Introduction

The world has recently faced difficult financial times due to financial crisis. The two latest monetary crises include the 2008 financial disaster and the 2010 European Debt Crisis. In particular, the 2008 financial crisis occurred due to high levels of volatility concerning subprime mortgage market. Subprime mortgage market indicated high levels of risks although most financial institutions found the market attractive.

As compared to prime mortgage market, subprime mortgage market promised huge profits. This was principally attributed to high interest rates associated with sub-prime mortgages as opposed to low interest rates charged on prime mortgages. Lehman’s Brothers had invested a good portion of its investment in the subprime mortgage market.

With high volatility of interest rates, Lehman Brothers was not excluded from registering losses due to the risky mortgage market. Individuals and institutional investors lost shares and other valuable investments after Lehman’s Brothers went under. The fall of Lehman Brothers forced the U.S. government to issue a bailout package of U.S$700 billion in a bid to salvage other institutions that were on the verge of bankruptcy.

Lately, it has been discovered that financial market activities have greatly contributed to financial crises. Financial products such as corporate bonds, government bonds and equities are mainly traded in both money and capital markets. Activities associated with financial institutions chiefly determine performance of financial markets.

Due to frequent occurrence of minor and major financial crises, different regulating bodies such as Capital Market Authority propose several regulations concerning the regulation of financial markets.

For instance, it has been proved beyond doubt that central banks of various nations normally set interest rates for commercial banks and other lending institutions. This step is a major move towards reducing the rate of inflation resulting from surplus of currency in the economy (Currie 2011, p. 83).

Independency of Central Banks

Central banks are principally charged with the responsibility of regulating a country’s economy through various policies. In many cases, roles of central banks include issue of currency, acting as lender of last resorts, serving as government’s bank, maintaining stability of financial systems among others. Apparently, the government generally controls a number of central banks.

This is indicated by the power of the president as well as the parliament or congress to choose the governing body of any central bank. Hardly would one find a central bank that is run privately.

Although the government largely influences operations and management of central banks, it is plainly true that independence of central banks would probably help in creating a favorable market for various financial institutions (Cooper 2004, p. 73).

An independent central bank would mean that government has a minimal influence on the operations of central bank. In this case, central bank will independently make its own decisions and as well set its own monetary policies.

Even though the responsibility of dismissing and nominating the governor and other members of the decision-making body lies in the hands of the government, it would be prudent to set a clear criteria including but not limited to experience, academic qualifications and personal behavior during selection of applicants for various positions.

In addition, central banks should also evaluate their level of financial independency. For example, it should be able to assess its own budget, amend provisions regarding distribution of profits over and above determining its accounting rules.

The U.S. Federal Reserve

The U.S. Federal Reserve, the European Central Bank and the Bank of England seem to have partly attained independence as compared to other central banks in the world. In particular, the U.S. Federal Reserve is partly public and partly private.

With its headquarters in New York, the Federal Reserve was set up with three main objectives including ensuring maximum employment, setting reasonable long-term interest rates and stabilizing prices. Stabilizing prices refers to maintaining a steady and fair inflation rate.

Although the Board of Directors heading the management of the Federal Reserve is to be chosen by President and approved by the U.S. Senate, it is confirmed that policies passed by the Board of Directors do not have to be approved by any branch of the government including legislature and executive.

This power is derived from the laws enacted by Congress. However, the Congress is charged with the responsibility of overseeing the entire Federal Reserve System.

The Central Bank of England

On the other hand, the Central Bank of England was initially formed as a private bank before it was nationalized in 1946, a year that it became a public institution. However, the bank still enjoys high level of independency bearing in mind that it regularly makes independent monetary policies. Presently, the Bank of England is fully run by a Treasury Solicitor on behalf of the U.K. government.

The most fascinating aspect of U.K. economy regards the authorization of eight banks, which unilaterally issue notes. All the same, the Bank of England issues notes single handedly in both England and Wales. In Scotland and Ireland, the Bank of England controls the issue of notes by other commercial banks.

Although the Bank of England Monetary Policy Committee is entirely responsible for making necessary financial policies, it is significant to note that the Treasury has the authority over ordering the Monetary Policy Committee to comply with certain monetary policies during either difficult financial times or high demand from the public side.

