- Australia is considering imposing a carbon tax on certain carbon-producing production Processes.

- Australian government ensures that the external costs are reflected by imposing a carbon tax.

- The amount of carbon emitted from production processes is effectively reduced through the imposition of the carbon tax.

- Cars and oil are complementary goods, and thus, they are consumed together.

- If the oil prices rise to $200 per barrel, the demand for new cars will reduce.

- An increase in oil prices will lead to an increase in the supply of new cars.

- The federal government has decided to adopt a free trade agreement on cars imported into Australia in six months.

- With the existing excise tax, the price of imported cars in Australia will be very high for the consumer.

- The decrease in the number of cars demanded will make the car suppliers reduce the number of cars they supply.

- Application of the free trade agreement will lead to the removal of exercise tax on all cars that Australia imports.

- Normal profit is determined by the efficient use and allocation of the resources available to a firm.

- Normal profit is determined when the difference between total costs and total revenue equals zero.

- Normal profit is going to vary with the general state of the economy.

- The price of personal computers has fallen significantly in the past ten years while demand has increased significantly.

- For the last decade, there has been a considerable decline in the price of personal computers which has in turn led to an increase in their demand.

- At the current low price, the marginal cost of producing the computers is equal to the marginal revenue earned from computer sales.

- The kinked demand curve has been one of the staples of oligopoly theory.

- It was formulated as a price rigidity theory.

- For two competing firms, if one of the firms reduces the price, the other firm also reduces the price to match that of its competitor.

- The setting of maximum levels of emitting pollutants or resource use has been an ancient method of controlling pollution.

- Firms doing contrary to these limits have been charged for their contravention.

- There have been inspectors monitoring the firms’ pollution levels.

- The tradable permits principle has been used as the cornerstone for international pollution agreements

- The work choices legislation came into effect in the year 2006.

- It was designed to improve the performance of the national economy as well as improving the employment level.

- This legislation promoted individual worker efficiency

- The legislation further compromised the legal striking power of the workforce.

- Activities of trade unions were restricted as well as on-site membership recruitment.

- Fair work legislation that came to replace the work choices legislation was designed to create balanced workplaces in all aspects of employment.

Australia is thinking of placing a carbon tax on certain carbon-producing production Processes. Explain what the impact on quantity demanded and supplied for goods that are impacted by this proposed new tax will be.

The diagram above shows the supply and demand curves as well as the private cost of carbon emissions. At price Pp, the market clears where the steel quantity supplied is Qp. This price only takes care of the private marginal costs of producing steel. External costs which are comprised of water and air pollution are not catered for by this price (Pp). This outcome is economically inefficient due to the oversupply, Qp, caused by the low price Pp. Only the private costs are factored in by consumers and producers thus omitting the external costs.

Thus, the Australian government ensures that the external costs are reflected by imposing a carbon tax. The market equilibrium is re-established at Qs, which is a lower quantity, and the price increases to Ps. The carbon tax is the marginal external cost equivalent. The negative externality of carbon emission is internalized by price Ps less Pp. Thus, the output of carbon emission from production processes is effectively reduced through the imposition of the carbon tax. On the other hand, firms raise the prices of their outputs and can make additional profits.

What will be the impact of increasing the price of oil per barrel to $200 on the quantity demanded and quantity supplied for newly manufactured cars. What about the impact on quantity demanded and supplied for new cars if extreme global recessionary conditions occur a year after the oil price rise?

Cars and oil are complementary goods, and thus, they are consumed together. Upon increasing the price of oil per barrel to $200, the demand for newly manufactured cars will decline. This is because the two commodities are used simultaneously, and therefore when oil becomes expensive, fewer new cars will be demanded. Moreover, an increase in oil prices will lead to an increase in the supply of new cars. The market players will be willing to offer more cars for sale due to the notion of making high profits connected to high oil prices.

