Client Profile

Mr. Martinez is the janitor/handyman at the apartment building that I am currently staying at. He has a wife and two kids and earns roughly $22,000 annually from his job which goes towards supporting both his family in the U.S. as well as other members of this family within Mexico. Out of his $22,000 yearly income, $2,000 goes towards his family in Mexico while $3,000 per year is utilized for his utilities expenses. Since he works as a janitor/handyman, he actually lives onsite in a 2 bedroom apartment that was allocated for his use by the manager of the building. As such, while he does not pay rent he still needs to pay expenses related to utilities and other normal costs (i.e. mobile phone cards, food, education expenses, etc.). Unfortunately, Mr. Martinez has not developed any form of retirement plan and is in need of assistance since he is already 38 and will likely retire in the next 30 to 40 years.

Objective

The objective of Mr. Martinez is quite simple; he wants to be able to save up enough money to at least partially pay for the college fund of his children and wishes to save for retirement. Thus, the goal of this financial report is to develop an outline of the necessary amount of funds to be allocated towards specific purposes.

The following is a breakdown of the yearly costs associated with each child and other related expenses of the family:

Children

- Kim: ($1,800 per year)

- Maria: ($1, 800 per year)

Wife

- Corazon: (Stay at home mom with no income)

Husband

- Jose Martinez: (Personal expenses: $3,000 per annum)

Cash Flow Analysis

Supplementary Income Source

Due to his relatively low monthly income, Mr. Martinez is eligible for the SNAP (Supplemental Nutrition Assistance Program) which enables him to avail of $150 per month in food assistance from the government.

Net Worth

Since Mr. Martinez has a relatively low income threshold and has no savings to speak of, his net worth is almost zero. He informed me that he has no property under his name either within the U.S. or in Mexico and does not own a car. Thankfully, his job provides him with the means to live in a location with his family for free.

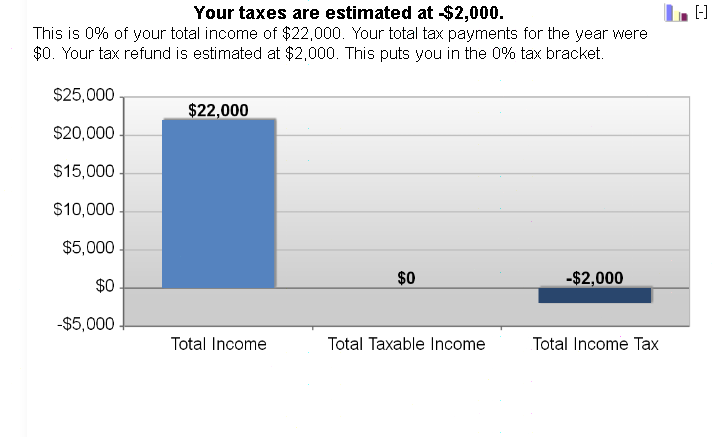

Analysis of Costs Associated with Taxable income

The following analysis examines the potential costs associated with paying taxes to the government and how this impacts the potential for Mr. Martinez to save for both a college and retirement fund.

- Dependents: 3

- Dependents qualifying for child tax credit: 2

- Income: $22,000 per annum.

- Taxable income: $0

- Adjusted gross income: $22,000

- Deduction for exemptions: -$15,600

- Standard or itemized deduction: -$8,950

- Taxable income: $0

Utilizing the 1040 Tax calculator of the IRS to determine the annual taxable income of Mr. Martinez, it was discovered that since he has three dependents (i.e. his wife and two children) and has a relatively low income threshold, this actually exempts him from paying any taxes per year. This is actually a relatively good situation since taxes could have potentially eaten into any form of retirement or college fund that he could have attempted to start.

Retirement Analysis

Based on the current lack of savings, assets or properties of Mr. Martinez, it can be stated with 100% percent accuracy that barring any form of sudden financial windfall (i.e. winning the lottery) he is ill prepared for retirement.

Insurance/ Risk Management Analysis

Given the current state of Mr. Martinez’s finances, life insurance is not an option at this time given the allocations to the college and retirement fund when correlated with his relatively low income threshold.

Specialized Analysis

Calculating College Fund Costs for the Children

Recent data shows that the average cost of a college education at a public college is roughly $22,826 which does not include other associated costs such as food, commuting fees, books, etc (Khan, 2013). Since the children of Mr. Martinez will be entering college at roughly the same time (they are 11 and 12 respectively), this means that the annual cost for just one child is $137, 523. If they are going to complete an entire four year degree (this takes into consideration potential problems with grades, extra subjects, etc.) this will result in a total cost of $275,046 for both of them. The following calculation takes into consideration that Mr. Martinez wishes to meet his savings goal for his children by the time they enter college and wishes to make monthly contributions to their college savings fund. This calculation also takes into consideration a five percent cost increase of a college education per year and a 0 percent tax base since Mr. Martinez is tax exempt given his relatively low income. For the purpose of this financial plan, a 529 educational savings plan will be utilized as the primary basis behind the calculation (Khan, 2013). The aim of this calculation is provide at least 15% of the projected cost so as to lessen the debt burden through federal loans for education later on.

