- Explaining NPV and FV:

- The net cash inflow at the present time within a business entity is usually used to compute the Net present value (NPV).

- A project is responsible for the generation of this cash flow.

- In order to obtain the actual net present value, the original investment that was made in a project ought to be subtracted from both the available salvage value and the generated inflows.

It is imperative to mention that capital budgeting relies on this measure since it is highly accurate when calculating the net value of a business entity at any given time. For instance, the value of time in terms of money is accurately accounted for by this measure (Fields, 2002). The latter is attained by making use of cash flows that have been discounted.

On the other hand, when the asset value is quoted at a particular future time, it is referred to as the Future Value (FV). In other words, the future value of a given nominal sum of cash at the present is the future value. This measure can also depict the rate of return of a current asset over a stated projected period into the future. Therefore, a given interest rate ought to be assumed over a current asset if the future value is to be computed.

Factors that are used in the NPV and the FV formulae

- NPV:

- A specified rate of return has to be established before NPV can be calculated. This rate assists in discounting cash inflows (net). Therefore,

- Net cash inflow = total cash inflow–direct expenses.

- When there is need to compute NPV, the cash inflow of the present value has to be determined.

- There are some instances when the cash inflows may vary or be equal in various periods. Hence, different periods may experience varying cash flows.

The formula of annuity can be used to calculate the present value when there is an even cash flow (Fields, 2002). Nonetheless, separate calculation should be conducted when the inflows are uneven.

In order to finally obtain the net present value, the initial investment is taken away from the total inflow of the present value. Hence, NPV is computed as shown in the following steps:

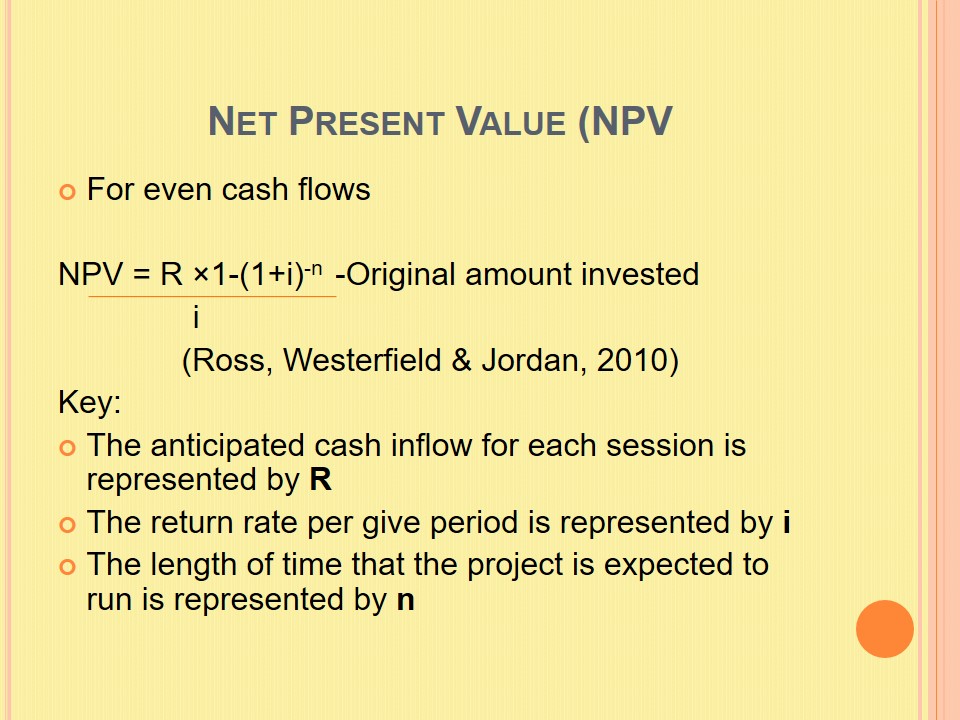

Net Present Value (NPV)

For even cash flows:

(NPV = R ×1-(1+i)-n)/i -Original amount invested (Ross, Westerfield & Jordan, 2010).

Key:

- The anticipated cash inflow for each session is represented by R;

- The return rate per give period is represented by i;

- The length of time that the project is expected to run is represented by n.

In the event that an uneven cash inflow is experienced,

NPV =R1+R2+R3+ …− original amount invested

(1 + i)1

(1 + i)2

(1 + i)3(Fields, 2002)

Key:R1, R2 and R3 are net cash inflows for the 1st, 2nd, and 3rd periods.

The expected return rates per given session is represented by I while the other variables remain as already explained above.

