Introduction

Background to the Research

The rapid growth of the Chinese economy over the past two decades has attracted numerous investors from the United States and Europe. Alibaba.com, Huawei, Legend Holdings, HNA Group, Suning, Amer International, and Country Garden are some of the largest private corporations that have registered impressive growth over the past decade. The rapid growth of these companies has been propelled by the massive population in the country and the rapid growth of the economy. As Forsberg and Ojala (2014) explain, China is currently the second largest economy in the world after the United States. As the purchasing power of the country’s massive population continues to increase, the Chinese market is rapidly becoming the target of many large corporations around the world. Investors around the world are also convinced that the best way of getting good returns out of their investments is to buy stocks in Chinese companies. The attractiveness of the stock of these Chinese companies explains why they are increasingly getting listed in the United States stock market. Alibaba Group Holding, Baidu, BIDU, and JD.com Inc are some of the Chinese firms already listed in the local stock exchange markets.

A worrying trend is emerging where some of these Chinese firms provide misleading financial statements primarily to lure unsuspecting investors. It is a common practice for most people to buy stocks with a sharp rise in value with the hope of making huge profits within a short period. Armed with this knowledge, these Chinese companies would instruct their accounting officers to inflate growth as a means of attracting investors (Chan, Pollard, & Chuo, 2007). The goal of these companies is to foster rapid growth by increasing revenues from investors instead of sales. On April 2, 2020, United States Securities and Exchange Commission was informed that Luckin Coffee, the largest local coffee Chain in China, was involved in accounting fraud (Dat, Mau, Loan, & Huy, 2020). The company had been registering rapid growth over the years and had attracted numerous local investors who were convinced that it offered a better opportunity that most of the local American firms. Within the first day of the revelation of the accounting fraud, the company lost 81% in its share price (Zhang, 2018). The company has since lost over 94% worth of share prices. Similar accounting frauds have been witnessed with several other companies such as Kangmei Pharmaceuticals and LeEco among other companies.

The corporate accounting scandal that is increasingly becoming common in China is a major cause of concern for many companies and investors in the United States. China has become a major global market that can no longer be ignored. Many American citizens and corporations have invested in these companies, but it is now evident that their investment is not protected (Pana & Tian, 2017). The 2008 global economic recession that crippled many economies around the world was caused by accounting fraud in the Wall Street and other major money markets around the world. The role that China currently plays in the global economy makes it highly influential. Such scandals may not only lead to loss of investors’ money but a major global recession that may affect the United States and other major economies. As such, it is important to discuss corporate accounting scandals that continue to occur in China and determine ways in which the problem can be addressed to help protect individual investors and the global economy.

Problem Statement

Corporate accounting fraud is emerging as one of the most popular white-collar crimes in many parts of the world. Unscrupulous businesspersons have perfected the concept of starting up small companies, using every means possible to give the impression that they are growing rapidly, and then inviting unsuspecting investors to buy shares of the company as a means of raising money. Hu, Yuan, and Xiao, (2017) explain that the problem with this strategy is that the perceived growth is always not supported by increasing sales and genuine expansion in response to growing demand. Instead, it is pushed by the growing size of investors who are thinking that they are making the right investment decision. When the scandal is unravelled, most of these companies often crash in the stock market, and are often forced out of operation (Wong, 2016). When it is one or two firms engaged in such corporate accounting scandals, it is easy for the Securities and Exchange Commission to address the problem and punish those who are involved. However, it may not be easy to address the problem if it affects numerous companies.

Chinese companies have infiltrated the United States securities market, including those that are exclusively operating in China. The case of Luckin Coffee is just one example of the rising cases of accounting fraud that is directly affecting American investors. Some scholars believe that the practice is becoming common because Chinese government has failed to take strong measures against the perpetrators (Zhang, Gong, Xu, & Gong, 2018). It creates the perception that this government is even encouraging these local firms to engage in accounting fraud as a means of attracting foreign investment. They know that when they are not caught, they will make major profits, but when their unscrupulous deals are revealed, there will be no major punishment from the government other than losing their current job. The problem is that such practices, if condoned, may have serious consequences not only to the American firms and investors but also the economy of various countries around the world, including China.

This investigation will benefit many American and European investors who are rushing to buy stocks of rapidly growing Chinese companies. It may be true that Facebook, Uber, and Alibaba among many other American and Chinese companies registered rapid genuine growth over the past decade. However, that does not mean every company that is recording similar trends is worth investing in, especially in a market where accounting scandals are becoming rampant. This study will focus on determining why China has become a hotbed of such unethical practices, why the Chinese government has failed to take corrective measures, and what local investors in the United States, Europe, and other parts of the world can do to protect their investment. The study will also help the United States Securities and Exchange Commission to enact policies that will protect the interest of American investors and the local economy from exploitation by unscrupulous Chinese investors.

Purpose of the Study

The events leading to, during, and after the 2008 global recession demonstrated how vulnerable the stock market is and the impact that it has on the economy. As Hail, Tahoun, and Wang (2018) explain, the greed of those trusted with the management of major corporations led to the suffering and pain of innocent Americans. Many people lost their jobs, houses, and even families because of the mistakes that were committed by a few greedy corporate executives. To these top managers, it may be a simple manipulation of numbers in their books of account, believing that such mistakes can easily be corrected if there is growth in sales. What they fail to realise is that their actions may have devastating consequences on the country’s economy and lives of many Americans.

Currently, the global community is battling the COVID-19 pandemic and many companies have already been forced out of operations. However, China has managed to contain the spread and the economy is already open. Many Americans and European investors may be tempted to take their money to these Chinese firms, which are promising growth at a time when many other western companies are shrinking. The problem is that with the current trend of accounting fraud, it is almost difficult to determine whether these companies are making legitimate promises or if they are keen on taking advantage of investors from the west. The primary purpose of the study is to expose the extent of this accounting fraud, identify why it has become rampant in China, how to identify such fraud, and the best way of dealing with them. Investors from the United States, United Kingdom, Germany, Canada, and other major European economies will benefit because they will be empowered. They will know how to make prudent decisions whenever they want to make their investments.

Aim and Objectives

The primary aim of the research project is to survey and reveal the limitations of current accounting standard setting and performance measurement system in China by reaching a wider range of participants. By analysing and summarising the responses from a sample of respondents, the researcher will try to find out how the setting and system could be improved in the future. Practicing accountants and corporations could inspired by this research to have deeper understandings of the routines and rules, and to consciously take actions to make better, more ethical and more responsible accounting decisions, and ultimately, to dynamically and positively influence the institution. It is expected that these professionals and entities will understand the significance of maintaining ethical accounting practices as a way of promoting professionalism and trust. The following are the specific objectives that should be realised through this investigation.

- To search and gather published information about corporate accounting scandals/fraud, and literature about accounting ethics, ethical behaviour and Institutional Theory.

- To survey and identify the different understandings of accounting ethical behaviour among accounting experts, lay experts and lay citizens.

