Introduction

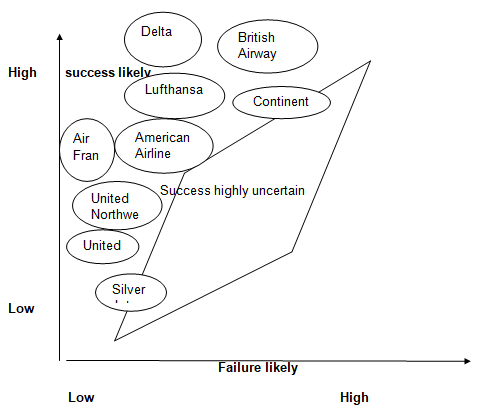

The Transatlantic airline market is one of the very competitive airline industries. Among the dominant airline companies in this industry are Delta, which dominates 12% of the market share. British Airways follows with a market share of 11%. In the third position we have two airlines that is, Continental and Lufthansa, which share equally 18% of the market share.

American, Air France, United Northwest and US Airways own 7%, 6%, 6%, 5%, 5% and 4% respectively. Other airline companies share the remaining 26%. Silver jet dominates about 2% of the market share. These airline companies operate in the US, Europe, India, Africa, and the Middle East. The table below attempts to determine similarities and differences that exist among airline companies in transatlantic market.

Analysis of Silver Jet market position in the transatlantic airline market using Porter’s five forces model

Industry rivalry: high

The industry is very competitive considering that giants like Delta and British Airways dominate the market. It is also true that these companies have been in operation for quite some time hence earning a strong loyalty from customers. The high price charged does not affect their position in the market.

Threats of substitute: strong

The market witnessed stiff competition from other means of transport such as road and advanced electric train. This has consequently forced many airline companies to lower their fare prices. Silver jet faced difficulties in the industry due to availability of other means of transport in the transportation industry (Porter 1990, p. 90).

Suppliers bargaining power: strong

It has occurred that other airline companies have been building strong relationships with manufacturers such as Boeing. This has been a threat to other airlines that do not have ties with manufactures.

Threats of entrants: low

The chances of entering this industry is quite complex, as it requires heavy capital base. This means that only few companies and individuals can afford. It is as well difficult to enter this market considering the fact that building loyalty perhaps takes quite a long time.

Buyer bargaining power: strong

Buyers can decide to leave one airline company if its charges are perceived to be reasonably high. This has frequently happened in this industry where many firms have lost customers on grounds that they charge high prices.

Attractiveness of investing in transatlantic industry

The transatlantic airline industry is attractive during economic recovery as well as at the boom. This is the time when several tourists tend to tour diverse countries. In addition, businesspersons as well as diplomats travel a lot during such periods (Ghemawat 1999, p. 31). This ensures that many aircrafts avoid flying with empty seats thus maximizing profits. The market for airlines is also attractive since it is very difficult for new competitors to enter the market.

Relationship between transatlantic industry strategic group and its organizational focus

The strategy of Sliver Jet was to broaden differentiation strategy which focused on providing quality services as well as offering diverse services, such as drinks, food, checks for security purposes among others. However, the company found itself in problems after its operations shut down in June 2008. The fall can be attributed to stiff competition.

List of References

Ghemawat, P 1999, Games Businesses Play: Cases and Models, MIT Press, Cambridge.

Porter, ME 1990, The Competitive Advantage of Nations, London, MacMillan Press.