Executive summary

The intention of this is report is to update the Supervisor about the outcomes of recent classes on Organisational Design & Technology. The learning outcomes of the course this applied to analysis the concurrent debated issue, its impact on the organisation and suggestive recommendation to realign the identified gap to over come the issues. This report would go for Lloyds TSB Bank as an organisation and it’s Strategy as a Key Determinant.

The report continues its efforts in response to apply the theoretical and empirical evidences of the Strategy of Lloyds TSB & its external and internal impact on the organisation by use of secondary research. The report has gathered most recent information on the Strategy of Lloyds TSB including up-to-date data and a large amount developing trends that would be useful for both academic researches as well as for business drive.

As the selected organisation is a financial institute, some economic and financial issues may arise by relevance though it is not at all a financial or market analysis. The learning outcomes of organisational key determinants imply their effectiveness to overcome the critical circumstances and manage risks. The impacts of such situation oblige the organisation to reconstruct its Strategies to realign the identified gap to over come the crisis. For instance Lloyds TSB Bank is a dynamic organisation and it strategy has designed for sustainable development. To face the crisis it required to change its Business strategies for both internal and external aspects.

Introduction

The Lloyds TSB Bank is the second largest player of UK mortgage market with their financial products and superior service (LTSB, 2008). Cheltenham & Gloucester (C&G), the UK’s largest mortgage provider merged with Lloyds TSB group on 01 August 1995. In UK Lloyds TSB registered as the no one in stipulation of Employee Share Plan (ESP), administration, as well as Share registration.

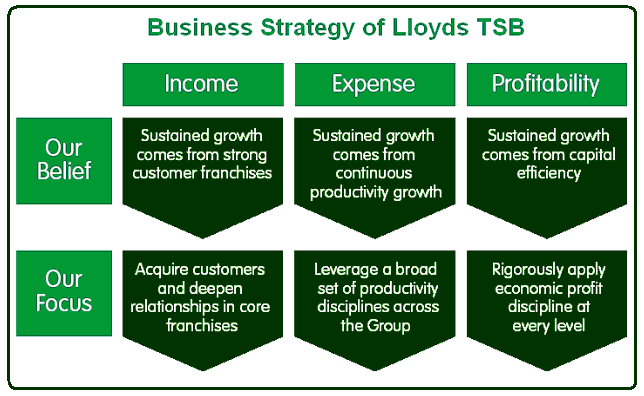

Its Business strategy leads products and services are offered by means of a unique distribution capability encompasses one of the most prevalent branch networks and intermediary channels in the UK. With a market capitalisation of £26.7 billion, Lloyds TSB Group enlisted in the London Stock Exchange within the FTSE 100. (Singleton and David, 2007) explained that the merger talk has been going on. By this time, a great recession hits the US economy in this month. US recession seriously influenced the UK market.

Consequently, Lloyds TSB and HBOS merger has started to be influenced with the recessional impact and would be thrown to a hazardous organisational crisis. For instance, the strategic analysis of Lloyds TSB demonstrated that the merger with HBOS would create a forceful business amalgamation would bring substantial benefits as a super-bank. Therefore, the boards of Lloyds TSB recommended that shareholders of HBOS would get 0.61 Lloyds TSB shares in favor of each HBOS share. When the merger news strike the market the share price of HBOS gained of 12% and Lloyds TSB gained about 2% up.

The gain lasts for show time. US recession news and Wall Street index fall seriously injured the strategy of Lloyds TSB. On 13 October 2008, Lloyds TSB addressed the investors to reassure it’s funding but failed to protect. The stock Lloyds TSB cut down about 40% at one point on the same day and on closing it stands 22% lower.

The grim situation of Lloyds TSB in case of 75% dropped in share price could be explained as bellow:

- The Bank of America (BAC)’s fall down with $34 billion market fund and some other US Bank’s collapse as well as US recession has caused the grim situation.

- Creating a simulated and panic in the money market by different media.

- The “Bail out Bill” failed to keep its role with resourcefulness for which it was stranded.

- Though it is not yet put into practice but join up with HBOS is news that influenced the price declining of Lloyds TSB.

