Introduction

The Abu Dhabi Company for Onshore Oil Operations (ADCO) is one of the most successful and significant oil companies in the United Arab Emirates (UAE) which operates in the region since 1930s. The company is discussed as the largest producer of oil in the Abu Dhabi National Oil Company (ADNOC) group.

The ADCO contributes significantly to the economy of Abu Dhabi and other Emirates because of constantly developing and improving the approaches to oil production in the region. Thus, the ADCO operates onshore, and its share in the industry is more than 50% (Wildcat Publishing 40).

The activities of the ADCO are not limited only by the oil production, and the company is interested in producing gas for Abu Dhabi (“Abu Dhabi Company for Onshore Oil Operations”).

The ADCO is the most influential player in the oil and gas industry of the UAE that is why much attention should be paid to the discussion of the business’s strategy, description of organization’s divisions, analysis of the role of the management information systems (MIS) division, to performing the Value Chain and Porter’s Five Forces Analysis, and to proposing the recommendations for increasing the efficiency and effectiveness.

The ADCO Business Focus and Porter’s Three Generic Strategies

In order to discuss the specifics of the ADCO’s business focus or strategy, it is necessary to determine the company’s business type.

The ADCO is focused on the oil and gas production. Since the 1960s, the company produced more than 10 billion barrels of oil and a lot of gas in order to support the activities of such companies as GASCO (Wildcat Publishing 40). From this point, the company is oriented to increasing production volumes and improving the operation strategies.

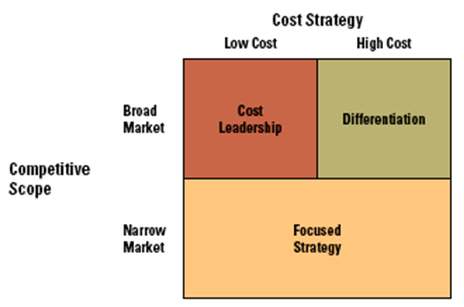

The company’s business focus can be determined with the help of referring to Porter’s Three Generic Strategies. These strategies are used to determine how a company can develop a strategy in order to achieve the competitive advantage within the industry. Strategies differ in relation to the market scope which can be broad and narrow or focused and in relation to the cost (Baltzan and Phillips 98).

As a result, companies can choose between proposing lower cost and differentiation. Furthermore, companies can choose to work for the narrow market while addressing the unique needs of the target audience. From this point, the three proposed strategies are the Cost Leadership, Differentiation, and Focused Strategy (Figure 1).

Figure 1. Porter’s Three Generic Strategies (Baltzan and Phillips 99).

The ADCO can be discussed as following the cost leadership strategy because of operating within the broad market and proposing different types of oil and gas products in the UAE. Furthermore, the ADCO operates with the focus on low costs while developing new approaches to saving costs and guaranteeing the effective use of resources.

The ADCO focuses on more profits while promoting the most advantageous reservoir development and decreasing costs (“Abu Dhabi Company for Onshore Oil Operations”). From this point, lower costs cannot be discussed as synonymous to lower prices because in spite of the fact that the ADCO’s pricing strategy is rather flexible, the company pays more attention to saving and controlling costs.

Main Divisions in the ADCO

The structure of the petroleum company which specializes in exploring and producing oil and gas depends on the necessity to provide operations and administration. It is important to focus on the organizational structure of the ADCO in order to understand how authority is delegated within the company.

The ADCO can be discussed as divided into four main departments which are also divided into units depending on the performed function. These departments are the administrative department, exploration department, production department, and marketing department.

The administrative department includes such divisions as Human Resources, Finance, Accounting, and Management Information Systems. The ADCO is governed by the Board of Directors including nine members. Mr. Abdul Munim Saif Al-Kindy is the company’s Chief Executive Officer.

The finance department in the ADCO is headed by the chief financial officer who regulates the strategic financial issues. Much attention is paid to accounting in order to control the revenues and expenses (“Abu Dhabi Company for Onshore Oil Operations”).

Human Resources Department is the important division because the ADCO follows the strategy of hiring the high-quality professionals and experts in the field.

The focus is also on Management Information Systems because of the necessity to manage and control the work of South East Asset, Bab and Gas Asset, BuHasa/Huwaila/BQ Asset, and NEB Asset from the office, and organize all the connected operations in departments (“Abu Dhabi Company for Onshore Oil Operations”).

The exploration department in the ADCO works to locate and explore the onshore oil and gas reserves. The ADCO focuses on acquiring hydrocarbons and minerals as a result of the geophysical exploration and geological operations. The ADCO works with the professionals in the industry and pays much attention to hiring geologists and experts to work in laboratories.