The following are the data inputs for the calculation:

- Years until college: 5

- Attending college: Full-time for 4 years

- Current cost of college: $25,000 (annual) in 2014

- College cost increase: 5% per year

- Projected total college cost: $20,629

- Target contribution: 15% of college costs

- Monthly deposit: $183 (for one child, multiply costs by two for both children)

- Assumed growth: 6% per year

By making contributions to the 529 plan of $183 per month (for just one child), in 8 years the plan of Mr. Martinez has the potential to pay $20,629, which is 15% of total projected costs of $137,523. Since Mr. Martinez has two children, the projected 529 plan payments would then consist of $366 per month ($4,392 per year) with a grand total of $41,258 during the 5 year savings period and extending towards the four years that his children will spend in college. Taking this into consideration, the amount of $4,392 per year should thus be allocated from the current yearly income of Mr. Martinez so that he can contribute in some way towards the college fund of his children.

Allocating Payment for College Fund.

Based on an examination of the spending habits of Mr. Martinez, it is recommended that in order to allocate enough money towards the college fund of his children he needs to reduce his personal expenses and the amount of money that he allocates towards his family in Mexico. The total reductions necessary would come up to a reduction to $304 for personal expenses and another $304 for money to Mexico. This is the only means by which Mr. Martinez can at least partially pay for his children’s college fund since his projected income over the next four decades shows that its increase during the first 5 years is still insufficient to support the current level of personal expenses along with the necessary monthly payments for the college fund.

Analysis of Projected Employee Salary Increase over 40 Years

Mr. Martinez explained that he and the owner of the building actually have an arrangement wherein so long as he continues to work exclusively within the apartment building, he can look forward to a salary increase of 1% per year. Such an arrangement has been created through a valid and notarized contract which compels the owner of the building to abide by its stipulations. It is based on this that a projected employee salary table can be created which shows exactly how much money Mr. Martinez will earn per annum and how much could be potentially allocated towards his retirement fund.

Investment Analysis

The goal of this investment plan is to create some form of retirement fund for Mr. Martinez despite the relatively little amount that can be worked with. It is based on this that the primary goal of his investment plan is to have Mr. Martinez stick to his current budget allocated for $22,000 with the 2% per year increase in salary going towards investments in the stock market. It was decided that the best possible way to create significant gains for Mr. Martinez is to invest in stock markets within up and coming developing countries such as the Philippines due to the potential for high growth (Investing in the Philippines, 2007). The reason behind this strategy is due to the fact that the Philippines has consistently shown rapid economic gains over the past year with an estimated 7 percent GDP growth by the end of 2013 which outpaces that of its regional neighbours (Bloomberg, 2013).

Investment Plan

When examining the acceptable risk tolerance for this type of investment plan, it was decided to invest the 2% per annum increase within the local market in the Philippines in the form of stocks related to real estate, telecomm and other major corporations within the Philippines. A conservative estimate of the annual yields derived from this particular strategy is around 1.5 to 2 percent depending on the current condition of the economy.

One of the primary reasons behind investing in this stock market is the potentially high yields that can be attained through investing in such an investment vehicle given the current growth of the local market. When evaluating the current investment strategy, which takes into account a risk tolerance of 0.005, the original plan of investing into the local stock market will not have changed at all given the fact that it has been set at the lowest percentage allowable based on current investment standard practices. If through some unexpected happenstances that a threat has expressed itself creating a great deal of concern regarding the original amount slated to be placed within the stock market fund, it would be possible to lower the initial amount to be invested in particular industries and allocate them into other ones with the excess percentage being relocated to the recently crated ETF (Exchange Traded Fund) within the Philippine stock market which has a current value of $2.50 per share (Bloomberg, 2013). Such a move would of course result in a reduction of the possible yields from 1.5 to 2 percent to roughly 0.5 to 1 percent given the decreased amount of investment in the real estate investment fund which has a higher potential yield in the long term.

Summary

Role in the process of developing the financial plan

My actions in the process of creating this financial plan involved an initial conversation with Mr. Martinez regarding his long term financial planning goals. I often talk to him now and then when I enter and exit the building and he is usually quite nice. I learned that he had no financial planning experience and no retirement plan to speak of. It was due to this that I took it upon myself to help him develop a retirement plan that could enable him to retire in 40 years time with a reasonable amount of money.

Client relations and Interaction

Implementation and monitoring in this instance involves me talking to Mr. Martinez on a daily basis (which I already do) and asking him about this adherence to the plan and whether he is capable of following it. The delivery of the financial plan to Mr. Martinez involved me explaining to him what he can do to ensure that he has a good retirement and how he can at least partially pay for the college education of his children.

Research and Analysis

The research and analysis portion of the financial plan development examined potential methods to maximize the earnings of Mr. Martinez in the long term. It was due to this that investing in the stock markets of up and coming developing economies seemed to be the best approach given the relatively low stock value yet high potential earnings.

Development of the Financial Plan

The development of the financial plan took into consideration several factors: the ability of Mr. Martinez to allocate enough money for his children’s college fund, current wasteful spending that could be allocated towards better purposes as well as a projected income examination in order to determine long term income potential. By examining these factors, it became possible to develop a financial plan that addresses the initial concerns of Mr. Martinez of having a retirement plan as well as being to at least partially pay for the college education of his children.

Delivery of Financial Plan to the Client

The delivery of the financial plan involved me talking to Mr. Martinez regarding what he should do to achieve his goals.

Reference List

Bloomberg. (2013). Moody’s gives Philippines investment – grade rating. Filipino Reporter. p. 4.

Investing In The Philippines. (2007). DPC: Dredging & Port Construction, 4.

Khan, S. (2013). What College Could Be Like. Communications Of The ACM, 56(1), 41-43.