- World wide influence of US recession has caused Lloyds TSB’s share price is diminishing later then second of October 2008.

- Lloyds TSB is gain profit within a short term which is the one of the important motivators of the Lloyds TSB. It has to take long term planning because planning plays an important role of BAC’s collapse.

From these points provides the rationales for Lloyds TSB as it has faced a continuous falling of share price. In order to overcome these problems, Lloyds TSB needs to protect rumor of all kind of media. It should required long term planning to sustain in market and the industry with strong pedestal.

Determinant

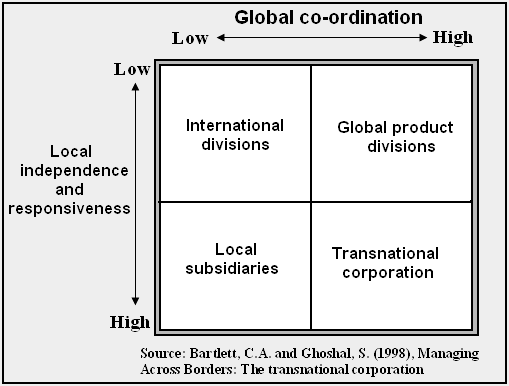

Bartlett, C. A. and S. Ghoshal’s Model

Bartlett and Ghoshal’s transnational structure is directly fit for Lloyds TSB group. This theory mainly seeks to obtain multi-domestic strategy and the global strategy. Here, it is important to mention that this structure is similar to the matrix. However, it has two particular features. It fit best with Lloyds TSB group’s structure because

- It react particularly to the challenge of globalization, and

- It tends to have specific duties within its cross-cutting dimensions;

- outlines the relationship between the project manager, functional managers and their subsidiaries

- Consideration of adverse economic circumstances for which the global profitability may reduce.

