Introduction

Treasury management is the management of an enterprise trading in government and corporate bonds, currencies, financial futures, and the associated financial risk management.

International treasury management deals with enterprise holding at a global level trading in bonds, futures, options, derivatives, currencies and payment systems (InvestorDictionary, 2011). This essay focuses on what treasury management is, and role it does play in developed markets and banks.

Definition of concept

Treasury and its responsibilities fall under the scope of chief financial officer and his/her responsibilities include capital management, risk management, strategic planning, investor relations and financial reporting (Scribd, 2011).

The main tasks of treasury management include maintaining the liquidity of the business enterprise, risk management, hedging and insurance management, accounts receivable management, bank relations and investor relations (Scribd, 2011).

Some of services offered by the treasury management include improving the receivable collection process, increasing control and management of the disbursements, enhancing the level of timely and comprehensive information controls, enhancing liquidity controls, reduce potential of fraud and possible losses to an organization and provide the most advanced technological tools available(Amegybank, 2005).

Types of system followed in developed markets

In this article, two examples of developed markets in United Kingdom and Germany treasury management systems are considered.

The bank of England is the central bank that regulates all financial institutions in United Kingdom; “they are five payment and clearing systems that relate to cash and treasury management” (Treasury Management, 2000, p. 1). All the five operate under the auspices of the association of payment and clearing services (APACS) (Opeartions, 2000).

The unit of account is the Great Britain pound. It’s divided into 100pence; it is not a Euro currency:

The high value sterling system (clearing house automated payments system-CHAPS) is a same day system with real time gross settlement (RTGS) across accounts maintained by members with the bank of England. There is no minimum or maximum value for payments processed through CHAPS.CHAPS is owned directly by its members. (Treasury Management, 2000, p. 1)

The working of the CHAPS is detailed:

The CHAPS clearing Company also offers a CHAPS Euro system which Functions identically to traditional CHAPS payments except that instructions are passed through SWIFT instead of the CHAPS sterling network. This system links to TARGET for the settlement of cross border Euro payments. (Treasury Management, 2000, p. 1)

The clearing system takes three days is controlled by APACS:

The check clearing system is managed by the check and credit clearing company limited under the auspices of APACS. Check clearing in the UK is a three day cycle regardless of location in the country with day one being date of deposit and day 3 being day of final settlement. (Treasury Management, 2000, p. 1)

For international transaction a US dollar clearing system is availed: “There is a U.S dollar check clearing system using a major international bank as the settlement bank for checks drawn on U.S dollar accounts located in the city of London” (Treasury Management, 2000). The BACS system is very essential in the treasury management system due to the vital role it plays:

The ACH system is called BACS and operated by bankers automated clearing services (BACS) which is part of the association for payment and clearing services. It takes three days from advice of issuance to ultimate settlement and is float neutral to payers and beneficiaries. (Treasury Management, 2000, p. 1)

The city of London has been considered to be quite ideal and it readily acts as the global centre for treasury management; the city has good infrastructures:

All common treasury management techniques are permitted in the UK including leading or lagging, re-invoicing, sweeping and cash concentration. Multilateral netting is permitted without restriction. Pooling of the sterling is permitted as is pooling of other currencies. (Treasury Management, 2000, p. 1).

The size and complexity of the United Kingdom market makes it a tempting point of entry for virtually all financial institutions. The competition then ensures thin margins and requires all organizations to focus on areas of special competence to survive (Treasury Management, 2000).

There is a huge foreign exchange market in London and membership in the European Union and a very reliable transport network make the United Kingdom market a good location for shared services centers and regional treasury centers. (Treasury Management, 2000, p. 1).

The London centre provides many ways which can be used in managing treasury:

There are several overnight and short term investments options for resident or nonresident corporations, options range from banks deposits through time deposits, certificate of deposit, repurchase agreement and government securities referred to as gilts.

Overdrafts are permitted with the amount and rate determined by each bank. Short term loans, commercial paper and bankers’ acceptances are the other principal sources of finance. (Treasury Management, 2000, p. 1)

Germany Treasury System

Second developed treasury system to look at is the Germany treasury system. Germany has the largest European economy and is the 4th biggest economy in the world; it’s the headquarters for the European central bank. The currency used is the Euro (EUR).

