IT Integration and Synchronization

Modernity is often referred to as the age of information, which makes IT a central aspect of any business. It has been acknowledged that IT integration and synchronization contribute to the development of an organization’s competitive advantage as companies manage to share information quickly and carry out tasks effectively. In simple terms, IT integration and synchronization increase “the amount of internal collaboration” and make it more efficient (Fredendall and Hill 221).

Organizations can provide products and services of a higher quality as the vast majority of errors can be eliminated due to effective communication. TAL Apparel understood the need to integrate and effectively manage internal collaboration in the 2000s. The company’s Managing Director, Harry Lee, stresses that the efforts made to address this goal have started paying off quite recently (Farhoomand and Ho 5).

The company invested considerable funds in the improvement of its internal communication and information sharing, but there were several unsuccessful attempts due to the use of inefficient software and strategies as well as the abundance of platforms developed within different departments and facilities. At present, the company has sound information and communications infrastructure that has contributed to the organization’s growth.

Vendor Management Inventory (VMI) and Made-to-Measure Initiatives

TAL Apparel employed vendor-managed inventory and made-to-measure approach that resulted in significant benefits for the company. The use of these methods has led to the development of a serious competitive advantage. TAL Apparel received the data that enabled the company to forecast future demand and produce its products timely. The made-to-measure initiative was rather costly as it required the use of state-of-the-art software and hardware as well as extensive training of the staff.

As for the particular results of the use of the strategies mentioned above, it is necessary to state that the company displayed a substantial growth in inventory turnover (35%) and sales (19%) (Farhoomand and Ho 5). Importantly, the use of these methods was associated with a strategic repositioning in the value chain. Instead of simply responding to retailers’ demand and providing required products, the organization has started offering new services that include “demand forecasting, product design, material sourcing, and test marketing” (Farhoomand and Ho 8).

TAL Apparel started developing new products that were sold through popular retail chains. The use of effective IT technologies (as well as IT integration and synchronization) has enabled the organization to come up with efficient forecasts and products that became popular among customers. It is noteworthy that the shift to vendor-managed inventory and made-to-measure approach requires substantial investments, but the organizational growth shows that the funds invested return (and increase) in considerable financial gains.

Value Chain of the Global Apparel Industry

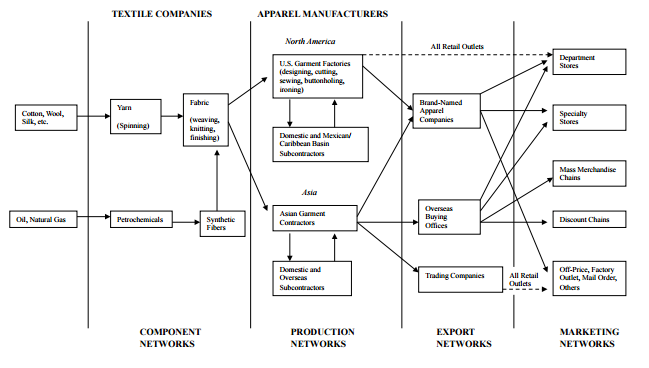

The value chain of the global apparel industry includes such areas as raw materials, manufacture, wholesaling, retailers (see fig. 1). A brief analysis of the chain shows that there have been certain shifts in its geography. Raw materials are mainly produced in developing countries due to the low cost of manual labor and quite a significant amount of resources (Fredendall and Hill 39).

Manufacturers have also been located in developing countries, but there are certain changes in particular locations. Asia (the Asian Three Big) dominated at the end of the 20th century as two-thirds of products within the industry were produced in that region (Farhoomand and Ho 2). The changes in the WTO regulations and some internal factors, however, made the region less attractive due to the increasing costs. In the 2000s, countries of the Caribbean and Latin America became popular locations for manufacturers. As for wholesalers, these are North American, European, and Asian companies while retailers are mainly European and North American companies.

The Dynamics of the Apparel Value Chain and How the Global Apparel Industry Is Classified as Buyer-Driven Industry

As has been mentioned above, there have been certain changes in the apparel value chain associated with the regions involved. Another significant change that is taking place is the changing roles of the stakeholders (Fernandez-Stark 1). Such producers as Tal Apparel do not confine their services to mere production but expand the range of services provided. They start forecasting sales and even designing clothes (Farhoomand and Ho 8). Nevertheless, the apparel industry is still classified as buyer-driven.

Retailers are still the leading stakeholders who make decisions concerning designs, range, amount, and so on. Some retailers use new services offered by Asian manufacturers, but these are still quite occasional cases that do not influence the overall distribution of roles. The reason behind this type of approach might be associated with such concepts as brand and promotion. Retailers promote their brands and products, so they want to make sure that their effort will be successful. Retailers also know their markets well and are not likely to fully rely on the manufacturer’s expertise. Things are unlikely to change in the near future, so the apparel industry will remain buyer-driven.

Works Cited

Farhoomand, Ali, and Phoebe Ho. TAL Apparel Ltd.: Stepping up the Value Chain. Harvard Business Review, 2005.

Fernandez-Stark, Karina, et al. The Apparel Global Value Chain. Web.

Fredendall, Lawrence D., and Ed Hill. Basics of Supply Chain Management. CRC Press, 2016.