Miles and Snow’s model

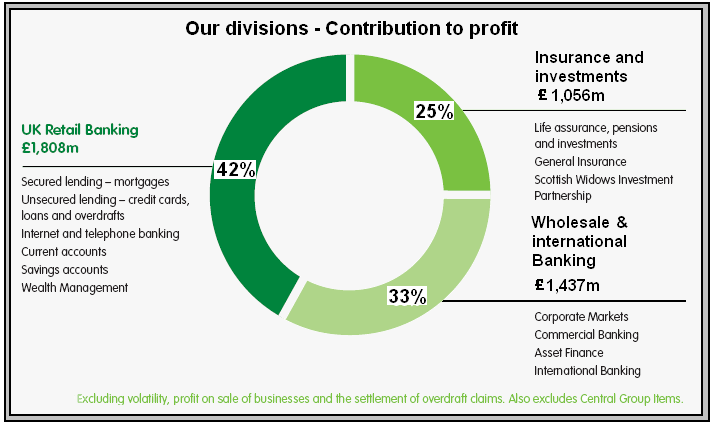

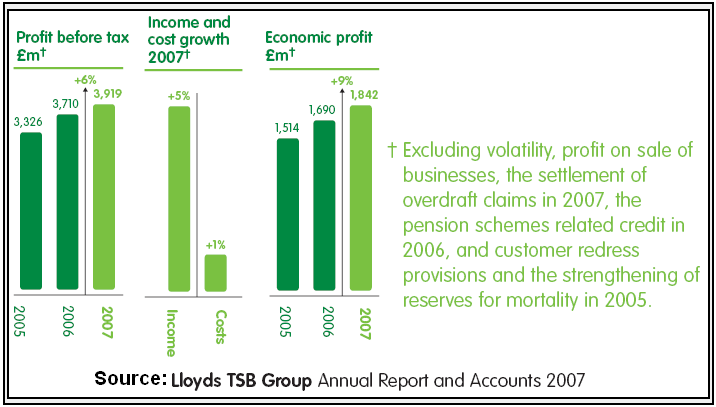

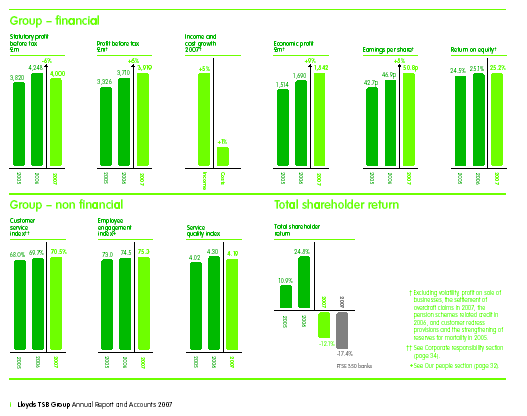

Miles and Snow provides organizational theory where they argued that there are mainly three larger performing business kinds and rest of the organisations are less than average or average. They define organization as such as defenders, analyzers, Prospectors are organizations. The Annual report 2007 of Lloyds TSB demonstrates that the growth rate is high, EPS (for 50% are awarded). It has clear and precise mission and vision which has designed to the number one financial services organisation in UK. According to their theory, these characteristics are important to holds superior position.

Now it should require to discuss whether Lloyds TSB conforms to the theories of Miles and Snow. Their models does not conform this organization directly but there exists some similarities with basic strategy set and characteristics & behavior with all of them. Lloyds TSB is totally different from defenders because it is a large organization with high profile. If it consider reactors, then it is essential to say that their characteristic indicates that it has no efficiency and it always searching market opportunity. Comparing three types of company it can argued that prospectors are organizations is fit best for Lloyds TSB as it holds dominant positions. This model fit best for all the organisatinal aspects such as technological, structural and strategically aspects.

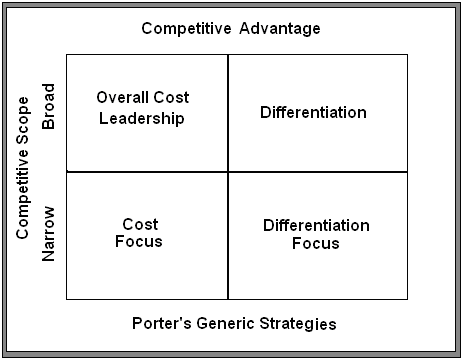

Porter’s model

It indicates Lloyd’s position in relation with other rivals as it has been indicated as second biggest bank in the UK. This approach for corporate strategy is known as Porter’s “Five forces model”. For this case study of Lloyds TSB, five forces of Porter’s model can be described as bellow-

- Threats of new competitor: As an admired financial service provider Lloyds TSB is highly concern of the entrants of new threats in the competition.

- Consumers bargaining power: Lloyds TSB keep an eye to every customer’s budget. For common products in the industry they provide better service for a low cost than other.

- Suppliers bargaining power: To bring out their objectives Lloyds TSB meet their all levels of managers and their subordinates to discuss operating plans and amend them if necessary.

- Substitute products threats: Lloyds TSB is enabling to uphold in the industry with repeatedly changes of the technology. As a result their credit card is the second largest in the UK market.

- Competitors’ rivalry: The Lloyds TSB Bank is the second largest player of UK mortgage market with their financial products and superior service. This information indicates that their marketing policy, products and services are high feature oriented than its competitors.

Mintzberg’s model

Horizontal differentiation indicates that it distributing all tasks and sub-tasks at the same level. It structure is also known as horizontal specialization. These types of structure can fails if it breaks up important specialist culture. For instance, Lloyds TSB includes specialist areas of accounting and finance department, management team and HRM development team as a result it has a high level of horizontal differentiation1.

On the other hand, vertical differentiation points out that in this structure all tasks and sub-tasks are distributing in accordance with influence or power of the authority or hierarchy. Lloyds TSB has low vertical differentiation complexity and it is less centralize process and this structure is not fit for Lloyds TSB.

Centralization as a character of an Organization as well as Lloyds TSB refers the amount of authority and autonomy given to multinational divisional managers is a reflection. Centralization offers a variety of strengths well suited to today’s customer finance market. Lloyds TSB choose centralization as their organization’s criteria for following reasons-

- In multiple locations, specialized skills, talent and technology are sometimes neither affordable nor practical.

