Introduction

Housing is the main stay of any economy and the U.S economy is not an exception to this rule. Housing is constantly accounting for more than twenty percent of the gross domestic products (GDP) of the USA.

Housing sector also plays a pivotal role in the U.S. economy as both the development, construction and sale of housing create a noteworthy tax revenue, income and employment. As per the National Association of Home Builders survey, the construction of about one hundred single family homes creates about two-hundred and fifty full-time jobs during the construction period for the local community and about $11 millions in income for local workers and business. Further, subsequent occupiers in these newly built homes will be spending about $3 million in income per annum and also there is every opportunity for the creation of an additional 75 jobs by each project. The aggregate value of the country’s housing stock stood at $13.4 trillion as of 2003, which comprised about forty percent of all consumers’ durable goods and fixed assets. As per Millennial Housing Commission report of 2002 ( p12), the housing sector also opens up a considerable quantum of jobs and income as about 3.5 million jobs and $166 billion in local income were generated due to construction activities.

According to the Joint Center for Housing Studies (2004), housing also buttresses the U.S economy through home equity, which doubled more than $8.4 trillion in 2003. According to a Housing and Urban Development study (2004), in 2003 alone, homeowners took out more than $139 billion by way of cash from their home equity account. Between 2000 and 2004, mortgage refinancing exceeded $7.9 trillion (Schwartz 2006, 4).

Further, according to Gamzon (2007), in the U.S.A, pay and use senior housing projects are carried out by many private agencies since senior housing is a $ 65 billion industry and hence, this sector is being considered as a fastest developing industry and is being regarded as the 6th larger commercial real estate asset category. Despite of this giant size, the growth in the seniors’ housing has been modest in the U.S.A. According to Sheridan (1999), the requirement for seniors’ housing is on the increase in the U.S and is considered to be not hampered by business and economic cycles and is anticipated to remain one of the most attractive and reliable industries throughout the globe. (Fritsch 2007, 15). According to research study perused by the National Alliance to End Homelessness, the homeless population in USA is likely to increase by one-third in the next decade and likely to double between 2010 and 2050 due to aging of the baby boomers –which refers to citizens born in the 1950s. The aforesaid research report discloses the current stages of poverty among the elderly population as a chief reason to the incremental enhancement in the aggregate of homelessness Americans turning 65 or more.

To achieve this agenda, it is strongly stressed by NGO’s that panacea for this is to declare a “ Right to Housing “ notion that should be the basic structure not only for a new social agenda but also for a redesigned housing policy of the USA. Right to housing ensures the right to reside in peace, security and dignity. This privilege must be offered to all individuals despite of their income status or access to economic resources, and the quality of housing offered must have enough space, privacy and security.

In U.S.A, senior housing is regarded as a lucrative and stable market for private equity investment and for institutional lenders. Keen interest is being focused on senior housing industry due to vibrant industry fundamentals like high occupancy ratios, aging demographics, low capitalization rates and increasing rental revenues from the senior housing projects. According to DeLisle (2007), there has been and is likely to remain to be the inflow of debt and equity financing from local, national and international sources as there exists a strong tendency to pump in capital to stable markets.(Fritsch 2007,8).

This research essay analyses future of senior housing in U.S.A by discussing the current data on senior homelessness and how U.S government should fulfill this gap by introducing various reforms by way of recommendations in the concluding part of this research essay.