The European Central Bank

The European Central Bank has exclusive right of governing fiscal policies of 17 member states. Perhaps, it is one of the central banks with high level of independency worldwide. Nonetheless, the bank was established with a major aim of stabilizing prices. Stabilizing prices is concerned with keeping low rates of inflation. In particular, inflation rate was resolved to remain below 2%.

The European Central Bank makes independent decisions regarding its operations. This means that it is rarely influenced politically given that it controls the economies of over 17 member states.

The amount of coins and notes to be issued by any national bank of member state is merely controlled by the European Central Bank. Moreover, the bank ensures smooth financial market operations, which include settling part of members’ financial securities.

Financial Intermediaries

Financial intermediaries are financial institutions that link buyers and sellers in the financial market. The financial intermediaries deal with savers and borrowers. Savers are perceived to be the surplus economic agents while the borrower is perceived to be the deficit agent.

Savers usually deposit their excess cash in accounts they hold with financial institutions including Investment banks, commercial banks and mutual funds among others. Conversely, borrowers would borrow funds from these financial institutions with an aim of financing various activities.

Savings are accepted as deposits by financial institutions, which are later converted to loans and lent to both government and businesses. Acting as a mediator between borrowers and savers, financial intermediaries attempt to reduce costs and risks associated with both direct saving and lending.

Special Roles of Financial Intermediaries

Risk Transformation

Financial intermediaries endeavors to covert some perceived risk assets into less risky assets. Reducing riskiness of investments is majorly done by spreading the risk to different borrowers. The failure of one individual to pay interest rate and eventual principal would have minimal impact on the assets of the financial institution. This assures investors minimal chances of losing their savings.

A lender who directly deals with a borrower is likely to lose his or her amount if the borrower encounters difficulties in repaying the loan (Certo 2011, p. 67). In addition, in some financial institutions the savers are guaranteed a given interest rate that is earned on the amount saved.

Accepting Deposits and Lending Funds in Diverse Denominations

Most financial intermediaries manage to match both deposits and loans on various portions. For instance, a financial intermediary usually collects small deposits from various consumers. The financial firm later on amasses the deposits and gives a huge loan to a borrower who wishes to take a big loan.

On the other hand, an intermediary can as well collect a large deposit from a single savor and thereafter give the same deposit in small to different borrowers that wish to borrow small deposits. Acting as intermediary, financial firms allow depositors to save their savings in different sizes. Similarly, borrowers have the opportunity to borrow funds in convenient sizes.

Maturity Transformation

This refers to a situation in which an intermediary is able to reconcile conflicting requirements for both borrowers and lenders. For instance, a borrower might require a specified amount of loan, which he or she is not able to attain from a particular lender. On the other hand, a lender is not able to find a borrower who would take such a huge amount of savings.

Therefore, with the existence of financial intermediaries, one is able to borrow and lend any amount of money (Whelan 2010, p. 56). To make sure financial intermediaries act as an arbitrator, it usually converts short-term liabilities into long-term assets.

The long-term assets include loans that have a maturity period of over one year. The ability of converting deposits into long-term assets enables financial intermediaries to meet various needs of borrowers and lenders. This eventually assists in protecting institutions against market failures leading to low costs of lending and borrowing.

The Quantitative Analysts and Financial Crisis

The Dotcom Burbles

The world has constantly experienced financial crises since the beginning of 2000. It is no doubt that the dotcom bubble, which was linked to increasing investment in technology, had much heavy impact on the economy. One of the largest companies that had invested in technology but faced financial difficulties amid dotcom crisis was WorldCom.

WorldCom had seen its stock prices appreciate within a short period that attracted various investors to purchase its shares.

However, due to several companies’ attempts to invest in the internet and technology, most of shares associated with technology and internet depreciated leading to great losses amongst shareholders and other investors. This rendered some of the technology companies such as WorldCom bankrupt. WorldCom specifically went under in the year 2002.

The 2008 Financial Disaster and Mortgage Assets

In the year 2008, another financial crisis that had much bigger magnitude followed. The crisis emerged due to persistency and consistency of the volatile mortgage assets. Both prime and sub-prime mortgages attracted diverse financial institutions. However, the sub-prime mortgage market was more attractive as compared to prime mortgage due to its relatively high interest rate.

Several banking institutions such as the Lehman Brothers had invested much of its assets in the sub-prime mortgage market. The volatility of the sub-prime mortgage market was so intense that Dow Jones Stock Market recorded in a particular day amid the crisis an intra-day range of a 1000 basis points.

