Abstract

This paper explores the need for Singapore airlines to seek more to meet its strategic goals. It shows that competition in the aviation sector is the greatest undoing for the company because it has eroded the company’s profits and limited its operational efficiencies. At the same time, diverse customer needs and high service expectations have forced the airline to seek partnerships with other companies. However, because Singapore laws prohibit full cross-border partnerships, the company’s partnership strategy may be limited in this regard. Nonetheless, because the same government guarantees antitrust immunity, the airline may still yield positive results from such partnership agreements.

Introduction

For over five decades, Singapore Airline has made a name for itself as a reliable airline company (Fickling, 2012). Its reputation in the global aviation sector is good. From its Changi airport hub, Singapore Airlines has developed an expansive service network that spans more than 90 cities around the world (Heracleous & Wirtz, 2009). However, its strongest market presence is in Asia and Oceania (Heracleous & Wirtz, 2009). Besides passenger transport, Singapore Airline also offers other airline services, such as airport engineering and aircraft handling.

The dominance of Singapore Airline has declined in the last few years. For example, the company has since lost the coveted prize of being the world’s best airline to Qatar Airways (a price it held for five years, before 2008) (Fickling, 2012). Since then, it has had trouble regaining it. The company’s dominance in the airline industry is also declining, based on the eroding operational competency of the airline (Fickling, 2012). For example, Singapore Airline outwitted its rivals by operating a fleet of large Airbus A380s (Heracleous & Wirtz, 2009). However, its competitors have caught up with it and are now operating the same aircraft.

For instance, Thai Airways International and Malaysia Airlines operate these aircraft and enjoy the same competency as it does. Based on these developments, Singapore Airline has to find new strategies to address the competitive pressures it currently experiences because they undermine the company’s goals. This paper addresses partnerships as a strategic tool for achieving the company’s long-term strategic goals. However, before delving into the details surrounding this strategic option, it is pertinent to understand what contributed to the current situation of Singapore Airline.

What contributed to the Current Situation?

Competition in the aviation sector is at an all-time high (Akbar & Abdullah, 2010). Many regional airlines are grappling with the problem of reduced profitability and declining passenger numbers because of an influx of major competitors in the aviation sector. The main competitors of Singapore Airlines are in Europe-Asia routes because other dominant airlines, such as Emirates Airlines and Qatar Airlines, have a significant market share (Pasiuk, 2006). Low-cost airlines, such as Air Asia and Qatar airways, are also shrinking the market share of Singapore Airline in the regional and economic market segment (Fickling, 2012). In this regard, competition from low-cost airlines and long-haul carriers shows that the market share of Singapore Airline is declining from both ends of the market (premium and economy market segments).

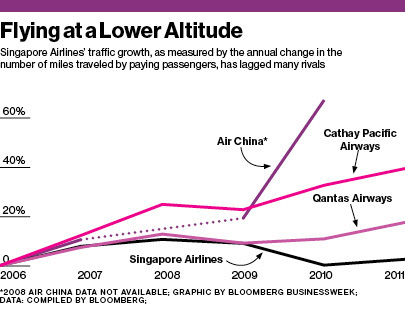

Since 2008, Singapore Airline has reported a 12% decline in passenger traffic (Fickling, 2012). Compared to its rivals, the airline has reported among the lowest traffic growth as a measure of the miles traveled by paying passengers. The diagram below shows this fact.

These factors explain why the airline has reported declining profitability in the last five years. In fact, experts are pessimistic about the company’s prospects of reporting double-digit profit margins as it did in the past (Heracleous & Wirtz, 2009). Despite these challenges, Singapore Airline remains one of the most resilient and respectable airline companies in the world (Heracleous & Wirtz, 2009). However, the above-mentioned factors have undermined the company’s long-term strategy, which is to create the world’s best travel experience.

What is the Social/Political/Economic Climate of Topic?

Economic

Some of the challenges that affect Singapore Airline come from lower sales and low passenger numbers. Uncertain economic conditions in the global aviation industry have further worsened this problem because fewer people are traveling, and the cost of operations is increasing. Fuel costs alone account for more than 40% of the company’s operating costs (Fickling, 2012). However, this challenge is not only unique to Singapore airlines because Fickling (2012) says, “a weak economic environment and high fuel prices are particularly challenging to long-haul airlines” (p. 1). While competition is a basis for concern, airline companies also have to contend with stiff competition in industries that supply them with goods and services. For example, the two largest aircraft manufactures (Airbus and Boeing) compete with one another. At the same time, air traffic controls are monopolies.

