It is crucial to note that over time, some of the main macroeconomic variables are prone to considerable changes. The aggregate level of real output of an economy (usually represented by GDP or GNP) tends to grow.

The recurring deviations from the real aggregate output about the trend can be referred to using various interchangeable terms such as business cycles economic cycles, or economic fluctuations. Thus, macroeconomics can be divided into two major areas of research: one related to the study of short-term behavior of a product (business cycles), which is

Short-term macroeconomics; and another related to the performance of the product in the long term (a trend). The latter can be explained using various theories of economic growth.

Additionally, it is possible to characterize the macroeconomic variables according to the direction along the following cycle. First, variables which increase when the product level (income) increases are called “pro-cyclical” while those that decreases are referred to as “counter-cyclical.” Those that do not have a standard defined throughout the cycle are called “acyclic” reductions. The same reasoning is valid for the product level.

These variables can also be classified according to their correlation with the economic cycle (high or low) and by the timing of their oscillations. Thus, a variable is considered to be “leading,” if it tends to move before the aggregate output, “lagging” if it moves slower than a product and “coincidental” if it presents a cyclical pattern that occurs simultaneously according to changes in a product.

Studies of the business cycle were rather vague at the beginning of the century. It later lost importance, only to return as a major research agenda dominant in macroeconomic in the 70s. As it stands now, the study of the business cycle is am an important entity for economists and policy makers in the discipline of economics.

The contemporary market economies are characterized by two phenomena: a long-term growth trend and more or less significant fluctuations in activity around this trend. Economic cycles cover a more or less regular succession of booms and recessions. Expansion is typically a low point of activity at a high point, and conversely, recession refers to economic movement from a high to a low point.

Macroeconomic concerns

When the overall price level increases, it is referred to as inflation. Alternatively, it can be defined as the widespread and sustained increase in prices of goods and services within a particular economic region. To measure the growth of inflation at any given time, there are several key economic factors and parameters that must be put into consideration.

For instance, the Consumer Price Index (CPI) is used to measure the rate of inflation. Also, the National Consumer Price Index is used to compute the percentage increase in the pricing of products. Another measurement factor is the Producer Price Index. The latter is used to take a precise measurement of price growth of raw materials required for the process of production.

Realistically, three types of inflation can be identified. First, inflation for consumption or demand usually obeys the law of supply and demand. If the demand for goods exceeds the capacity of production or importation of goods, prices tend to increase indefinitely. Second, inflation costs occur when the price of raw materials goes up.

As a result, producers end up increasing their prices so that they can maintain a comfortable profit margin. The third type is known as self-constructed inflation. It automatically takes place when a strong future price increase is seen in advance. After that, it gradually adjusts itself.

Inflation expectations generated by the vicious circle is common in high-inflation countries where workers demand wage increases to counteract the effects of inflation that often give rise to a vicious cycle of inflation.

To curb inflation, central banks tend to increase the interest rate on public debt. As a result, interest rates are increased in consumer loans (credit cards, mortgages, and so on). By increasing interest rates of consumption, product demand slows down.

The downside of this control measure is that it slows the industry that produces given products. This can lead to economic stagnation and unemployment.

When inflation goes beyond the standard level, it is referred to as hyperinflation. It implies that there is a substantial or sharp rise in the price of goods and services within a very short period. In some instances, the price increase might go as up as 50 percent within one month. A fall in price level indicates that the rate of inflation is negative.

To measure the actual performance of an economy, an aggregate growth output is the right index to employ. It refers to the total of products generated by an economy. Other macroeconomic factors worth considering in this discussion include recession, depression, and unemployment rate.

When two quarters experience a drastic decline in aggregate outputs, it usually leads to recession. When recession persists for a considerably long period, it culminates into economic depression. The rate between those that are employed and the unemployment can be used to calculate the unemployment rate within any given jurisdiction.