An indication of an intra-day range of 10% interest rate was an obvious indicator that sub-prime mortgage market was emerging as a more risky asset. The volatility led to drastic loses in the value of shares for companies that had invested in the sub-prime mortgage market.

According to high-profile investors and economic analysts such Dr. Johnson, it was believed that bonds based on commercial and residential mortgages were less risky. It was astounding when it emerged that one of the largest lenders of mortgages became bankrupt.

Lehman’s Brothers had several branches in the U.S and abroad in addition to competent governing board as well strong capital that ensured strong performance (Mankin 2009, p. 95). The fall of Lehman’s Brothers rendered thousands of employees jobless. Both individual and institutional investors encountered huge losses in relation to their investments.

In particular, Lehman’s Brothers shares lost value significantly even though directors had attempted to disguise the losses through posting strong financial statements to boost confidence. Bondholders on the other hand lost their investments after the fall of the bank. Notably, bondholders were on the verge of losing their principle bearing in mind that most business units were sold at a loss.

Although the financial disaster began in the U.S., it is confirmed that the effect spread rampantly to other nations that traded with the U.S. Specifically, stock markets of other world economies recorded falls in prices of stocks various listed companies.

This was coupled with high inflation rates among several countries that saw hiking of commodity prices. The 2008 financial meltdown left several questions unanswered including whether mortgage assets are not risky investments as put forward by Dr. Johnson.

The European Debt Crisis

The persistence and consistence of financial difficulties that erupted in 2010 left many European countries in bad conditions. Many had predicted that the safest investments included the sovereign debts. However, after the debt crisis, which saw a good number of European nations suffer financially many investors, disapproved the belief.

A country such as Greece found itself in heavy debt crisis forcing it to seek bailout from the European Union leaders. The Greek government made a mistake, which was related to giving generous salaries over and above pension benefits to its employees.

Although several leaders initially declined to heed the call from Greece’s government, the European Central Bank later on accepted to issue out a bailout package of 100 million Euros to salvage Greece’s economy. Similarly, France owed Italy huge debts. France defaulted to finance its debt, which rendered Italian’s financial system weak. The creditors of Italian’s Central Bank were also severely affected.

This led to contagion crisis that affected most European nations. On the other hand, Ireland had a strong financial system that issued funds to property investors. Conversely, the real estate market burbles emerged when most investors with Ireland’s banking system invested in property market. This chiefly led to contraction of Ireland’s financial system after many investors defaulted to finance their loans.

Iceland banking system had grown significantly. As a result, it issued huge debts to global investors. The Ireland’s banking system however contracted leading to difficulties in paying interest rates on the bonds plus principle amounts. Portugal was no exception to the financial crisis.

Many financial and economic analysts argued that member states of the European Union did not have unilateral authority with regard to salvaging their economies through various methods such as printing their own notes.

This argument was considered more substantial when it was realized that the U.K. economy printed notes to expand its economy. This leaves a big question as to whether the once risk-free public debt should not be classified among the systematic risk assets.

The Monetary Policy and the Quantitative Easing

Although many nations use monetary policy to lower the interest rates of lending which encourages borrowing, it is also clear that monetary policy apply effectively on short-term assets. In particular, monetary policy is applied on Treasury Bonds. The treasury bills have a maturity period of less than one year, which means that they are short-term assets (Moss 2002, p. 64).

To expand an economy, the government would propose expansionary policies, which would mean repurchasing the bonds. Therefore, supplying adequate money to the economy, which would lead to lower interest rates, is highly discouraged. Nevertheless, if government realizes that interest rate is approaching zero, it would choose quantitative easing approach to continue facilitating economic growth.

Quantitative easing includes purchasing of long term assets such as mortgages with a maturity period of more than one year. For instance, following the economic crisis that hit the U.S. economy in the year 2008, the Federal Reserve made a move to purchase an almost trillion dollars security backed mortgages. This helped ease the U.S. mortgage market and therefore salvaged most banks on the verge of being declared bankrupt.

Likewise, the European Central Bank made a successful attempt to rescue a great number of European member states from debt crises. Nevertheless, a more confusing question arises with regard to European individual nation’s National Banks.

No single national bank is allowed to make independent policies regarding its operations such as expanding the economy through printing notes unless it has consulted the European Central Bank. Irrespective of the magnitude of riskiness, it is also fascinating that Dr. Johnson’s theory failed to identify that public debts are risky assets as well.