On the other hand, if extreme global recessionary conditions occur a year after this rise in the oil prices, the demand for new cars is bound to decline further. This is because the recessionary conditions will lead to a further rise in oil prices to meet the increased cost of operations. Similarly, the supply of new cars will shoot up because the manufacturers will translate the escalating oil prices to mean better returns from the sale of new cars.

The federal government has decided to adopt a free trade agreement on cars imported into Australia in six months. Explain how you think this will affect the price and quantity demanded and supplied imported cars into Australia before the free trade agreement is applied and after it is applied.

The figure above illustrates the impact of an existing excise tax before the introduction of a free trade agreement. With the existing excise tax t ( Pc-Po), the price of imported cars in Australia will be very high for the consumer. Consequently, this leads to a corresponding decrease in the quantity demanded of cars to Q1 as shown by the demand curve. The decrease in quantity demanded cars makes the suppliers of these cars reduce the quantity supplied. This is illustrated by the supply curve with tax.

On the application of the free trade agreement, the excise tax will be completely removed on all cars imported into Australia. With the adoption of the free trade agreement, the market for imported cars will clear at point t Eo where Po is the price charged and Q is the quantity supplied. Thus, the institution of the free trade agreement will lower the prices of cars imported into Australia and at the same time increase, the quantity demanded these cars.

Question 2

What determines the size of the normal profit? Will it vary with the general state of the economy?

Normal profit is determined by the efficient use and allocation of the resources available to a firm (Hall & Hitch, 1939). It’s determined when the difference between total costs and total revenue equals zero (TR-TC=0). Normal profit is going to vary with the general state of the economy because it’s that minimum profit level required for the firm to continue existing in a competitive environment.

The price of personal computers has fallen significantly in the past ten years while

Demand has increased significantly. Use cost and revenue diagrams to illustrate these events. Explain the reasoning behind the diagrams you have drawn.

From the above diagram, the initial price of a personal computer was Pm and the quantity demanded at this price was Qm. For the past decade, there has been a considerable decline in the price of personal computers which has translated to a fall in their demand. At the current low price Pc, the marginal cost of producing the computers is equal to the marginal revenue earned from computer sales.

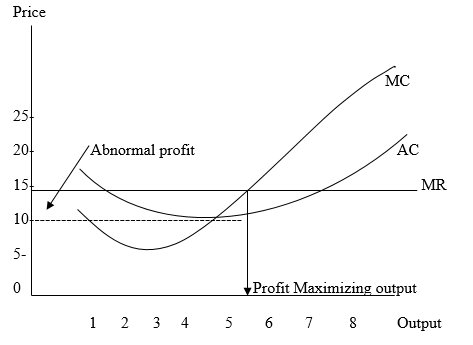

Question 3 (a)

MR = 14

Question 3 (b)

Question 3 (d)

Supernormal profit (14-10)*5.5=22

Question 3 (e)

In the long run, the marginal revenue/ demand curve will shift downwards causing the price of the products to fall. The long-run marginal revenue curve will cut the long-run average cost curve from the minimum point. In the long run, therefore, the firm will only enjoy normal profits. This will be significant in determining the long-run price.

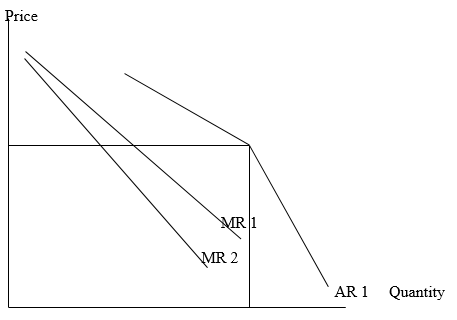

Oligopoly: Demand curve and the kinked demand curve

The kinked demand curve has been one of the staples of oligopoly theory. Originally, it was formulated as a price rigidity theory. It is said that in a situation of two competing firms if one of the firms reduces the price, the other firm also reduces its price to match that of its competitor. However, it will not match its price if at all; only one firm opts to initiate a price increase. This gives rise to a kink in the perceived demand curve at the prevailing price. The resulting discontinuity in one firm’s marginal revenue implies that the other firm will not adjust its price in response to small changes in costs giving rise to price rigidity.

