20 Years of Airline Business Performance

The past 20 years have brought many challenges to the global airline industry. All around the world, companies have suffered severe losses due to volatile fuel prices, incremental costs, a periodic reduction in the number of passengers, and several extraordinary events. Namely, three main points had a significant negative impact on the economy and performance of airline companies: the September 11 attacks in 2001, the financial crisis of 2008, and the COVID-19 pandemic of 2019.

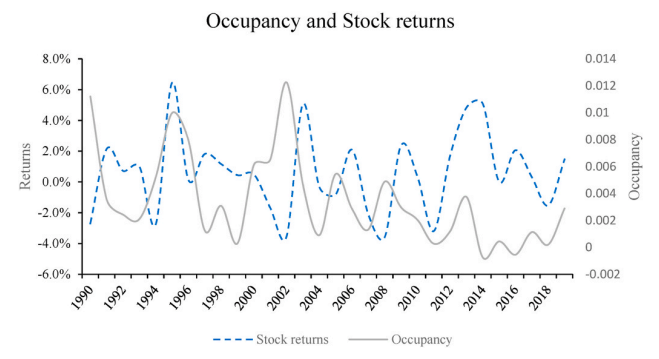

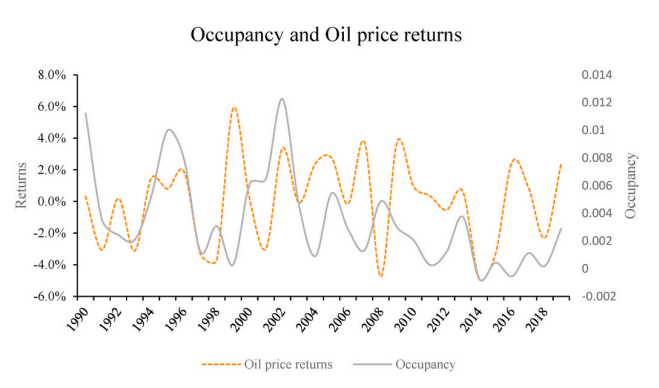

The 9-11 event had a great world resonance that paralyzed airline operations for days and significantly decreased the public desire to travel by air. In the U.S., the place of the event occurrence, the impact was the strongest (Zhang and Zhang, 2018). For example, Figure 1 showcases the dynamics of U.S. airline companies’ seat occupancy, stock returns, and oil returns over the sample. As can be seen, stock returns and seat occupancy show sharp drops due to the terrorist attacks of 9-11. Another recession due to the 2008’s financial crisis is evident from the opposite curve development of stock returns and occupancy. It is connected with the lower returns from oil prices highlighted in figure 2. Since airline companies incurred high costs because of increases in oil prices caused by financial instability, it had put respective pressure on airline stocks.

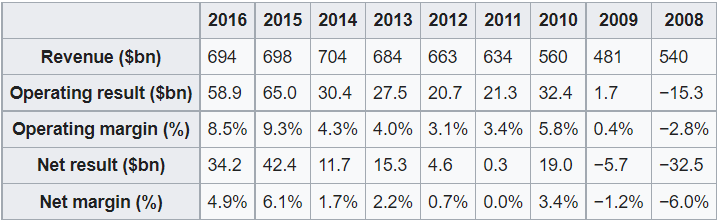

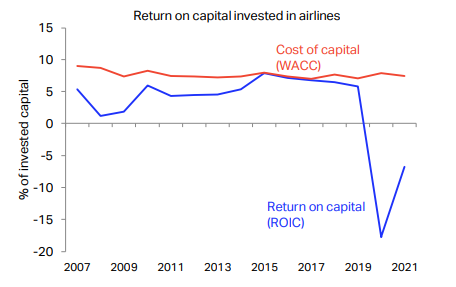

The decade that followed after 2008 can be generally considered prosperous for the industry. Figure 3 illustrates the statistics of the global airline industry’s annual revenues and associated parameters. Judging by the operating result, the losses of 2008 have been gradually converted to profit in 2016. In terms of returns on investments, the airline industry’s debt providers have been historically rewarded for their contributions, usually investing in security assets (Joshi and Ashu, 2020). In business cycles prior to 2019, the airline industry has generally been able to generate enough revenue, serving its debts and paying the suppliers’ bills (IATA, 2020). However, the pandemic’s effect proved to be the worst crisis the industry experienced. Figure 4 presents the returns on airlines’ capital investments from 2007 to 2021. Despite the cost of capital remaining relatively stable, the losses caused by the issued lockdown went from 5% to almost -18% (IATA, 2020). Nowadays, the industry is in a recovery state, while companies around the world are looking for the means to adjust their costs to lower revenues and restore their activity.

