Summary

This paper aims to examine Tesla Motors’ business model in terms of its competitive advantages. First, an overview of the company’s entry strategy will be provided to examine the challenges that Tesla faced when entering the market. Next, the paper will consider the question of Tesla’s profitability, regarding the company’s competitive advantages, revenue, and operational cost numbers, as well as providing an estimation of the future potential for the evolution of the company. Further, based on the findings from the previous sections, this study will suggest several strategies to benefit and strengthen Tesla’s position in the industry. In the context of these suggestions, a policy for overcoming the competition will be discussed, and finally, an overall conclusion will be drawn.

Tesla’s Entry Strategy

Barriers Tesla Has Had to Overcome

Considering the five forces framework, which was described by Thompson, Peteraf, Gamble, and Strickland (2018), it is essential to identify the involved parties for each force (p. 51). The competition from rival sellers is significantly high while the competition from new entrants is likely to be weak since Tesla itself is still a newcomer (Van den Steen, 2015, p. 5). The producers of substitute products (gas-fueled cars) are also considerable rivals for the company. Suppliers do not have significant bargaining power since Tesla has very advantageous contracts with its suppliers, for example, with Panasonic (Van den Steen, 2015, p. 7). The bargaining power of buyers is moderate because the buyer’s group appears to be concentrated primarily in the United States.

Further, it is essential to discuss the entry barriers. The car industry comprises one of the largest markets in the United States; thus, Tesla Motors was in a challenging position upon its entry into this market (Van den Steen, 2015, p. 1). The three principal aspects of automobile production include (a) car design; (b) car manufacturing; and (c) car marketing, distribution, and service. First, it should be noted that the development of a new car design involves significant expenditures (up to $6 billion) and a prolonged period (4 to 5 years) (Van den Steen, 2015, p. 2).

Manufacturing incurs significant operating costs, such as those for large assembly plants, and the industry of marketing, distribution, and service is highly competitive (Van den Steen, 2015, pp. 2–3). Also, Tesla’s team comprised people who had no experience in the car industry, which presented another barrier (Van den Steen, 2015, p. 6). Finally, the market for electric cars was fraught with considerable uncertainty about the long-term profitability related to their manufacture, resale value, and safety (Van den Steen, 2015, p. 5).

What Nissan Can Learn from Tesla’s Approach

Nissan can be considered a primary competitor of Tesla Motors. In 2007, Carlos Ghosn, CEO of Nissan, initiated the development of the Nissan Leaf, the most ambitious project in the electric vehicle (EV) industry (Van den Steen, 2015, p. 5). This new addition to Nissan’s offerings was designed from the ground up, a process that took the company three years, albeit somewhat faster than the company’s standard four-year span (Van den Steen, 2015, p. 5). The Nissan Leaf is a mid-sized family-oriented sedan whose battery was developed in “a joint venture with NEC” (Van den Steen, 2015, p. 5).

It would be possible—perhaps even advisable—for Nissan to adopt two primary aspects of Tesla Motors’ business approach. First, Tesla entered the market with the Roadster, a high-end product that aimed for an upper-class market segment (Van den Steen, 2015, p. 6). This approach helped the company to establish its position as a leader in the industry. Second, Tesla outsourced the design of their battery to Panasonic; thus, the company was able to create a very powerful motor at less expense (Van den Steen, 2015, p. 7).

The Possibility of Other Car Manufacturers Following Tesla’s Approach

Numerous governments, including that of the United States, are concerned with reducing toxic emissions from cars. Accordingly, they are promoting the adoption of EVs by setting a minimum percentage of electric vehicles to be sold by a particular manufacturer (Van den Steen, 2015, p. 5). Therefore, other companies may choose to follow Tesla’s approach. The company’s success has proved to other car manufacturers that the EV market has considerable commercial potential. However, many other companies entering the EV market would have to shape their entry strategies accordingly since Tesla Motors dominates the industry.

Tesla’s Profitability

Tesla and Profits

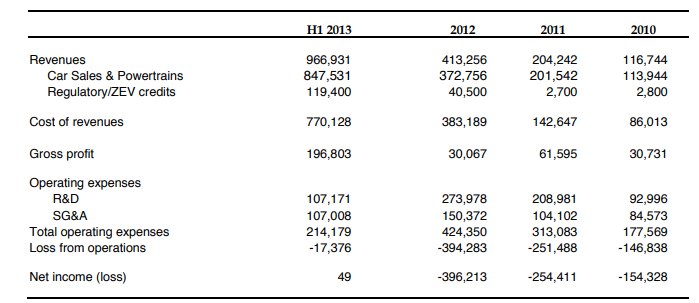

In considering the whole picture, it is essential to discuss the question of Tesla’s profitability. Undoubtedly, the company has enjoyed a successful entry to the market: In the first half of 2013, “it sold 10,500 model Scars” and “its market cap was about a quarter of that of BMW” (Van den Steen, 2015, p. 9). More particular data from the case can be found in Exhibit 1. According to Thompson et al. (2018), the company’s total revenues have grown from 204,242 to 2,013,496 dollars from 2011 to 2013, respectively (p. C-203). Also, the researchers mentioned that Tesla raised “over $1 billion by issuing new shares of common stock” (Thompson et al., 2018, p. C-203).

