Introduction

The Arab Spring that started on December 17, 2010, in Tunisia affected several counties in the Gulf Cooperation Council. The economy of Tunisia, Egypt, Libya, Syria, and Iraq among others was adversely affected by the uprising. Many people were forced out of their work and out of their homes because of the growing insecurity in the major cities in these countries. It is estimated that about half a million people lost their lives during the Arab Spring.

In Syria alone, over 400,000 people lost their lives in the civil war that ensued (Abat 2013). The uprising has a serious impact on the real estate industry in the region. Many buildings were destroyed by constant shelling in major cities in Syria and Libya.

Many people were forced to flee their homes in Egypt, Iraq, and Tunisia, reducing the demand for houses to lease or rent. The tourism industry plummeted as international visitors avoided these politically unstable countries for security reasons. Business travelers also had to consider relocating their offices to safer countries within the region. As the economy of these countries suffered, that of safer regional countries benefitted significantly. In this paper, the researcher will look at how the Arab Spring affected the GCC’s real estate industry.

Discussion

The Arab Spring’s primary goal was to topple dictatorial regimes and replace them with democratic leadership in the Arab world. Nickerson and Sanders (2013) argue that not many people had anticipated the serious economic consequences that it would have. In Tunisia where the revolution started, the regime quickly collapsed and it did not result in prolonged civil strife, but about 338 people lost their lives (Altomonte & Ferrara 2014).

Countries such as Syria, Libya, and Yemen were not as lucky because they ended up in armed conflict. Egypt has also suffered from the prolonged civil strife that claimed the lives of over 800 people and paralyzed the economy. Many people were displaced from their homes because of insecurity. Most of the economic activities were disrupted as people fled from the war (Kettl 2013). It is important to note that while some countries were affected negatively, others benefited from the problem. In this section, the researcher will look at both cases.

Negative Economic Impact of Arab Spring

Egypt, Tunisia, Libya, Yemen, and Syria are the countries that were worst affected by the Arab Spring. A report by Kettl (2015) shows that over 50% of Libya’s real estate market in Tripoli was affected either directly or indirectly when the country toppled its long-time ruler, Muhammar Gaddafi. As Hamdan (2012) notes, the real estate sector booms when there are a general economic boom and population increase. However, that was not the case in Libya during this period. The economic prosperity within the country that had increased the demand for quality housing and other products offered in the real estate market suddenly ended. Egypt, Syria, and Yemen faced the same fate during that period. It is important to look at each area of the real estate sector affected by the Arab Spring in the stated countries.

Buying Property

The buying of property in these countries, especially in Syria and Yemen, has been virtually brought to a sudden stop because of the ongoing revolution against the government. People are fleeing from these countries to neighboring states or to the west in fear of their lives. Cities such as Aleppo have been destroyed by constant shelling and over 70% of its population has left for safer countries (Altomonte & Ferrara 2014). Many houses have been destroyed by the constant bombing of the region from the government fighting the rebels. The demand for property in this region is at an all-time low. No one is keen on purchasing housing units in this region not only because of the high levels of insecurity but also because of the massive drop in the population of the residents.

Property Lease

The demand for property lease has dropped significantly in the affected countries. In Yemen, the Houthi rebels forced over 200,000 families to flee their homes in the southern part of the country (Behnassi & McGlade 2017). People are not leasing houses in these major cities affected by the revolution. Instead, they are considering moving out, a trend that has resulted in cases where most of the rental houses are vacant. Most of the developers have been registering serious losses because of reduced occupancy levels in their premises.

Commercial Properties

Commercial properties were also affected significantly by the Arab Spring. Most of the rental offices in major cities in Cairo, Tripoli, and Tunis were vacant at the height of the revolution. In Egypt’s city of Alexandria, foreign investors were forced to relocate for fear of being targeted by the rebels. The rate of renting commercial properties in cities such as Damascus is still low because of the slow pace at which businesses are picking up after a long period of civil strife.

Hotel and Tourism

According to Altomonte and Ferrara (2014), one of the worst affected subsectors of the real estate industry was the hotel and tourism industry. Egypt is one of the leading tourists’ destinations at a global level. Ancient cities have not only been attracting historians but also leisure tourists keen on seeing the pyramids and other beautiful sites that the country has to offer. However, when the revolution started, most of the tourists had to move to other regional destinations where they were assured of their security. Local tourism was also affected as most of these tourists opted to stay in their homes or travel to other countries because of security concerns.