- Decentralized locations usually mean an increase in overhead and staff. Coordination of products, money and control also add to the cost of decentralized locations

Organisational Effectiveness

According to (Robbins, P. S. and Judge, A. T., 2004) to measure the organisational effectiveness following aspects has considered taking in to account

Innovation

(Reuters, 2008) investigated that Lloyds TSB bank has been always innovative so that it has gained an award of most innovative working practices. This bank has always tried to find out something new in the banking sector of UK. Lloyds TSB bank has merged with other companies several times. (Newstrom, J. W., Davis, K, 2004) addressed that it is very enthusiastic to serve the customers by reducing the gap among a bank and customers with different account. The bank has introduced an Islamic account for specific type of customers. Lloyds TSB Bank has invented new thing time by time and results improved business cash flow.

It provides the loan very easily and with a different service. Lloyds TSB bank was nominated for most impressive deployment of security. It has won an award of most innovative use of document management system. Lloyds TSB was also nominated for most innovative use of payment and exchange system. It lets instant transfer of money between online saver and Lloyds TSB account. Their most competitive interest rate comes from their innovative ideas. They also provide online tax advice, information, budget planning, and many more services. They provide phone-banking services for round the clock.

Lloyds TSB keeps its continuous effort to achieve it’s objectives for innovation. Its innovation is deeply linked to Organizational Structure. Lloyds TSB’s Organizational structure encourages creativity and innovation. Its organizational structure does not allow for complete structural change, but it allow the promotion of structures to facilitate into the existing structure.

As a Mechanistic structures Lloyds TSB includes centralized control and power, straight down communication links, evidently defined tasks, submission to supervisors, inflexibility and firmness. For mechanistic structure, factors those allow to impose innovation in the right path without across-the-board change. Its innovation and organizational structure are linked through-

- Direct communication with the decision makers,

- Strong communication and informational stream among the departments,

- The substantial development of ideas from problem to solving, product development to commercialization

- Resourceful teams for innovation researching outside but connected into the organization, whose processes, cultural level etc circulate among the existing structure.

Quality

(Reuters, 2008) also added that the Lloyds TSB is one of the best quality service providers of the industry. It gives highest interest rates and through other facilities and become the market leader for quality services. It processes loan very quickly. Asset based lending is another quality service of the Lloyds TSB. The bank has used all its available assets in a flexible and imaginative way to fund its ambitions and finance its business objective.

Lloyds TSB Commercial Finance offered businesses asset based financing for over 40 years. Lloyds TSB Commercial Finance is currently funding over 14000 UK businesses of all sizes. Invoicing discount is a quality service of the bank, which enables providing funds to ones business by providing money against unpaid sales invoices. This is a service unlike factoring which keeps ones business secrets. There is a service of the Lloyds TSB bank, which can be used to fund new and used cars, coaches, buses and other this type of vehicles. Lloyds TSB Commercial Finance funds the capital investment programs as diverse as road freight, construction, printing and engineering service.

The essential quality objectives Lloyds TSB are as:

- To ascertain quality objectives on appropriate occupations and levels

- To make certain that they’re quantifiable

- Take account of objectives considered necessary to meet product requirements.

- Correspond to all staff the sense of objectives and who & how helps to achieve them.

- At some stage in management reviews, assess the demand for changes to quality objectives.

Lloyds TSB’s improvements the quality functions motivating organizational impact and competence expose the best practices in optimizing the quality of the organization. It faces the challenge of effectively configuring their Quality organizations to deliver optimal performance the, impact and efficiency in today’s market. For quality improving growing regulations and cost reduction should result on the structure of the organization. Lloyds TSB’s operation across various countries can use information exposed in this study should benchmark and get better performance in significant quality region such as organizational Size and Management Structure Thus, in this way quality impact on Lloyds TSB’s structure.

Cost-Effectiveness

(LTSB, 2008) mentioned that Lloyds TSB bank has been so much cost effective. It utilizes its assets and other equipments in such a way that it can minimize cost. Accentor and SAP think that they can help Lloyds TSB bank to minimize its cost. SAP an organisation, which helps other organisations to reduce cost and improve their organisation by superior cost effectiveness. SAP is a leading software solution company, which is helping Lloyds TSB bank.

