Introduction

This is a report with information on different Sukuks (Islamic bonds). It shows historical data, bid prices and ask prices (ALCLICK, 2009). The information shall be useful for comparison of different Sukuks.

Public Sukuks

Components of the Dow Jones Citigroup Sukuk Index, 2008

Source: Citigroup Index LLC., November 2008

*Amount in US $ Millions

Sukuks Issuance by Industry

Source: Dow Jones, 2008

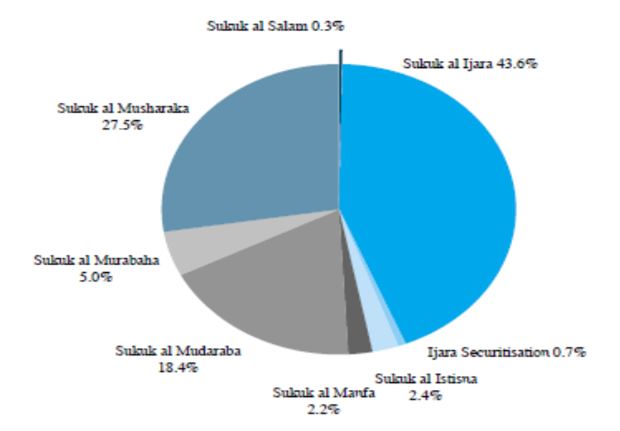

Shari’ah Structure

Issuances by Type of Shari’ah Structure

Source: Dow Jones, 2008

From January 1997 to November 2008

Source: Dow Jones, 2008

Source: IIFM dated 29/03/2010

Tenor

Tenor is an imperative factor in the sukuk market as a tool for raising Islamic capital markets. Therefore, it is a source of concern for market players.

According to Dow Jones, only 3.69 percent of the total issuances have a tenor of over 20 years or more. This represents only 19.8 percent of the issuance volume.

Long-term tenure has 16.44 percent (the period is more than 10 years). This represents 38.1 percent of the issuance volumes. This cannot favor countries’ development needs. For instance, the need for infrastructure development and other long-term financial needs require $21.7 trillion by 2014.

Source: Dow Jones, 2008

The most common form of tenor is the medium-term. From the above charts, we have the following observations:

- Five-year tenors have 18.79 percent in numbers and 31.2 percent of the total sukuks issued

- Five to nine year tenors have 45.13 percent of total issuances

- One to nine year tenors constitute 53.42 percent of the total of issuances, which represent 58.48 percent by volume

- Five to 19 year tenors are 47.82 percent and 59.2 percent in terms of numbers and volumes respectively

- Medium-term implies issuance between one to 19 years of tenor. They represent 55.03 in terms of numbers and 75.9 percent by volume

Industry Statistics

Secondary Market Prices, 2013

Source: Web.

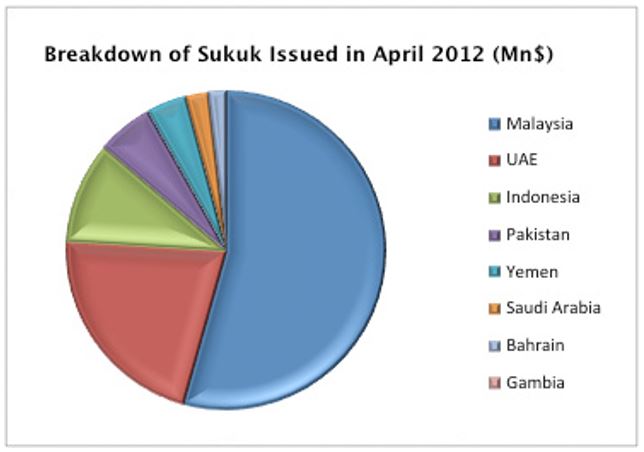

The Sukuk market gained strength in 2002. The Malaysian government issued sukuks, which were worth US$600 million. This development in the sukuk market occurred because of sovereign benchmark issues. These figures grew steadily by 40 percent within six months in 2007.