- To critically analyse the data and explain the limitations and problems of the current accounting standard setting from Institutional Theory perspectives, and summarise in what aspects/directions it can be improved in the future, according to the survey responses.

- To provide inspirations for accountants and corporations in making better accounting decisions and for professional bodies in improving current accounting standard setting and accounting performance measurement system.

Overall Research Approach

The study will involve collection of both primary and secondary data to have a comprehensive understanding of the issue under investigation. Secondary data will help in understanding the historical perspective of the issue being investigated. Journal articles, books, and reliable online sources will form the basis of secondary data sources. Data from secondary sources will mainly be presented in chapter 2 of this paper. They will also be used to support arguments made throughout this paper. Primary data will be collected from a sample of respondents. The researcher is keen on conducting a survey to help understand the current state of the issue being investigated and to address any existing research gaps. Using purposive sampling approach, about 200 participants in China will be contacted to help in gathering the needed information. Collected data will be analysed quantitatively. A detailed explanation of the research approach is explained in chapter 3 of this report.

Potential Limitations

It is important to discuss potential limitations that may negatively affect the ability of the researcher to collect the needed information in this study. One of the major limitations was the language barrier. Some of the respondents who were contacted and were willing to take part in the study could not communicate properly in English. Withdrawal of some of the participants was another major concern that the researcher had to deal with when collecting primary data. The researcher had to replace those who withdrew from the study. Another potential challenge was the limited number of studies conducted in China about this issue. Accounting scandals and ethical dilemma associated with it have been documented in North America and European markets (Yee, 2020). However, it is challenging to find books and journal articles discussing this issue in detail regarding the Chinese market. A detailed discussion of the limitations is provided in chapter three of the report.

Dissertation Structure

The dissertation has six main chapters. Chapter 1 provides background information, explaining the primary goal of the study, objectives, and the problem that it seeks to address. The chapter also provides a preview of the research approach and potential challenges. Chapter 2 focuses on a detailed review of literature. It provides a historical analysis of corporate accounting scandals in China and the resulting ethical dilemma that practicing accountants and corporate heads in this country face as they try to address the problem. The study looks at various theories applicable to the study and how they can help address the ethical dilemma in accounting. Chapter 3 provides an explanation of the research method used to collect and analyse data. Time and place of data collection, research question, and sampling and sample size are discussed in this chapter. Questionnaire design, data collection method, problems encountered, and ethical considerations observed are also explained. The chapter ends with the discussion of validity, reliability, and generability issues and the approach used to analyse the collected data. Chapter 4 is the description of data, which focuses on explaining the survey and data collected from respondents. Chapter 5 entails the analysis and presentation of the data in form of graphs and figures. The last chapter is the conclusion and recommendations.

Literature Review

Introduction

The previous chapter provided background information about the topic and outlined research goals and objectives. In this chapter, the focus is to provide a detailed review of the literature. According to Zhang, Rasiah, Cheong (2019), when conducting research, it is essential to ensure that already existing information is not duplicated. Reviewing literature provides important background information about an issue under investigation. Understanding what other scholars have found out makes it easy to identify research gaps that need to be addressed. The chapter begins by conducting historical analysis of corporate accounting scandals in China. The chapter then reviews various theoretical concepts relevant to the topic under investigation. Ethical dilemma in accounting is also discussed in this chapter and how the responsible individuals have tried to deal with it. The chapter also focuses on the application of the information gathered from secondary sources to the topic of the study.

Historical Analysis of Corporate Accounting Scandals in China

China was one of the countries that were significantly affected by the Second World War that ended in 1945. As it became a communist state, rulers of this country introduced various economic reforms meant to ensure that they could feed their population. Some of these communist policies and practices made impossible for the country to join World Trade Organisation. The economy was tightly under the control of the communist government. Zhang, Djajadikerta, and Trireksani (2019) explain that the decision to close the economy from external companies was a move by the Chinese authorities to protect local companies from stiff competition. During that period, many companies emerged and enjoyed government protection and the huge local market. It was not until 2001 that the government complied with the international standards and policies set by the World Trade Organisation (Agrawal & Cooper, 2017). At this time, the communist party was sure that the local companies in China had growth enough to withstand competition in the global market. The rapid growth of these Chinese firms also meant that they needed to go global as a way of expanding their market share. The move was specifically beneficial to these firms.

When China finally opened its economy on December 11, 2001, many western companies were keen on tapping into its huge market and the rapidly growing economy. At the same time, many Chinese firms were rushing to tap into massive opportunities in the global market. Sim, Lohwasser, Lee, and Curatola (2018) argue that challenges begun to arise because of the different accounting practices. The European Union, the United States, and Japan, among other major trading blocks, had harmonised their accounting standards to enhance easy trading. However, China was still using its traditional accounting standards that failed to meet international standards. The desire to compromise as a way of fostering a positive relationship between China and WTO led to a situation where the country was allowed time to conform to international accounting standards (Cheng, Lin, & Wong, 2016). It took time for the country to comply, and even then, it has failed to stick to the strict guidelines set by the international community.

The 2008 global economic recession was a wake-up call to the international community as the dangers of manipulating accounting records were laid bare. A section of unscrupulous executives of large corporations in the Wall Street, with the assistance of unethical accountants and other financial experts, were able to provide misleading information to investors and customers (Wang, Lee, & Crumbley, 2016). A problem that started in the United States quickly spread to Europe, parts of Asia-Pacific, and Africa. Many people lost their homes, jobs, and investments. It was apparent that economies around the world are intertwined, and events going on in one country can easily affect other countries. As such, it was necessary to have strict measures that can prevent unethical practices in the corporate world.

China was not as badly affected by the global economic recession as many other developed nations. Yoo (2019) argues that instead of this recession becoming a warning to Chinese companies, it became an inspiration to some local unscrupulous executives and accounting professionals. Since 2008, many Chinese corporations have been keen on listing on United States stock market or to at least attract foreign investors. The local Chinese companies realised that global investors are attracted to rapidly growing companies. Jack Ma became a billionaire after his company’s (Alibaba) initial public offering (IPO). Many other Chinese companies followed the same trend. The desire to join the billionaires and millionaires club pushed some of the executives of start-up companies to inflate their books of account as a way of attracting foreign investors.

On April 2, 2020, the United States Securities and Exchange Commission revealed that it was investigating a major accounting scandal at Luckin Coffee. The company had attracted thousands of American investors who believed that it was poised to become one of the largest coffeehouse in China. The revelation has led to the massive drop of the company’s share prices by over 90% (Chen, 2017). This case is not isolated as many incidences of accounting fraud have been revealed in this country. In August 2019, China Securities Regulatory Commission revealed that Kangmei Pharmaceutical Company was involved in manipulating its financial books. Prior to this, LeEco had also been penalised in 2017 for its involvement in massive accounting malpractices that led to loss of money for investors. Chen, Samanta, and Hughes (2019) explain that accounting fraud is increasingly becoming common among young executives keen on becoming millionaires.

