Introduction

Social security Administration also known by the abbreviations, SSA is an independent body that administers social security insurance to the aged, accident victims and the disabled. Employees are usually expected to pay the social security taxes so as to benefit from the scheme and the benefits usually depend on the contributions.

The program has more than 62,000 employees across the country. Besides its head quarters, it has 10 regional offices, 8 processing centers and more than 13, 000 field offices.

The Social Security Board now known as the Social Security Administration was started by the social security Act so as to oversee the administration of new projects by the social security program. The board is composed of three executives that are appointed by the president.

The Board merged into the Federal Security Agency which was mainly made up of the Public Health Service, the Civilian Conservation Corps and the board itself together with other agencies. To tame the inflationary effects on fixed incomes, the Cost of Living Adjustments were incorporated into the SSA programs.

During its inception, the program only targeted workers bellow 65 years as long as they were within the states that were in its jurisdiction. The age restriction was later eliminated. Those employees that are not provided with a pension plan are particularly encouraged by the government to join the Social security program so as to benefit.

This paper focuses on the programs of the SSA, the financial analysis and the future projections. Some of the aspects analyzed include the financial rations like the liquidity, activity, leverage and profitability ratios. The case study also uses the strategic audit worksheet, SWOT analysis, IFAS as well as SFAS so as to analyze the current state of Social Security Administration and possible future implications.

Social Security Administration Background

Social security Administration was started as an independent body that would help people have social security and get social insurance. The applicants are expected make contributions to the scheme and the benefits that a person gets depends on the contributions made.

This scheme was started by the law and it was meant to ensure that people have a decent life even after loosing their jobs or their ability to earn their livelihoods for instance through accidents or illnesses.

The scheme has programs that target the old people, the disabled as well as victims and family members of those who had registered with the scheme. It gets most of its funding from the contributions that the employers and employees get remit to the scheme each month.

The social security scheme has various offices spread across the country which are meant to ensure that its members throughout the country get their services without much difficulty. The scheme also gets much of its funding from the government. The scheme however faces a lot of competition from other pension schemes and pension programs offered by private insurance companies.

Analysis

Despite the numerous challenges experienced by the social security administration, the program has managed to accomplish much. In the recent past for instance, the world economic recession posed a challenge to the program financially.This however did not hinder the compensation and benefits of its members.

Taking the example of 2011, the Social Security Administration funding from the government was less by $ 1 billion. This implied that the organization had to incur some budget cuts. Instead of carrying out blanket cuts across the board, priority was to be given to the most important activities so as to continue serving the members.

Findings have shown the workforce has been quite instrumental in offering quality social security services to the public through the adoption of new business strategies and use current technology in ensuring that thechanging needs of the members are met.

This has resulted in an increase of about 4% in the productivity of the organization recently. The compensation process has been reduced to less than a year hence more claimants are able to receive their benefits within a short period. The payment accuracy has greatly increased and the number of claimants who are awaiting compensation due to their pending cases has significantly reduced.

Through the establishment of customer care centers and tele-centers that deal with online services, the social security customer satisfaction index has greatly improved and the number of applicants being served at a time has greatly increased hence reducing the workload by a great margin.

Audit reports have shown that the Social Security Administration has complied with all the set laws and regulations and all the financial reports are reliable as they are in line with the given guidelines.

The organization has been channeling its earnings and efforts in ensuring quality service delivery to the members. The efforts are geared towards ensuring and maintaining public trust as most people depend on it. There is need for the government to help the organization to improve its services.

Financial Data For 2011

(Dollars in Billions)

Net Position

Change in Position

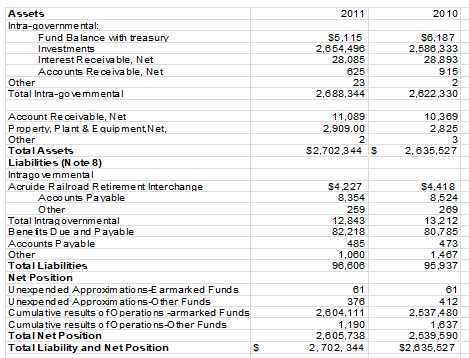

Balance Sheet as at September 2011 and 2010

(Dollars in Billions)

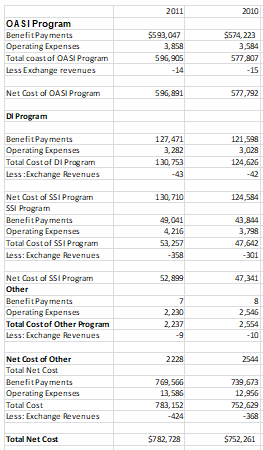

Statement of Net Cost for 2011 1nd 2010

(Dollars in Billions)

The total assets have been increasing in the recent years at a steady pace. The increase in the assets in 2011 f0r instance was a 2.5% increase from the previous year. The investments have also increased steadily due to the increase in the amount of revenue from tax collection as well as earnings from the investments.

