Introduction

Glaxo Wellcome and SmithKline Beecham combined in 2001, and turned into GlaxoSmithKline, the second largest pharmaceutical company around the globe and operated in about 120 nations by affiancing with formation, innovation, production, and promotion of pharmaceutical and customer healthcare products with the highest level of care to assure the most superior quality of services for the global customers (GlaxoSmithKline, 2010).

Operating throughout a global network of production spots, GlaxoSmithKline offers its wide ranging drugs and other Medicare-products to the final consumers all over 150 realms of Europe, North America, Central and South America, Caribbean, Asia, Australasia, South East Asia, Africa, and Middle East. The company undertook the reorganization process of the entire business in 2007 to augment its revelation to emergent countries and it completed four mergers in those emergent countries throughout half of the 2007 financial year (Loughran, 2009).

Recently, GlaxoSmithKline has made a $3.6bn takeover of Stiefel, one of the biggest autonomous dermatology businesses of the globe- this new-fangled firm has expected to have a joint turnover of about $1.5bn and a strengthened product-pipeline. In order to carry out uninterrupted business operations it takes various programs such as the ‘PHASE initiative’ that operates in 16 nations including Bangladesh, Bolivia, Brazil, India, Indonesia, Kenya, Malawi, Mexico, United Kingdom, etc.; in the international region, its Global Community Partnerships concentrates on supplying partnership funding for health education.

Table 1: Key Statistics of GlaxoSmithKline plc. Source: Yahoo Finance (2010).

Pharmaceutical Market Profile of the World

Illustration of the world pharmaceutical market profile has mostly focused on the robust growth of this sector for the last decade as well as potential market forecast within 2012. Before attempt to continue broad discussion, it should require to consider about the global market share of multinational companies in this sector –

Table 2: Market share of the Pharmaceutical Companies in global market. Source: Pharmaceuticals Industry Analysis (2004, p.9).

Pharmaceutical market researchers and the major players of this industry have wished to earn aggregately more than trillion dollars in terms of their revenue though there have keen potentiality of changing market development and growth strategies to achieve revenue target. In terms of production volume, the UK has ranked at peak and other side, 34% most significant pharmaceutical markets have generated from other regions and countries (North America, Latin America, Europe, Asia-Pacific and Africa). An exclusive study on pharmaceutical market during 2006 has pointed that recent slump of this market growth has because of patent expiry of several major blockbuster markets (US and Western Europe) at the same time.

Conversely, emerging areas (Asia and Latin America such as India, China, Brazil, Russia) of the global geography have earned enormous success. Statistical overview has forecasted that in 2010–12, CAGR (Compound Annual Growth Rat) of the world pharmaceutical industry would be around 6% (RNCOS, 2008). An empirical study of the pharmaceutical industry highlighted that key growth drivers have shifted towards the emerging countries due to low-cost of production and low-wages of labours globally increase of disease prevalence, increase of per capita income of the common people, and in case of blockbuster market players, M&A has most effective tool for market growth (Anon, 2008).

Considering above discussion, following are the major study outcomes of global pharmaceutical industry (RNCOS, 2008) –

- From 2000–05, revenue of the aggregate industry was US $534.8 billion, and it has quantified that it would be around US $1043.4 billion at the end of 2012 where current CAGR rate has been 8% (RNCOS, 2008);

- At the end of 2007, North America has titled as the largest global pharmaceutical sales magnet by involvement of 42.8% and market forecast has anticipated that during 2012 it might be 49% excluding Europe and Asia-Pacific region. Conversely, European market specially, central and eastern Europe would have been faced a sluggish market growth for next five years because of patent expiry of common and significant drugs and medicines, diseases related with lifestyles and significant changes in principle market development strategies as well as drug pipeline supply chain management;

- Due to an unutilized large population in the Asia Pacific region, there have a strong potentiality and opportunities of market diversification (Bio Pharmaceuticals, Pharmacogenomics and Biologics market). Additionally, excluding Latin American countries like Brazil and Mexico have shiny future in lucrative global pharmaceutical market

Foreign exchange rate

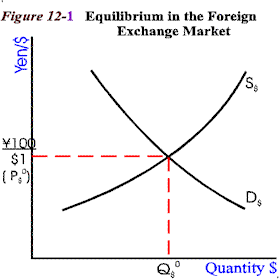

Hypothetically, the term foreign exchange rate or the exchange rate has quantified price/value of a country’s currency/money, which would be equivalent to another country’s money. For instance, in following table a comparative scenario among US dollar ($) and Japanese Yean (¥) exchange rate has presented. In the macro economic study, the exchange rate has treated through the balance of payments, for instance, if the value of the US dollar in exchange of the pound sterling were 1.56, then the US buyer would have to buy one pound with 156 US cents.

