Target Corporation

Comprehensive market research and the detailed analysis of the peculiarities of Target Corporations functioning contributed to the acquisition of data needed for the determination of advantages and disadvantages of four strategies offered as a possible way of further company’s evolution. Besides, the first strategic alternative suggests doing nothing and continue to compete in the given sphere. However, this very approach should be considered inefficient and even mistaken.

There are several reasons for this statement. First, the case provides us with information that shows the gradual deterioration of the situation and Targets functioning. The increased rivalry combined with the significant shifts in the structure of market precondition the appearance of new brands which should be taken into account to guarantee that Target Corporation will be able to continue its growth.

Furthermore, the appearance of new and powerful competitors that can attain success in the given sphere means that that company lacks a competitive advantage that would be able to guarantee its stable positions. For these reasons, in case these tendencies are disregarded, the further deterioration of the situation will be observed. Target Corporation will continue to lose its customers, and the level of income will also decrease.

The adherence to the same strategies that were used before and the absence of any change strategy would have a pernicious impact on the company’s functioning and might even result in its collapse. The case and information provided in it emphasize the necessity of change to be able to meet the majority of the modern challenges and overcome them. For this reason, the strategic alternative that is focused on the preservation of the corporations current state could hardly be considered appropriate.

Another option available for Target Corporation is to scale back groceries to mainly non-perishable staples and convenience items. This decision might be considered the most appropriate one as it contributes to the sign company’s restructuring along with the preservation of its traditional image. The corporation will have to devote about $1 million per store to initiate the procedure of remodeling. Additionally, there is also the need for the significant reduction of square footage allocated to groceries – from 20 to 25 percent of selling space.

However, despite these actions and possible spending, the given strategic approach might still be considered appropriate. Several main points contribute to its great efficiency. First, the company will be able to preserve its unique image and loyalty of customers who are interested in its services. The alterations will not touch the brand or its unique character.

For this reason, the majority of Target Corporations clients will be able to come here frequently. Furthermore, The company will be able to continue to develop its brand labels, and this fact is crucial for the further rise and evolution of the given company. Preservation of independence combined with the reconsideration of several strategies that are not efficient anymore will contribute to the improved outcomes and assure the company’s further rise.

Yet, there is still a threat of numerous problems caused by the possible complications related to the format change as customers might feel confused because of this process. However, the expected positive outcomes and significant improvement of the company’s functioning, as well as the increase of the level of revenues, might evidence the efficiency of this very course of action.

Besides, there is another perspective that includes the attempts to look for a new partner and initiate the procedure of outsourcing. Despite numerous advantages that it could offer to the company, the given strategic alternative is still less promising than the above-mentioned one. Hence, the obvious positive aspect of the given restructuring is that Target Corporation will not have to worry about the complex supply chain related to perishable products which are now considered one of the most significant weaknesses of the company. However, the given step poses a significant threat to the development of the brand names associated with the Target Corporation and could confuse the target audience.

Moreover, if to consider the long-term perspective, the company might also face other retailers unwillingness to work with it and place its shops on their territories especially in geographic areas where these very retailers have their stores. Thus, it is also vital to mention another important aspect which is a significant decrease in the level of independence that has always been associated with the brand. It means that in case the agreement with other companies is made and Target Corporation initiates the procedure of outsourcing, it’s functioning, and possibilities for the further rise will be limited as it will have to act resting on the peculiarities of the companies that will be considered it partners. In this regard, the above-mentioned facts contribute to the reconsideration of this perspective. It should be taken as inefficient as the given strategic approach undermines the nature of the company and deprives it of an opportunity to act independently, disregarding the functioning of other partners.

Finally, there is another strategic plan available for Target Corporation. The company might abandon the category in which it functions at the moment. The given approach might be considered the most expensive one among all mentioned above. It will require significant investments from the company as remodeling costs will rise to $3 million per each store. Moreover, there will be a great need for additional equipment and software that will also increase the price of this restructuring and contribute the doubtful results.

On the one hand, the given strategy provides an opportunity for the strengthening of its market position and further growth as the opportunities for the usage of new products will appear. On the other, loyal customers will leave Target Corporation because of such a significant change in the course. Additionally, the company’s staff might also suffer from such a radical reorganization and feel lost. For this reason, the given approach should be considered inappropriate as it deprives the company of its major competitive advantage and results in the loss of the target audience. This fact might have a pernicious impact on the whole company.

Altogether, analyzing the environment in which the company functions, its strengths and weaknesses, it is possible to assume that the second option that implies the focus on the non-perishable staples is the most efficient for the company as it contributes to the improved outcomes and acquisition of a significant competitive advantage needed to guarantee the further rise and evolution. It could be recommended as the only possible perspective to attain success and remain beneficial.

Business Environment Analysis

Investigating the functioning of the Target Corporation to determine the most appropriate approach that could be used to attain success and guarantee the company’s rise, it is crucial to perform a comprehensive analysis of the most important aspects of the company to determine the perspectives that await it. For this reason, such tools as SWOT analysis, Porter’s 5 Five Forces model, PEST, and other tools should be explored.

Porter’s Five Forces Analysis

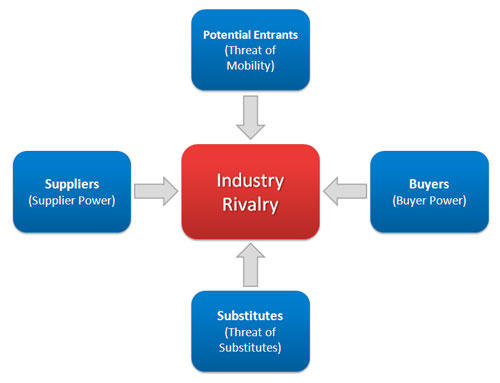

First, applying the Porter’s Five Forces, one could admit the complexity of the situation in the sphere.