The ADCO production department works to organize and control drilling activities. It also includes the engineering division. The field production is realized with the focus on using the advanced technologies and support of the partners. The marketing department of the ADCO includes the sales division and cooperates with the logistics unit.

Specialists in marketing are responsible for developing the strategies of promoting the company’s products widely (US Geological Survey 28). The company focuses not only on increasing production volumes but also on improving the sales volumes.

The MIS Division

Management Information Systems (MIS) work to assist people in solving a variety of business problems. The MIS division works to incorporate the information related to different departments and units, to analyze and manage with the help of computer technologies, and to distribute it within all the company’s departments.

The whole system works because of the continuous monitoring of inputs, feedback, necessary transformations, and outputs (Baltzan and Phillips 112). The role of the MIS department in the work of the petroleum company is significant because the system guarantees the access to the same information for different departments responsible for managing and performing operations.

Generating Business Intelligence

Business intelligence can be described as the work of technologies to collect, manage, analyze, store, and distribute the data necessary for problem-solving and for the decision-making process.

The MIS department promotes the further development of business intelligence in relation to the petroleum company because all the departments receive the access to the effective single system with the help of which it is possible to organize operations, control sales, distribute the information to different parties, resolve tax issues, maintain costs, and organize accounting procedures.

Achieving Competitive Advantage

The example of the ADCO demonstrates that the use of the MIS is also effective to increase the competitive advantage because the information system works to reduce costs, develop strategies, improve productivity and performance, and contribute to improving management (“Abu Dhabi Company for Onshore Oil Operations”).

As a result, the business value related to such petroleum companies as the ADCO can increase significantly because of the use of the MIS.

Porter’s Five Forces Analysis

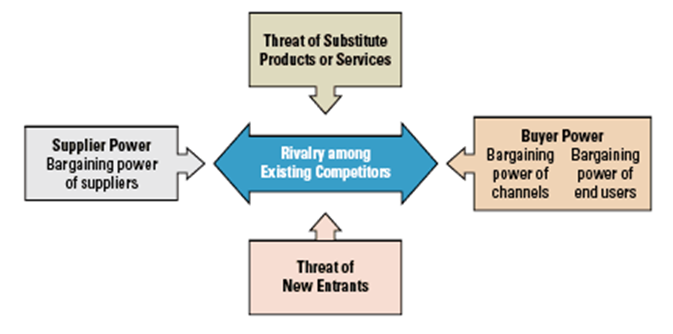

Michael Porter proposed the Five Forces Model in order to discuss the competitive forces which can influence the company’s performance within the industry (Figure 2). While referring to the analysis of the competitive advantage of the ADCO and to analyzing its profitability, it is necessary to discuss Buyer Power, Supplier Power, Threat of Substitute, Threat of New Entrants, and Rivalry among Competitors in relation to the ADCO.

Figure 2. Porter’s Five Forces Model (Baltzan and Phillips 114).

Buyer Power

The Buyer Power within the oil and gas industry in the UAE is rather low because the market and industry is controlled by the ADNOC group. The ADCO is the most successful member of the group, and the company can control the prices and costs with little attention to the Buyer Power. Furthermore, much attention is paid to developing the MIS in order to organize the production and marketing effectively.

Supplier Power

The Supplier Power in the industry is rather high because the companies from the ADNOC group prefer to work with the partners during a long period of time. The effectiveness of cooperation is based on reputation. As a result, there is a chain of suppliers working with the ADCO, and these suppliers can be discussed as rather influential because of the prolonged partnership connections (Vassiliou 54).

Threat of Substitute

Discussing the oil and gas industry in the UAE and referring to the ADNOC group, it is possible to note that the Threat of Substitutes is high while paying attention to the competition within the group. In order to reduce the Threat of Substitutes, the ADCO works to invest in exploration and development new technologies to enhance operations and promote sales.

Threat of New Entrants

The Threat of New Entrants related to the petroleum industry in the UAE is rather high because of the variety of barriers to overcome in order to enter the industry.

The ADCO and the other companies belonging to the ADNOC group operate in the field during a long period of time that is why it is rather difficult for new competitors to enter the industry where the focus is on using significant human, financial, and intellectual resources.

Rivalry Among Competitors

The ADCO operates in the oil and gas industry in the UAE since the 1930s. In spite of the fact that it is rather difficult to enter the industry, the competition among petroleum companies should be discussed at the international level.

From this point, the Rivalry among Competitors tends to be rather high because of using many resources to promote companies and gain more customers. As a result, to reduce the rivalry, the UAE petroleum companies united in such groups as the ADNOC group (“Abu Dhabi Company for Onshore Oil Operations”).