In the international money market with the duration of time, foreign exchange rate value has changed due to several reasons and here increase of currencies proportionate to another currency has termed as appreciation and conversely, depreciation has indicated price reduction of currencies. Fluctuation of exchange rates has greatly impact on different countries interest rates, aggregate value of export and import, FDI, per capita income, investment scopes and so on. Globally, US$ is the most dominant foreign currency and fluctuation of US$ has great impact on global trade balance. Additionally, price changes in oil, gas and gold has impact on changes in US$ value. Meanwhile, in recent years Euro has become growing significant against US$ dominant image (Pearson Education, 2010).

Credit ratings

Both in domestic and international credit rating policies have similar characteristics. Corporate bodies, domestic and foreign government policies have mostly focused on aggregate cost of debt though this consideration has no impact on the WACC. During credit rating, government of a country has also required to consider share market attitude as well as shareholders interest (Bodie, Kane, and Marcus, 2005). It has unambiguous that optimal credit rating of an organization has not always been considered the highest rating or scoring.

Hypothetically, credit rating has displayed information on default potentiality, value of loan and losses as well as recovery percentage. Additionally, the credit rating has warned the government how to minimize debt risks, but not suggested potential equity benefits (Pandey, 2007). Common misunderstanding of credit rating has arisen during discussion on corporate and government business operation objectives and vision, and it would referenced that there have strong trade-off among credit rating, and both business and financial risks (Ross, Wererfield, and Jaffe, 2006).

Rational to fluctuate exchange rate and credit ratings in different countries

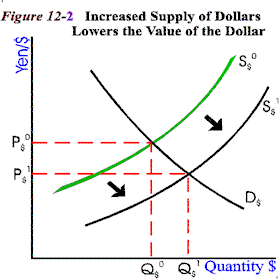

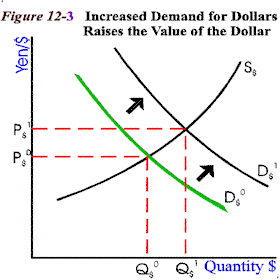

Stability of the foreign exchange rate and price has drawn through demand supply equilibrium in diverse market (Kaplan, 2002). On the other hand, equilibrium of the capital market has quantified the interest rate of a nation (Kaplan, 2002). Under macro economic study exchange rates determination have generated through inflation and GDP equilibrium where these two dynamics have considered respectively as demand and supply (Kaplan, 2002). Fluctuation of the components of demand and supply of the exchange rates have termed as the floating exchange rate and in following illustration three fundamental assumptions of exchange rates fluctuation have drawn (Kaplan, 2002).

Assumption-1, equilibrium phase

In following figure horizontal axis has indicated quantity of US$ and the vertical axis has presented supply of US$ consistent with the other foreign currencies in the money market. As for example, this figure attributed through Japanese currency. Equilibrium point of the curve has determined price of the US$ and thus surplus and deficit condition have act as dynamics of fluctuating exchange rates.

Assumption-2, depreciation

During this circumstance due to oversupply of the US$ price has been fallen of the exchange rates and conversely import value of country has increased.

Assumption-3, appreciation

During this phase demand for exchange rates has increased against domestic currency and hence price of the foreign exchange rates have increased and denoted as the appreciation. Additionally, this circumstance has also indicated higher interest rates against US$ in international money market.

Affect of oil price variation

Due to buffering effect, fluctuation of oil prices both in local and international market has greatly affected variation in US$ prices globally. Consequently, increase of exchange rates has also made variation in consumers and suppliers demand supply volume like oil demand in transportation industry (KPMG LLP, 2008)

Impact on global economy and business operation

Due to a macro economic component, exchange rates have been also a dynamics of global economy as well as business operations and strategies. Firstly, concept of exchange rates have related with individual country’s currency value and reserve (Block, and Hirt, 2005). Secondly, concept of supply and demand has constructed supply chain management of the country; more specifically, aggregate import and export values. Excluding these issues interest rates, inflation rates, unemployment ratio, and per capita income have varied because of exchange rate variation (Block, and Hirt, 2005). Hence, global business operation and it strategies have also affected by the fluctuation of foreign exchange rates (Besley & Brigham, 2007).

Conversely, effects of credit areas of credit rating on global economy have almost similar to the exchange rates (Elkhoury, 2008). Additionally, here government’s debt liability and price index of the consumers have included (Elkhoury, 2008).

