Introduction

There are various reasons for the success or failure of companies. Companies operating in the same line of business may perform differently due to their varying circumstances in business. Marketing strategies, management strategies, and innovation are some of the aspects of business that have been examined by this article.

Johnson& Johnson And Pfizer

Johnson & Johnson is an American company with its headquarters in Delaware, and deals with various consumer commodities. The company is known for its pharmaceutical products, which sell around the world. Moreover, the company is known for the scholarships it offers for students (Czinkota & Ronkainen, 2004).

While the company primarily deals with pharmaceutical products, it has endeavored to diversify its products to include sanitation products and toiletries. The company initially started its business by manufacturing wound dressings in the nineteenth century, but continued to expand into production of other pharmaceutical commodities.

Pfizer Inc. is an American pharmaceutical company founded in the middle of the nineteenth the century. This company has centered its marketing efforts on research (Rodengen, 1999). This means that innovation has been the company’s main marketing tool (Kotler, & Armstrong, 2012). Moreover, the company has experienced several mergers leading to its expansion.

The research projects at Pfizer have helped the company forecast future market trends (Zikmund, 2010). A research project in cooperation with the Massachusetts institute of technology has helped the company move more into the field of research. This field is important to the company since it deals with pharmaceutical products (Rodengen, 1999).

Both Johnson & Jonson and Pfizer are pharmaceutical companies. In addition, they are public companies with large capital base. In recent years, both companies have faced scandal allegations after some people died after taking pharmaceutical products from both of the companies. Some products from Johnson & Johnson were found to be laced with cyanide while defective hearts valves from Pfizer inc. caused many deaths in the United States.

On the other hand, the two companies have some differences in the products they offer to their customers. While Pfizer has succeeded in business through innovation in manufacture and processing of pharmaceutical products, Johnson and Johnson succeeded mainly due to diversification of its products.

Organization at Microsoft

Microsoft Corporation is a multinational company that ranks among the biggest single business enterprises in the world. Recently, particularly in the twentieth century, Microsoft has succeeded in dominating the world software market. Among other things, organization of the business and proper business structure are the major reasons for success of Microsoft as a multinational company.

Steve Ballmer, the CEO oversees all business operations of the company, while Bill Gates the more outspoken of the founders of the corporation, is the chairperson and the chief software architect (Wallace & Erickson, 1992). Moreover, a board of directors elected by the shareholders governs the company.

This structure is consistent with the laws of the federal government and the state laws. The reason for the success of Microsoft is the specialization of its departments in specific products (Guffey & Loewy, 2010). The corporation has divisions, which have their own management separate from other departments. A chief executive officer is assigned to each division, and is answerable to the chief executive officer only.

This kind of an organization is said to be costly to maintain due to the reduced economies of scale, but simplicity in management is enhanced (Feigenbaum, 2009). Besides, this organizational structure is more appropriate for the company since it sells products that require research and brain power to produce.

Employees of the company are near each other and are able to interact with each other in the course of development of the products. Alternatively, it can be said that this organizational structure enhances communication between employees working in the same line of production (Guffey & Loewy, 2010). Furthermore, this kind of structure reduces the bulk of management work for the company management (Feigenbaum, 2009).

The major advantage of this strategy by Microsoft Corporation is that the company is able to direct its various divisions to specialize in certain lines of production without having to abandon production of some products (Wallace & Erickson, 1992). In other words, the company has been able to expand into other lines of business rather than reduce the number of products that it had been dealing with previously.

Management at Wal-Mart (Newsletter)

Wal-Mart is one of the few companies, which have a good financial management and have a history of a stable financial base. The company is known for its financial stability (Wheelen & Hunger, 2008). Profits at the company have been on a steady rise for a long time, and the company still intends to continue to improve on the pricing of its products (Loveless & Morter, 2011).

Dominance of the company in the pricing of products has been a useful tool in realizing success at Wal-Mart. In 2011, the company announced that despite the increased revenue and profit, it would reduce prices for its products in a move to strengthen its hold on the retail market (Roberts & Berg, 2012).

Wal-Mart has recently dedicated 500 billion dollars to reduction of the level of fuel consumption for its vehicles. The overall effect of this move is the reduction of overhead costs and increased revenue. This is a more permanent solution to the increasing operating costs, especially after the recent market recessions.

Furthermore, the fuel consumption reduction is a part of a larger scheme to reduce consumption of energy at Wal-Mart over a number of years. To minimize the cost on energy, Wal-Mart has chosen to keep all services that demand power functional, but reduce wastage of energy at its stores (Loveless & Morter, 2011).

Wal-Mart has forecast that consumers will increasingly demand cheaper and healthier food products, which are a major commodity for the company stores. In this regard, the company has set on to stock its stores with cheaper foodstuffs, which are projected to make a profit of over 14 billion dollars annually. This is a high but achievable target, which takes considerable effort in innovation in order to accomplish (Loveless & Morter, 2011).

