Introduction

Every successful company has a clear mission and vision at the outset. The objective of the business is stated in the mission statement, and its goals and direction are established in the vision statement. This essay will discuss our company, which aims to be a one-stop shop for all sports-related activities, along with its purpose, vision, and SWOT analysis. These activities include finding individuals to play sports with, reserving sports facilities, and renting out sporting goods. We will assess our company’s competitive position, strengths and shortcomings, and the resources we need from potential investors to strengthen them.

Mission, Vision, Goals

Our mission is to unite people through sports by promoting an active lifestyle, fostering new relationships, and cultivating a sense of community among sports enthusiasts. Our objective is to give sports enthusiasts a comprehensive solution that addresses all facets of sports-related activities, making it the go-to website for anyone who wants to explore their passion for sports. Our vision is to become the leading sports application service in the market by providing a seamless user experience to sports enthusiasts worldwide. We aim to develop a platform where users can conveniently book sports venues, rent sports equipment, and connect with their sports partners. We aim to utilize technology to enhance user experience, provide personalized recommendations, and promote an active and healthy lifestyle.

SWOT Analysis

Strengths

Our company has several advantages that give us a market edge. First, our distinct business strategy provides sports aficionados with a comprehensive service that addresses all facets of sports-related activities. As a result, those wishing to explore their passion for sports often turn to our site.

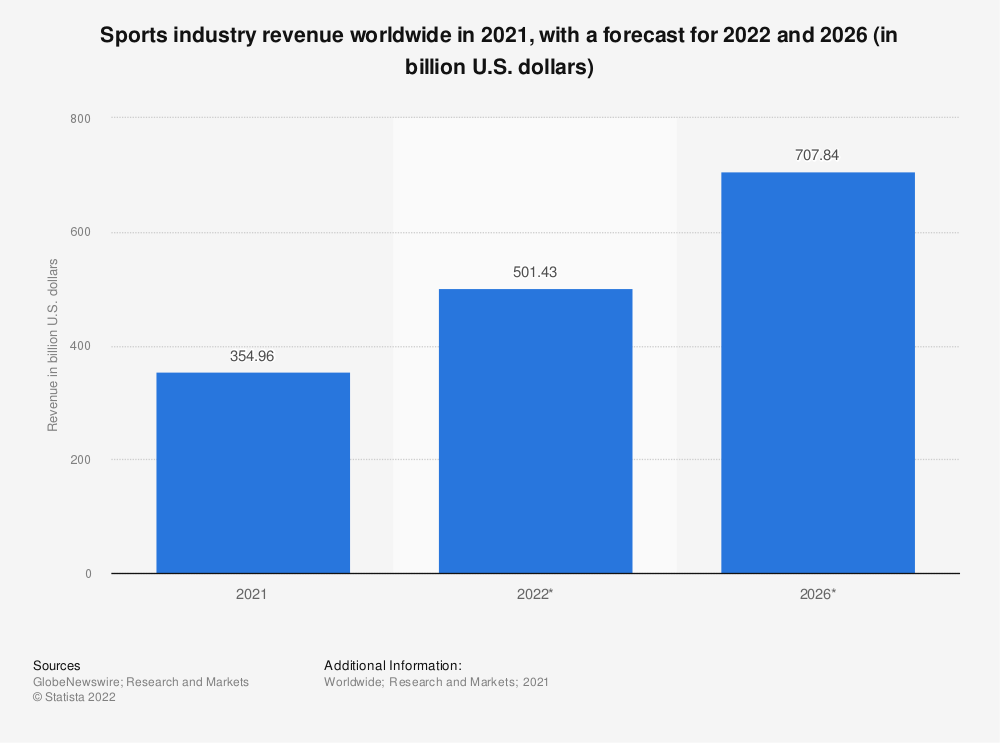

Second, regardless of age or computer proficiency, thanks to its user-friendly UI, anyone may utilize our platform. This broadens our pool of possible clients and increases our growth potential (“2022 Sports Industry Outlook | Deloitte Global”, 2023). Thirdly, there are several opportunities for growth and expansion in the sports business, which is expected to experience significant growth over the next few years (“2022 Sports Industry Outlook | Deloitte Global,” 2023). Lastly, our platform may work with sports clubs and facilities to expand our customer base and revenue sources.

Weaknesses

Our company has some problems that need to be fixed despite its positives. First and foremost, substantial financial resources are required to develop and implement a comprehensive sports platform (Sreenivasan & Suresh, 2021). This presents a significant obstacle, especially for startup companies (Sreenivasan & Suresh, 2021).

