The essay explores the major concerns for a South African FDI planning to invest in Venezuela. Despite the exciting potential investment in Venezuela, some of the concerns evident include varying financial systems, potential agency problems, and political risks.

The essay will first compare South Africa’s and Venezuela’s corruption percentage index followed by an overall political risk of both countries.

In both the developed and the developing world, the most credible and appropriate tool used to measure the level of corruption in the public sector is the corruption perception index (CPI) (Aguilera 2009).

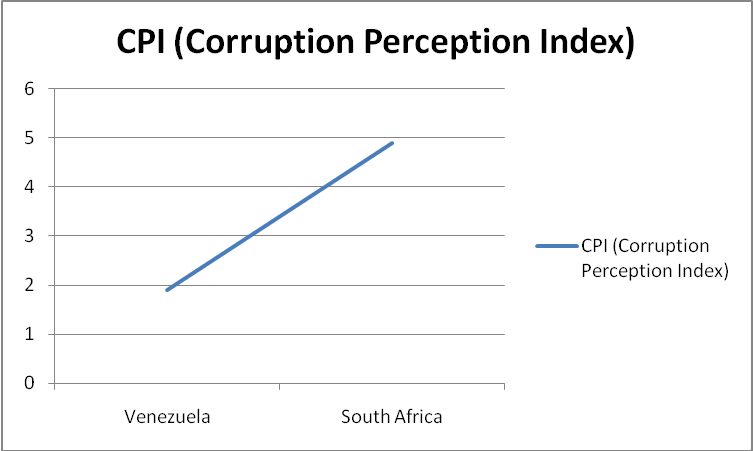

This tool is used to determine the corruption percentage index of an economy. In regards to the current CPI statistics, South Africa has a CPI of 4.9 while that of Venezuela is 1.9.

The diagram below compares the corruption index of both countries as provided by Transparency International (2011).

Figure 1: CPI comparison for South Africa and Venezuela

From the figure above, Venezuela is more corrupt country compared to South Africa. The current findings show a slight decrease in the ranking of CPI. For example, in 2007-08, South Africa had a CPI of 5.1 while Venezuela’s CPI was 2.0 (Radwan & Pellegrini 2010).

The major differences in CPI of the two countries could be caused by poor corporate governance, poor laws, and legal frameworks.

This is supported by Aguilera (2009) who observes that most of the underlying legal systems in Latin America (inclusive of Venezuela) have issues related to corporate governance. The issues in these countries have resulted in high corruption levels which may hinder foreign direct investors.

In their study, Leuz, Lins and Warnock (2008) established that countries with poor corporate governance have poor disclosure, ownership structures, and outsider protection laws, which hinder foreigners from investing.

Political risks have negative effects on foreign direct investors. They also discourage FDI from investing in developed and developing economies. Compared to South Africa, Venezuela is ranked highly in terms of political risk.

From a political perspective, Venezuela has more political risks which may discourage foreign direct investors.

The most common political risks experienced in both developed and developing economies are expropriation/ nationalization of foreign assets, policy instability, and political violence.

For example, nationalization of the privately owned oil reserve by President Hugo Chávez in 2007 resulted in tensions with major FDI investors such as Chevron Corp, Exxon Mobil Corp, ConocoPhillips, and BP PLC (Baek & Qian 2011).

With regard to South Africa, the political unrest as a result of continuous strikes and stoppages by trade unions in the mining sector deterred willing FDIs from investing.

Expropriation could be minimized through legal protection of the investor, which in return could promote effective corporate governance.

However, Porta, Lopez‐de‐Silanes, Shleifer, and Vishny (2000) warn that expropriation technology becomes less efficient when legal protection is provided to outside investors.

For example, it becomes much easier to undertake insider trading, which makes the company more vulnerable to outside investors.

Legal protection could also be used to ensure that external investors are protected from biased tax laws and shareholders regulations (Porta, Lopez‐de‐Silanes, Shleifer, & Vishny 1998).

Issues related to political volatility could be prevented through policies which promote democracy, transparency, and governance. On the other hand, policies could be used to reduce expropriation risk coupled by strong property rights, so as to attract more FDIs.

We conclude that South Africa has a low level of corruption compared to Venezuela. This has been promoted by underlying legal issues, which have resulted in poor corporate governance, transparency, and ethics.

Compared to South Africa, Venezuela is highly ranked in terms of political risk level. The common political risks are expropriation/ nationalization of foreign assets, policy instability, and political violence.

Reference List

Aguilera, R V 2009, A Comparative Analysis of Corporate Governance Systems in Latin America: Argentina, Brazil, Chile, Colombia and Venezuela, In Robert McGee, Ed. Corporate Governance in Developing Countries, Springer, New York.

Baek, K & Qian, X 2011, An analysis on political risks and the flow of foreign direct investment in developing and industrialized economies, Buffalo State College, SUNY.

Leuz, C, Lins, K V & Warnock, F E 2008,’ Do Foreigners Invest Less in Poorly Governed Firms?’, The Review of Financial Studies, vol. 22, no. 8, pp. 3244-3285.

Porta, R, Lopez‐de‐Silanes, F, Shleifer, A & Vishny, R W 1998,’ Law and Finance’, Journal of Political Economy, vol. 106, no. 6, pp. 1113-1155.

Porta, R, Lopez‐de‐Silanes, F, Shleifer, A, Vishny, R W 2000, Investor protection and corporate governance, Journal of Financial Economics, vol. 58, no. 1, pp. 327.

Radwan, I, Pellegrini, G & World Bank, 2010, Knowledge, productivity, and innovation in Nigeria: Creating a new economy, World Bank, Washington, DC.

Transparency International 2011. Corruption perception index (CPI). Web.