They believe that the best way of attracting foreign investors is to give the image that they are expanding rapidly. According to Christensen, Cote, and Latham (2018), although some of these fraud cases are unearthed by Chinese authorities, studies have revealed that the government has not done enough to stamp out the malpractice. Some of the punitive measures that it takes against companies found to be responsible for the fraudulent accounting activities are only meant to convince the global community that the government is discouraging the practice. In such a repressive government system, cases of accounting scandals could not be increasing if the government were committed to fight the practice.

The growth of the concept of guanxi is also partly responsible for the rising cases of accounting fraud in China. The business community has come to value networks or connections (guanxi) that facilitate new business deals (Shawver & Miller, 2017). The business community believes that an individual with a wider network has a better capacity to make business deals than the one without. As such, many young executives and professional accountants have come to value such networks more than business ethics. An accountant would be willing to help a start-up company to inflate books of account if such a process would promote its growth and create a greater guanxi. As long as the target for such accounting fraud is foreign investors, they find these practices acceptable.

Theoretical Concepts

Theoretical concepts can help in explaining the unethical trends in corporate accounting, which are becoming common in China. John Rawls’ Theory of Justice is one such concept that focuses on justice and the need to promote a morally acceptable society based on two primary principles (Gow & Kells, 2018). The first principle is the right of liberty that everyone should enjoy. It means that one should not be subjected to unnecessary restrictions that may have negative effect on their normal way of life. However, there is a condition that one has to observe as they enjoy their liberty. Their right should not affect the ability of others negatively.

Accountants must understand that as they fight excessive government regulations that may affect their normal way of operations, they have a responsibility of ensuring that they respect the law and do not engage in unethical practices that may affect others. The second principle holds that social and economic benefits should be open to all (Mascarenhas, 2018). As one seeks to take advantage of these opportunities, it should be based on principle of fairness, not the desire to make quick profits at the expense of others. An accountant who inflates books of account of a company for financial or career gains must understand that their actions will be detrimental to investors or other stakeholders. As such, their gains are unlawful and would warrant some form of punishment.

Mohist theory of ethics has widely been practiced in China for decades. It emphasises on the concept of inclusive care attitude where one advised to avoid self-cantered approach of doing business. It is essential for one to ensure that their actions benefit them and those close to them. Greed is a virtue that this theory strongly opposes. One must realise that when handling limited resources, they have to take into consideration the interests of others. If everyone embraces greed, then there will be chaos in the society. If one is conscious of others welfare as they struggle to achieve their own goals, they will avoid practices considered unethical. An accountant will avoid manipulating accounting books even if they are promised huge rewards as long as they are aware of and concerned about the impact that their actions would have on others.

Ethical Dilemma in Accounting

Accountants are often expected to work under a given code of conduct. However, cases often arise when they face various ethical dilemmas that limit their capacity to make the right decision. One of the most common challenges that these accountants face is the pressure from their superiors. In the current competitive business environment, Du, Varottil, and Veldman (2018) explain that companies are under pressure to present impressive financial records to shareholders during annual general meetings. Such reports can be used by the board of directors to determine whether top executives would retain their jobs or if it is necessary to recruit a new more effective team. Such financial reports also have a direct impact on the shares of a company in the securities market. They are used to help in determining the company’s growth (Roy & Saha, 2018). The problem is that sometimes a company may fail to register impressive financial performance as would be expected by the board of directors. As such, they may instruct accountants to manipulate financial records to support a given narrative that would be pleasing to the decision makers. In most of the cases, such anomalies often involve inflating accounting records to show that there is growth in revenues within a given financial year.

The dilemma that accountants would face in such a case is to choose to commit the fraud or lose their jobs. In the United States, it is easy for a reputable accountant to get a job in another company in case they are fired because of their principles. However, the same is not the case in China and other countries in Asia (Syed & Ying, 2019). Only a few companies in China are paying their accountants salaries that can be compared with what their counterparts in the United States earn. In such cases, one would fear losing their job because finding an alternative may not be easy. They are forced to engage in such unethical practices against their wish because they need to protect their job.

Temptation is another common challenge that these accountants often face. According to Vasudev and Watson (2017), falsifying books of account is a lucrative business for unscrupulous accountants willing to engage in the business. In China, start-ups are willing to do everything to attract foreign investors. The only way of doing so if they cannot achieve genuine rapid growth is to manipulate their books of account. Executives of these companies are willing to pay huge sums of money to those who can help them in the falsification of the documents (Gal, Akisik, & Wooldridge, 2018). For those greedy accountants who cannot resist the temptation of earning a lot of money by doing very little, overcoming this temptation is difficult. Others are given promotion in their companies as they become co-conspirators in these criminal acts.

Confidentiality is another major ethical dilemma that accountants often face in their normal practice. According to Kranacher and Riley (2020), accountants are often required to avoid sharing their findings with third parties when auditing books of account of a given firm. The ethical dilemma arises when they unearth major accounting fraud during their audit. Sharing the information with the public or other third parties may help investors and customers to avoid unnecessary losses. However, doing so is considered an unethical practice. Failure to share the information with third parties may lead to a case where the fraud is not stopped, especially when the government fails to take immediate action after receiving the report. On the other hand, leaking the information goes against standard practices that accountants are expected to observe. Amat (2019) advises that in such cases, it is often advisable to give the government time to respond to the fraud. If they fail, then leaking the information to the public, which in this case will be considered whistle-blowing, may be the only ethical option left for the accountant.

Application of the Information Gathered from Secondary Sources

Corporate accounting scandal in China is a great concern to investors and business entities keen on exploring this market. In the United States and within the European Union, strict laws have been enacted to protect individual investors and corporate entities, especially after the 2008 global economic recession (Kranacher & Riley, 2020). The problem is that some of these local investors wrongly believe that these foreign investment destinations also have such strict laws as those in European Union and the United States that can help in protecting their property. However, studies suggest that China has more relaxed laws and regulations when it comes to fighting fraud. Many unsuspecting individuals and companies have lost their investments after being lured to companies that they believed had healthy revenue growth. This study provides critical information that these investors can use in case they decide to invest in China.

Limitations of the Current Accounting Standards and Performance Measurement Systems Used in China

It is important to investigate the limitations of the current accounting standards and performance system used in China. According to Wells (2017), the Chinese generally accepted accounting principles (GAAP) is significantly different from international financial reporting standards (IFRS) or the American GAAP. As such, it is common to find cases where books of account have to be translated from the Chinese GAAP to IFRS when they are needed by foreign investors. The process of conversion is a major weakness point because it may be open to manipulation. Greedy accountants can take advantage of such opportunities to adjust books of account to achieve certain objectives.