Political

Competition is central to the operations of airline companies. It fosters innovation, productivity, and growth for most players in the sector (Fischer & Kamerschen, 2003). However, the global aviation market is inefficient. Therefore, it is difficult for companies to compete on an equal platform. Competition has been a hallmark in the aviation sector. It was mild when governments used to be majority shareholders in aviation companies. However, the wave of privatization (that started in the 1980s) jolted the industry by making most airline companies vulnerable to privatization. The lack of government involvement increased the competitive push for players in the sector to seek more passengers through aggressive operational and marketing strategies (Fischer & Kamerschen, 2003). Such intense competition is evident in most parts of the world.

For example, in the US, all airline companies are private and compete with one another in this regard. Competition in the airline sector increased a notch higher after the entry of low-cost airlines, such as Southwest, Ryan Air, and Easy Jet (Fickling, 2012). These airline companies have not only eroded the market share of other short-haul flights but also increased their market shares in segments previously dominated by major airline companies. Existing state carriers have also reported increased competition from other airline companies, such as those that originate from the Persian Gulf (Fickling, 2012).

Some observers say these airlines have introduced stiff competition in the sector because of fuel subsidies, reduced landing costs, and other state privileges offered to them by their governments (Fischer & Kamerschen, 2003). As if these pressures are not enough, the airline industry has continued to suffer from the pressures of increased terrorism threats (especially after 9/11). The rise of global communicable diseases, such as SARS and Ebola, has further compounded operations in the industry.

Social

Observers have criticized the aviation sector for its high carbon footprint. Within the transport sector, experts say it accounts for the large volumes of fossil fuel and greenhouse gas emissions (Schueneman, 2014). In fact, the Air Transport Action Group claims that the aviation sector contributes 2% of the global carbon emissions (Schueneman, 2014). Some observers say this percentage could be higher because the industry prefers to portray a modest contribution of greenhouse gases (Schueneman, 2014). However, independent studies show that the aviation sector is among the fastest-growing contributors to greenhouse gases in the world (Schueneman, 2014). These studies also show that within the transport sector alone, the aviation sector contributes up to 13% of greenhouse gas emissions (Schueneman, 2014). Based on these statistics, the aviation sector has received immense social pressure to reduce its greenhouse gas emissions. To counter this pressure, some airline companies have merged to develop alternative energy. For example, there has been a global push among airlines to develop biofuels as an alternative to fossil fuels. However, without the participation of many airlines, it is difficult to actualize this dream. Indeed, many Airlines have to contribute towards research and development processes that would actualize this dream. This goal has magnified the need for seeking beneficial partnerships in the aviation sector.

What is the Core of the Issue Today?

The doctrine of partnerships in the aviation sector remains misunderstood by many people. Regardless of these facts, it remains a major topic of discussion for most airline companies (Fickling, 2012). Seeking a beneficial partnership is not only a useful strategy in the aviation sector but other economic sectors as well. However, they are more common in the airline sector than all other sectors (Borenstein & Rose, 1994).

Partnerships between aviation companies are not new. This is because airline companies in 1919 (and beyond) used it to overcome industry competition (Pasiuk, 2006). For example, in the 1920s, small airline companies adopted a rationalization and consolidation strategy to compete with long-haul airline companies that enjoyed government subsidies (Borenstein & Rose, 1994). Furthermore, in 1924, four airline companies (Instone Air Line Company, British Marine Air Navigation, Daimler Airway, and Handley Page Transport Co Ltd) collaborated to form a new airline company – Imperial Airways to counter competition that came from other airline companies (Pasiuk, 2006). These intrigues show that most partnerships in the airline sector emerged during the 1980s and 1990s when mergers and acquisitions characterized changes in the airline sector (Borenstein & Rose, 1994). Experts feared that this trend would create an increased concentration in the industry and deny customers the benefit of a deregulated industry (Borenstein & Rose, 1994).

