacity for a given volume of Australias exports to pay for a given volume of its imports.

Improved terms of trade is significant to Australia since it enables the country to indulge in the purchase of more imports given its level of exports to the rest of the world.

However, volatility in a countrys terms of trade results in volatility in investment, consumer spending, inflation, and economic growth. Consequently it makes macro-economic management extremely difficult (Gruen 2011, p. 5).

Reasons for the Main Movements in Australia’s Terms of Trade over the Last Decade

Impacts of Major World Economic Events

Global economic conditions have been one of the key drivers of Australias term of trade in the past decade. In particular, previous cycles in economic growth among Australia’s main trading partners and the Great 7 (G7) countries have often resulted in swings in Australia’s terms of trade.

These swings were mainly evident in the post 2007 global financial crisis. According to Australia Treasury (2012, p. 9), Australias terms of trade has suffered from the ongoing recession in the Euro area, slow recovery in the United States and reduced demand in the emerging Asian economies.

These volatilities in international economic growth rates have consequently resulted in volatility in Australias terms of trade.

Diversification of Australia’s Export Base

Compared to the 1970s and 80s, Australia’s volatility in terms of trade has significantly declined from the 90s to present. This decline is attributed to export diversification efforts. Australia diversified its exports especially in terms of its industrial sector (Valadkhani, Layton & Karunaratne, 2005, p. 295). Traditionally, primary products were the dominant exports (mining and agricultural products).

However, in the recent past the country has diversified to manufacturing and of late the services sector. The performance of the country beginning from the year 200 onwards in terms of knowledge intensive exports was good. Currently, China is the leading importer of Australias services (Austrade 2012, p. 1).

Decline in Price of Australia’s Exports

Australia is a resource rich nation exporting metal ore and minerals. In the 1980s and 1990s, rapid industrialization and urbanization in China resulted in strong growth in the demand for Australias major commodity exports.

The strong demand from Asia, and expectations that the demand will continue to grow drove commodity prices to high levels and attracted record investments in Australias resources industry (Gregory 2011, p. 44).

However, in the past decade, Australia witnessed adecline in prices for these resources in the international market in the past decade has in turn adversely affected the countrys terms of trade. For example, in 2009, slow growth in the Chinese economy resulted in a high trade deficit for Australia given that China is one of the countrys major trading partners.

According to the (Australian 2012, p. 1), in October 2012, earnings from minerals and metal ore declined by 7% as a result of the falling prices in the international market. In fact major mining companies in Australia such as Rio Tinto and BHP Billiton deferred investing billions into the mining sector and instead chose close their mines because of the declining prices and Australias poor currency strength.

Impact of a Decline in the Terms of Trade on the Australian Economy

Mundell-Flemming Model

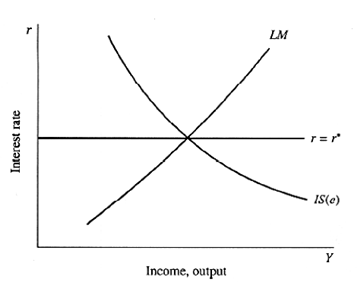

Under the model, international and domestic interest rates are assumed to the same. Australia being an open economy, we analyze the effect of a decline in the terms of trade in the short run using the Mundell-Flemming Model.

Australias GDP (Y) is a function of consumption (C= C(Y-T); Investment (I(r)); Government Expenditure (G), and Net Exports (NX(e)). The model has three equations:

IS equation = Y = C (Y-T)+G+I(r)+ NX(e) where Y is income, C- consumption, G, government expenditure, T- taxes, and NX(e)- representing net exports.

LM equation = M/P = L (r,Y), where M/P is the money supply, L is liquidity as a function of income and interest rate.

Interest Rate equation = r=r*where r is the fixed interest rate

When the economy is at equilibrium, it is depicted by the diagram below:

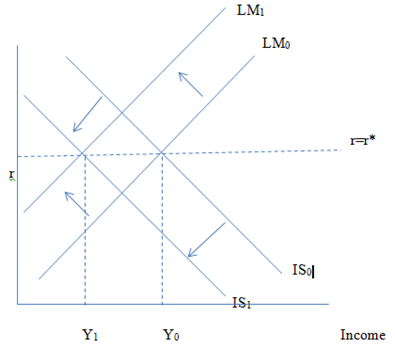

A decline in Australias terms of trade affects the economy through the IS curve. When import prices are more than export prices, the IS curve shifts inwards to the left from IS0 to IS1.

Given that interest rates are fixed at r, the money supply in the economy reduces from LM0 to LM1. Output or income in the economy drops from Y0 to Y1, and the economy attains a new equilibrium but at a reduced level of output.

These changes affect several macroeconomic variables: Australias Gross Domestic Product declines because the inward shift of the goods market (IS curve) implies reduced demand. Consumption, investment, government expenditure and net exports all decline.

In addition, Australia is likely to suffer from unfavorable balance of payments. This is because more of the countrys exports will be required to purchase a given volume of imports.

Similarly, as the country’s GDP declines, investments in the economy are discouraged resulting into slow economic growth and high unemployment rate.

Furthermore, a decline in the terms of trade is equally likely to lead into inflation in the Australian economy. From the figure above, the inward shift in the IS curve forces the government to pursue a contractionary monetary policy.