Tourism in Tunisia, Syria, Yemen, and Libya has also been affected by the same problem. The massive drop in the number of tourists in these countries also meant that the hotel industry was affected. Most hotels remained closed in many parts of the GCC countries affected by the Arab Spring. In Tripoli, hotels registered less than 5% occupancy during that period (Altomonte & Ferrara 2014). Although countries such as Egypt and Tunisia are witnessing relative calm, the tourism and hotel industry is yet to recover fully. Some international travelers still feel that the region is not safe enough for them to visit. As such, the rate of occupancy of most of the hotels in these countries is still relatively low compared with what was the case before the start of the spring.

Positive Economic Impact of Arab Spring

The Arab Spring, as undesirable as it was, had a positive impact on some of the GCC countries. It is important to note that, countries such as Saudi Arabia, Oman, Bahrain, Qatar, and the United Arab Emirates also witnessed some forms of a public uprising in online platforms or other areas. However, the governments of these countries acted swiftly by changing the constitution or introducing extensive reforms to respond to the concerns of the public. The quick action of these governments averted a revolution and enhanced stability. It is estimated that over 2 million people immigrated to these stable Arab countries, significantly boosting their real estate market (Al-Mawali 2015). These stable Arab countries benefited from the Arab Spring, especially in the real estate sector.

Buying Property

The United Arab Emirates and the Kingdom of Saudi Arabia are some of the biggest beneficiaries of the Arab Spring, especially because of the boost it had in their real estate sector. In 2009, there was a bubble burst in the real estate sector of the United Arab Emirates following the decade-long prosperity of the industry. The cost of property suddenly dropped by over 40% as the supply exceeded the demand (Buswell 2016).

Many international developers quickly relocated from major cities such as Dubai to other parts of the world because of the reduced profitability in the industry. However, that changed as many people from neighboring politically unstable countries such as Yemen, Egypt, and Libya started immigrating to cities such as Dubai and Abu Dhabi.

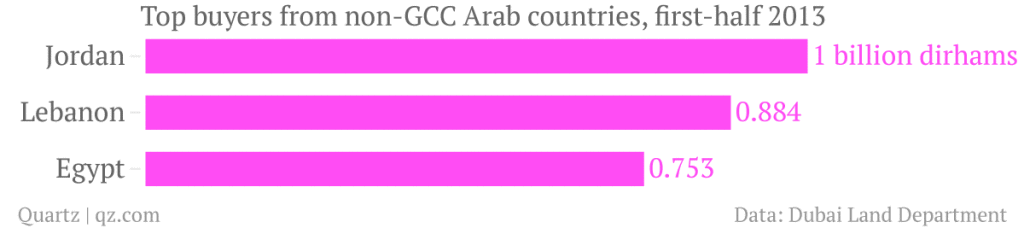

Some of them were buying property to resettle their families. The governments of Saudi Arabia and that of the United Arab Emirates liberalized house ownership policies in response to the inflow of people from war-torn countries to allow them to purchase housing units to settle their families (Altomonte & Ferrara 2014). Regional investors noticed the new opportunity as the population continued to grow. Figure 1 below shows the nationality of the top regional buyers of property in Dubai.

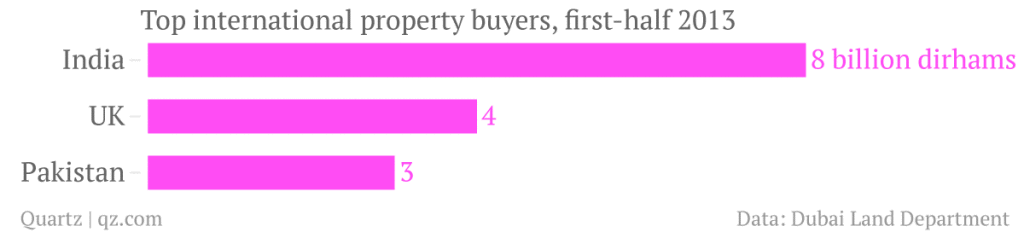

The local opportunity did not just attract local and regional investors. International real estate developers also noted the growing demand for housing units as the population of these cities continued to grow. The city of Dubai attracted many international real estate developers. Figure 2 below shows the top investors in this industry.