This bank has also been able to reduce printing and distribution cost. The company now saves several tons of paper and thus reduces its cost. By using Internet and computer, it has been able to decrease high costs, which was not possible before invention of the computer and the Internet. ‘Lloyds TSB’ bank has been able to reduce its cost by its call centre. After research and development, the bank has taken a strategy for a monthly door drop campaign. The bank has been able to reduce cost of liabilities from the purchase of goods and services massively. Cost is also very low for it’s customers to open an account and maintain that account.

Customer-Responsiveness

(Reuters, 2008) stated that with superior customer responsiveness, Lloyds TSB has gained customers trust and made the customers loyal to them. It is very much customer responsiveness its online banking became very popular and has been awarded. Lloyds TSB offers four types of basic services in their website; for example personal, business, private and corporate. The main slogan of the Lloyds TSB is ‘you first’.

The slogan implies how much customer responsive if Lloyds TSB bank. It provides instant support for its present and potential customers. Mainly shorter services, administration, and distribution cycles are essential for ongoing customer satisfaction. By using their website, customers can know their balances and their status in the bank very quickly. Its website instantly lets its customer’s statements by date, amount, and payment type.

Research Findings to Support Argument

(Thompson, A. et al, 2007) explained that the uninterrupted strengthening schedules could show the way to early situation and beneath this schedule behaviour tends to rapidly deteriorate when realignment are suspended. However, continuous realignment is appropriate for newly emitted, unstable, or low frequency responses. In this context, alternating realignment prevent the early situation reasoning that they do not go behind every response. Their initiatives are suitable for steady as well as high frequency responses.

Added that the Managers those who are the most effectual in their jobs should be promoted the fastest (Vector, R., 2003). Researchers looked at the issue of what managers do from a somewhat different perspective. Added to perform the excellent job managers turn up the swiftest within the organization (Weick, K. E., 2007). The effectiveness of hourly pay rates and tips as methods for reinforcing desired behaviours all managers should engage in following managerial activities-

- Conventional management performs decision-making, planning, as well as controlling.

- Their activity also involved exchanging routine Communication and information as well as processing paperwork.

- The Human resource management performs motivating, managing conflict and imprisoning as well as recruitment and training.

- Managerial activities also include socializing, networking politicking, as well as interact with outcasts.

Linking theory to practice

Evaluation

According to (Weick, K. E., 2007) the UK based financial services group Lloyds TSB Bank is a foremost player in the global market who endow with an inclusive variety of banking and financial instruments both in the home and abroad. Lloyds TSB is a customer driven financial service provider.

In accordance with (Newstrom, J. W., Davis, K, 2004), The Lloyds TSB Bank’s impending influence on the environment comes out from its organisational operations and it persuades in the situation where the bank can uphold the advancements to improving its environmental performance. The Key arenas where Lloyds TSB can draw attention are as contracts and lending activities, purchasing as well as property management.

(Singleton, David, 2007) addressed by means of raising awareness of staffs and encouraging office waste, such as paper and plastics recycling The Lloyds TSB Bank would minimise the waste amount that they create.

- The Lloyds TSB Bank cuts its energy consumption taking different energy-saving measures and applying recognised guidelines and its property management codes of practice.

- The Lloyds TSB Bank integrates explicit environmental needs into conventions with its prime suppliers

- For The Lloyds TSB Bank, it’s workable to identify products from sustainable sources and materials made of recycled supplies otherwise intended to be easy to re-use.

- The Lloyds TSB Bank persists to give detailed course of action to the lending officials who would help them to recognizing environmental risks both in the UK and overseas.

- The Lloyds TSB Bank act in accordance with all relevant environmental, health and safety measures mentioned in the legislation

- The Lloyds TSB Bank makes its statement publicly on their environmental management initiatives.