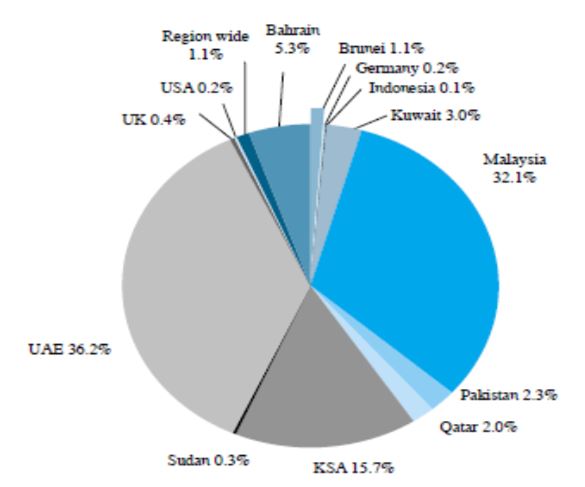

About 36 percent of the issuances came from Asia, specifically Malaysia, Brunei, and Pakistan. The GCC contributed about 62.1 percent between 2001 and 2007.

Between 2001 and 2007, the UAE led in the issuance of sukuks with regard to sizes. It issued 36.2 percent of the total world Sukuks issued during that period.

During the same period, Malaysia contributed 32.1 percent sukuks issued between 2001 and 2007. This implies that Malaysia was the largest player in the issuance of sukuks. This represented 137 issues while the UAE issued 29.

Sukuk markets have grown exponentially. However, it faces several challenges related to economic conditions, regulatory, and legal issues. This observation considers Shariah compliant provisions. These trends are common in any emerging security markets.

However, there are efforts from Islamic regulators to control such problems. These regulators include the Accounting and Auditing Organization for Islamic Financial Institutions, the International Islamic Financial Market, and the Islamic Financial Services Board.

- Corporate issuances have demonstrated strong and rapid expansion since 2001. This includes both public and private issuances.

- The value rose from USD0.4 billion in 2003 to USD9.9 billion in 2006. This represents a growth of 2,380.7 percent.

- Malaysia issued most of the Shariah-compliant corporate sukuks. This was about 90 percent in 2004.

- Most corporate issues take the form of quasi-sovereign. Sovereign natures of the risk behind these sukuks drive investors’ actions.

Annual Issuance in Tenor Categories by Number of Issuances

Source: Dow Jones, 2008

Major Managers of sukuk securities: 2001 year to September 2005

Source: Islamic Finance News, 2005

Sources: Saudi Arabian Monetary Agency and Bank Negara, Malaysia, 2005

Dow Jones Islamic Market Indexes Performance Report* in part based on back tested performance, 2008

Regional break-up of the Domestic Sukuk Market

Source: IIFM 1st edition, 2010

Recent Corporate Sukuk Issues in the GCC

Source: Zawya, 2008

For the Year International Market Global Market

Source: IIFM Sukuk issuance Database, 2010

The following table provides the current fixing rate and return payment details for Sukuks, which are administered by LMC and is prepared for the benefit of Sukuk investors.

Last Updated 25 Aug 2008

Source: Web.

The following table provides the details of Sukuk trades executed by LMC in the Secondary Market:

Last Updated 27 March 2007

Source: Web.

The following list is sorted in alphabetical order with LMC administered Sukuk at the top:

Last Updated 7 May 2008

Source: Web.

Main observations from various sukuks

- The data reveal that there is a great demand for sukuks since 2001

- There should be sound Shariah laws to manage the sector

- Malaysia has the most active sukuks

- The sector needs right frameworks of laws, regulations, and legal systems to support the growth

- Most comprehensive data cover periods between 2001 and 2008

Reference

ALCLICK. (2009). Sukuk information and Sukuk market data. Web.