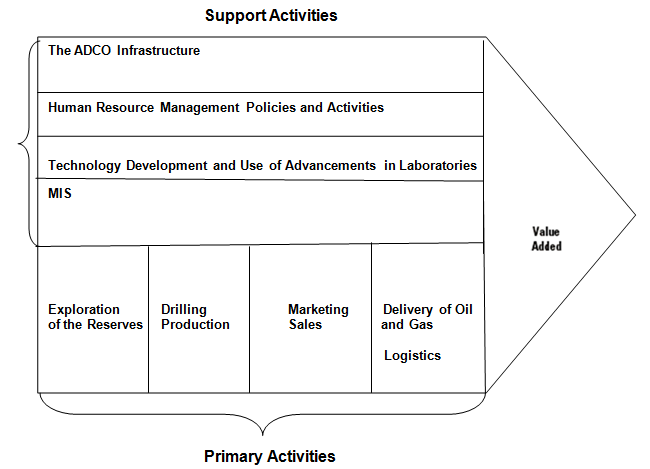

Value Chain Analysis

In order to analyze the business’s potential, Porter also proposed to use the Value Chain Analysis. The focus is on activities which add value to the company’s production and increase the competitive advantage. These activities can be classified as primary and support ones. The primary activities include the raw materials and resources and the activities associated with production (Baltzan and Phillips 121).

The ADCO works to explore the reserves, drill and produce oil and gas, market the oil and gas, and deliver the products. The support value activities include the company’s infrastructure, the policies and activities of human resource management, the technology development and advancements associated with the laboratories’ activities, and the use of the MIS to manage and control all the processes (Figure 3).

Figure 3. The Value Chain for the ADCO

The ADCO adds to the business value while focusing on primary activities, and exploration and drilling add to the business value by 60%. More than 7% is referred to the MIS, and more than 10% is referred to the development of technologies in order to create the competitive advantage with the focus on the eco-friendly exploration and production (“Abu Dhabi Company for Onshore Oil Operations”).

Recommendations

The Plan to Measure the Efficiency and Effectiveness of Business

The business potential can also be measured with the help of metrics oriented to assess the company’s progress in achieving the success and addressing the customers’ expectations. It is important to develop the plan which includes the approaches to measure the business’s efficiency and effectiveness.

The Efficiency IT metrics can be used at the ADCO in order to measure the performance of the MIS and associated systems as well as the approaches to using the company’s resources. The Effectiveness IT metrics measure the impact of the operations and outcomes on the business’s progress and goals achievement (Baltzan and Phillips 128).

The plan to measure efficiency and effectiveness of business should include the focus on analyzing the efficiency and effectiveness indicators. While measuring the efficiency in relation the ADCO operations, it is necessary to focus on such factors as the following ones:

- The hours spent on exploration, drilling, and production.

- The hours spent to analyze and distribute the data and information with the help of the MIS.

- The resources spent to perform the exploration and production procedures.

Thus, the focus on the business efficiency is the first step of the plan. The second step is the concentrate on the business effectiveness. It is important to measure how the ADCO is close to adding more value to business. The important indicators are the following ones:

- Actual sales.

- Savings and revenues.

- The net profit.

- Goals achievement.

In order to contribute to increasing the ADCO’s efficiency and effectiveness, it is necessary to concentrate on the following recommendations:

- The realization of the business process reengineering with the emphasis on intensifying the workflow between the parties of the ADNOC group.

- The improvement of the reservoir development by using the advanced technologies and procedures.

- The improvement of the MIS to contribute to the business progress and integration of resources.

- Optimization of the systems’ work with the focus on the MIS.

Conclusion

The Abu Dhabi Company for Onshore Oil Operations (ADCO) is one of the most influential petroleum companies in the United Arab Emirates, and its progress depends on utilizing the effective strategies and innovative systems important to support administration and operations.

From this point, the ADCO can be discussed as the successful competitor within the industry, and the company’s success is a result of the effective strategy followed by the managers. Much attention is paid to developing the technological advantage and to the use of the MIS as the guarantee of the effective use and distribution of the necessary data.

Works Cited

Abu Dhabi Company for Onshore Oil Operations. 2014. Web.

Baltzan, Paige, and Amy Phillips. Business Driven Technology. New York, NY: McGraw-Hill/Irwin, 2008. Print.

US Geological Survey. Minerals Yearbook, 2008: Area Reports, International, Africa and the Middle East. Washington, DC: Government Printing Office, 2010. Print.

Vassiliou, Macy. The A to Z of the Petroleum Industry. New York, NY: Scarecrow Press, 2009. Print.

Wildcat Publishing. The Oil & Gas Year Abu Dhabi 2010. Abu Dhabi: Wildcat Publishing Resources, 2011. Print.