Introduction

Discovering of Panama’s pacific coast by Vasco Nunez de balboa in 1513, empire builders and merchants saw the need to have a shortcut for ships to sail from the Atlantic to the Pacific oceans. This would save them the 12,000 miles long journey they have to take around South America. Several visionaries tried in the next two centuries to advocate for the channel creation. Simon Bolivar, a revolutionary, hired architects and engineers to plot a viable route for the canal after independence.

Col. Charles Biddle of the U.S army sent by President Andrew Jackson in 1835 confirmed the impracticality of the Panama Canal project (DuTemple, 2003, p. 12). However, over the next years several speculators came up with possible canal building schemes. Theodore Roosevelt, the president opted to ensure us naval power domination in the two oceans by building the canal.

This is because of the long time it took naval ships to the Caribbean from San Francisco during the brink of war with Spain. In 1903, the independent state of Panama gave U.S. a nod to start the construction. Several risks challenges came at the beginning of the project like yellow fever that was overcome (DuTemple, 2003, p. 7). The canal was completed in 1913 and opened in 1914. The canal is a viable commercial project and its expansion is set to be complete by 2015.

Panama Canal expansion risks and risk management methods

Panamax project is a large infrastructure project in terms of the resources involved and the amount of work at hand hence it involves various risks. Therefore, formal risk management methods are vital in a project of its magnitude thus the need to know the enterprise risks involved (Kendrick, 2003, p. 2).

Such is a combination of natural environmental risks, operational and financial risks. Panama Canal Authority (ACP) has the task of assessing the risks and coming up with an elaborate risk management plan. All the risks faced by the expansion project are characterized into a risk management cycle which balances on management measures.

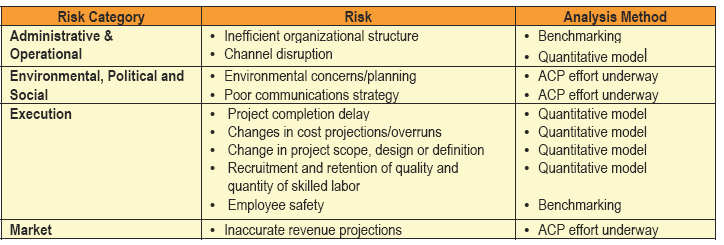

ACP’s risk management plan prioritizes and quantifies the material risks involved in the project. There is analysis of unexpected future risks with reference to the present working scope. The review by ACP identifies several risks that can prejudice the completion of the Canal expansion project, though probable risk implications vary across the association. The table below elicits the risks involved in the expansion project (mayo, 2005, p. 1-2);

The risk on analysis can cause a delay of over 1 and ½ years with costs shooting up to $200 million. The main quantifiable risks involved are;

- Completion delay as a result of material delay: This can arise from difficulties on the side of contractors delivering resources, labor, logistics, equipment and bad weather. However, many of these have chances of partial mitigation.

- Structural organization: The present organizational structure may prove efficient and effective with the present work scope. However if can be dysfunctional with the expansion of the project. ACP’s risk management plan captures the organizational structure.

- Safety of the employees at the expansion project: Based on the statistics available, this risk does not merit the materiality threshold.

- Skilled manpower for the project: Recruitment and retention of skilled manpower for the expansion project also poses a big challenge. Mitigation of this is through a transition and mentoring program.

- Project costs: This includes change in the initial project cost estimation and overruns.

- Project definition and scope: This captures the changes in the initial project design and definition.

- Disruption of channel: Since the channel is currently under utilization, the expansion project presents a disruption challenge.

- Political, environmental and social risks: They include risks associated with water resources handling like availability, pressure from environmental and other interest bodies. This causes delay in approval and political interest interference.

- Market risks: market variable like demand, competition pricing strategies and world economic trends are dynamic. This can lead to difficulties in toll raising, economic crisis, and shipping market tendency changes.

ACP has the task of evaluating the level of exposure of the Panama Canal to future risks than involve probability of an undesired result within the specified project cost, technical aspects and task schedule.

Risk impact analysis

The Panama Canal expansion project risks exposure to occurrences which are likely to impact on its financial performance. The projected risk value is a product of risk impact and probability of the risk occurring (Kendrick, 2003, p. 3). Having more information about the risks gives an upper hand towards mitigating, transfer or total risk elimination (Inside U.S. trade, 1983, p 11). ACP has adopted a structured way in identifying, assessing and analyzing to develop a risk management plan which includes;

- Identification of risk: There is identification of the technical and financial risks associated with the Canal expansion and their probability determined.

- Analysis of the risk: At this stage, there is analysis of the identified risks to establish the level of their implications. This is done by rating the risk and risk event prioritization by probability and intensity of the impact.

- Planning of the risk: This involves a documenting a continuous risk assessment plan for monitoring and evaluation. It involves evaluation of how the risks have evolved and assigns sufficient resources as per cost and time frame.

- Monitoring of risk: Tracking of the risk management tools performance against defined metrics. Further risk management options can be introduced where appropriate.

- Documentation of risk: It includes documentation of records and reports of the risk management strategies for result monitoring.

Recommendations on managing Panama Canal expansion

With the various challenges and risks presented by the Panama Canal expansion project, several recommendations will ensure successful project completion. There has to be an examination of the functional ability of the canal when expanded to estimate yearly vessel traffic. Establish the price advantages of the new Post Panamax vessels. Evaluation of availability of adequate water for the project’s demand is vital as it has an impact on the number of vessels to utilize the canal reasonably.

Assessing of adjacent ports for the ability to handle Post Panamax vessels is fundamental. The ports are putting forward various measures and adjustments in preparation of the increased ship traffic on completion of the Canal project. Investigation on the possibility of routing sea traffic from the west to alternative ports is important and consideration of the associated sailing costs.

Assess the alternative port’s capacity to accommodate the additional traffic with reference to reasons that favor diversion or attraction of ships to that port. Additionally, a study to examine to economic reasons that motivate new container orders is necessary to validate the viability of the expansion project.

References

DuTemple, L. A. (2003). The Panama Canal. Minneapolis, MN: Lerner.

Inside U.S. trade. (1983). Washington, D.C: Inside Washington Publishers.

Kendrick, T. (2003). Identifying and managing project risk: Essential tools for failure- proofing your project. New York: AMACOM.

Mayo. D, (2005). The Panama Canal Authority CanalExpansion Risk Assessment Report. Web.