The liabilities also grew due to the increase in the number of beneficiaries as well as the benefits that had accrued from the past years. The net position of the organization had increased due to the growth in the asset base than the liabilities.

Financial Ratios Liquidity Ratio by 2011

Formula:

LR = liquid assets / total liabilities.

= 2909 / 96606 = 0,030112001325

Liquidity ratio for 2010

= 2825 / 95937 = 0.0294464075383

This ratio indicates that the social security administration can acquire short-term borrowings by taking the liquid assets as security.

These assets can easily be converted into cash so as to cover the amount owed. The results above indicate that the liquidity ratio increased in 2011 from the previous year which is a clear indication that the organizations ability to handle short term credits had increased which is attributed to the increase in the liquid assets.

Profitability Ratio

By calculating the profitability ratio of the social security scheme, it is possible to determine whether it is viable and whether it will be operational even in the future. It becomes possible to determine the overall performance of the program. In the ratio, the profits made by the firm are compared against its size, total assets and the gains or sales made.

From these, it is possible to compare the organization’s performance to other firms as well as the previous years.This ratio determines whether the scheme is good at running its businesses and whether it is performing well in comparison to its competitors.

The rations indicate whether profits are being made. From this it is possible to infer whether the social security scheme is operating at a loss or profit and whether it is outdoing other competitors or it is trailing behind in its performance.

Gross Margin

This indicates the amount that a firm keeps as profit in relation to the sales. This is usually in the percentage form. The greater the margin the higher the premium a firm charges for its services or products. The formula is;

Gross Margin = Gross Profit / sales

In the Social security case;

Gross Margin = (625 + 11089) – (8357+485) /625 + 11089

(11714 – 8842) /11714 = 0.2451767116271

In percentage terms = 0.2451767116271 * 100 = 24.5177%

This indicates that the firm will fix its prices so as to ensure that a 24.5177%profit is made.

Operating Margin

This usually indicates precisely how much profit or loss a firm is making by putting into consideration the operating and marketing costs that are incurred before the goods are sold or services delivered.

Operating Income/Net Sales

In the above case, operating Margin cost=13586/11714 = 1.1598087758238

In 2011, the operating margin for social security scheme was higher. This indicates that the firm operated at a loss. This could be attributed to the inflation and macroeconomic instability across the globe. All these contributed to a higher operation cost hence plunging the scheme into a loss.

Net Profit Margin

This usually indicates the revenue that is kept by the company after all the expenses and other sources of income have been considered.

= Net Profit or loss / Net Sales

In the given case, the net margin would be; (11714-13586) / 11714

= -0.1598087758238

This is an indication that the firm made a net loss -0.1598087758238

As a percentage, this could be expressed as 15.98% loss.

Free Cash flow margin

This usually stands for the revenue that the management can turn into cash. The formula for the free cash flow margin is; Free cash flow/sales

In this social security case, it would be,

848,912/ 11714 = 72.4698651186614

The high free cash flow in this case can be attributed to the fact that the federal government funds the scheme and hence the high free cash flow margin.

Return on Assets

It is a measure of the organizations capability to convert its assets into profit. The formula for this is; (Net Income + after tax interest expense)/ (average total assets). In the calculations, the after tax interest expense is added back to the net income. This is because the ratio measures the ability of the asset to generate revenue for the firm regardless of whether it is from debt holders or shareholders.

The formula for return on assets can be summarized as follows

ROA = Net Income / Total Assets

= (5115 + 28085 + 625 + 23 + 11089) /2,702,344) = 44937 / 2702344 = 0,0166288969872

This is the firm’s ability to turn its assets into profit.

Return on Equity

This indicates the firm’s return on the shareholder’s investments. It is usually expressed in the percentage form. The formula is;

ROE = Net Income / Shareholder’s equity = 44937/ (2,702,344 – 96,606) = 44937 / 2605738 = 0,0172454022622

As a percentage, this would be;

1.72454022622 %

Activity Ratio

Activity ratio can be termed as the firm’s investment in an asset or assets in relation to the returns from the assets or a group of assets. One of the ratios that fall under this category is the average collection period while the other is the inventory turnover ratio.