Wal-Mart has also ventured into the stock market, and has been trading since 1970. While the company has been doing well in the stock markets for decades, there have been several recent revelations of scandals in its stock market sector. The company has experienced a setback due to revelations of bribery at the stock market (Roberts & Berg, 2012).

This is a serious drawback for any stock trader, and the company is likely to lose a significant advantage brought by its enormous size at the stock market. In order to spread the risk in the capital markets, Wal-Mart should venture into other financial services (Loveless & Morter, 2011). This will help the company succeed in managing its capital base and cater for the financial deficits that may arise in the company in seasons when business is not doing well.

Hewlett Packard, Huawei Technologies and Their Operating Environments

Hewlett Packard is an American company dealing with computer products. In recent times, the company has faced difficulties in managing operating cost for its factories in America. This has made the company to start shifting its operations to Asian countries. While Hewlett Packard is, a major manufacturer of computer products, recent competition from the Asian counterparts has made it outsource its operations in order to survive (House & Price, 2009).

On the other hand, Huawei Technologies is an Asian electronic giant. The reason for growth of Huawei is the cheap labor and materials from the Asian continent and particularly china. Due to the lower operating costs in Asia, the company was able to make profits before the American electronics manufacturers decided to shift their major operations to Asia.

The reason for the disparity between HP and Huawei is the labor they use for production and distribution. Labor force in American countries is highly paid and requires a high pay to maintain (House & Price, 2009).

On the other hand, labor in the Asian countries is cheap and may be used to produce cheap goods of reasonable quality, which are particularly suitable for the developing countries (Wheelen & Hunger, 2008). While Hewlett Packard relies on its reputation as a computer maker, Huawei depends on cheap labor to create a stiff pricing competition for manufacturers based in the west.

Vertical Integration

General Electric (GE) is one of the companies that have adopted a strong vertical integration process (Slater, 2000). The firm consists of multiple subsidiaries, which deals with electronics manufacturing and healthcare services. Based on the nature of the firm in relation to its suppliers and buyers, one can establish the degree of integration pattern that has been adopted (Harrigan, 2003). The firm employs the upstream supplying processes and downstream retailing processes.

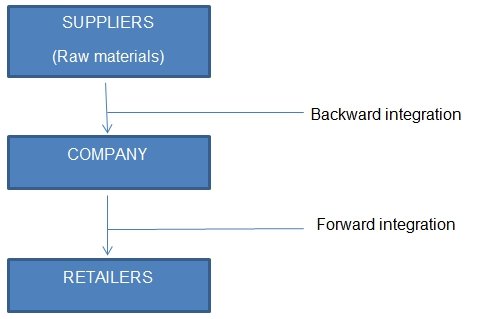

Some of the types of vertical integration include backward (upstream), forward (downstream), and balanced vertical integrations. The healthcare company, which is a derivative of the General Electric Company, exhibits the backward vertical integration (Slater, 2000). On the other hand, forward vertical integration concerns the company’s involvement in delivery of their products and services (Eisenmann, 2006). This form of integration has led to good relationships within the organizational structure of the firm.

Forward integration entails the company’s involvement in supply chain at retail level. Through this process, the company can influence the pricing of their products and services. In this regard, the company can lower their prices relative to their competitors to increase their market share.

On the contrary, backward integration involves the company’s participation in supply of resources (Eisenmann, 2006). Under this case, the company acts as a retailer, where the company flows back in the supply chain to source for products and services. The balanced integration involves the company’s involvement in all processes of the company, from the sourcing of raw materials to the final delivery of products.

Through the various companies that form the whole organization, vertical integration has enabled the organization to focus on its goals and objectives. Some of the vital missions of the organization have been the concentration on high productivity, and enhancement of workforce morale. Based on the leadership employed, the company has focused on its multiple goals. As a result, balanced integration made the company expand and grow its market share.

Flow chart of vertical integration

The flow chart below illustrates the manner in which organizations adopt balanced integration in the organizations. In this case, they have both forward and backward integration. This helps the organization to reduce the costs of production while enhancing the revenue from its products or services (Harrigan, 2003).

Diversification strategies

An appropriate company that illustrates the importance diversification strategy is Google Inc. The company, which initially began as a search engine provider, has grown and diversified its products and services. The company has diversified to engage in manufacture of software for mobile handsets, offering advertisements services, and acquisition of various subsidiary companies in the capital markets.

This form of diversification has enabled the company to reduce risks attributed to single investment while increasing the overall earnings of the company (Eisenmann, 2006). Through the diversification, their reputation has grown in the market and earned it respect from its competitors. As a result, the company is able to expand and attract more partners and customers.

Memo

To: All management staff

From: Project manager

CC: Director

Topic: List of recommendation for diversification

- Through diversifications, companies should always minimize the risks associated with different forms of strategies to yield anticipated returns.

- Diversification strategies should consider the objectives of the companies and needs of its stakeholders to prevent future problems.

- Diversification is critical for the success of businesses, especially, when the economic conditions fluctuate over time.