The statistics show that 60% of Dubai’s real estate market, accounting for over 53 billion dirhams, is owned by foreign investors (Al-Mawali 2015). Citizens from the GCC countries have invested 19 billion dirhams into this market.

Property Lease

Property lease in the GCC countries that were not affected by the Arab Spring significantly improved as many foreigners flocked these cities. A report by Behnassi and McGlade (2017) shows that the city of Riyadh experienced a 12% increase in population in 2012 as it was forced to accept refugees and asylum seekers from regional countries affected by the spring. As Azoury and Bournois (2014) note, property lease was one of the subsectors of the real estate market that benefited the most from the inflow of people. The problem of dropping demand for property leases in cities such as Dubai suddenly ended. The demand for these products started surging as developers were presented with new opportunities.

Commercial Properties

The commercial properties in these countries also benefited from the increased demand. Many offices were rented out by non-governmental entities trying to settle refugees and asylum seekers. The commercial sector experienced a boost, especially in the food and clothing sectors. It means that the demand for commercial properties to rent increased in cities such as Dubai and Abu Dhabi. The booming business brought about by the increased population meant that most of the commercial properties were fully rented out. Behnassi and McGlade (2017) observe that because of the stability in these countries, they attracted regional and international investors since other countries such as Libya and Egypt became less attractive.

Hotel and Tourism

The tourism and hotel industry has also benefited significantly because of the political instability in the neighboring countries. According to the World Bank (2014), the city of Dubai has distinguished itself as one of the top global tourists’ destinations. It has one of the most developed transport (road, rail, water, and air) infrastructures in the world. The government has invested a lot in this sector by enhancing security and making it easy for tourists to move with ease while in the country.

However, the city always has to compete for international tourists with rivals such as Cairo, Jerusalem, and Damascus which are historical centers. Spiritual centers such as Mecca and Medina also pose a serious challenge for international tourists. The Arab Spring has been beneficial to the local tourism and hotel industry in Dubai, as shown in figure 3 below:

As shown in the figure above, from 2009 to 2013, which is the period when the Arab Spring seriously affected countries such as Libya, Egypt, and Syria, the local tourism and hotel industry in Dubai has increased by over 12%. Hotel occupancy increased from 70% to 82% (Buswell 2016). It is a sign that tourists were avoiding volatile cities in preference to those considered safer, such as Dubai.

Conclusion

The Arab Spring is one of the most unique uprisings in the modern history of the Arab world because it affected several countries in the Middle East and North Africa and took an almost similar path. People in the affected countries were demanding political democracy. The revolution had a serious negative impact on the real estate of countries such as Syria, Yemen, Tunisia, and Libya. However, Arab countries that were able to overcome the wave such as the United Arab Emirates, the Kingdom of Saudi Arabia, and Oman benefited economically.

Reference List

Abat, A 2013, Constitutional violence: legitimacy, democracy and human rights, Edinburgh University Press, Edinburgh.

Al-Mawali, N 2015, ‘Intra-Gulf Cooperation Council: Saudi Arabia effect’, Journal of Economic Integration, vol. 30, no. 3, pp. 532-552.

Altomonte, C & Ferrara, M 2014, The economic and political aftermath of the Arab spring: perspectives from Middle East and North African countries, Edward Elgar, Cheltenham.

Azoury, N & Bournois, F 2014, Crisis, globalization and governance: how to draw lessons, Cambridge Scholars Publishing, Newcastle upon Tyne.

Behnassi, M & McGlade, K 2017, Environmental change and human security in Africa and the Middle East, Springer, Cham.

Buswell, J 2016, Service quality in leisure, events, tourism and sport, Cabi Publishing, Toronto.

Hamdan, S 2012, ‘Arab Spring unrest helps lift Dubai hotel business’, The New York Times. Web.

Kettl, D 2013, System under stress: the challenge to 21st century governance, Cengage, New York, NY.

Kettl, D 2015, Politics of the administrative process, John Wiley & Sons Publishers, Hoboken, NJ.

Nair, N 2013, ‘The Arab Spring is helping fuel a boom in Dubai’s property market’, Quart. Web.

Nickerson, J & Sanders, R 2013, Tackling wicked government problems: a practical guide for developing enterprise leaders, Cengage, New York, NY.

World Bank 2014, Global economic prospects, volume 8, January 2014: coping with policy normalization in high-income countries. The World Bank, Washington, DC.