Consequently, the amount of money in circulation is reduced. This adversely affects the economy as banks resort to tighten their lending policies. This further discourages investment by firms and households worsening the unemployment problem and slowing economic growth.

The changes equally affect Australias real exchange rate. The fact that Australia’s exports can purchase few of its imports implies that its exports are cheaper. This equally indicates that the Australian dollar is weak compared to foreign currencies.

Foreign countries will require less of their currency to purchase Australian dollars. However, this impacts negatively on the domestic importers. Importers must have more Australian dollars in order to purchase a given volume of foreign currency before importing products and services from those countries.

Similarly, Australia will suffer from foreign exchange deficits. Given the unfavorable terms of trade, Australia will be using more foreign exchange to purchase a given volume of imports.

However, with low prices for domestic products and services in the international market, the foreign exchange received from exports will be the less than the foreign exchange used to imports goods and services.

Implications for Monetary and Fiscal Policy of the Decline in the Terms of Trade

As already noted, a decline in a countrys terms of trade is equivalent to an increase in the price of imports relative to exports. If Australias export prices decline relative to its imports, the country will not only have a low standard of living, but will also have less ability to purchase imports.

A prolonged deterioration in terms of trade can result in low GDP and poor living standards. Because of this, the objective of monetary and fiscal policy is to stimulate aggregate demand and increase exports

Expansionary Fiscal Policy

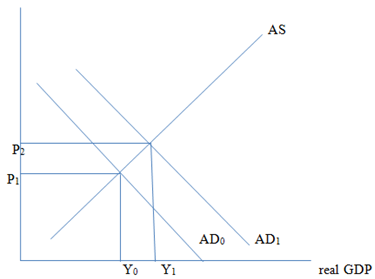

To stimulate demand, the government will pursue an expansionary fiscal policy by increasing government expenditure and reducing taxes. From the aggregate demand function, an increase in government expenditure G will increase aggregate demand and increase economic growth.

AD= C+G+I + (X-M)

With a decline interms of trade, then economys real GDP falls to a low level Y0. At this level investments, consumption and output are low. The economy suffers from high unemployment. The government can correct this using fiscal policy by increasing its expenditure and reducing taxes.

This shifts the aggregate demand curve outwards to the right from AD0 to AD1, income is increased from the original Y0 to Y1. The government can inject more money into the economy by investing in infrastructure and productive activities to boost output and growth.

Through a reduction in taxes, some of the goods that were initially imported can be produced in the domestic economy thereby improving the countrys GDP by increasing income, output and employment.

Expansionary Monetary Policy

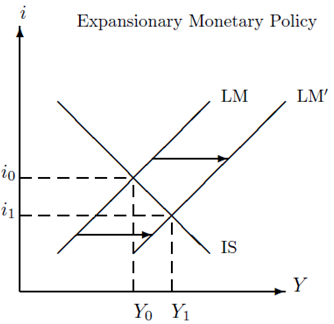

With the low output arising from the decline in terms of trade, the government through the central can pursue an expansionary monetary policy. The IS-LM diagram above indicates the economic changes arising from the increase in money supply.

Initially, the economy is at equilibrium with output Y0 and interest rate i0. However, owing to the deteriorating terms of trade, output Y0 is too low and is characterized by high unemployment, inadequate foreign exchange reserves, high import prices and low export prices (Reserve Bank of Australia 2013, p. 1).

When the central bank increases money supply, the LM curve shifts outwards to the right from LM to LM, equilibrium output increases from the initial Y0 to Y1. The central bank can increase money supply by using three tools open market operation, discount rate and reserve requirements (The Australian, 2012).

All the three tools whether used together or separately will have the effect of increasing the amount of money circulating within Australias economy and bring down interest rates.

The low interest rates coupled with extra supply of money will stimulate Australias economy by encouraging additional expenditures on total production, in particular investment and consumption expenditures. With the increased aggregate production, the country uses more resources, creates more jobs and unemployment declines (Lowe 2012, p. 8).

This is the stimulation the Australian economy needs in a situation of deteriorating terms of trade with high rates of unemployment. Given that the effects of monetary policy on the economy are not usually immediate, it is recommended that the policy should be implemented immediately there are signs of declining terms of trade.

In conclusion the volatility in Australias terms of trade over the past decade has been a direct result of various factors both internal and external. These include global events; drop in commodity prices in the international market and the move by Australia to diversify its exports.

List of References

Austrade 2012, Latest from Austrade: China now Australia’s top destination for services exports – Austrade. Web.

Gregory, RG 2011, Then and Now: Reflections on Two Australian Mining Booms, Centre for Strategic Economic Studies, Victoria University, Melbourne.

Gruen, D 2011, The Macroeconomic and Structural Implications of a Once-in-a-Lifetime Boom in the Terms of Trade, Address to the Australian Business Economists, Sydney.

Lowe, P 2012, The Changing Structure of the Australian Economy and Monetary Policy, Address to the Australian Industry Group 12th Annual Economic Forum, Sydney.

Reserve Bank of Australia, 2013, Monetary Policy. Web.

The Australian, 2012, Trade deficit widens as softer commodity prices hit exports. Web.

Valadkhani, A, Layton, P & Karunaratne, D 2005, ‘Sources of volatility in Australia’s export prices: evidence from ARCH and GARCH modeling’, Global Business and Economics Review, vol. 7, no. 4, pp. 295-310.