Buyer power could be described as high. The fact is that the economy recovers from the aftermath of the 2008 financial crisis and provides people with an opportunity to obtain extra incomes and spend money on things they need. The great purchasing power of customers is a positive aspect that impacts the functioning of Target Corporation greatly and might guarantee stable and high revenues.

However, continuing the investigation, it is vital to admit a significant threat of substitutes which means that the company suggests products that could easily be replaced with the other ones. It results in the increased tension in the functioning of the Target Corporation and conditions the necessity of the creation of some specific offering that might interest customers. Supplier power could be described as moderate. The company does not depend on them greatly as numerous brands suggest their services and Target could make deals with them.

Thus, the threat of a new entry is rather high. The existence of the demand for products provided by the agents functioning in the given sphere contributes to the appearance of new brands that want to obtain incomes and enter this market. Altogether, resting on this data, it is possible to admit high industry rivalry and the unique importance of the competitive advantage that might guarantee the company’s further rise.

PEST Analysis

PEST analysis proves the existence of the positive environment needed for the company’s further rise. Investigation of the political factor shows that the existing tax policy and other regulations create a solid basis for a company’s evolution and further rise. Moreover, the state of the economy also should be considered a positive aspect that should be explored when creating a marketing strategy. The increased level of income contributes to the stable level of revenues and preconditions their further rise which is one of the factors needed for Target Corporation’s rise.

Thus, social conditions are also beneficial. Numerous investigations show that population is ready to pay money for the products that will meet their demands for the quality. Finally, the rapid rise of technologies could also be explored by the company to increase the efficiency of different processes. Besides, investigating the company’s functioning, it is also vital to admit its focus on the creation of a certain competitive advantage that might help it to evolve and win the rivalry. Yet, it tends to provide customers with outstanding perishable products that meet their high demands for quality.

Moreover, the comparatively low price combined with the respect given to the loyal customers improve the brands image and contribute to its popularization. Moreover, an array of brands incorporated in Target Corporation and the provision of its unique products might also be considered its significant competitive advantage. The exploration of these facts helps the company to evolve and remain beneficial.

Therefore, the company’s financial health is one of the main factors that should be investigated. The table below demonstrates the profit peculiar to the industry

Table 1: Industry profit averages as a percentage of sales.

It shows that the level of revenues remains high. Customers could be characterized by a high level of demand. For this reason, they spend a lot to satisfy their existing needs. Thus, Target Corporation is characterized by a stable level of income. However, the 2008 financial crisis impacted the company and resulted in the deterioration of its showings. Thus, it managed to recover and guarantee further rise. The company’s current financial statement shows that in 2015 it managed to earn $74 million only in merchandise sells. Yet, the last events pose a certain threat to the company’s security and might undermine its financial health.

Supply Chain Analysis

Investigating the company’s supply chain, follow-up services, and the major operations, it is possible to admit their great efficiency and well-organized nature. Thus, as stated above, there are still several problems related to perishable products supply chain which needs improvement badly. Additionally, the lack of space could also be considered a significant drawback of the company’s supply chain. Finally, a company possesses numerous resources that could be used to guarantee its further expansion and preserve its leading positions. At the moment, its capabilities could be estimated as powerful. Its budget and financial flows provide an array of opportunities for further improvement.

Conclusion

Altogether, the above-mentioned tools for internal and external analysis provided the data that could be incorporated to accomplish a comprehensive SWOT. Besides, the company’s loyal target audience and focus on the goods popular with people might be considered its main competitive advantage that contributes to its further rise and growth. Additionally, several other brands are developed by Target Corporation and this fact contributes to its gradual evolution.

Yet, the latest tendencies show the corporations significant weakness which is the lack of new ideas and approaches to its restructuring. Target Corporation explores the same strategy it used to implement a decade ago and it could not but affect its functioning. Moreover, the problems in the supply chain related to perishable products, storage, delivery, and supply might be considered another significant weakness.

The investigation also shows that there are significant problems with selling spaces for perishable products. Yet, considering these facts, there are several opportunities peculiar to the company. It could focus on the improvement of the most problematic aspects of its functioning and remain the most significant factor in the given sphere. Additionally, there is also an opportunity for the further growth that comes from the great potential and beneficial market conditions. It could also focus on the development of brands associated with the given corporation.

Thus, there is a great threat of new rivals which also function in the given sector and might deprive the company of a significant number of customers and decrease its incomes. Additionally, in case the market conditions will alter and downtrend could be observed, the company might suffer from a decrease in the level of income. These data could be presented in the following table:

Bibliography

Baden-Fuller, Charles, and Vincent Mangematin. “Business models: A challenging agenda.” Strategic Organization 11, no. 4 (2013): 418-427. Web.

Bells, Sonya. “An Analysis of the US Grocery Market.” Market Realist. 2015. Web.

OReilly, Kelley, Paper, David, and Sherry Marx. “Demystifying Grounded Theory for Business Research.” Organizational Research Methods 15, no. 2 (2012): 247-262. Web.

“Porter’s Five Forces Analysis.” PESTLE analysis. Web.

Robinson, David. “Target Corporation: The Grocery Business in the Bull’s Eye.” Harvard Business Review. Web.