Future Value (FV)

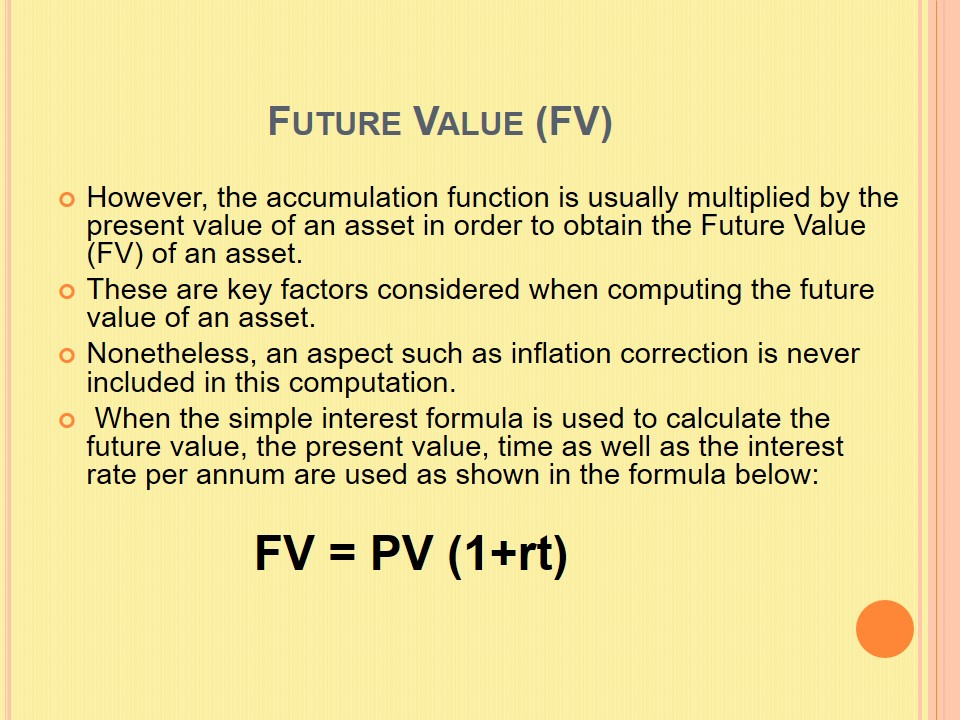

- However, the accumulation function is usually multiplied by the present value of an asset in order to obtain the Future Value (FV) of an asset.

- These are key factors considered when computing the future value of an asset.

- Nonetheless, an aspect such as inflation correction is never included in this computation.

- When the simple interest formula is used to calculate the future value, the present value, time as well as the interest rate per annum are used as shown in the formula below: FV = PV (1+rt).

- Present Value is represented by PV, time is represented by t and the annual interest rate is represented by r.

- Even though the above simple interest formula can be used to obtain the future value of an asset, it is hardly employed in FV calculations since it is more comprehensive and significant to use the compound interest formula.

- Better still, a linear growth of an asset is usually assumed when the simple interest formula is used.

- This ignores other pertinent factors (such as interest earned) that may equally be instrumental in creating a multiplying effect when ploughed back to the business.

It is also imperative to mention that the future value can be calculated using either the simple interest or compound interest formula

The following compound interest formula can be used: FV = PV (1+i)t.

Formula: FV = PV (1+i)t

- In the above formula, the present value is represented by PV, time is represented by t while the rate of interest over a given time is denoted by r.

- when the above compound interest formula is used, an exponential increase on the future value of an asset is experienced.

- This occurs only when there is a positive rate of interest. The time factor used in the formula depicts the growth rate (Ross, Westerfield & Jordan, 2010)

Worked Examples

- Both the Net Present Value and Future Value formulae are indeed important since they can be used to calculate and obtain the unknown variants at any given time.

Example 1 :

- How long will a $500 deposit placed in a bank take to increase by twice the amount? Assume that the bank allows an 8% interest rate per annum and which is also compounded on a yearly basis.

Solution 1:

- We are supposed to work out for the number of periods or length of time that will be taken for the initial amount to double.

Given:

- r = 0.08;

- PVo = $500;

- FVn = $1000;

- n =?;

- The known quantities as given above may be substituted in the compound formula and then proceed solving for the unknown value n.

- From the formula PVo = FVn (1+ r)-n a rearrangement can be done as follows:

- PV0/FVn = (1 + r)–n.

Example 2:

- A businessman deposited $2,000 in bank account. The bank allows interest rate that can be adjusted. The rate during year one is 10% and it is annually compounded. The rate is adjusted to 8% in the second year. This rate is then compounded quarterly. How much will the businessman have in the bank account after 2 years?

Solution 2:

- We need to form and solve an algebraic equation as shown below:

- FV2 = FV1 (1.02)4

- FV1 = PVo (1.10)1

- When the known numeral values are substituted in the above equation,

- FV2 = PV0 (1.10) (1.02)4

- = $2,000(1.10) (1.02)4

- = $2,000(1.10) (1.08243);

- = $2,000(1.190675);

- = $2,381.35.

When the logarithm of the equation is taken on both sides, log(FVn/PV0) = –n log(1 + r) or n log(1 + r) = log (FVn/PV0) solving for n we have,n = log(FVn/PV0)/log(1 + r) when the known values are plugged in, we have n = log ($1000/$500)/log (1 + 0.08) = 9.