Introduction

The Chinese government’s announcement to open the Shenzhen stock market to foreign investors brings both opportunities and challenges. Under the Stock Connect program, Hong Kong investors are given the opportunity to buy shares from the Shenzhen stock exchange, which currently holds the majority of China’s consumer and tech companies. In return for this ability, mainland investors can also buy stocks from Hong Kong.

Market Size, Industry Sectors, Liquidity and Volatility

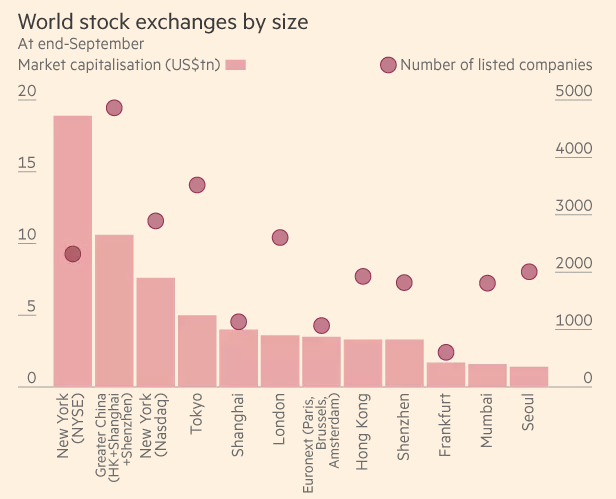

Shenzhen is the ninth-largest stock exchange in the world by market capitalization and the eighth largest by a number of listed companies (Wildau):

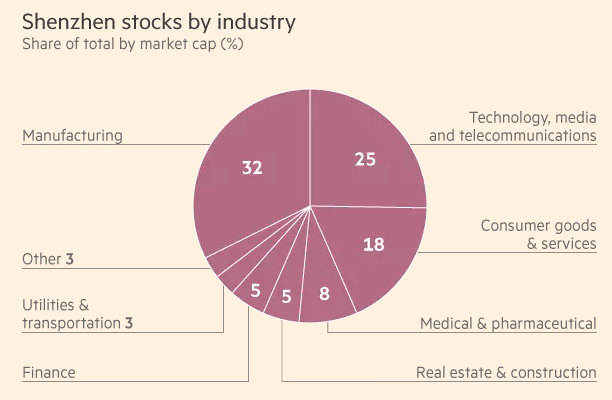

One of the reasons that it could be worth investing in Shenzhen’s stock market is that the companies there are concentrated in some of the most rapidly developing industries, such as health care, technology, and media (the so-called “New China”), whereas the Shanghai sector is predominantly oriented towards the industries of “Old China” such as energy and finance (Shaffer).

Therefore, the Shenzhen-Hong Kong connection will potentially open up a new and profitable world to investors looking to monetize the growth of these developing markets.

With regards to liquidity and volatility, the Shenzhen market is one of the most liquid by share turnover velocity, which measures turnover as a proportion of the total market cap (Wildau). Retail investors in the region favor Shenzhen due to the proliferation of small-cap stocks that present more opportunities to gain momentum. On the other hand, because speculators prefer to operate in Shenzhen, the market is becoming more volatile (Wildau). The beginning of 2014 serves as a good illustration of this situation; at that time, the Composite Index of Shenzhen either increased or decreased by 1% around 250 times per day, compared to 149 times in Shanghai and 105 times in Hang Seng, as shown in the diagram below:

The new ties between Shenzhen and Hong Kong are similar to the ones between Shanghai and Hong Kong with one key difference: only a daily quota will be available for Shenzhen (Shaffer). However, analysts have stated that removing the restrictions and opening up the stock market to foreign investors would not make a tremendous change. According to Shaffer’s article in CNBC News, China has not yet gotten a full grasp of the value of creating trustworthy markets, and the fact that they are opening up to foreign investors does not solve this fundamental problem. Indeed, it has been asserted that many investors still stay away from China’s regulatory environment because of its risks. Nevertheless, compared to the past decade, the business climate in the country is improving, and some analysts have stated that the interest of foreign investors in Shenzhen’s market could potentially exceed that of Shanghai, which is a promising forecast.