In China, accounts are classified by functions, unlike the international standards where they are classified based on their nature (Emeagwali, 2017). Such a significant difference in the classification of the accounts is a major concern to foreign investors. It makes it difficult to understand these accounts unless they are translated into international standards or American GAAP. Bowers (2019) explains that in China, companies are often forced to use historical cost method because it is difficult to obtain fair value information of assets. On the other hand, IFRS emphasises the need for valuation of assets, taking into consideration their depreciation over time. The Chinese approach to auditing assets has a major limitation because some assets lose value very fast while others can retain their value for long periods. For a company that is keen on inflating its books of account, one of the best ways of doing so is to have high estimates for their assets whose actual value may be significantly lower (Balleisen, 2018). A foreign investor or a company keen on acquiring such a Chinese firm will not realise the existence of such an anomaly until it may be too late.

Accounting Principles in China

It is important to investigate the common accounting principles embraced by accounting experts that makes it easy for them to engage in unethical practices. When China made a decision to join the World Trade Organisation, it made concrete steps align its accounting principles with those practiced in the international community. Integrity is one such principle that guides actions that Chinese accountants take in their normal duties. They have to be transparent with their client while at the same time protect confidentiality rules. The current trend where unethical practices are becoming increasingly common in the country is primarily caused by greed. The country has embraced strict policies and guidelines that have to be followed by companies when making their annual financial reporting. However, many start-up companies are flouting these rules and regulations because of the desire to attract foreign investors (Ugwulali, 2019). Their unscrupulous accounting practices have not gone unnoticed by the government. The problem is that there has been no concrete action taken by relevant authorities to fight this problem.

When making their annual financial records to the government, most of these Chinese companies are often keen on following strict guidelines set by relevant authorities because they are aware of the possible punishment that they can face when they fail to do so. However, such principles of integrity become less necessary when it comes to dealing with foreign investors. These cases of fraud are specifically common among upcoming companies that are keen on listing in the United States or any of the European stock exchange markets. A perception has been created that the Chinese government is no longer responsible for such fraud in financial reports, pushing the responsibility to authorities in the affected countries. The World Trade Organisation and other global agencies have to develop a means of fighting such problems.

Managing Ethical Dilemma That Chinese Accountants Face

The review of literature has revealed the dilemma that accountants face when auditing Chinese firms, especially those that target foreign investors. Caliyurt (2019b) explains that it is important to find ways through which these accountants can overcome them as a way of promoting ethical practices. One of the ways of addressing these ethical dilemmas is for the government of China to have laws that can protect workers from arbitrary dismissal or demotion from their positions. One of the main fears of Chinese accountants that force them to engage in accounting fraud is the possibility of losing their jobs if they fail to follow instructions from their superiors (Beecken & Beecken, 2017). It means that even if an accountant is keen on avoiding accounting malpractice, the threat of sacking leaves them with limited opportunity to do the right thing. When they are assured of government protection, they may not only be willing to avoid engaging in such practices but also remain committed to reporting them to the relevant authorities so that corrective measures can be taken.

Local accountants in China may also need to be empowered so that they can understand the long-term impact of their fraudulent actions. Weygandt, Kieso, and Kimmel, (2018) note that majority of these accountants engaging in unethical practices are often focused on achieving short-term benefits. They fail to understand the fact that some of these short-term gains may have major negative implications on their growth in the long run. The current trend is creating a negative image on the country and local companies. They are increasingly getting associated with fraud, and that means investors are likely to avoid them in future (Farah, 2018). Instead of coming to China, these European and North American investors will target alternative regional market where they are assured of integrity and transparency.

The international community can also help in addressing the challenge that local accountants face when they are instructed to manipulate financial records. In the United States and many European nations, systems have been developed that enables accountants to report any form of financial malpractices in their companies without being subjected to any form of punishment (Çalıyurt, 2019a). Such reporting systems have made these accountants confident and more willing to maintain integrity in their actions. However, the review of literature indicates that such systems are not effective in China. The concept of whistle blowing in the country is frowned upon and highly discouraged even by the government itself. It is viewed as a high level of betrayal that should not go unpunished. There is a need for a culture change to ensure that local accountants feel obliged to report any cases of accounting malpractices without the fear of intimidation from colleagues, employer, or even the government.

Research Methods

The previous chapter has explored different secondary data sources to help understand what other scholars have found out about the issue of corporate accounting scandals in China and the ethical dilemma attributed to it. In this chapter, the focus is to explain the approach that was used to collect, analyse, and present primary data collected from a sample of the targeted population. Pettey, Bracken and Pask (2017) argue that analysing primary data enables a researcher to verify the finding made from secondary sources. It also makes it possible to make policy recommendations based on the current facts instead of wholly relying on information that others gathered. This chapter also discusses ethical considerations that had to be observed and problems encountered when collecting and processing data from secondary sources.

Time and Place of Data Collection

Planning is essential when one is keen on conducting a successful academic research. As explained in the research proposal, the first step in this project was the preliminary review of literature that started on April 6, 2020. The researcher then developed a research proposal which was submitted on April 20, 2020. Questionnaire was developed and by June 8, 2020, data collection had started. Primary data was analysed and presented in figures and charts. The researcher developed a draft which was then reviewed and by August 24, 2020, the final draft had to be ready for submission. Although some of the victims of accounting scandals are American citizens as discussed in the literature review, it was necessary to collect data from the place where the practice was rampant. As such, primary data was collected in China. The researcher believed that investigating the problem from its source would make it easy to understand where the problem is common and ways in which it can be addressed.

Research Questions

Corporate accounting scandal is not something new in the field of accounting. The 2008 global economic recession was largely blamed on accounting scandals in the Wall Street and other major global stock exchange markets. The topic has attracted the attention of scholars over the years who are interested in finding the causes, how to identify the problem, and the best way of dealing with it. As Boubaker, Cumming, and Nguyen (2018) argue that it is essential to be very specific when conducting a study in such a widely researched field to ensure that there is no duplication of already existing work. As such, the following questions were developed to help collect specific data from the sampled respondents.

- How rampant is the problem of corporate accounting fraud in China?

- What are the limitations of the current accounting standards and performance measurement systems used in China?

- What are the common accounting principles embraced by accounting experts that makes it easy for them to engage in unethical practices?

- What has been the role of the Chinese government in promoting/condoning or discouraging accounting standards among Chinese firms?

- What ethical dilemmas do accountants face when auditing Chinese firms, especially those that target foreign investors?

- Are there concrete evidences that the Chinese government and accounting bodies in this country are keen on fighting these accounting scandals?

- How can the current accounting standards and performance measurement systems in China get improved?

The above question formed the basis of the questionnaire, which was developed to help with the collection of primary data. It was essential to understand whether the accounting scandals common in this country is promoted by the Chinese government to attract unsuspecting foreign investors or if it is a deliberate effort by individual unscrupulous businesspersons keen on stealing from the local and international investors.