Economic growth

When the production possibilities of an economy are expanded, it results in economic growth. This implies that an increase in the actual value of Gross Domestic Product (GDP) can be precisely used to measure the growth of an economy. It is equally crucial to understand the meaning of real GDP. Within a single year, any given nation produces goods and services from various sectors of the economy. When the total production is put together and then quantified in terms of prices, it results in the real Gross Domestic Product of a country.

Phases of a business cycle

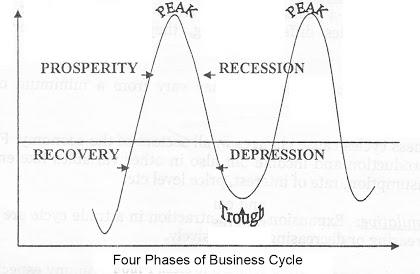

A business cycle has four distinct phases. These include the peak (prosperity), recession, trough (depression), and recovery phases. These have been illustrated in the diagram below.

The Peak (prosperity) phase

The standard of living rises when the margin of profits, prices, employment, income, and output expand. Such a period in the business cycle is known as the peak or prosperity phase. Some of the key features of this phase include:

- The high volume of output

- Increased trade coupled with a high degree of demand

- Increase in the rate of employment and income generation activities

- Rising rates of interests

- Inflation

- Investment and the marginal efficiency of capital improves

- Impressive business optimism

- Substantial expansion in credit pool offered by banks and other financial institutions.

Recession phase

This phase marks the point at which the peak turns to trough. In other words, the economy begins to shrink. Slow down in economic activities is experienced during this economic phase. Investors tend to give up future investments, and overproduction immediately, the demand level begins to drop.

This phase is also marked by a drop in profits, prices, employment, income, and the overall volume of production. An economy experiences a negative response from the business community, owing to pessimism and low confidence. The level of credit also falls because both individuals and financial institutions rush to secure more liquidity in their investment portfolios.

Tough (Depression) phase

Depression usually sets in when people begin to experience a low standard of living owing to persistent fall in the margin of profits, prices, employment, income, and output of production. This phase is characterized by:

- A substantial drop in trade and output of production

- The rise in unemployment and a decline in revenue

- A drop in interest rates

- A decline in the marginal efficiency of capital

- Overall business pessimism

- Bank credit contracts

- Deflation

- A drop in investment

Recovery Phase

This is a phase at which an economy begins to revive itself from depression. Hence, it is the turning point from the trough phase to expansion. This phase is marked by a gradual rise in the number of economic activities. Investment portfolios tend to increase owing to improved production of goods and services coupled with a rise in demand. Also, profits, prices, employment, income, and output begin to experience a steady rise.

There is a positive response from the market owing to the increased confidence level to invest. Once investments have been stimulated, the economy which was once depressed begins to recover. This phase also warms up credit expansion from banks and other financial institutions. Activation of the stock markets is also evident during the recovery phase of the business cycle. The recovery phase eventually transforms into the peak or prosperity phase, and the cycle begins to repeat itself.

Trend lines

During a given business cycle, the economy’s output performance can be traced using trend lines. The latter is used to relate one business cycle phase to another, such as one prosperity to another one depression phase to another depression phase. When economic growth is in the offing, trend lines that slope upwards are used. Hence, as the trend lines get steeper, it signifies a rise or improvement in the growth of an economy. At a time when the growth of an economy is negligible, horizontal trend lines can be seen.

Macroeconomic Policy Challenges and Tools

There are several challenges faced by macroeconomics in the modern economy. It is crucial to mention that these challenges are policy-based.

Hence, resolving the challenges demand a critical look at the prevailing economic policies. To begin with, boosting economic growth is a major challenge that most economies struggle with almost every financial year. Whereas there are both market and non-market forces that fuel economic growth at any given time, monitoring and regulation of these forces are sometimes hampered by policies on the ground.

Second, keeping inflation low is a strenuous economic task. When the prices for goods and services rise beyond the sustainable levels, it becomes quite difficult to maintain economic growth. Inflation may sometimes be fuelled by external factors that are beyond the control of a government. Other macroeconomic policy challenges include reducing local and international deficits, reducing the rate of unemployment, and stabilizing business cycles.