However, these fears were unfounded because new low-cost airlines, such as Southwest airlines, slowed down the trend towards industry concentration (Borenstein & Rose, 1994). Nonetheless, partnerships in the airline sector transferred the business to major airlines. For example, Riwo-Abudho et al. (2013) say, the ten leading airline companies shared 95% of domestic passenger trips in Europe. In fact, the top five airlines shared 70% of the domestic business (Riwo-Abudho et al., 2013). This outcome showed that most partnerships in the airline sector yielded increased business.

Why is the Issue relevant to the Industry?

There are different kinds of partnerships in the aviation sector. They include joint ventures, built, operate and transfer (BOT), build, own and transfer (BOT), Built, own, lease and transfer (BOLT), lease, develop, operate (LDO), build, own, and operate (BOO), and management contracts (MC) (Singapore Press Holdings, 2007). To foster partnership agreements, all the parties involved must meet their objectives. While such objectives may vary, success is the common denominator for all the players involved. Simply put, all the players involved striving to have a win-win outcome in their agreements (Singapore Press Holdings, 2007).

Northwest Airlines and KLM are examples of airlines that have successfully pursued this strategy. There have been other smaller domestic partnerships between airlines, but experts posit that the greatest alliances in the aviation sector include the Star Alliance, Sky Team Alliance, and One World Alliance (Fischer & Kamerschen, 2003). Singapore Airline belongs to the Star Alliance (Heracleous & Wirtz, 2009). The power of such an alliance stems from their high capacity in international aviation circles. For example, Riwo-Abudho et al. (2013) say they provide an 80% capacity over the aviation routes that span across the Atlantic and Pacific. They also command the same percentage over Europe-Asia routes. These factors show that most partnerships are relevant to the aviation industry.

What are the Effects of the Issue from the Smallest to the Largest?

Improved Operations

Through its elaborate partnership strategy, Singapore airline has joined the Star Alliance, which has helped the airline to expand its global presence in more than 140 countries (Heracleous & Wirtz, 2009). Indeed, partnership agreements are important for aviation companies because their customers have an increased need to have seamless services (despite the logistical hardships of delivering such services).

However, few airlines can deliver such services without seeking the help of other airlines. For example, few airlines can generate sufficient passenger traffic to justify a seamless service itinerary. To overcome these operational problems, airline companies have to seek partnerships to provide the network and service expectations required by their customers. This is the case of Singapore airlines because its customers have strong networking and service requirements. Nonetheless, legal requirements restrict partnership agreements (especially foreign participation in local company operations). Therefore, this provision stifles cross-border partnerships.

Increased Sales

The decision to collaborate with another airline is an important one for any management body that oversees the activities of airline companies (Borenstein & Rose, 1994). This strategy has been of more concern to domestic airlines that fear that such a strategy could attenuate competition (Borenstein & Rose, 1994; Riwo-Abudho, Njanja, & Ochieng, 2013). Legal considerations are also important because governments often supervise partnership agreements after evaluating how they affect the competitive landscape of the sector. Studies by Riwo-Abudho et al. (2013) show that airline companies, which operate in areas where they enjoy strong market power, likely build higher capacity markets. This outcome suffices because such partnerships are likely to enjoy the benefits of higher pricing as opposed to high demand. In fact, evidence shows that such companies could charge $9 more for every ticket sale, compared to what their competitors could offer (Borenstein & Rose, 1994).

Customer Loyalty

For a long time, airlines have sought partnerships in the aviation sector to increase their customer numbers. For example, airline companies find it easier to handle large volumes of passenger traffic by using common airport facilities (Singapore Press Holdings, 2007). In hindsight, these partnerships are useful in identifying areas of weakness for the airline companies and seeking better ways of solving them. Airlines could realize these improvements by identifying unique customer needs and requirements and using the partnerships to know how to meet these needs and requirements. Through these partnerships, airlines can also increase customer loyalty, especially for customers who are loyal to either of the parties involved in the partnerships.

Discussion

Despite increased competition in the aviation sector, Singapore airline has never reported an annual loss since its inception in 1972 (Fickling, 2012). Its large cash deposits have spurred its growth trajectory. Competition has led to significant losses for Singapore Airlines. According to Fickling (2012), the company has reported a net loss of about $31.7 billion between 2001 and 2010. The cutthroat competitive environment has also eroded shareholder value during the same period.