A Right to Housing

It is estimated that in the 21st Century, about 100 million people in USA live in housing located in unsafe neighborhoods and which is likely to be physically inadequate. Thus, it is the primary duty of the American government to provide truly affordable, high-quality housing, especially in good neighborhoods for all. Further, the National Housing Goal of the American government is stressing to provide a respectable house with all amenities like heating , water facilities , clean with enough space , privacy and security and an appropriate living atmosphere for each and all American family units. This is articulated in the 1949 Housing Act and reasserted in succeeding legal initiatives. To achieve this agenda, it is strongly stressed by NGO’s that panacea for this is to declare a “ Right to Housing “ notion that should be the basic structure not only for a new social agenda but also for redesigned housing policy of the USA. Right to housing ensures the right to reside in peace, security and dignity. This privilege must be offered to all individuals despite of their income status or access to economic resources, and the quality of housing offered must have enough space, privacy and security. Thus, “Right to Housing “notion is not only based on the ethical foundation but also on the principle of ideals of common wealth and natural justice. This concept is also based on an extremely pragmatic outlook –the prime role that housing plays in people’s lives. If a ‘ right to housing ‘ is realized or achieved , it will also achieve other associated advantages like employment opportunities ,personal health and safety , security of tenure , a decent education , economic security , and a multitude of economic opportunities and social relationship will also emerge.

In his State of the Union address in 1944, then American president Roosevelt asserted that there was a necessity for a whole series of social and economic rights, including a “Right to Housing “. President Roosevelt’s dream “Right to Housing “is yet to materialize. Though American economy is having all the resources to offer adequate housing to all its citizens but to implement this, we need an activist government which has a prime objective of social justice. Further, American government should focus more on the right to housing policy and should implement more programs to achieve this goal rather than pursuing a narrow policy on housing. What we need a social movement in which housing justice has to associate in an integral method with many other struggles for opportunities, justice and democratic association. To make the Roosevelt’s dream into reality, what we need now is to make a serious debate on the Right to Housing. What I suggest that Right to Housing should be made as a fundamental right by introducing a second bill of right. With billions of dollars being spent on Iraq and Afghanistan for fighting against terrorism, and to spend on relief works in the aftermath of devastating hurricanes like Katrina, the realization of the dream, Right to Housing may appear far distant than ever. This has compelled the U.S. government to shelve the billions to introduce new domestic social initiatives on the right to housing policy for now.

I am of the strong opinion that health of a society can be assessed by the affordability and quality of its housing for seniors’ which comprises of the thirty percent of citizens of U.S.A. A society proclaiming deep worries for human wants, must not be so deeply lacking in this province, Even at the dawn of the new century, U.S government is still witnessing grave and profoundly ingrained housing issues, As a fundamental right, housing to all policy should be the main and chief goal of the American government which offers a best springboard for initiating closely associated economic and social reforms. (Brat et, Stone & Hartman 2006).

The atmosphere where one lives –especially if one is poor, and / or a color person – plays a pivotal role in establishing an individual’s place in the local community and in the society. Residing in an inferior housing in an impoverished neighborhood may restrict an individual’s ability to secure an adequate education for their wards and may limit the opportunities for finding a decent job and to strip off them of decent community facilities and public services? (Bratt, stone and Hartman 2006, 2)

As per testimony released by “U.S. Department of Housing and Urban Development” , an approximate of 671,888 individuals experienced homelessness in any one night in USA as of January 2007 and about fifty-eight percent of them were residing in shelters and transitional housing and the remaining forty-two percent were unsheltered. (PBS.Org, n.d.)

Housing is considered to be one of the necessities of life and there were stories that homeless people freezing to death each winter offer stark prompts how housing has become a basic need.

As per Friedman (1968), in the past years , occurrence of events like the Great Chicago fire of 1871 and the Cholera epidemics that ravaged the densely populated urban provinces in the start and at the mid of the nineteenth century vehemently corroborated the association between health and safety of the people and poor housing conditions.

According to Wood (1934), there was a pressure from the public after the above incidents and hence, there was passing of tenement house laws, first in New York City succeeded by other bigger cities and also to safeguard the non-poor who were residing in adjacent neighborhoods. Thus, the main objective of the tenement law was to administer the “safety, health and morals of the tenants.” (Bratt, stone and Hartman 2006, 3)

According to Urban Institute findings (1999), the importance of a right to housing can be demonstrated through the distress witnessed by homeless who are at greater peril of both mental and physical illness, assault, substance abuse and in the case of children, prolonged and frequent absences from school. Thus, a mere non-availability of a mailing address puts them with infinite hardships to apply for public assistance and for jobs or to admit children in schools. (Schwartz 2006, 3).