Average Collection Period

This usually indicates the average waiting period in which goods or services taken on credit are supposed to be paid. This is usually in days. The formula is

(Accounts receivable / sales) * 360

The accounts receivable represents the customer’s promises for later payments. In the social security case, average collection period = (11089 / 907298) * 360

(11089 / 907298) * 360 = 4.3999215252321

It is hence expected that 4 days are the average number of days that payments are supposed to made for those who received the services on credit.

The low average collection period implies that the scheme takes a shorter time to collect its cash from the debtors which is a clear indication that the organization is stronger as most of its cash is not held up in the form of debts.

A higher average collection period would indicate that the organization is weaker as most of its cash it not paid on time. This would then imply that some of the activities would be at a standstill due to the insufficient funds.

Inventory Turnover Ratio

The ratio indicates whether a firm has more or less products in the inventory form. Too much goods in the inventory form might lead to the firm experiencing economic problems as the inventories are supposed to be financed until they are sold.

Fewer inventories on the other hand might imply that the firm might fail to meet the customer needs and this might lead to the loss of customers. By finding the inventory turnover ratio, one helps reduce the risk of having too much inventory or too little.

Formula = Cost of goods sold / average inventory

In the above case, average inventory= (6105+2909) / 2 =$ 4,507 billion

Operation cost = 721,248 = Inventory turnover ratio = 721,248/4,507 = 160.028400266253

The organization has a high inventory turnover ratio. This indicates that it has fewer goods in the form of inventory. This is an indication that fewer funds are used to finance such inventories although the result might be the loss of some customers who might prefer the competitors that have enough inventory goods.

Leverage ratios

The leverage ratio which is also known as the debt to equity ratio is supposed to indicate the amount of debt on affirms balance sheet. The more the debt a company has the riskier it is especially on its stock given that in the case of bankruptcy, the stock is supposed to be used to settle the company’s debts.

This ratio indicates the level to which a firm depends on debt so as to finance its operations. 2:1 is the uppermost acceptable debt leverage ratio limit.The debt is not supposed to exceed 1/3 in the long term. A higher leverage ration is an indication that the firm might find it difficult to repay its interest and principle incase another funding is to be sought.

The formula for the financial leverage is;

Leverage Ratio = total debt / shareholders equity.

=2,688,344 / 2,702,344 – 96,606

= 1.0317015755229

Total Debt to Assets

The form 0.0357489646026 ula for this is total liabilities/total assets

= 96,606 / 2,702,344 = 0.0357489646026

Capitalization Ratio

Long-Term Debt

Long-Term Debt + Owners’ Equity

=2,688,344/ (2688344+2605738)

= 0.5078017303094

These ratios are a clear indication that the social security scheme depends on debts to fund most of its activities. Most of the funding is from the l government.

Debt / Equity Ratio

This indicates the level to which a firm relies on its debt holders to finance its activities as opposed to its owners. A higher debt/equity ratio is a clear indication that the company relies more on debts so as to finance its activities that it relies on its owners.

This is risky. A low debt/equity ratio on the other hand indicates that the firm is stable as it does not majorly rely on debts so as to finance its activities.

Debt equity ratio= (Long-term debts + short-term debt)/ total equity

In the given case, debt/equity ratio=12’843/2,605,738

The small debt/equity ratio is a clear indication that the company is not in much debt as it does not fund most of its activities from debts.

SWOT Analysis for the Social Security Administration

Through SWOT analysis, it is possible to determine the strengths, weaknesses, opportunities and threats that the scheme encounters. In this case, there are various strengths that give the scheme a competitive advantage over its competitors.

IFAS

Mean characteristics of young adult (aged between 18 and 40) female SSI and AFDC recipients (in percent)

According to the findings, it is clear that there is an overlap between the families that received the supplemented security income and those which get aid due to the fact that they had dependent children.

Individuals from families that received the supplemental security income and those that received aid due to having dependent children were interviewed.

Most of these families had disabled sole bread winners. Most of them had conditions that could not allow them to perform the normal daily duties that could enable them provide for their families.

Some for instance were disabled and had been either on wheel chairs or were using canes, crutches or even walkers for more than six months. Some had mental conditions that rendered them unable to perform the normal duties that could help them provide for their families (Ware, 2009).

The overlap between the families that are on social security income and those that get aid due to having dependent children has resulted in case overloads which has had implications on the period taken before these families can receive their benefits.

According to the findings, some of the factors that are put into consideration while a person is applying for these benefits include the disability status, the individual’s education background as well as race.