Examples of Implemeneted Strategies

In order to survive during harsh times and prosper in the good ones, airline companies implemented various strategies in different business areas. The workforce management section will generalize activities such as firing, hiring, and training employees. The consumer policy section will summarize policies and general customer approaches. Efforts directed at the improvement of aircraft in possession in this paper will be discussed in the aircraft efficiency section. Finally, the operations between companies associated with the change or modification of ownership will be viewed in the last paragraph.

Workforce Management

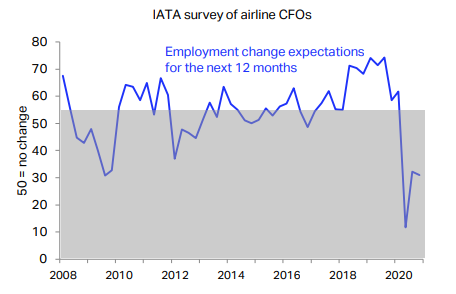

During harsh times, airlines face pressure to limit their expenses. If air travel does not recover quickly, the workforce in the industry will also come under pressure. Figure 6 presents the employment change expectations for the 2008-2020 period. For instance, due to the COVID-19 pandemic, the estimated airline employment might decline to 1.9 million in 2020 and register only a slight improvement in 2021 (IATA, 2020). In turn, productivity will likely fall as well, with the average employee providing fewer available tonne kilometers annually. However, airline profit margins will continue to be limited despite wage declines in the industry. The jobs being created not only aim at productivity for airline employers but also have to be highly effective for the employing economies.

In this context, recruitment and selection processes become critical for business owners. According to Alola and Alafeshat (2021), recruiting the best candidates in the organization significantly contributes to productivity. Meanwhile, successful selection and recruitment represent the efficiency of the human resource department. Therefore, organizational productivity is determined by the type of workers employed. To cover the mentioned factors, human resource management utilizes many theories, such as, for example, social exchange theory (SET).

SET is among the most influential theoretical paradigms in understanding workplace behavior. It was adopted to describe, develop and set the hypothetical relationship of the associated variables. One of the SET’s attributes is that workplace relationships develop over time until they reach commitment. Moreover, people engage in these relationships because of the potential mutual benefit. For instance, when organizations recruit and train employees, they, in turn, respond by providing expert ideas (Shin, Lee, and Hall, 2022). This relationship can be considered symbiotic, implying there should be something in exchange. Consequently, applying SET in human resources is based on the exchange rule.

Consumer Policy

Consumer policy involves factors that influence customers to prefer the chosen company. For instance, price discrimination as the source of price variation depending on the customer type is common in the airline industry (Zhang, Zhang, and Huang, 2021). Zhang, Zhang, and Huang (2021) define three degrees of price discrimination: first, second, and third. Under first-degree discrimination, companies obtain the entire consumer surplus; it depends on the company’s ability to determine the consumer’s reservation price. Price discrimination of a second degree implies the practice of an individual’s price change for different quantities of the same product. For instance, a flyer program falls within this type as it awards points to passengers that can be used later, resembling a sort of discount. Finally, third-degree price discrimination directly sets different prices for different consumer groups. Many airlines offer corporate travel programs and lower contract prices – an example of the practice of this price discrimination type.

The newly emerged technology has enhanced price discrimination in a variety of ways. Means, such as artificial intelligence or big data, can lead to a revolution in personalization and airline pricing (Anshari et al., 2019). Dynamic pricing resulting from big data allows airlines to predict customer preferences and demand, offering them an optimal fare (Wang, Tsai, and Ciou, 2020). In turn, the artificial intelligence system can track the volume of search requests on the airline website based on the customers’ browsing patterns (Bala and Verma, 2018). Consequently, the airlines can make rapid changes to airfare when needed.

Aircraft Efficiency

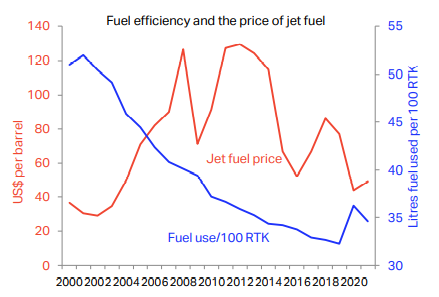

Careful management of fuel is a leading priority for the aviation industry. The expansion of air transportation and fuel prices restated the need for continuous monitoring. These fluctuations continued even after the year 2008, as is evident from Figure 7. With all these upsurges in jet prices, fuel expenses can reach nearly 40–50% of the airline’s overall operating cost (Singh, Sharma, and Srivastava, 2018). Also, the CO2 emissions proportional to aircraft fuel consumption are rapidly rising according to the transportation growth. Thus, both economic and environmental challenges demand advancement in aviation fuel efficiency. It will reduce the share of fuel in the operating cost, secure fuel availability for a more extended period, and restrict the environmental footprints (Fafoutellis, Mantouka, and Vlahogianni, 2020). Aviation fuel efficiency is measured in revenue passenger kilometers performed per fuel consumption unit. Aviation fuel efficiency in the past was achieved through aircraft technology, but the pace was hindered due to the limits of the engine and aerodynamic efficiency improvements. Consequently, the aviation industry started to consider all feasible options, such as alternative fuel development, socio-economic and political conditions’ exploitation, advanced aircraft design, and improvements in aviation infrastructure.