Housing Policy in the United States

According to Katz et al (2003), U.S housing policy is footed on the following principles:

- Expand and preserve the provision of high-quality housing units.

- Make the present housing more readily available and more affordable.

- Encourage economic and racial diversity in residential neighborhoods.

- Assisting households to build wealth.

- To connect housing with essential supportive services.

- To encourage a well-balanced growth of Metropolitan. (Schwartz 2006, 5).

Further, U.S housing policy is based on the following objectives:

- To make sure that a minimum level of housing quality.

- To increase the availability of housing by encouraging new house constructions, maintenance and to make an improvement of the present stock.

- To achieve stabilization both in assets price and rents.

- To stabilize both the house construction and business cycles.

- To encourage investments and savings by offering incentives.

- To reduce crowding.

- To support home ownership.

- To minimize economic and racial segregation; and

- To nourish and develop community development. ( Green and Malpezzi 2003, 85)

Initially, the US housing policy during the utilization and production phase from 1860 to 1940 was chiefly directed by the inherent assumption that each division or class of people might have varied housing standards. As a result, it was common to apply one set of norms for worker housing and a different set of norms for rich class housing. Thus, the underlying presumption is that mobility and assimilation would restructure individuals to higher echelons of housing as their economic and social conditions improved. With the onset of changes in the economic and social structure, more analogues set of norms arose apparently to safeguard safety, health and welfare of the community.

According to Dowens (1982), local governments prefer housing norms in all eligible neighborhoods to eliminate safety and health hazards. (Jarrett 2006, 216).

Between the period 1930 and 1960, the Federal government gave prime importance to on subsidizing housing units. From 1970 onwards, there has been a shift to subsidize the people. According to Michael Teitz , federal government new housing policy from 1970 onwards focused on the participation by poor people in housing markets in the same way as other groups in society and that public programs should encourage that participation. Though, there is a general shift from supply –side to demand –side grants have occurred in the past few decades in the U.S housing policy, some critics have suggested that U.S housing policy should have the mixture of both the demand-side and supply –side grants.

Of late, the U.S housing policy has started to be driven by such goals as fostering economic self-sufficiency and independence for recipients (Green and Malpezzi 2003, 90).

Presently, US housing policy can be described, which is mainly market-based. U.S housing policy is looking towards the private segment as the source of the majority of housing, and hence, housing policy assumes that the major portion of American citizens will be able to buy or rent housing on their own.

Further, US housing policy also offer tax incentives as an assessee can deduct both his local property taxes and the interest paid on the mortgages from their federal income-tax commitments. Thus, U.S housing policy confirms the significance of the market and also offers a subsidy to the poor is responsible for racial segregation by residential location and also influences the development of neighborhoods. (Blau & Abramovitz 2007, 350).

The background for U.S housing policy has many facets, which include home ownership, the paucity of affordable housing and the spread of homelessness ,the part played by the suburbs , the vital impact of race and the possibility of housing bubble and looming of subprime mortgage crisis. (Blau & Abramovitz 200,350).

Future of Senior Housing

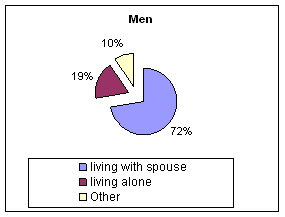

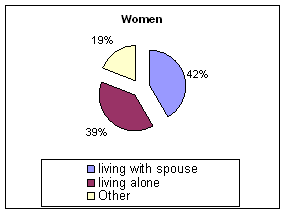

There were about 38.9 million older people with 65+ age group is living in U.S in 2008 with an increase of about 13% or about 4.5 million senior people since 1998. The number of Americans who will cross 65 is expected to increase by thirty one percent during the end of this decade. One out of every eight Americans is an elder American. About 1.6 million of the 65+ elder population resided in an institutional setup like nursing homes in the year 2008. Further, about 2.4% of the seniors resided in senior housing with about one supportive service accessible to their residents.