Tesla’s Competitive Advantages

Thompson et al. (2018) mentioned that Tesla Motors constitutes a group of companies performing focused (also referred to as market niche) strategies (p. 136). In particular, Tesla employs a focused differentiation strategy since it

- aims for a relatively narrow segment

- can provide a high-end product (Thompson et al., 2018, p. 137).

Focusing on a particular market niche creates a high level of competition. However, Tesla has the following advantages:

- its market entry was immensely successful, establishing its position as an industry leader,

- it holds to “in-house” manufacturing and assembling policy,

- it has built a network of company-owned retail stores instead of independent dealerships (Van den Steen, 2015, p. 8).

Estimated Evolution of Tesla’s Position

Also, it is possible to suggest the way Tesla’s position in the market will evolve by the end of 2014. Based on information about the company’s performance in the past, it is eminently possible that Tesla can significantly extend their business. In particular, Musk has expressed ambitious plans involving “shipping 40,000 Model S per year by the end of 2014,” and he also stated that he aims to create more accessible mass-produced EVs (Van den Steen, 2015, p. 8). However, as Thompson et al. (2018) have noted, in 2014, Tesla sold 17,300 cars, while Nissan sold 30,200, figures showing the growing competition in the market (p. C-222).

Potential for Change in Revenue or Operational Cost Numbers

Given the fact that the company’s position will evolve due to a variety of economic aspects, it is apparent that revenues and operational costs will also change accordingly. First, Tesla aims to extend its production line by including the Model X, a new crossover SUV, and thus, the company’s revenues are projected to continue to grow (Van den Steen, 2015, p. 9). Simultaneously, extending the production line means additional operating costs, and the company will have to generate enough profits to offset these additional costs.

Evolution of the Automobile Industry

Possibilities for Strengthening Tesla’s Future Position

Based on the previously retrieved information, it is appropriate to state that Tesla Motors, despite its significantly successful entry to the car industry and subsequent performance, still faces numerous challenges, most notably the rapidly growing competition in the market. It could be proposed that Tesla should continue to invest in the development of lower-class mass-produced EVs. Since the company’s competitors are primarily focusing on high-end production (one of Tesla’s strengths), it would be a sagacious step to fulfill the demand for cheaper electric cars (Thompson et al., 2018, p. C-222).

Tesla’s Problem of Imitation or Entry by Competitors

Preventing entry by other competitors is hardly possible for Tesla Motors. The company has stated that it would not initiate any lawsuits against companies that use Tesla’s patents, claiming it is not concerned with imitation (Thompson et al., 2018, p. C-214). However, in the case of several manufacturers, entry into the market would significantly raise the level of competition. First, BMW should be mentioned, as this well-known company launched its i3-series electric car model in 2013 (Thompson et al., 2018, p. C-222).

Second, Mercedes-Benz is also competing with Tesla, having introduced a “premium compact B-Class electric vehicle in the United States” in 2014 (Thompson et al., 2018, p. C-222). Third, Porsche, Audi, Cadillac, and GM are also aiming to extend their presence in the EV market shortly (Thompson et al., 2018, p. C-223).

Conclusion

Finally, it is appropriate to draw conclusions based on the Tesla Motors case by considering the issues raised in the conducted study. It is evident that the company has enjoyed a positive measure of success in entering the market, and Tesla continues in its position as one of the prevalent competitors in the market. Among the reasons for the company’s immense success would be Elon Musk’s leadership qualities and ambitions as well as the company’s innovative approach to designing, manufacturing, and distributing the product. Nevertheless, this case study also identified concerns regarding the future sustainability of Tesla Motors due to the possibility of a high level of competition in the rapidly growing EV market.

References

Van den Steen, E. (2015). Tesla Motors. Harvard Business School, 9-714-413, 1-25.

Thompson, A. A., Peteraf, M. A., Gamble, J. E., & Strickland, A. (2018). Crafting and executing strategy: The quest for competitive advantage: Concepts and cases (21st Ed.). New York, NY: McGraw-Hill Education.

Appendix