Introduction

The resources boom in Australia has come to an end and has affected the investment in the resources sector. Since April 2012, A$ 150 billion of the intended ventures are either held up or called off as per the government data.

The withdrawing commodity markets and feeble investment interest have forced mining companies to shift to lower margins (End of Australia’s resources boom hits investment in sector, 2013).

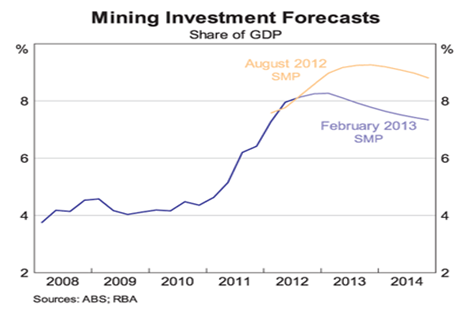

The recent ABS survey of firms’ capital expenditure plans declares that the investment in mining sector in 2012-13 was modified from 40% to 20%.

Figure 1:

Source: Kent, 2013, Para 14

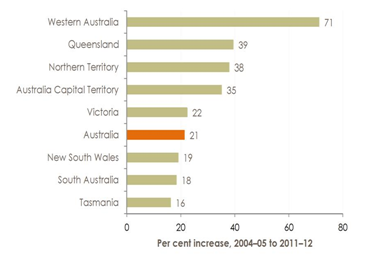

Mining industry has the most influential economic and environmental impacts in Australia’s economy. The Australian Bureau of Statistics (ABS) declared that in the year 2005-06 to 2009-10 witnessed the increase of 21% in the GVA of mining industry in Australia. The value of mining industry exports doubled in the year 2006-07 and 2010-11(Pimpa, 2013).

“The contribution of an industry to the overall production of goods and services in an economy, gross domestic product (GDP) is measured by gross value added (GVA)” (Australian Bureau of Statistics, 2013, para. 9).

Economic growth in Australia since 2000

Australia has been standing out among OECD countries due to its sound economic policies. However, the slow growth of Australia’s economy is because of the financial crisis of 2008-2009. Australia is making efforts for the adjustment in the structural changes that is due to the commodity bang (OECD Economic Surveys Australia, 2012).

The recent mining boom initiated in the year 2000 that led to the escalating cost of commodities linked with mining. The following figure illustrates the rise in the non-rural commodity prices:

The mining boom has affected the Australian economy in some way or the other.

The export companies as well as the struggling import businesses have made the Australian dollar to trim down the price competitiveness in the international market.

“The Reserve Bank of Australia declared that the mining- related commodity prices peaked in August 2011, and are now down by around 23 percent from this peak.

There have been sharp falls in Australia’s key mining export commodities, coal and iron ore, but despite this, mining prices still remain at high levels” (Pham et. al, 2013,p.2). However, the Australian dollar is maintaining its value with respect to mining commodity prices (Pham et. al, 2013).

ABS Cat. No. 5249.0, Australian National Accounts, Tourism Satellite Accounts 2010–11 as cited in Pham et.al, 2013, p. 3.

There can be seen significant variation in the economic performance in the different Australian states and regions due to the mining boom (Pham et. al, 2013).

Sustaining economic growth in future

The constant uninterrupted economic growth of Australia for past two decades will sustain in two conditions in near future: 1) the potency and span of the resources boom; and 2) productivity growth.

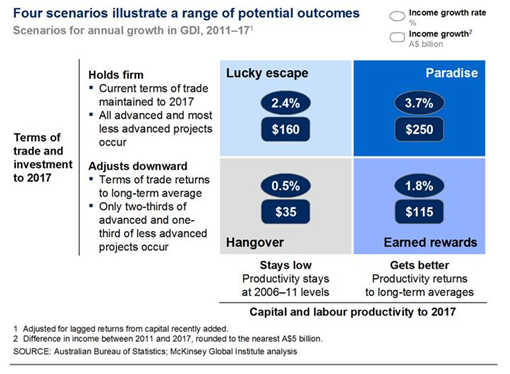

Australia’s income growth in near future will depend upon maintaining a scenario that involves returning productivity growth to its historical standards, maintaining the terms of trade bringing all the advanced ventures and three-quarters of the partially developed projects to the stream. However, that too would ensure only 3.7 percent income growth as compared to the standard growth of 4.1 in the past.

But the worst-case scenario is draws attention that suggests that the terms of trade is leaning toward their long term average there is likely to be only two-thirds of advanced capital projects and one-third of the less advanced projects coming to realization and suggests no development in the current productivity growth. This sobering scenario may be threatening to the Australian income growth of 0.5 percent till 2017.

