Executive Summary

The discussion presented below describes market equilibrium as a scenario when the recorded level of supply and demand intersects. The introduction of a shock will alter or adjust both supply and demand. The decision by the government of Germany to introduce a price ceiling will trigger a similar outcome. Nonetheless, more people in this county will be in a position to afford electricity despite the possible shortage in energy supply.

Market at Equilibrium

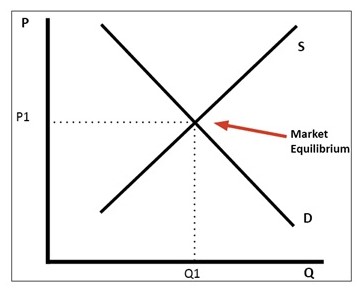

In the field of economics, a given market will be in a perfect equilibrium when the forces of demand and supply overlap (see Fig 1). This scenario will usually trigger what is known as equilibrium price (P1). If the targeted market does not encounter any external influence, chances are high are that the identified variables will remain unchanged (Ngondya and Mwangoka, 2017). This representation depicts the Germany electricity market before the introduction of the proposed shock.

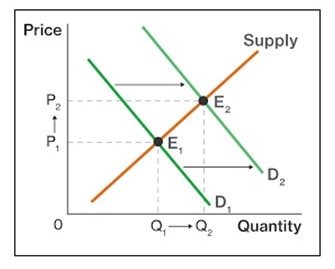

The selected shock for the current scenario is that of fixing price at a specific level. When the intended commodity or product is marketed at the implemented value, the level of demand (D2) will increase since more people will be able to afford it (Ngondya and Mwangoka, 2017). Incidentally, the recorded supply might remain constant for a period of time and eventually drop (see Fig 2).

This analysis echoes the scenario expected in Germany if the government introduces a price ceiling on electricity. Such a move will encourage more Germans to purchase electricity than ever before. This decision is essential since it will protect more consumers of power (Ohlhorst, 2015). The national grid could become strained and disorient the current level of electricity supply.

Possible Consequences

The identified price ceiling will have specific consequences on Germany’s electricity sector. The outstanding outcome is that more citizens will be in need of power than ever before. The available generators and distributors will also find it hard to meet the demand. Consequently, different regions across the country might record increased power shortages (Böhringer, Landis and Reaños, 2017). Excess demand will become a reality should the government invest heavily to minimize scarcity. A detailed analysis and knowledge of these possible outcomes will guide all policymakers to make informed decisions regarding the move.

Market Forces

Perfect markets experience diverse forces that can eventually stabilize the equilibrium. In Germany, the National Energy Act of 1988 established the country’s electricity sector as the best example of a natural monopoly (Ohlhorst, 2015). This move reduced chances of competition among different producers and suppliers of this utility. From this knowledge, it is agreeable that the introduction of a price ceiling would force all stakeholders to provide electricity at the recommended price. Such an initiative will ensure that the existing force of supply, price, and demand do not interfere with the artificial equilibrium. It will, therefore, be hard for this market to record a restoration of the original equilibrium.

Conclusion

The government’s decision to introduce a maximum pricing policy will present various benefits to more Germany citizens. Some of them will include the availability of affordable power and reduced chances of exploitation. However, the decision could result in increased power shortage, thereby making it impossible for the suppliers to meet the recorded demand. Additionally, the market will take long to record a natural equilibrium due such an intervention.

References

Böhringer, C., Landis, F. and Reaños, M.A.T. (2017) ‘Economic impacts of renewable energy promotion in Germany’, The Energy Journal, 38(S11), pp. 189-209.

Ngondya, D. and Mwangoka, J. (2017) ‘Demand–supply equilibrium in deregulated electricity markets for future smartgrid’, Cogent Engineering, 4(1).

Ohlhorst, D. (2015) ‘Germany’s energy transition policy between national targets and decentralized responsibilities’, Journal of Integrative Environmental Sciences, 12(4), pp. 303-322.