According to Chapman 2007, seniors as of today’s marketplace are sophisticated in their lifestyle and much educated and hence, their expectations and preferences are more advanced now. Seniors now demand resort type larger apartments with individualized attention.

The following table demonstrates the information as to the estimated growth of the 75+ age class in the year 2035.

The above data indicates that in the near future , increase in the total number of seniors who are in 75 or above is estimated to grow substantially both as a proportion of the total population and in terms of the absolute numbers. This demonstrates into a vibrant and developing market base for seniors’ housing in U.S.A. (Fritsch 2007, 12).

According to U.S Census Bureau, there are about fifteen percent seniors who are aged 75+ have an annual income more than $ 30,000. This translates into about 2,526,000 seniors. Further according to Gist & Hetzel (2004), seniors income comprising of a mixture of salary or wage income, retirement income and social security income. According to Bissell (2007), some seniors are having additional income like Mediaid assistance permitting seniors with lower income to enjoy these housing facilities, equity from private residence sale and financial support from their adult children. This demonstrates that there is a great profitability for the investment in senior housing schemes. (Fritsch 2007, 14).

According to National Alliance to End Homelessness report, the number of homeless elder citizens will be likely to increase by about thirty-three percent over the next decade (homelessforums.com). National Alliance to End Homelessness estimates that the homeless population in USA is likely to increase by one-third in the next decade and likely to double between 2010 and 2050 due to aging of the baby boomers –which refers to citizens born in the 1950s. The aforesaid research report discloses the current stages of poverty among the elderly population as a chief reason to the incremental enhancement in the aggregate of homelessness Americans turning 65 or more. As on date, elder residents make up about thirty-seven million or about thirteen percent of the U.S residents of whom about one million reside in acute poverty. Further, by 2050, it is estimated that the aged population in USA is anticipated to climb to 89 million.

In 1900, senior citizens aged 65 or above, remained at 3.1 million whereas, as of date, it has increased to seven million and about 13% of the aggregate population. The homeless seniors figure is likely to increase by eight million by the year 2050.

The poverty level among senior citizens is slowly coming down from thirty-five percent in 1950 and remained around fifteen percent in 1975 just after the introduction of social security measures and just oscillating between nine and eleven percent in contemporary period.

There are several governmental housing assistance programs, which are available for low –income senior citizens in the guise of rental assistance or affordable housing. “PHAs (Local Public Housing Authorities) “are administering the majority of the housing assistance for the seniors. In the state and local level, the appropriate State Housing Finance Agencies, “the local Department of Housing and Community Development” and “the U.S Department of Agriculture (USDA)” are also overseeing the housing assistance.

Certain elder housing support schemes are funded by the “USDA’s Rural Housing Assistance programs “and the” US Department of Housing and Urban Development. (Hud.org n.d.).” All U.S government housing assistance is over-subscribed and is having a heavy waiting list. U.S government housing assistance is made available senior citizens with low income, which include the following:

- “The Housing Choice Voucher Program

- HOPE for the Elderly Independence Program

- Public Housing

- Local Rental Assistance Program

- Section 202 Supportive Housing for the Senior Citizen Program.”(Hud.gov, n.d).

Significance of U.S Government Housing Assistance to Elderly Citizens.

- It offers help to a greater part of elderly renters who have extreme house rents.

- To offer low-income seniors with service-packed preferences to live independently.

HOPE for the Elderly Independence Program

This scheme offers a mixture of supportive services to low-income senior citizens and HUD Section 8 rental assistance. The main goal of this scheme is to enlarge the use of Section 8 rental help to the weak senior tenant population and to assist them to shun nursing home placement or other limited setup when community and home based choices are deemed proper. The eligibility criteria for this program is the elderly citizens aged about sixty –two or still older , and who have a problem in carrying out the daily three basic activities like bathing , dressing ,eating and grooming and home administration activities like shopping ,laundering , housekeeping and moving from place to another.