Marginal revenue curve corresponding to the kinked demand curve

Profit maximizing output

Marginal cost = 150.

The ancient pollution tackling method has been the setting of permitted maximum levels of emitting pollutants or resource use. The other way has been the setting of acceptable minimum levels of quality of the environment. Firms doing contrary to these limits have often found themselves on the receiving end due to the heavy fines charged for their contravention. For the above regulations and laws to be effected, there have been inspectors monitoring the firms’ pollution levels.

To be on the safer side, the Australian environmental authorities have been instrumental in the formulation of tough ambient standards. These legislations can always be relaxed later if the effects of pollutants become negligible. The legislation that has stood the test of time is the sale of tradable permits which give firms a certain degree of polluting rights. The tradable permits principle has been used as the cornerstone for international pollution agreements on the reduction of severe pollution outcomes. The graph below shows how Australia has engaged in tradable permit agreement in a quest to promote the environment.

The work choices legislation came into effect in the year 2006 and was triggered by many workplace relations amendments of the 1996 Act. It was designed to improve the performance of the national economy as well as the employment level improvement. This was through doing away with unfair company dismissal laws and the assurance that legislation changes do not disadvantage workers. Thus, this legislation promoted individual worker efficiency as well as making them answerable to the workplace authority rather than the industrial commission.

The legislation further compromised the legal striking power of the workforce thus, requiring workers to seek the unmet promised conditions with no collective representation. Moreover, activities of trade unions were restricted as well as on-site membership recruitment. On the other hand, fair work legislation that came to replace the work choices legislation was designed to create balanced workplaces in all aspects of employment.

The changes introduced by this new legislation include the establishment of the national employment standards. The NES ensures minimum enforceable conditions and terms of employment through safety nets provided by the legislation. Also, the NES has replaced the provisions of the Australian conditions and fair pay standards of the nonpayment rate. The perceived effects of the work choices legislation are that it was too harsh in addressing the plight of workers. On the contrary, the fair work legislation is more accommodating as far as the welfare of workers is concerned. This is because the issues addressed by the legislation are solely for the worker’s benefit.

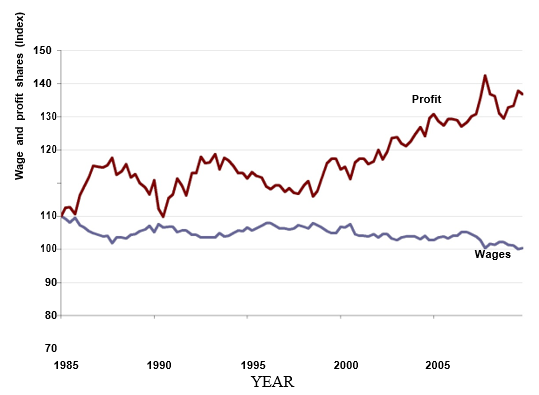

A graph for Wages and profit shares of national income, for the period between 1985–2011 (Source: SouSou ABS 5676.0).

From the above graph, businesses continue to perform pretty well upon the implementation of the Fair Work Act. The graph depicts that profits have been growing double as fast as wages since the Act came into effect

References

Hall, R., and Hitch, C 1939, Price theory and business behavior, Oxford Economic papers 2, 12-45.

Almeida, R., 2004, The Labour Market Effects of Foreign-owned Firms. Addison Wesley Publishing Company: New York.

Eaton, G. E., 2001, Globalization and Labour Market Reform: Issues of Governance, Accountability and Equity. Canada APF Press, Canada.

Orley C. Ashenfelter and Richard Layard, ed., 1986, Handbook of Labour Economics. Amsterdam: North-Holland.