Impact of credit rating & exchange rate on GSK

The professors Imed Eddine Chkir and Jean-Claude Cosset stated that the impact of exchange rate and credit rating has influenced the Multinationals to adopting bi-dimensional scenery of the diversification strategy that involved with elevated agency costs of debt as well as the mixture of both categories of diversification ensure lesser operating risk in the emerging market (Chkir and Cosset, 2009). Even though such strategies influence the determinants of capital structure through factors like widespread profitability plus operating risk, which will negatively interconnected with the debt ratio of the MNCs in global pharmaceutical industry.

GlaxoSmithKline (2008) confirmed that the counterparty risk management policy of this Pharma MNC functions with a selective group of financial institutions that faced towards long-term credit ratings maintained by CCO rather than Corporate Treasury. All overseas branches and CFO have integrity with the CCO to scrutinize the credit rating of any counterparties, and it is the duty of CCO to notify all variations of credit rating to the Corporate Treasury for take appropriate measure in time. Lehman Brothers was the baker of GSK during its collapse in 2008; GSK was capable to reduce the impact of credit crush as it implemented the policy of holding cash equivalence and liquid investments to face unavoidable circumstances. The counterparty credit rating of GSK has shown in the following table-

The collective credit risk of GSK in relation to its financial instruments possibly will have a counterparty aimed to long-term credit ratings and the follow above table demonstrates the credit ratings of counterparties in support of liquid investments including cash, cash equivalents as well as derivatives.

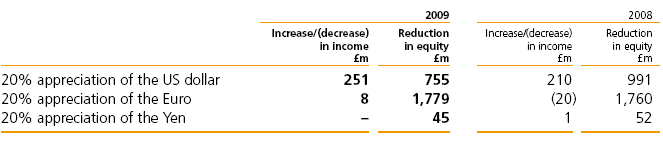

Meanwhile the exchange rates also have tremendous impact of GSK while GlaxoSmithKline (2009) reported following data regarding its influence on exchange rate in different countries –

The above table demonstrates that the volatilities to foreign exchange rates upon its America dollar, Euro as well as Yen have at least 20 percent variation that has evidenced from the data of 2007 to 2009 with fully hedged to maturity along with currency swaps (GlaxoSmithKline, 2009).

Current Strategies of GSK

The pharmaceutical company has currently undertaken various strategies, which includes the following:

- The company is implementing its plan to expand the business globally by branching out its Medicare-products to construct further unwavering product-portfolio and it is spending in major growth areas such as in promising markets like India, in formation of some vaccines, and in the customer healthcare segment (GlaxoSmithKline, 2010);

- It wants to engender the future sales augmentation through intensification of the central business-operations and adding it up with amplified speculation in development zones, for instance, in R&D, new product developments, research works, marketing and promotional facilities, etc (Annual report, 2009);

- The business’s strategy is to strengthen its market in emerging economies and especially in Japan; with this vision, it accomplished ten mergers in 2009 and launched the Viiv Healthcare program as a joint-venture with Pfizer designed to offer more upgraded treatment-facilities for AIDS infected patients (ICIS.com, 2010);

- Its key focus would remain on improving and creating products that are the most superior ones in terms of quality and maintaining the foremost supply of medicines, assuring that those are upholding the reputation of GSK (Annual report, 2009);

- Since GSK is expanding its operations, it would focus more on diverging and enhancing an advanced capacity of mid size Medicare-products for clearly defined customers, which would improve a low-risk portfolio that is independent on the performance of one or two large products (PR Newswire, 2010);

- GlaxoSmithKline is indeed a very huge and multifaceted business, which has been facing problems with managing and coordinating their operations; in such circumstance, the company has planned to simplify and renovate its organizational structure to lessen difficulties, advance proficiencies, and diminish expenses; this international reorganization program is an essential catalyst of the company’s strategy (GlaxoSmithKline, 2010);

- Moreover, GSK would emphasize to rearrange the entire production process, rationalize and modernize its activities, lessen working capital, and so on (GlaxoSmithKline, 2010);

- GSK has intended enhancing its rate of return on investment along with a long-standing plan to boost its rate of return for research and development to approximately 14 percent for the betterment of the business as a whole (Annual report, 2009);

- In order to execute the expansion strategy, besides of many other plans, the company has made a $253m takeover of Laboratorios Phoenix, an Argentine player of this industry sector to speed up sales and broaden its portfolio in the Latin American section (GlaxoSmithKline, 2010);

- GSK has been changing in a more biotech approached-business, building little divisions of with about eighty scientists to trail advancement agendas; as per Andrew Witty’s policy, the company would form a venture-arm to spend in emerging innovative treatments (FierceBiotech, 2010).