Section 8 Program / Housing Choice Voucher

This scheme offers decent and sanitary housing to senior citizens in the private market. Seniors can find their own convenient home for rent and the same will be reimbursed as per the limit set out in the scheme and the income of the senior citizen should not exceed the limit set out in the scheme. (HUD.gov, n.d).

- “Local Rental Helping Scheme”

- Finance assistance is offered to elders through “HOME Investment Partnership Scheme”.

Public Housing

It offers honest, affordable and secure housing for rental for qualified low-income families and senior citizens and people with impairments. Under this scheme, senior citizens are not required to pay not more than thirty percent of their monthly income as rent. With the help of federal government funding, the local PHA own and manage public housing complexes. PAH fixes the eligibility for the scheme and is based on the senior citizen’s their annual gross income, +62 ages, etc. (HUD.gov, n.d).

Section 521 Program or Rural Housing Services (RHS)

Under this scheme also, an eligible senior citizen is required to pay not more than 30% of his income as rent to the housing premises.

Supportive Housing Program for the Elderly under Section 202.

Nonprofit , private housing and service oriented organization is engaged in the construction and rehabilitation of structures under capital advances received from the federal government offers supporting housing for elderly persons who have low-income and this program is also known as Section 202 program. Thus, the Section Two Hundred Two scheme offers rental grants for the eligible schemes to assist them to be reasonable. Under the Section Two Hundred Two scheme, caring services like rations, housing and transportation for elders with impairments are also extended.

Often, preference is given by PHAs to specific groups of households or individuals. This offered more comfort to PHAs to channelize their restricted housing grants to individuals like elders who have maximum housing requirements. There exists always a mismatch between the available fund to HUD and the local PHAs and the demand for housing assistance, a long waiting period is not an exception and is common. Thus, senior citizens demand for low cost rental should be met by PHAs by securing more funds from the federal government.

In the year 2010, an aggregate of $ 825 million was allocated for the Section 202 funding. There was an increase of approximately $ 60 million in the year 2010 as compared to the year 2009 allocation. However, federal government has proposed to allocate just $ 550 million for the year 2011 and recommended for suspension of program for the year 2011. No doubt, elderly citizens with low income or homeless elders will be affected drastically due to this proposed fund cuts. It is to be observed that at any given time, there are projected 10 seniors for each and every Section 202 housing unit that is available and due to this fund cut, the poorest elders have wait longer period for new housing units in their communities. (Hud.gov, n.d).

According to NAMI (National Alliance on Mental Illness), American government budget for section 811 and 202 programs, there is a lesser allocation of funds for the financial year 2011. According to CBPP ( Center on Budget and Policy Priorities ) , senior housing issue is closely associated with the income and employment opportunities , it is urged that U.S government should not curtail budget allocations for rental assistance programs as this will not help to lift senior families out of poverty and may hamper the plant to decrease senior homelessness.

Despite of abovementioned various programs to eliminate homelessness among seniors, there is not much progress in reducing the homelessness among seniors. Further, homelessness leads to many issues like premature death and due to violence.

The association between restricted access to healthcare, compromised health and poverty are the main reasons for non-success of above welfare schemes. As per NEAH report, the main reason for the homeless among seniors is due to the job loss. As per the “Housing and Urban Development homeless” evaluation report finds that as of September 2008, just 2.8 % of country’s homeless was sixty-two or older. Since, by 2020, the seniors are likely to constitute more than 25% of the American population which is an up from 12.6 % from now, it is expected that there will be a corresponding increase in homeless seniors. Due to increase in cost of living and as a result of static income , senior housing should be given more preference by introducing an affordable housing to seniors as it is evidenced that each federal housing scheme , there are many numbers of senior people who are on the waiting list already(Creamer 2010).