Figure 5:

Source: Taylor et.al, 2013, p.4

Mining and non-mining Sectors

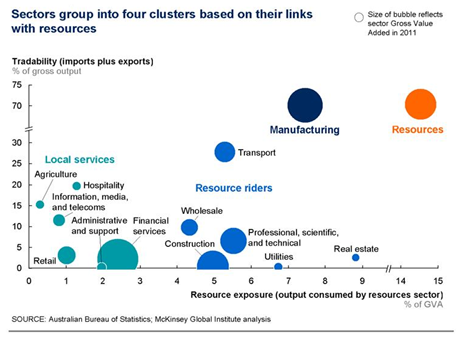

Conventionally, the economy of Australia can be divided into two-speed economy. One is a flourishing resources segment and the other comprises of all other gradually developing segments. However, it is wise to see Australia’s economy divided into four parts. The following figure illustrates the four sectors with respect to their link with the resources.

Figure 6:

Resources sectors: Enforce capital productivity for successful investment

According to Shann (2012), the speedy growth yet decreasing capital productivity in the resource sector has been evident in Australia’s economy.

The lowest ridge in the scenarios for future income escalation is suggestive that future investment in the resource sector will surpass the previvious levels of income growth. There is an urgent need to get the capital productivity right that may lead to the prospective income growth (as cited in Taylor et. al, 2013).

To capture the gains, it is necessary that the individual companies and the policy makers work together. Government is required to provide support through providing environmental approvals, development of the infrastructure, and enhancing industrial relations so that there can be balance maintained between growth and other social good.

Resource rider sectors: Need to improve efficiency

The other sectors like transport and professional services have also been affected by the mining energy boom; however, these have witnessed decrease in productivity.

“These sectors attracted the vast majority of the overall economy’s increase in labor from 2005 to 201, but the contribution of labour productivity to sector output fell to zero during this period” (Taylor et.al 2012,p.6). It is important that new ways and more integrated cross-sector approach in resource productivity should be incorporated to make the infrastructure development more cost efficient.

Local services: committing again to microeconomic reform

Local services like retail trade and telecommunications do not exhibit any major impact of the resources boom. These sectors have shown solid productivity growth of A$49 billion to the overall income growth in 2005-2011.

It is important that efforts from the individual companies in the form of innovative operating representation and government’s endeavor to rationalize regulation, promote improvement and encourage competitive markets can boost productivity. For this purpose, Australia needs to adopt the microeconomic reform as it did in 1990s.

Manufacturing: Creating the base for long-term competitiveness

Australia has seen continuing erosion in manufacturing productivity and employment. There has been a significant decrease in the capital productivity in the past six years except for the limited counterbalance created by the labor productivity.

Improvement in the manufacturing sector can be derived through further cost efficiencies in the subsectors that contend mainly on price, enhancing labour mobility in the manufacturing sector along with a strong and facilitating ecosystem for bringing novelty in manufacturing. These measures can bring extra national income of about A$ 90 billion a year and sustain the historic scenario by 2017(Taylor et.al, 2013).

Outlook

It is difficult to state with surety when the climax will come about and the speed at which the mining investment will descend as a share of GDP. The decisive factors will be the actions taken on the uncommitted ventures and the speed of development in the existing projects along with the degree and features of the added overruns.

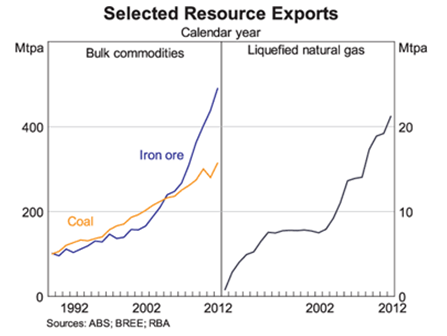

However, there is a possibility of increased mining investment for quite some time as a huge bulk of work is still in progress. With the mining investment becoming weaker, it will enter upon the set phase of mining boom. The exports will rise as a reaction to the investment that has been taken on.

The manifested growth in the resources like iron ore, coal and LNG exports for some time is suggestive of the further growth in these resources from 2015.

Figure 7:

Conclusion

The trend in the mining investment reflects that the economic growth will be a little less around and will pick up later in 2014.As the growth rate of sectors other than the resources sector is gradual, it is better to observe the signs for some more time (Kent, 2013).

References

Australian Bureau of Statistics 2013, Mining Industry, Australia, cat. no. 301.0, ABS, Canberra, from AusStats database.

End of Australia’s resources boom hits investment in sector, 2013. Web.

Kent, C., 2013, Reflections on China and Mining Investment in Australia, Reserve Bank of Australia. Web.

OECD Economic Surveys AUSTRALIA 2012. Web.

Pham, T. D., Bailey, G. & Marshall, J., 2013, The economic impact of the current mining boom on the Australian tourism industry. Web.

Pimpa, N., 2013, Australian mining industry: development or detriment? Web.

Taylor, C., Bradley, C., Dobbs, R., Thompson, F. & Clifton, D., 2013, Beyond the boom: Australia’s productivity imperative. Web.