The Deustshe Bundedebank is the central bank and regulates all financial institutions in the country. They are nine Landeszentral banks in the various German states which are branches of the Bundersbank and are responsible for banking activity within their geographical area (Treasury Management, 2000).

They are “three clearing systems in Germany that relate to cash and treasury management” (Treasury Management, 2000, p. 1). They are:

- The high value system or the Euro Access Frankfurt (EAF-2) is an inter-bank real time settlement system (RTNS). EAF-2 is used by member banks for transfer amounts greater than 50,000 Euro domestically with no minimum for international transfers.

- An additional high value system, the ELS or electronic counter is an RTGS system for all German banks including those participating in the EAF. It is primarily used for large settlements between non EAF members or for transactions which failed to settle within the EAF.

- They are also circuit checks and electronic transfers which are administered by the central bank nine branches and which settle through the EAF. There is one day clearing float cycle in the process of checks in addition to third party bank processing float.

All common treasury management techniques are permitted including “leading, re-invoicing, sweeping and cash concentration” (Treasury Management, 2000, p. 1).

Multi lateral netting is permitted without restriction. It is further shown that, “The basic operating account is the current account and banks are allowed to pay interest on current accounts maintained by corporations” (Opeartions, 2000, p. 1).

A generic electronic banking system called multi cash provides a standard for all banks reporting activities. Internet banking is very common. Time deposits from one day to one year are common short term investment along with T-bills and Repos. Private placements- in lieu of the developing commercial paper market round out the range of short term investments opportunities.

Overdrafts are allowed though at the restriction of respective banks. Germany has a reliable means system of communications. Bandwidth is also available, electronic banking is also highly available. They are also mortgage banks, savings banks, agricultural banks and other specialized banks (Treasury Management, 2000).

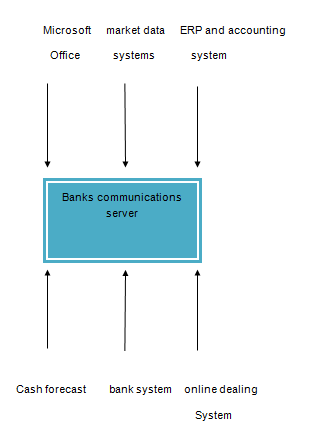

Drawing of a treasury management system followed by banks in UAE

The treasury management system for Dubai banks follows this system where bank systems are used for the daily and intra-daily upload of balance and transaction information and also for the secure export of messages.

Some of the banks in UAE are Standard Charted bank, Barclays bank, Philippine national bank, Citibank, royal bank of Canada, Arab bank for investment, HSBC, Arab emirates investment bank, bank of Baroda, first gulf bank, Dubai Islamic bank among others (Scribd, 2011).

ERP and accounting systems are used for the export of accounting journal entries and the import of accounts payable and receivable summaries and cash forecasting purposes.

Microsoft office for using word, excel outlook, access mostly for input of data. On-line dealing systems for the export of interest rate transaction execution requests and the import of the execution details executed and market data systems for the import of interest rates and volatilities (Scribd, 2011).

Conclusion

Treasury management is very important in the business world mostly to financial institutions and governments. It also makes individual business units of an entity to be charged at a market rate for the services offered, making their operating costs more realistic.

Treasury management has many objectives which include maintaining liquidity, optimizing cash resources, establishing and maintaining access to short and long term financing, managing risk and maintaining shareholder relations that are critical in today’s advanced financial world.

References

Amegybank. (2005). International Treasury Management. Retrieved from: https://www.google.com/search?q=international+treasury+management&ie=utf-8&oe=utf-8&aq=t&rls=org.mozilla:en-US:official&client=firefox-a#hl=en&client=firef

InvestorDictionary. (2011). International Treasury Management. Retrieved from: https://www.google.com/search?q=international+treasury+management&ie=utf-8&oe=utf-8&aq=t&rls=org.mozilla:en-US:official&client=firefox-a#q=treasury+management+definition&hl

Scribd. (2011). Busines Law. Retrieved from: https://www.scribd.com/doc/19074523/Treasury-Management

Treasury Management. (2009). Treasury resources. Web.