Secondly, gaining a firm foothold in the business isn’t easy, given the abundance of sports-related applications already available. Thirdly, keeping up with the latest technical developments can be challenging, making it difficult to stay competitive. Lastly, regulatory compliance may increase operating expenses and complexity, posing a risk to the business’s long-term viability (Panel, 2023). Those weaknesses, however, can be mitigated in the future.

Opportunities

Our company possesses numerous positive traits that will ensure its success. It has numerous opportunities to grow and expand its market (“2022 Sports Industry Outlook | Deloitte Global,” 2023). First, as our platform becomes more well-known, we can tap into new markets and attract more users. Additionally, by collaborating with sports clubs and facilities, we can expand our client base and gain access to their resources and facilities, thereby improving our services.

Second, we can broaden our consumer base by expanding our services beyond sporting activities to include fitness classes, health programs, and diet plans. Finally, we can improve our users’ experiences and engagement on our platform by making personalized recommendations using data analytics and artificial intelligence. To give our users these opportunities, we offer sports center booking services and equipment rental services, making it easy to reserve sporting venues and hire sports equipment to satisfy their enthusiasm for sports.

Threats

Despite the potential for growth and expansion, our company faces several challenges that require attention. First, a weak economy may hurt discretionary expenditure, lowering the demand for sports-related activities (Di Domenico et al., 2020). Second, as technology advances, it may become increasingly difficult for existing firms to compete, as newcomers to the market may gain an advantage. Thirdly, our platform is vulnerable to cybersecurity risks, such as data breaches, which can result in financial losses and reputational damage. Lastly, changes to laws and regulations may impact our ability to provide services to our users by increasing operational costs.

Resources from Potential Investors

We need resources from potential investors to address our company’s shortcomings and risks, and capitalize on our strengths. To create and introduce our platform, as well as to grow and maintain our operations, we require financial resources. Additionally, we require resources to stay current with technological developments and maintain a competitive platform. We also require legal support to ensure compliance with all relevant laws and regulations, thereby avoiding any potential legal issues that may arise (Sreenivasan & Suresh, 2021). Last but not least, we need funding to combat cybersecurity concerns, such as data breaches, and to safeguard the security and privacy of information about our consumers.

Before investing in our company, investors should consider several potential risks. First of all, it may be challenging to maintain and grow our business due to financial troubles, such as a shortage of finance (Peña et al., 2021). Second, operational risks could harm consumer confidence and revenue, including system failures and technical issues. Thirdly, potential legal risks could result in financial penalties and legal troubles, including violations of laws and regulations. Finally, reputational risks such as negative press and word-of-mouth can damage our brand’s reputation, eroding customer confidence and potentially costing us money.

Mitigation Strategies

We require financial support from our investors to reduce these potential dangers. First and foremost, financial resources are essential to ensure we have sufficient funds to maintain and expand our operations (Panel, 2023). This includes resources for marketing and advertising, research and development, and administrative expenses.

Second, operational resources are required to maintain the functionality and security of our platform, including technical support and infrastructure improvements (Panel, 2023). Thirdly, we require legal resources, including legal counsel and compliance officials, to ensure compliance with all applicable rules and regulations and prevent potential legal issues (Panel, 2023). To maintain a positive brand image and foster customer trust, reputational resources such as public relations and customer service are essential.

Conclusion

We intend to provide our investors with a buyback option or an initial public offering (IPO) of the business as part of our exit strategy. We want to offer them a fair market value for their shares in the event of a buyback option, or we will allow them to sell their shares on the secondary market. This will provide our investors with a liquidity option, allowing them to recoup their investment (Panel, 2023). In the event of an IPO, we intend to provide our investors the option of either selling their shares on the open market or holding onto them in anticipation of future capital gains. Our investors will be able to understand the potential return on their investment by doing this.

Reference List

Di Domenico, L. et al. (2020) “Impact of lockdown on COVID-19 epidemic in Île-de-France and possible exit strategies,” BMC Medicine, 18(1). Web.

GlobeNewswire. (2022). Sports industry revenue worldwide in 2021, with a forecast for 2022 and 2026 (in billion U.S. dollars). Statista. Web.

Panel, E. (2023) “Risk Management: 15 Strategies To Protect Workers And Your Bottom Line,” Forbes. Web.

Peña, J. et al. (2021) “Sports in time of COVID-19: Impact of the lockdown on team activity,” Apunts Sports Medicine, 56(209), p. 100340. Web.

Sreenivasan, A. and Suresh, M. (2021) “Modeling the enablers of sourcing risks faced by startups in COVID-19 era,” Journal of Global Operations and Strategic Sourcing, 15(2), pp. 151–171. Web.

“2022 Sports Industry Outlook | Deloitte Global” (2023) Deloitte. Web.