Sampling and Sample Size

Corporate accounting scandal in China is a worrying problem to many foreign investors who are keen on buying stocks in some of the rapidly growing companies. It is almost impossible for one to know whether they are making an investment in a legitimate company or in a Ponzi scheme. As such, it was prudent to collect data from specific individuals who could provide the needed information. Data had to be collected from respondents in China. The researcher classified the respondents into three distinct groups. Respondents will be distinguished and divided into three classes, which includes experts, lay expert, and lay citizens. The experts are professional accountants currently working in different auditing firms and other corporate entities in China.

The lay experts are accounting trainees, accounting educational staff and students, and staff who are working in a corporate environment. The lay citizens are people who are working in a corporate environment but have no professional knowledge in accounting. The decision to classify respondents was motivated by the desire to understand how rampant the problem is in the country. Practicing professional accounts would easily know if there are accounting frauds in the country. The lay experts may also know of the potential existence of the problem if it is becoming rampant. However, if the problem is known even to the lay citizens, then it is an indication of an existence of a serious problem.

The researcher opted to use non-probability purposive sampling method because of the three classes of participants selected. This method meant that the researcher had a greater control in selecting those who participated in the study. A sample size of 200 participants was identified to take part in the primary data collection process. Respondents were contacted through social media platforms. LinkedIn was used as a primary social media platform for reaching out to the participants. The sample size was considered large enough to provide unbiased information about the issue under investigation. It was also a manageable number to facilitate an online survey. In order to standardise response from participants, it was necessary to use a questionnaire to collect data from the sampled respondents.

Questionnaire Design

A questionnaire was developed to facilitate the online survey. The questionnaire had three main sections. The first section of the questionnaire focused on determining the academic background and residency of the participants. As Kumar (2019) explains, individuals who are highly educated in a given field have the capacity to provide expert opinion instead of making unfounded allegations. As explained before, it was equally important to ensure that the participants are either Chinese currently living in China or non-Chinese who have been living and working in the country for some time. The second section of the questionnaire focused on the experience and field of practice of the participants. This section made it possible to determine whether the respondent was an expert, lay expert, or lay citizen based on the three classes indicated above. It also made it possible to understand the level of experience of each of the respondents. The last section of the questionnaire focused on specific questions regarding corporate accounting scandals in China and ethical dilemma that it presents to different stakeholders. This was the most crucial section of the document because it focused on addressing all the primary research questions.

Data Collection

Once the questionnaire was developed and the participants identified, the next step was to collect data. The researcher started by explaining to each participant how they were supposed to answer each of the questions. All the clarifications were made before e-mailing the questionnaire to individual respondent. The respondents were expected to go through all the questions and answer them in the most sincere way possible and to the best of their knowledge. Although most questions were structured to facilitate quantitative data analysis, a few of them were unstructured, allowing respondents to provide answers using their own words. The respondents were expected to answer the questions and send back filled questionnaire within a span of two weeks.

Problems Encountered

It is necessary to note that during the process of collecting primary data from the sampled respondents, some challenges were encountered that had to be addressed to ensure that the needed details were obtained. One of the major challenges was the withdrawal from the study of some of the participants. The fact that they were at liberty to withdraw from the study without being questioned meant that it was difficult to understand the reason behind their decision. As such, researcher had to find their replacement to ensure that a given sample population was maintained. Replacing these participants was a time consuming process that delayed access to data needed for the study. Communication was another challenge when handling some of the participants. It was not possible to include individuals who could not speak in English even if they were willing to and available for the study. The numerous restrictions set by the Chinese government against popular social media platforms such as Facebook, Twitter, and Whatsapp also delayed effective communication with respondents.

Ethical Considerations

When collecting data from sampled respondents, it was necessary to observe ethical considerations. One of the important ethical issues that have to be observed was the protection of the identity of the respondents. Mami (2019) argues that when collecting data from respondents, one must understand endeavour to protect all respondents. It is common to find cases where views of a respondent vary from that of the majority of the population. In the current society where cases of intolerance are increasing, it is possible to find cases where the respondent becomes a target. The issue of accounting scandal is highly sensitive and people are always willing to use any means necessary to protect their image even when they are corrupt.

When they realise that one is revealing information that may jeopardise their unethical means of creating wealth, they can become violent. As such, the identity of all the respondents who took part in the investigation was protected. Instead of using their names, the respondents were assigned codes. They were informed about the confidentiality that would be maintained just to encourage them to answer each of the questions freely. They were also informed that they had the liberty to withdraw from the study in case they felt compelled to do so. Before collecting data from the sampled participants, the researcher explained the goal of the study and the role that they were expected to play.

Validity, Reliability and Generalisability

It was important to ensure that validity of the instrument used in the data collection was capable of achieving the intended goal. The researcher developed a pilot questionnaire and conducted a pre-test just to ensure that the instrument is capable of collecting data as desired. It was confirmed that it was capable of facilitating the research. It was equally necessary to protect the reliability of the data by enhancing the overall consistency of a measure. The researcher was keen on ensuring that all the respondents were affected by the same external forces to ensure there is consistency in their responses. It is the reason why all of them were from China. Enhancing generability would help in ensuring that the data could be applied in different setting to help address the problem of corporate accounting scandals in China. As such, data was obtained from individuals working in different organisations and industries within the country.

Data Analysis

When primary data has been collected from a sample of respondents, the next phase is to conduct an analysis. The raw data has to be processed into meaningful information (Politano, Walton, & Parrish, 2018). The researcher used quantitative data analysis method to process primary data. The statistical approach was used to help determine the extent of the problem and some of its primary causes. Data was fed into the Microsoft Excel spreadsheet and analysed statistically to generate the output, which was then presented in graphs and charts. It is important to note that although the primary method of analysing data was statistical in nature, it was also essential to allow respondents to explain some of the phenomena they have encountered and the approach they feel would help in addressing such problems in the country.

Data Description

The previous chapter has provided a description of data that was collected from participants and discussed ethical codes expected of accounting professionals. In this chapter, the focus is to provide a description of data that was used in the project. The chapter discusses response rate to the survey, a breakdown of demographic information, presentation of data, ethical codes, and how to improve data collection in future.

Response Rate to Surveys

Reaching out to the participants through online platforms was a major challenge. As such, it was crucial to ensure that the response rate for those sampled was high enough to meet the targeted sample population. The researcher explained the significance of the study and benefits that it would have to different stakeholders within China and abroad. The role of the participants was also explained. They were informed that their identity will remain anonymous just to ensure that they are protected from any form of criticism that may arise from their diverse opinion. Regular communication was maintained through various online platforms to ensure that they did not forget to fill the questionnaires within the period set for the study. These measures helped in improving the response rate for the survey. Only a few of them failed to respond to the research questions within the right time. They were effectively replaced to ensure that the top number of the participants remained 200 people.