For the Self Invented Personal Pension otherwise known by the abbreviations SIPP, the individual characteristics that are considered include the age, marital status, the disability status, the person’s education level, his/her participation in other programs such as the SSI and AFDC.

The economic status and policy variables at that particular time are also put into consideration. For the children to benefit, other factors are considered too, for instance, the age of the parents, the race, education and the level of disability are considered.

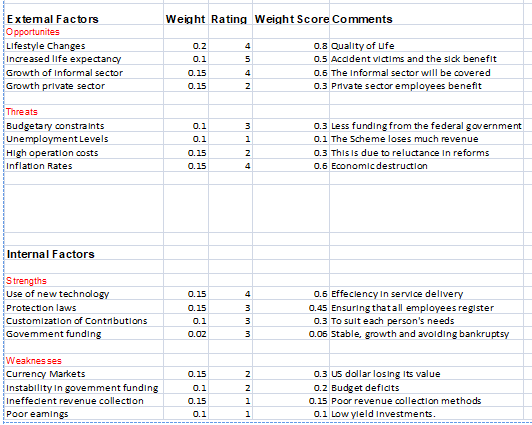

Internal Factors Analysis Summary(IFAS) and External Factors Analysis Summary Table(EFAS)

From the EFAS it is possible to infer the external factors that affect the scheme. Focus is given to the opportunities which are available externally that the scheme can exploit so as to expand and even get more funding.

These include the targeting of the informal and private sector. Attention is also given to the external threats that are likely to influence the operations of the scheme like the inflation, budgetary constraints, unemployment and high operation costs.

The IFAS on the other hand focuses on the internal factors that affect the operation of the scheme like the use of new technology and customization of contributions.

Comparison of SSI recipients at their first SIPP interview and post-SIPP recipients (in percent)

SFAS

From the chart above, it is quite evident that there has been an increase in the book value in the recent years. This is can be attributed to the fact that the number of members who are joining the scheme is increasing.

It can also be attributed to the improvement in the collection of contributions that were otherwise lost in the past years due to poor collection methods. The increase in the book value can also be attributed to the efficiency in service delivery which leads to customer satisfaction.

This helps to retain the existing customers and even attract new ones. The reduction in the net income can be attributed to macro economic factors like inflation and high unemployment rates which simply lead to the reduction in the total income being collected from the members.

Definitions

- INCBVt represents the incremental R square for the book value.

- INCNIt represents the incremental R square for the net income.

Conclusion

The Social Security Scheme has been instrumental in making sure that its members have a decent life even after they retire, become ill or are incapacitated due to their involvement in accidents. The scheme has been receiving much support from the government particularly in terms of funding. This has helped it to avoid being plunged into much debt or even bankruptcy.

The management has been working hard so as to reduce the workload and even improve its services to the clients hence improving its customer satisfaction index. This has been made possible by employing the current technology in its service delivery. The starting of online services for instance has helped reduce the workload and made the work easier.

The processing period has been reduced to less than a year. This has prompted most employees to register with the scheme given that other schemes take a longer period before processing the benefits hence increasing the book value.

The scheme has also had its own difficulties particularly due to the high inflation rates and the world economic recession. This resulted in the reduction of the income that the scheme earned especially in 2011. All the same, the scheme continues to play a significant role in the welfare of its members.

There is need to even better the services offered by the scheme and reduce the period that individuals have to wait before they can be compensated.

References

Bertoni, D. (2011). Social Security Administration: Management Oversight. New York: DIANE Publishing.

Bovbjerg, B. (2006). Social Security Administration: Improved Agency Coordination. New York: DANE Publishing.

Ferrara, P. (2000). Social security: the inherent contradiction. Massachusetts: Cato Institute.

Kutz, G. (2011). Social Security Administration (SSA): Cases of Federal Employees. New York: DANE Publishing.

Matthews, J. (2012). Social Security, Medicare and Government Pensions. Chicago: Nolo Press.

Meyerson, N. (2010). Social Security Policy Options. New York: DIANE Publishing.

Osterweil, L. (2007). Social Security Administration Electronic Service Provision. Washington: National Academies Press.

Ricard, R. (2007). Social security: promise and reality. Washington: Hoover Press.

Sacks, A. (2004). 2004 Social Security Explained. New York: DANE Publishing.

Tomkiel, S. (2008). The Social Security Benefits Handbook. Washington: Sourcebooks, Inc.

Ware, W. (2009). Elements of systems modernization for the Social Security. National Academies: Washington.

Wunderlich, G. (1998). Social Security Administration: critical issues. Washington: National Academies Press.