Risk and Return Analysis

1-Year Treasury Constant Maturity Rate

20-Year Treasury Constant Maturity Rate

Moody’s Seasoned AAA Corporate Bond Yield

Moody’s Seasoned BAA Corporate Bond Yield

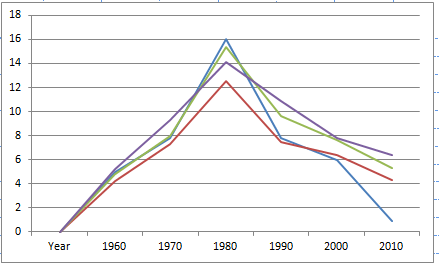

A Graph Showing Interest Rates for Four Different Bonds from 1960 to 2010

Red line-20-Year Treasury Constant Maturity Rate

Purple line- Moody’s Seasoned BAA Corporate Bond Yield

Green line- Moody’s Seasoned AAA Corporate Bond Yield

Blue line-1-Year Treasury Constant Maturity Rate

1-Year and 20-year Treasury Constant Maturity Rate Between 2000 and 2010

The 1-Year Treasury Constant Maturity Rate

Mean E (R1) = 3.6

Standard deviation= [Var (R1)] ^1/2

SD (R1) = 4.684^1/2 = 2.164

The 20-Year Treasury Constant Maturity Rate

Mean E (R20) =6.16

Standard deviation= [Var (R20)] ^1/2

SD (R20) = 1.9594^1/2 = 1.400

Methods of Hedging Interest Risks

Purchasing of Interest Rate Futures Contract

This is one of the methods of managing interest rate risks. In this case, the buyer of futures contract will pay the seller any amount of interest rate exceeding quoted value in the future contract. In contrast, the seller will compensate the purchaser of futures contract any amounts below the quoted rate incase the interest rate falls in value.

Use of Swaps

Here an exchange is made in terms of payment between two or more parties. In this scenario, one of the parties agrees to pay future floating rates and consequently receive fixed interest rate. The other party, on the other hand agrees to receive floating rate and pay fixed interest rate.

Comparison of the 1-Month Treasury Constant Maturity Rate and Other Factors

The 1-Month Treasury Constant Maturity Rate is more volatile as compared to other factors. Other four factors, which include the M2 Money Stock, the Gross Domestic Product, the Consumer Price Index in All Urban Consumers and the University of Michigan Consumer Sentiment Index, experience less volatility. Their movements are more predictable and therefore one is able to judge the future trend without difficulties.

On the other hand, the 1-Month Treasury Constant Maturity Rate experiences drastic booms and busts that one would find difficult to predict any future interest rate (Gomez-Mejia & Balkin 2011, p. 21). Probably, 1-Month Treasury Constant Maturity Rate matures in a short period. This is why its price keeps on changing on a monthly basis depending on demand.

Conclusion

This paper has extensively discussed several fundamental aspects concerning Finance. Through discussion, it has been noted that once perceived less risky assets such as public debt and mortgage assets should be taken as the most risky assets. The riskiness of sovereign debt and mortgage assets is justified by European debt crisis and the 2008 mortgage crisis respectively.

More importantly, it has been discovered that independency of central banks will play a major part in facilitating enormous economic growth. Immense influence from government at times prevents financial institutions and other firms from competing effectively in an economy.

This results to derailed economic growth. In addition, it has been confirmed that financial intermediaries are crucial in any economy. Financial intermediaries are predominantly charged with the responsibility of converting short deposits into long-term assets. In general, government and financial systems should be effective to enhance economic growth.

List of References

Certo, S 2011, Modern Management: Concepts and Skills, Prentice Hall, New York.

Cooper, M 2004, Dust to eat: drought and depression in the 1930’s, Clarion Books, New York.

Currie, D 2011, Country Analysis: Understanding Economic and Political Performance, Gower Publishing Limited, Burlington.

Gomez-Mejia, L & Balkin, D 2011, Management: People, Performance and Change, Prentice Hall, New York.

Mankin, G 2009, Principles of Economics, Cengage Learning, New York.

Moss, D 2002, A Concise Guide to Macro Economic Analysis, Harvard Business School Publishers, Massachusetts.

Whelan, C 2010, Naked Economics: Undressing the Dismal Science, W.W. Norton and Company, New York.