Alliances and Mergers

In the airline market, only a few airlines compete against each other, making the market oligopolistic. In this context, an increase in concentration due to airline alliances and mergers provide significant market power to the airlines (Franck and Peitz, 2019). Today, three major alliance groups – One World, Star Alliance, and SkyTeam – control over 60% of the world market (Zhang, Zhang, and Huang, 2021). Other reasons for airlines to merge include expansion of service networks, traffic feeding between partners, cost efficiency, and quality improvement (Zhang, Zhang, and Huang, 2021). For example, a merger between the British and Spanish companies of British Airways and Iberia allowed them to compete with other airlines and secured annual savings of €400 million (Santana, Valle, and Galan, 2019). A significant part came from reducing or eliminating overlapping and unprofitable European routes. In many countries, antitrust laws and active enforcement made mergers and alliances difficult to use as a tool for market power gain.

Reference List

Ali, N.S.Y., Yu, C. and See, K.F. (2021) ‘Four decades of airline productivity and efficiency studies: A review and bibliometric analysis’, Journal of Air Transport Management, 96, p.102099.

Alola, U.V. and Alafeshat, R. (2021) ‘The impact of human resource practices on employee engagement in the airline industry’, Journal of Public Affairs, 21(1), pp. 1-12.

Anshari, M., Almunawar, M. N., Lim, S. A., and Al-Mudimigh, A. (2019) ‘Customer relationship management and big data enabled: Personalization & customization of services’, Applied Computing and Informatics, 15(2), pp. 94-101.

Bala, M., & Verma, D. (2018) ‘A critical review of digital marketing’,International Journal of Management, IT & Engineering, 8(10), pp. 321-339. Web.

Fafoutellis, P., Mantouka, E.G. and Vlahogianni, E.I. (2020) ‘Eco-driving and its impacts on fuel efficiency: An overview of technologies and data-driven methods’, Sustainability, 13(1), p.226. Web.

Franck, J. U., and Peitz, M. (2019) Market definition and market power in the platform economy.

Bruxelles: Centre on Regulation in Europe (CERRE).

IATA. (2020) Economic performance of the airline industry. Web.

Joshi, S.K. and Ashu, S. (2020) ‘Smart airline solutions are the next game changer for airline industry’, Journal of Hospitality Application & Research, 15(1), pp.37-56.

Lee, D.S., Fahey, D.W., Skowron, A., Allen, M.R., Burkhardt, U., Chen, Q., Doherty, S.J., Freeman, S., Forster, P.M., Fuglestvedt, J. and Gettelman, A. (2021) ‘The contribution of global aviation to anthropogenic climate forcing for 2000 to 2018’, Atmospheric Environment, 244, p.117834.

Mollick, A. V., and Amin, M. R. (2021). Occupancy, oil prices, and stock returns: Evidence from the U.S. airline industry. Journal of Air Transport Management, 91, pp. 1-9.

Santana, M., Valle, R. and Galan, J.L. (2019). ‘How national institutions limit turnaround strategies and human resource management: A comparative study in the airline industry’, European Management Review, 16(4), pp.923-935. Web.

Shin, S.I., Lee, K.Y. and Hall, D.J. (2022) ‘Examining the role of perceived social benefit and trust matter in sustainability of online social networking community-social exchange theory perspective’, International Journal of Web Based Communities, 18(2), pp.109-129. Web.

Singh, J., Sharma, S.K. and Srivastava, R. (2018) ‘Managing fuel efficiency in the aviation sector: Challenges, accomplishments and opportunities’, FIIB Business Review, 7(4), pp.244-251.

Sobolev, L. (2020) ‘Labour Productivity in Different Segments of Aircraft Industry’, Research in World Economy, 11(3), pp.245-250.

Wang, S. C., Tsai, Y. T., and Ciou, Y. S. (2020) ‘A hybrid big data analytical approach for analyzing customer patterns through an integrated supply chain network’, Journal of Industrial Information Integration, 20. Web.

World Airline Rankings (2017) Web.

Zhang, A. and Zhang, Y. (2018) ‘Airline economics and finance’, in Halpern, N. and Graham, A. (eds.) The Routledge Companion to Air Transport Management. Oxon: Routledge, pp.171-188.

Zhang, A., Zhang, Y., and Huang, Z. (2021) ‘Airline economics’, in Vickerman, R. (ed.) International Encyclopedia of Transportation. Amsterdam: Elsevier, pp. 392-396.