However The Lloyds TSB Bank continues its assessment, evaluates its achievements in contrast with the targets. The Bank is also looking for opportunities to raise more awareness on environmental policy among their employees. The Deputy Group Chief Executive is responsible for the Bank’s environmental policy. This policy will be The Lloyds TSB Bank reviews its environmental policy on a regular basis for appropriate up-to-date.

Solutions/ Recommendations

The present US recession is almost similar to the Great Depression of thirties. In UK, the crises may turn this one feels deeper, durable and more damaging if appropriate measures are not taken right now. Organisations have to reconstruct their strategy to overcome the cash crises. Most UK banks Like HSBC, UK already curtailed its big working force and rescheduled its organisational change. Lloyds TSB Group would take a review on it strategy and take organisational change to face the challenge of US recession. Considerable points for strategic change may take into account

- Lloyds TSB Group would take into account the aftermath conditions of US recession and reconsider configure the merger decision.

- HBOS and The Lloyds TSB group merger could gain a recessional gain it held in prior.

- Bad Credit recovering drive supported for further implication.

- Reduce mortgage costs

- Amplify employee engagement;

- Augmented customer satisfaction;

- Enhanced responsiveness to changes in patterns of customer behaviour;

- Sustain for expansion of new markets and

- Innovation in existing markets;

- Enhanced brand perception.

- Formulate a disciplined hierarchy for management responsibility and reporting.

- Root out the conflict between quality group and Lloyds TSB for better performance.

- To remove stress and conflicts change the working shifts in factory.

- Remove all types of communication barriers.

An organization’s internal structure contributes to illuminating and predicting behavior. That is, in addition to individual and group factors, the structural relationships in which people work has bearing on employee attitudes and behavior. Strategy, size, technology, and other environmental issues determine the kind of structure an Organisation will have. For a sound accountability Lloyds TSB needs to centralise its organisational structure.

Bibliography

Connors, R. & Smith, T. (2006), Benchmarking Cultural Transition, Journal of Business Strategy.

Consortium Research Program, (2008), Organisational structure. Web.

Hatch, M.J., (2006), Organisation Theory: Modern, symbolic, and postmodern perspectives”, 2nd ed., Oxford University Press, ISBN: 0-19-926021-4.

Kulzick, R. S. (2004) Miles and Snow Organizational Types? (C) 2000 Kulzick Associates. Web.

LTSB (2008), Corporate responsibility. Web.

LTSB (2008), Annual Report and Accounts 2007. Web.

Porter, M. E. (2004), Competitive Strategy, Export Edition, New York: The Free Press, ISBN 10: 0743260880.

Porter, M. E. (1998), Competitive Advantage: Creating and Sustaining Superior Performance, 1st edition, New York: The Free Press, ISBN-10: 0684841460.

Newstrom, J. W., Davis, K. (2004), Organisational Behavior, 11th Edition, Tata-McGraw Hill Publishing Company Limited, London, ISBN: 0-07-047264-5.

Robbins, P. S. and Judge, A. T., (2004), Organisational Behavior, 12th ed. Prentice Hall, India, ISBN: 0-13-170901-1.

Reuters (2008), Lloyds TSB terms for acquisition of HBOS, London. Web.

Singleton, David (2007), Lloyds TSB reviews PR in complex environment. Web.

Simon, Herbert A. (2007), Administrative Behavior: A Study of Decision-Making Processes in Admini.

Stoner, J. A. F., Freeman, R. E., Gilbert, D. R. (2006), Management, 6th Edition, Prentice-Hall of India Private Limited, ISBN: 81-203-0981-2.

Thompson, A. et al (2007), Strategic Management, 13th edition, Tata McGraw- Hill Publishing Company limited, New Delhi, India.

Vector, R., (2003), Organisational Behavior: Core Concepts, 5th ed., Mason OH: South-Western, ISBN: 0-324-17072-6.

Weick, K. E., (2007), The Social Psychology of Organizing, 5th edition, McGraw Hill, ISBN: 0 07554808-9.

Robbins, S., P., & Barnwell, N (2006) Organisation Theory: Concepts & Cases (5th ed) New York: Prentice Hall. (65800994 Rob-02)

Yahoo, Finance, (2008), Lloyds TSB Group plc (LYG). Web.