Breakdown of Demographic Information

As explained in the questionnaire design discussed in the previous chapter, it was necessary to ensure that the demography of the respondents met specific criteria. All the respondents were adults aged over 25 years currently working and living in China. The researcher was able to reach out to 108 male and 92 female participants. It was necessary to collect data from participants with some form of experience. That is why the researcher chose to collect data from adults aged over 25 years who have been working for some time. The ability of each of the respondent to read, write, and speak in English was a major factor that had to be considered when identifying participants. There was the concern that translating these questions to Chinese and then translating the responses back to English may lead to distortion of information. The information about the demographic breakdown of the respondents allowed the researcher to meet the sample characteristics required.

Presentation of Data

Data collected from the primary sources was analysed using quantitative method, as explained in the previous chapter. Data was presented in the form of percentages and other statistical values to help understand the magnitude of a given issue under investigation. The outcome of the analysis was presented in graphs and charts for the purpose of clarity. Each of the graphs and charts used to present the outcome was accompanied with detailed explanation to help readers to understand information presented.

The Ethical Codes

Understanding the ethical codes helps in defining what is expected of professional accountants in their daily assignments. The analysis will help in explaining why the practices among a number of Chinese accountants are considered unethical. Xie (2019) explains that one of the cardinal codes of conduct for accountants is integrity. Accountants are expected to be honest in their professional businesses and relationships. They must maintain regular communications, avoid misleading practices, and ensure that they address concerns of their clients. External stakeholders should be able to trust information that an accountant provides as accurate to enable them make critical decision.

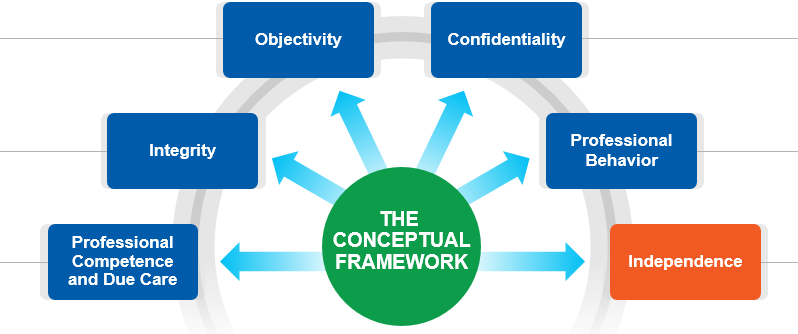

Another code of conduct for practicing accountants is objectivity. They should avoid any form of bias at all times and ensure that their judgment is based on facts. They need to avoid conflict of interest and cases where their decisions are influenced by forces other than factual financial records. Professional competence and due care is another ethical code of practice for accountants (Himick, Brivot, & Henri, 2016). They have to understand that it is their responsibility to provide professional accounting services without allowing themselves to be influenced by external forces. They need to stick professional standards and existing laws that guide their practice. They must understand that they have a responsibility to provide accurate accounting services to their clients, the government, and members of the public who may want to use such information to make investment decisions.

Professional accountants are expected to observe the rule of confidentiality in their practice. Mascarenhas (2018) explains that accountants are required to release their findings only to the relevant authority. They should not facilitate insider trading or related practices by releasing information without the authority of the client or the government. They should also avoid the temptation to share information of one firm with another rival company because that may have unexpected negative consequences. Professional behaviour is another code of ethics that these accountants have to observe. According to Gow and Kells (2018), accountants are expected to avoid promotional activities that may compromise the need to maintain confidentiality in their reporting. Whenever they encounter challenges in their investigation when reviewing books of account, they need to engage relevant authorities within the company instead of taking actions that may affect the reputation of the company. It is also essential for accountants to ensure that there is independence in their practice. Their report should be based on facts as revealed in their investigations instead of pressure from specific individuals. Figure 4.1 below identifies these codes of conduct expected of accountants in their professional practice.

How to Improve Data Collection in the Future

Data collection can be improved if a researcher may seek to conduct a similar investigation in the future. One of the best ways of improving data collection is maintaining communication with the respondents. Regular phone calls and chats through popular social media platforms may act as a reminder so that they can complete filling the questionnaires within the right time. Planning is essential in improving data collection. As Amat (2019) explains, one should know the targeted participants in advance in terms of their location, how to reach them, their availability, and what can be done to motivate them to take part in the study. Planning also involves preparing an effective questionnaire at the right time and delivering it to the participants in the most effective way. If possible, face-to-face interviews would be more preferable than online survey which was used in this study. However, it requires one to have enough time to interview each of the participants. One may also need to overcome the problem of physical barrier.

Data Analysis

In the previous chapter, the researcher provided a description of primary data that was used in this research project. In this chapter, the focus is to discuss results that were obtained from respondents. According to Bowers (2019), data analysis provides a researcher with the opportunity to present their findings that can confirm or refute information available in secondary sources.

Results

The results presented in this chapter were obtained from the analysis of primary data. As explained in the methodology section, data was analysed using quantitative methods. The excel spreadsheet was used to statistically analyse the data. The outcome of the analysis was presented in graphs and charts as shown below. It is important to note that in some sections, respondents were asked to provide explanation on their responses. As Amat (2019) observes, sometimes it may be necessary to go beyond statistics and explain why a given phenomenon happened in a given way and what can be done to address the problem. In this case, it was equally important to ask respondents how they feel the problem of corporate accounting fraud can be addressed.

How rampant is the problem of corporate accounting scandal in China?

The first question focused on determining how rampant cases of corporate accounting scandals are in China. Respondents were expected to state whether they feel such cases are common based on a Lickert scale of 1-5. The 200 respondents answered the question as shown in figure 5.1 below based on their personal experience. A significant majority of the respondents (53%) stated that cases of corporate fraud are significantly rampant in China. Another 27% felt that the problem is rampant in the country. The chart shows that 7% of the respondents stated that they were not sure about the prevalence of the problem even though they stated that they had heard of such cases. The figure shows that 15% of the participant stated that the problem was uncommon/highly uncommon based on their personal experiences.

The researcher was interested in determining whether the Chinese government is aware of the growing corporate accounting fraud in the country. The fact that an overwhelming majority of the respondents feel that the problem is becoming common, it was necessary to determine whether the government is aware of the problem. As shown in figure 5.2 below, 126 of the 200 respondents stated that it is highly likely that the government of China is aware of the existence of the problem. Another 48 participants shared the same view. It means that the majority of the participants (87%) of the participants feel that the problem is known to the government. Only 10% of those who were interviewed had an opinion that is contrary. The Chinese government is one of the most repressive regimes in the world, always keen on monitoring actions of corporate and individual citizens. As such, it is very unlikely that it may be unaware of these unethical practices.

What has been the role of the Chinese government in promoting/condoning or discouraging accounting standards among Chinese firms?

Corporate accounting fraud is a highly unethical practice that every government would want to discourage through conducting appropriate investigations and punishing those who are found to be involved. It is naturally expected that the Chinese government would do the same to ensure that its corporate entities do not engage in such practices as a way of protecting both local and foreign investors. The researcher asked participants if they believe the government is abetting accounting fraud that is increasingly becoming common in China. Figure 5.3 below shows their responses. It is evident that 140 of the participants (70%) of the respondents feel that the government is actually abetting such unethical practices. They explained that the government is aware of the fraud in accounting, especially among corporate entities targeting foreign investors. However, the government is yet to take concrete action that would discourage the practice. This repressive government has the capacity to investigate, prosecute, and punish individuals and corporate providing misleading accounting information. Its inaction is an indication that it does not care or even supports such actions as long as it helps in attracting foreign investors into the country.