In the absence of any independent living legislation, there is the possibility of FDI in the senior housing facilities. However, there exists a cumbersome municipal approval process which needs simplication. U.S government should encourage repatriable FDI in senior housing projects and should simplify the municipal approval process and this would attract more FDIs in this sector. Though , there is managed assisted living legislation in U.S.A , its successful implementation is hampered due to high development cost charges and U.S government should revamp this to kindle development in the senior housing programs. Though, both local, federal and international level investors are eager to invest in senior housing facilities in U.S.A, their interest is hampered by the rising capitalization rates. U.S government should make policy reform like announcing profit and capital repatriation in senior housing facilities to attract more foreign investments in this sector. (Fritsch 2007, 11).

It has been identified that there exists many development opportunities in U.S.A in the senior housing market and it appears to be more attractive. The availability of low cost financing and minimal development legislation has minimized the blockades to the implementation of the projects and low cap rates will facilitate in worthwhile senior housing project investors due to high enhanced property values in the near future. The demand for seniors’ housing is demographically influenced and intervening need driven, it is expected that there will be continued interest to be shown by institutional investors and private equity interest in this industry regime in the near future although there has been currency depreciation. (Fritsch 2007, 11).

The Fair Housing Act

This act is applicable to residential housing and bars discrimination in renting, selling, insuring or lending residential housing property on the footage of color, race, religion, handicap, age, sex, family status, or national origin. Under some state law, there will be some additional classes, which are safeguarded under the state law. Under the provisions of the Fair Housing Act, there are substantial numbers of requirements for senior housing like having eighty percent or more of the housing units occupied by at least one resident whose age is either 55 or above. (Jennings, 555).

Some states as a condition of variance require the builders of housing units to rent some portion of the units to senior citizens or disabled individuals. Thus, while granting approval for apartment complex, state government like California requires that the complex be maintained as a low-to-moderate income senior housing project. Thus, as a part of this agreement, housing complex has to compulsorily to rent units chiefly to poor, disabled or elderly tenants. Further, these housing units are required to provide necessary security measures to cater for the special needs of the senior citizens. (Jennings, 210).

It is estimated that by 2020, aged people 55+ will be crossing about fifty percent of all the votes cast and hence, elders will have a strong political voice than their forerunners. ( Hud.gov, n.d).

During April 2010, 27 senators signed a memorandum thereby requesting the appropriations’ subcommittees to maintain the level of funding of $300 million for Section 811 and $ 825 million for Section 202 programs. This is mainly intended to block the proposed budget cuts to these senior housing programs as recommended by the U.S administration (aahsa.org).

There has been a proposal by the American government to introduce LIHTC (“the Low Income Housing Tax Credit Program “). Due to subprime mortgage crisis, many affordable senior housing programs witnessed a complete halt in their activities when the investor pool exhausted and developers battled to revamp deals. Through, ARRA (America Reinvestment and Recovery Act), Congress attempted to address some of the issues with tax credit exchange programs and gap financing. The main intention behind LTHTC scheme is to generate more jobs and to kindle development. This bill would facilitate investors to employ the credits for the tax obligations for 5 earlier years. (aahsa.org).

Recommendations

Housing for elders and seniors should be given top preference, especially in targeting low-income housing tax credits. To mitigate the housing issues faced by elders, it is recommended that direct financing programs should be established through a stage housing trust fund. It is desirable to hold on the Section 8 housing programs, and it is recommended that greater incentives should be offered to building owners to induce them to remain in the program. U.S government should make sure that a fair share of senior housing policy is maintained. Bonds may be issued by U.S government for the abolishing the gap that exists in the supply side of the elders’ dwelling units. Under the Special needs’ category, it is better to add a “at risk elderly “or “frail elderly” clause. U.S government should earmark adequate funds to repair the dilapidated elder housing units which need immediate repairing of heating and plumping. It is recommended to increase the present state government funding sources for improvements of elderly home units, especially through the stage CDBG program. It is suggested to create a state low-interest loan program, especially for home repair, mainly to benefit low-income persons.