- The implementation costs of the diversified strategies should not exhaust the capital base of the company. In this case, the anticipated returns from the strategies adopted should be higher than the cost of implementation.

- The alternatives chosen for the diversification strategies should be critically evaluated to yield the expected returns for shareholders. In addition, the project manager should evaluate the project over time to ensure it conforms to the investors’ needs.

Organizational Alliances

Effective organizational alliances between organizations have been crucial for the expansion in the market embedded in competition. Microsoft Corporation and Hewlett Packard (HP) Company have strong alliances with regard to computer software and hardware respectively (House & Price, 2009). Microsoft Corporation focuses on software production, which encompasses various products and services.

On the other hand, Hewlett Packard is a multinational hardware company that focuses on all types of computer hardware such as laptops, palm tops, desktops and other computing devices. Since the two companies fall under the same line of business, they have alliances with regard to their products (Culpan, 2002).

In addition, the complementary relationships between their products enhance their alliances. In this case, HP produces the hardware before recommending Microsoft products to be used in their products. As a result, they have enhanced their market and expanded across the globe (House & Price, 2009).

The benefits derived by organizations from alliances are numerous. Initially, the companies that have alliances benefit from the forces inculcated into their business that meet their required rate of growth. This is mainly due to change from a competitive environment to a collaborative environment.

Based on this factor, the organizations’ organic growth is enhanced (Culpan, 2002). Moreover, the speed and efficiency in market is vital, and partnerships greatly enhance it. Due to the collaboration created by alliances, organizations can share their visions and missions. Similarly, the complexity in the market industry increasing has necessitated most organizations to go for alliances. The inability of single companies to gather all the essential resources for addressing customers varied needs has bolstered alliances.

Notably, the growing costs of research and developments have driven organizations to go for alliances. Due to the varied needs of customers, organizations spend huge funds on research and development intending to tailor its products and services according to customers’ desires.

Therefore, to defray the increasing costs of R&D, organizations adopt alliances. Under these agreements, they can cost-share the expenses and achieve their objectives as anticipated. For small companies, alliances allow them to enter into an equal platform with large companies in the global market. This indicates that companies would be able to compete and expand their market share (Culpan, R. (2002).

Another benefit attributable to alliances is the consolidation of customers of organizations involved. Since companies come up with shared mission, they aim to attract the customers of their immediate partner to their products or services. As a result, the market share will grow dramatically. In addition, companies could undertake shared advertising combining their products and services, which boosts the overall performance of the companies (Culpan, 2002).

Importance of alliances within organizations

- Organic growth independently is not adequate for required rate of growth in an organization.

- Alliances improve the speed of performance and positions in the market.

- Search of relevant expertise in the complex market demands alliances.

- Alliances defray the costs of research and development.

- Alliances allow expansion and growth to international markets.

- Alliances consolidate individual organization’s customers.

Conclusion

The management approaches of various organizations are vital for their successes. By integrating all essential types of approaches, they can expand and grow in the market. As a result, managers should be very skillful in selection of appropriate patterns for their organization.

References

Culpan, R. (2002). Global business alliances: theory and practice. Westport, CT: Quorum Books.

Eisenmann, T. R. (2006). Google, Inc.. Boston, Mass.: President and Fellows of Harvard College.

Feigenbaum, V. (2009). The power of management innovation: 24 keys for sustaining and accelerating business growth and profitability. New York: McGraw-Hill.

Guffey, M. E., & Loewy, D. (2010). Essentials of business communication (8th ed.). Mason, OH: South-Western/Cengage Learning.

Harrigan, K. R. (2003). Vertical integration, outsourcing, and corporate strategy. Washington, D.C.: Beard Books.

House, C. H., & Price, R. L. (2009). The HP phenomenon innovation and business transformation. Stanford, Calif.: Stanford Business Books.

Kotler, P., & Armstrong, G. (2012). Principles of marketing (14th ed.). Boston: Pearson Prentice Hall.

Loveless, R., & Morter, A. (2011). Walmart inside out: from stockboy to stockholder. Las Vegas, Nev.: Stephens Press.

Roberts, B. R., & Berg, N. (2012). Walmart: key insights and practical lessons from the world’s largest retailer. London: Kogan Page.

Rodengen, J. L. (1999). The legend of Pfizer. Ft. Lauderdale, FL: Write Stuff Syndicate, Inc..

Slater, R. (2000). The GE way fieldbook Jack Welch’s battle plan for corporate revolution. New York: McGraw-Hill.

Wallace, J., & Erickson, J. (1992). Hard drive: Bill Gates and the making of the Microsoft empire. New York: Wiley.

Wheelen, T. L., & Hunger, J. D. (2008). Strategic management and business policy: concepts and cases (11th ed.). Upper Saddle River, NJ: Pearson/Prentice Hall.

Zikmund, W. G. (2010). Business research methods (8th ed.). Mason, OH: South- Western Cengage Learning.