Conclusion

The purpose of this report was to discuss the influence of actual and potential changes in the exchange rate on GlaxoSmithKline’s global operation. However, this paper has also considered information about the world’s pharmaceutical sector, the connection between changes in exchange rate and global pharmaceutical companies. As one of the foremost pharmaceutical companies of the world, GlaxoSmithKline is running successful operations throughout Europe, North America, Central and South America, Caribbean, Asia, Australasia, South East Asia, Africa, and Middle East, serving its consumers with the highest level of customer care offering high quality vaccines, medicines, and other products.

Recommendation

In order to become global market leader in pharmaceutical industry, GSK should focus on the following issues –

- For a real progression, the company needs to re-design it’s strategy for global operation and it should reduce its dependency on the US market;

- At the same time, it should increase the market drive in the Asian market, for example, India and Japan is the potential market;

- In order to minimise the risk of US recessionary impact on US currency and probable inflation, GSK needed to invoice for its items in Euro;

- It should develop its global marketing strategy considering the competitors’ strategy, for example, market leader Pfizer seeks to manage its foreign exchange risk by operational means, including managing expected same-currency revenues compared with same-currency costs and same-currency assets proportionate to same currency liabilities;

- The pharmaceutical industry is experiencing challenges, GSK should implement its existing strategy for the Least Developed Countries (LDCs);

- The management should expand its business by concentrating on the mergers and acquisitions strategies;

- The credit crunch, fall down of the US sub-prime money market and recession have been seriously injured the global economy, therefore, it should increase the budget to develop research department to measure the interest rate, credit risk, default risk, country risk, liquidity risk, market risk, and business risk.

Reference List

Anon (2008) Global pharmaceutical market forecast to 2012. Web.

Besley, S. & Brigham, F. E. (2007) Essentials of managerial finance. 14th ed. New Work: Thomson South Western College.

Block, B. S. & Hirt, G. A. (2005) Foundations of financial management. 11th ed. Boston: McGraw-Hill Irwin.

Bodie, Z. Kane, A. & Marcus A. J. (2005) Investments. 5th ed. New Delhi: Tata McGraw-hill.

Chkir, I. E. & Cosset, J. C. (2009) Diversification strategy and capital structure of multinational corporations. Web.

Elkhoury, M. (2008) Credit rating agencies and their potential impact on developing countries. Web.

FierceBiotech (2010) GSK chief elaborates on biotech strategy. Web.

GlaxoSmithKline (2008) Annual Report 2008: GSK is changing. Web.

GlaxoSmithKline (2009) Annual Report 2009: GSK is changing. Web.

GlaxoSmithKline (2010) Deliver more products of value. Web.

GlaxoSmithKline (2010) GlaxoSmithKline: A full-service contract manufacturing partner. Web.

GlaxoSmithKline (2010) Grow a diversified global business. Web.

GlaxoSmithKline (2010) GSK drives Latin America growth strategy with acquisition of Laboratorios Phoenix.Web.

GlaxoSmithKline (2010) Simplify the operating model.Web.

ICIS.com (2010) GlaxoSmithKline: strategy and financial highlights information from ICIS. Web.

Kaplan, J. (2002) The balance of payments and exchange rates. Web.

Kesič, D. (2008) Strategic Analysis of the World Pharmaceutical Industry. Web.

KPMG LLP (2008) Oil and gas prices: the exchange rate impact. Web.

Loughran, P. (2009) GlaxoSmithKline says job cuts are not related to the downturn. Web.

Pandey, I. M. (2007) Financial management. 9th ed. New Delhi: Vikas publishing house.

Pearson Education (2010) Define the term exchange rate using examples, Chapter 16: Specific Influences on Global Business. Web.

Pharmaceuticals Industry Analysis. (2004) The history and analysis of the pharmaceutical industry. Web.

PR Newswire (2010) GlaxoSmithKline unveils strategy for growth. Web.

RNCOS (2008) Global pharmaceutical market forecast to 2012. Web.

RNCOS (2008) World pharmaceutical market- 2007. Web.

Ross, A, Wererfield, R. & Jaffe, J. (2006) Corporate finance. 8th ed. London: McGraw-Hill.

Yahoo Finance (2010) Income statement, cash flow and balance sheet of GlaxoSmithKline plc. Web.