What ethical dilemmas do accountants face when auditing Chinese firms, especially those that target foreign investors?

During the review of the literature, various factors emerged as the main forces behind corporate accounting scandals in China, top of which are the desire to attract foreign investors and the needs to register rapid growth. It was necessary to engage the respondents and asked them the same question based on their knowledge and personal experiences. First, the researcher was interested in determining why individual accountants in China were willing to ignore their professional code of conduct by engaging in accounting fraud. The respondents said that these practicing accountants face a major dilemma in the country. They are aware of the code of conduct that they have to practice as professional accountants, top of which is integrity. However, they often find themselves in situations where their personal desires and the pressure they face at work compete against these code of conduct. When asked to state some of the major factors that often led to the dilemma and a trend where many of these professionals choose to engage in fraud, the respondents outlined five major issues, as shown in figure 5.4 below.

The most common factor that motivates accounting professionals in China to engage in corporate accounting scandals is the desire to protect their job. 95 respondents out of the 200, which is nearly half of the total number of the participants, noted that the desire to protect their jobs was the main reason why they engage in accounting fraud. Some of the top managers are very ambitious and highly demanding. They have targets to achieve and when they fail to meet sales target, they instruct their accountants to manipulate their books of account to achieve their goals. These accountants cannot refuse to follow instructions given to them if they want to retain their current positions. There is always a constant threat of a possible demotion or even dismissal if they fail to manipulate books of account as directed by their superiors. They know that what they are doing is wrong, but they are left with no choice if they want to protect their jobs. They are aware that if they fail to do as instructed, someone else will do it.

Desire for high pay and a promotion are the other two major factors that contribute to accounting fraud in China. These accountants are often given the option of getting promotion if they do as instructed. Such promotions are often accompanied with a higher pay. When the opportunity to climb the career ladder is not available at that moment, they are often promised an increased salary or a huge bonus to do as directed by the top managers. These direct financial benefits make it difficult for them to resist the temptation to engage in fraud. The desire to show loyalty to the superior officers is another major factor leading to the rise in such unethical practices. In China, totalitarianism is a common approach of management both in the corporate world and government institutions. As such, junior employees will often try to ensure that they demonstrate loyalty by following directives given by their managers without question. A few of the respondents identified the desire to please those in authorities as a reason why some accountants would manipulate financial statements within a company.

Are there concrete evidences that the Chinese government and accounting bodies in this country are keen on fighting these accounting scandals?

The United States, individual governments within the European Union and the global society in general have been keen on fighting corporate accounting malpractices, especially after the 2008 economic recession. A government that is committed to fighting this vice can achieve success because all it takes it to gave external auditing firms known for their integrity to review the accounting books to determine the truth. When asked to state whether they feel the Chinese government is committed to fighting corporate accounting fraud, the participants responded as shown in figure 5.5 below. It is evident that a significant majority (68%) of these respondents feel that the Chinese government is not committed to fighting corporate accounting fraud in the country, especially those that target foreign investment. 2% of the respondents stated that they were unsure, while another 30% felt that the government is doing something to address the problem. The power that the Chinese government has in fighting specific vices would make it impossible for large corporations to practice them against the wish of the authority. In fact, such practices often benefit the government as these corporations have to pay high tax that reflects their inflated accounts.

How can the current accounting standards and performance measurement systems in China get improved?

The effort that the global society has put in fighting corporate accounting fraud, especially among major multinational companies, is an indication of the seriousness of this problem. The researcher was interested in determining whether respondents felt that the current accounting problems in China could affect the global economy. An overwhelming majority of the respondents (90.5%) stated that such practices pose a major threat to the global economy. Only 8.5% believed that the global economy may not be affected by these practices, while another 1% stated that they are not sure about the possible effect. China is currently the second largest economy after the United States, and it has been attracting investors from all over the world. Most of these participants felt that if the current practices are not stopped, then the events leading to the 2008 economic recession may be witnessed once again.

People may be investing in briefcase companies used to enrich a few at the expense of the majority. When such frauds are revealed, these corporate entities often go out of operations, sinking with investors’ money. The resulting chain of events, especially the loss that suppliers would go through and customers expecting delivery of specific products can have a major negative ripple effect on the economy of different countries. The United States, United Kingdom, Germany, Japan, Canada, and Italy may be the worst affected countries because they have the highest number of individuals and corporate investing in Chinese companies. Figure 5.6 below summarises the information.

Addressing the current accounting fraud in China requires an effort from the government, corporate entities, and individuals who are involved in the manipulation of these documents. The researcher asked the respondents what they are currently doing to help deal with the problem. It is worrying that the majority of these respondents (125 participants) stated that they are currently not doing anything to address the problem. They explained that their current position and their commitment to retaining their jobs make it impossible for them to do anything in the fight against the vice. Their honesty was encouraging but it painted a grim picture in the fight against accounting fraud in China. A significant minority population stated that sometimes they would indirectly leak such scandalous practices in the social media without revealing their identity. However, they explained that the information they reveal may not be detailed enough to point to the direction of their firm because of the fear of a possible punishment from those in authority. A few of them noted that they can either confront authorities within their companies, report to the government, or even resign as shown in figure 5.7 below.

The most important goal of this study was to find ways of addressing the current problem of rampant corporate accounting fraud in China. A significant number of the respondents felt that one of the ways of addressing this problem is to empower foreign investors from Europe and North America. The primary motivation of these fraudsters is to lure unsuspecting investors into their company. If these people and corporate are empowered so that they can be prudent when making their investment in Chinese companies, the desire to engage in the practice will disappear. Another major step is to promote active supervision by international authorities. Entities such as World Trade Organisation and the European Union among others should monitor such practices and issues advisories and punishment where appropriate to discourage the practice. These international organisations should be invited because the Chinese government has shown its unwillingness to address the problem.

Some respondents felt that the Chinese government still has a major role to play in addressing the problem. If the government gets pressure from the international community, it is in the best position to fight this vice within its borders. It has the capacity to set strict laws regarding corporate accounting fraud and to use its forces to implement the law. The local accounting professional bodies in China can also develop strict rules and regulations that their members must follow when developing corporate accounting records. They should have the capacity to punish their members who fail to follow their guidelines. A few noted that it may also be essential to promote ethics and professionalism among local accountants. They have to understand that some of these practices may have short-term benefits to them and their firms but their long term effects may be devastating. They need to be reminded of the benefit of being ethical in their accounting practices. Figure 5.8 below summarises the information.