To attract wealthy investors, Shenzhen is currently working on improving market access and gradually limiting restrictions on the flow of money (Gismatullin and Robertson). With the removal of limits on foreign involvement in the bond market of the interbank, as well as with the “scrapped” guidelines on Qualified Foreign Institutional Investors’ asset allocations (Bloomberg News), Shenzhen is becoming more attractive for investors.

The Shenzhen-Hong Kong Stock Connect implies a more open system of finance, which is a step in the right direction to fix the issues that exist in Chinese markets. Since there is a tremendous difference in the way Shenzhen stocks are structured (only a quarter of the stocks are state-owned, compared with two-thirds in Shanghai) (Gough), there are more opportunities for foreign investors without having to experience a lot of pressure from state-owned companies. The Shenzhen Connect can open a new horizon of stocks that are representative of what the future holds for China, which is in contrast to the Shanghai Connect that represents the China of the past (Gough). This difference can also be explained by the distribution of industries as described previously; Shenzhen is focused on technology, media, and health care, while Shanghai is focused on finance and energy. It is expected that the new link with Shenzhen will open doors to smaller but more active international and domestic investors who are interested in the spheres of technology and entrepreneurship (Gough).

Investors looking to buy into the Shenzhen equity market will be presented with an opportunity to access stocks in the Shenzhen Stock Exchange Component Index as well as the Shenzhen Stock Exchange Small/Mid-Cap Innovation Index with a market value of more than six million yuan ($869 million) (Gismatullin and Robertson). Although the Composite Index has been changing, it was among the top performers in 2015, reaching 63% (Gismatullin and Robertson). In 2016, Shenzhen’s city benchmark gauge was down by 7.8%, according to Gismatullin and Robertson from Bloomberg.

Easier Hedging

For wealthy investors who are interested in buying stocks in Shenzhen, it is important to remember that the Connect link will potentially reduce the reliance on contract agents and, therefore, relieve the complications associated with renminbi hedging. This, in turn, will reduce the investment costs in Shenzhen and subsequently contribute to a decline in fees that investors pay—for instance, exchange-traded fund fees will decrease. The government will also be invested in monitoring the implementation of the Connect link to ensure that it contributes to the financial and economic reforms of the country as well as the reinforcement of the position of Hong Kong as a center of international finance (Gismatullin and Robertson).

Conclusion and Recommendations

Despite the challenges that Shenzhen is facing, the overall conclusion can be made that the Connect link will open an array of opportunities for wealthy investors, especially those who are interested in the rapidly developing industries of technology, media, and health care. With the depreciation of the renminbi and the abolition of the aggregate quota, the Stock Connect with Shenzhen is becoming a very popular choice for international investors. Furthermore, the Chinese government has also expressed its intentions to internationalize its market and strengthen the links between the equity market of the Chinese mainland and investors from around the world (Wells and Hughes).

Since the Shenzhen stock market is oriented towards entrepreneurship and innovation, the Chinese government is interested in opening the door to foreign investors who can contribute to the development and expansion of the sector. Although the market is volatile, it continues to expand and offer new opportunities. Paired together with the link between Shanghai and Hong Kong, the Shenzhen link will become the only effective route for investors from different countries to trade mainland stocks without having to get approval for their actions from the Beijing authorities. Overall, it is advisable for wealthy investors to look into buying equity stocks in Shenzhen due to the creation of the Shenzhen-Hong Kong Stock Connect and the increased focus of the sector on innovation and technology, both of which are very profitable.

Works Cited

Bloomberg News. “China Said to Scrap Foreign Allocation Limits to Lure Investors.” Bloomberg, 2016. Web.

Gismatullin, Eduard, and Benjamin Robertson. “Hong Kong Investors’ Wait to Trade Shenzhen Stocks Is Over.” Bloomberg, 2016. Web.

Gough, Neil. “Shenzhen Connect Offers Chinese Stocks? Will the World Buy?”NY Times, 2016. Web.

Shaffer, Leslie. “China Opening Shenzhen Stock Market May Meet Similarly Tepid Response as Shanghai-Hong Kong Connect.” CNBC, 2016. Web.

Wells, Peter, and Jennifer Hughes. “Will Foreign Investors Bite at China’s Shenzhen Link?” Financial Times, 2016. Web.

Wildau, Gabriel. “Five Charts that Explain how the Shenzhen Stock Exchange Works.” Financial Times, 2016. Web.