Competition has also seen Singapore Airline lose its market share in some of its key routes. For example, Air Asia recently accused Singapore Airlines of preventing it from operating in the Singapore-Kuala Lumpur route (a highly lucrative route for the airline) (Singapore Press Holdings, 2007). Because of political pressure, the government of Singapore had to open the route to the competition. Consequently, Singapore Airlines lost more than 40% of its market share. Malaysia Airlines, which also profited from the limited competition in this route, lost more than 17% of its market share after the entry of new players in this route (Singapore Press Holdings, 2007). To maintain some semblance of market dominance in the route (and other routes), Singapore Airline pursues many partnership agreements. They appear below

Codeshare agreements

Besides being part of the Star Alliance, Singapore Airline shares codes with other major global airlines such as Virgin Atlantic, Malaysia Airlines, JetBlue airlines, Japan Airlines, and US Airways (Singapore Press Holdings, 2007). Other airlines that seldom codeshare with the airline include, Vistara, Garuda Indonesia, Silkair, and Transaero Airlines (Singapore Press Holdings, 2007).

Bilateral Aviation Agreements

Bilateral aviation agreements help companies to expand their network presence around the world. Singapore Airlines has benefitted from such agreements and expanded its networks as expected. The company’s greatest success is the bilateral trade agreement between Singapore and Thailand (Singapore Press Holdings, 2007). A similar bilateral agreement with the United Arab Emirates has helped the company to expand its route network to Dubai and other parts of the Middle East (Singapore Press Holdings, 2007).

Conclusion

Seeking partners is a common operational strategy for aviation companies. Partnerships in the aviation sector have bolstered the corporate strategy of Singapore airlines, which has succeeded in increasing its service network in this way. Such arrangements have reduced the need for mergers and acquisitions, as alternative strategies for managing competitive pressures. Partnerships have increased the company’s service quality and created more value for its customers, based on the services offered. These partnerships have brought significant benefits to the airline’s customers. Although this paper highlights the benefits of business partnerships, it is crucial to note that these partnerships cannot occur in a vacuum. Businesses have to share the same vision and goals. This principle should guide future partnerships of Singapore Airlines.

Stated differently, the airline should seek partnerships with other airlines that share its vision and goals. Overall, this paper’s findings are useful to policymakers and airline companies because they would enable them to find better ways of managing competition and improving their operations (Fischer & Kamerschen, 2003). Based on the same importance, Singapore Airline needs to foster existing partnerships because it is the best way for the company to give its customers what they want. Similarly, it is the best way for the company to realize greater efficiencies in its local and global operations.

References

Akbar, T., & Abdullah, T. (2010). Competition in the airline industry: The case of price war between Malaysia Airlines and AirAsia. Central Asia Business Journal, 3(9), 57-71. Web.

Borenstein, S., & Rose, N. (1994). Competition and Price Dispersal in the US Airline Industry. Journal of Political Economy, 102(4), 653-683. Web.

Fickling, D. (2012). Singapore Airlines’ Competition Rises. Web.

Fischer, T., & Kamerschen, D. (2003). Measuring Competition in the U.S. Airline Industry Using the Rosse-Panzar Test and Cross-Sectional Regression Analyses. Journal of Applied Economics, 6(1), 73-93. Web.

Heracleous, L., & Wirtz, J. (2009). Strategy and organization at Singapore Airlines: Achieving sustainable advantage through dual strategy. Journal of Air Transport Management, 15(1), 274–279. Web.

Heracleous, L., & Wirtz, J. (2014). Singapore Airlines: Achieving Sustainable Advantage through Mastering Paradox. The Journal of Applied Behavioral Science, 50(2) 150–170. Web.

Pasiuk, L. (2006). Vault Guide to the Top Transportation Industry Employers. New York, NY: Vault Inc. Web.

Riwo-Abudho, M., Njanja, L., & Ochieng, I. (2013). Key Success Factors in Airlines: Overcoming the Challenges. European Journal of Business and Management, 5(30), 84-89. Web.

Schueneman, T. (2014). Sustainability at 35,000 Feet: A Look at Business Aviation and Climate Change. Web.

Singapore Press Holdings. (2007). Air shuttle service agreement between MAS, SIA to be left out of Competition Act. Web.