In the U.S.A, the development of seniors’ housing is being affected from a macro perspective which includes the municipal specific development cost charges and the taxation of profits. U.S government should make further relaxations in these areas to attract more investments in this province. (Fritsch 2007, 11).

In U.S.A, there is no law regularizing the growth and development of independent housing facilities for seniors. This need of legislation is due to the fact that there is typically no care service is offered to the seniors. However, there exist some assisted living facilities to seniors provided by the State specific legislations. Hence, U.S government should introduce a federal legislation to nurture and development of private participation in the development of senior housing by extending tax credits and liberal interest subsidies to end homelessness. (Fritsch 2007, 7).

Government should see that all the benefits under the existing welfare schemes relating to senior housing at least 25 % should reach the elders. Government should try to earmark more funds for the senior housing schemes. U.S. government should seek the cooperation from private institutions for capital injection and public-private non-profit associations have to sponsor the affordable housing for elders on a yearly basis for the succeeding five years some of them could offer housing with financial supports. Transitional housing numbers should be augmented on annual basis and preference should be given to seniors. U.S government should contemplate to increase the number of elder supportive housing on the annual basis to spotlight to redress the homeless among elders.

U.S government should think of enhancing the national housing policy that safeguards and controls the present stock of homes for seniors, to augment the supply and at affordable cost. To convene conferences periodically so that key players from both federal and state ministries will participate in enhancing the service planning, sustainable and coordination of funding. U.S government should contemplate to introduce a new provincial scheme to put a full stop to poverty so that homeless among seniors may become a thing of the past. To eradicate duplication both in membership and roll, U.S government should examine the role of present colorations and planning bodies that are dedicated to homelessness. U.S government should earmark adequate funding for housing projects for seniors on a war footing basis. Further, U.S government should work for adequacy of security and income for senior housing projects by introducing an increase in minimum wages to be offered and to increase the quantum of subsidy for social assistance, Old Age Security and employment insurance for seniors.

U.S government should introduce a communication strategy to make sure that all the prime key players are aware of the measures undertaken by various government agencies and can participate and contribute suitable steps like scheduling forum for work for new eligible seniors and adequate training for agency staff. U.S government should disseminate updates on the progress of Community Action Strategy and on the available date which demonstrates housing outcomes for seniors. U.S government should on an annual basis evaluate the efficacy of the service structure and should introduce appropriate revision within available resources. U.S government should encourage coordination of research studies so as to offer detailed information about all facets of senior homelessness issue.

References

Aahsa.org, “Section 202 and 811 Funding For FY11 Support Letter Signed By 27 Senators.” Aahsa, 2010. Web.

Aahsa.org. “Congress Takes Up Tax Credit Legislation.” 2010. Web.

Blau, Joel & Abramovitz, Mimi. The Dynamics of Social Welfare Policy. Oxford: Oxford University Press, 2007.

Bratt, Stone and Hartman. A Right To Housing: Foundation for a New Social Agenda. New York: Temple University Press, 2006.

Creamer, Anita. “Study Warns More Senior Citizens Will Become Homeless.” 2010, Web.

Fritsch, Teresa. “A Strategic Analysis of Development Opportunities For Spectrum Seniors Housing.” 2007, Web.

Green, Richard K & Malpezzi Stephen. A Primer on U.S Housing Markets and Housing Policy. New York: The Urban Institute, 2003.

Hall, Peter Geoffrey. Cities of Tomorrow: An Intellectual history of Urban Planning and Design. New York: Wiley-Blackwell, 2002.

Hud.gov, N.D. “Section 202 Supportive Housing For Elderly Program. 2010. Web.

Jarrett, Alfred Abioseh. The Impact of Macro Social Systems on Ethnic Minorities in the USA. New York: Greenwood Publishing Group, 2000.

PBS.ORG, N, D. “Facts and Figures: The Homeless “, 2010. Web.

Schwartz, Alex F. Housing Policy in the United States. New York: CRC Press, 2006.

Squires, Gregory. Chicago: Race, Class and the Response to Urban Decline. New York: Temple University Press, 2002.