Discussion of Findings from Primary and Secondary Data

The review of the literature and analysis of primary data shows that corporate accounting scandals are becoming rampant in China at a time when the global society is fighting the vice. Studies have shown that the 2008 global financial crisis was primarily caused by accounting scandals in major money markets in the west (Wells, 2017). Large corporations were engaged in unethical practices involving hiding the real risks of their product portfolios and accurate state of their financial positions as a way of attracting more investors and customers. They outcome of such practices were disastrous. As such, new rules and regulations have emerged in Europe, North America, and other major economic zones to help fight such vices. The problem is that as the world struggles to eliminate this vice, little has been done by the Chinese authorities to ensure that they discourage it.

The information from the two sources shows that different stakeholders have different goals that explain why they are engaged in unethical accounting scandals. The fact that the government is not doing much to deal with this problem is not by chance. Bowers (2019) explains that the Chinese government is highly repressive and would easily know and punish individuals and entities that go against rules and regulations that it has set. However, the current trend shows that the government supports such practices. One of the main reasons why this government is reluctant to fight the vice is because of its desire to attract foreign investors, especially those from the United States and Europe.

China is currently the second-largest economy in the world and the government has been doing everything within its powers to enhance economic growth and stability. Attracting foreign investors into the local economy helps in generating the capital that local entrepreneurs need to help them expand their businesses. The government is willing to ignore corporate accounting scandals if that is what it takes to lure foreign investors into the country. The government also benefits directly from such unethical practices. When these accounts are inflated, the affected companies have to pay higher tasks to reflect the desired increase in earnings.

Corporations engaged in accounting fraud are primarily motivated by the desire to attract foreign investors. Emeagwali (2017) explains that a trend emerged in the United States and Europe where people would be convinced to invest in China because of the perceived rapid growth of these companies. Foreign investors would target upcoming companies registering rapid growth. As a way of attracting unsuspecting foreign investors, local Chinese companies would manipulate their financial statements and fabricate growth to help them appear more attractive than other rivals in the market. The fact that the government has not been strict in punishing those involved in such malpractices has only motivated the companies to embrace sophisticated approaches of hiding the truth about these malpractices.

Individual accountants also have various reasons to engage in such practices as discussed in the primary data analysis in this chapter. The majority are doing it as the only way of protecting their jobs. They know that if they fail to follow the directive given by their superiors, they can easily lose their jobs (Balleisen, 2018). Others are driven by greed to engage in such practices. They know that if they become accomplices to their bosses and agree to engage in fraud, they would get financial benefits and even a promotion. Another group is engaged in such unethical practices because of their desire to demonstrate loyalty to their bosses. A few do it as a way of pleasing their superiors, especially when they realise that these top managers are under pressure to demonstrate growth in their operations. The report emphasises the need for various stakeholders to be involved in addressing the problem. The international community such as the World Trade Organisation and European Union should put pressure on the Chinese government to address the problem. Individual investors, especially those from the United States and Europe, should be empowered so that they do not become victims of fraud. Local accounting bodies should also promote ethics among their members.

Conclusions and Recommendations

China has become one of the most attractive markets for foreign investors keen on tapping into the rapidly growing economy. However, a trend is emerging where corporate accounting fraud is becoming increasingly common. Many start-up companies are inflating their financial reports to give a false image that they are growing rapidly as a way of attracting unsuspecting foreign investors. The primary aim of this study was to survey and reveal the limitations of the current accounting standard setting and performance measurement system in China by reaching a wider range of participants. It was necessary to determine the primary causes of these accounting scandals and how different stakeholders can work as a unit to address them. The aim of the study was achieved with the help of both primary and secondary data. The researcher collected secondary data from journal articles, books, and reliable online sources. Primary data was obtained from a sample of respondents in China. 200 participants with the capacity to provide the needed information were involved in the study.

The results of this investigation revealed that corporate accounting scandal is increasingly becoming common in China. Both primary and secondary data indicated that the primary factor that has fuelled this unethical practice is the desire to attract foreign investors. Many Americans and Europeans are currently keen on buying shares of rapidly growing Chinese companies. The problem that has emerged is that most of these Chinese companies are now competing to attract foreign investors. They are inflating their books of accounts to give the impression that they are expanding rapidly. The Chinese government seems to be comfortable with such practices, which are attracting a large amount of foreign investment. It has the capacity to eliminate such practices but its inaction only demonstrates that it is in support of the practices. Such problems not only lead to financial loss to those who invest in these companies, but also an increasing loss of trust in Chinese companies. The current benefits may be short-lived as most of these foreign investors may look elsewhere. The negative implication will not only affect individual firms but also the overall economy of the country.

The study suggests that the current trend is also motivated by a culture that is repressive and limits free speech. Some of those individual accountants involved in manipulating financial records are not happy with such practices and would prefer to report them. However, they fear that they might lose their job. They engage in such acts as a sign of loyalty and to please their highly demanding superiors. Others are driven by greed as they are promised financial rewards and promotion. A culture change is needed in the society that has to be driven by the Chinese government. As shown in the discussion above, these unscrupulous accountants know that their actions are unethical and they also know that investors would eventually lose their money. There is no effective government supervision or commitments by relevant authorities to punish those who engage in these activities, which often motivate them to engage in these criminal acts.

It is important to discuss the potential and apparent limitations in the study. One of the major limitations was that this study was not able to interview those who were directly affected by the problem of corporate accounting scandals in China. The majority of these victims are in the United Kingdom, the United States, Germany, Italy, and other European countries. Interviewing these people would have provided a clearer picture of the impact of unethical accounting practices in China. Another potential limitation was the fact that all the respondents are currently working in various companies in China. There was the fear that some of them would hide the truth because of the fear that their identity might be revealed. Others would provide untruthful information because of their desire to protect their company and employment. The limited number of journal articles and books published by Chinese over this issue based on personal experiences was another concern. The researcher had to rely on books and journals published by American and European scholars who have tried to unearth such practices.

Recommendation on How to Fight Corporate Accounting Fraud in China

Corporate accounting fraud in China may seem to be the easiest way of attracting unsuspecting American and European investors to the country, and the current victims may be foreigners. However, the long term impact of these practices may have devastating consequences. It is important for various stakeholders to make genuine steps in addressing this problem before the reputation of local corporations may be destroyed. The following recommendations may help in addressing this problem:

- The international community, through bodies such as World Trade Organisation and the European Union, should put pressure on the Chinese government to crack the vice. They should get actively involved in investigating accounting scandals because it may cause a major impact on the global economy.

- The Chinese government should be concerned about the negative image that such practices may create about the local firms. It should use various agencies to investigate and punish individuals and corporations involved in such criminal acts.

- Professional accounting agencies in China should enact strict rules and regulations that their members should follow. There should be a clear mechanism of punishing those who fail to follow these regulations.

- Foreign investors, especially those from Europe and North America, should be empowered by revealing these accounting frauds to them. They need to know how to detect accounting fraud when they are planning to make their investments.

Recommendation on Future Research