Market Structure

According to the information below, the Australian fruit market structure is perfect competition. Firstly, many farms in different cities in Australia have other growing conditions for the respective products and logistics. Accordingly, Queensland supermarkets will buy fruit from local farmers to optimize costs or from larger chain companies in pursuit of quality.

Secondly, the market has a reasonably wide choice, which is confirmed by the possibility of relatively cheap imports (IBISWorld, 2022). Finally, this product is not very unique, especially given the stone fruit and apple growth from 2021 to 2022, according to the State Bureau of Statistics (ABS, 2022).

As a result, fruit suppliers in this area are forced to work in conditions of low prices and relatively low margins, but with excellent sales and growth opportunities, including exports. At the same time, the barriers are relatively low, especially with possible market differentiation.

Market Analysis

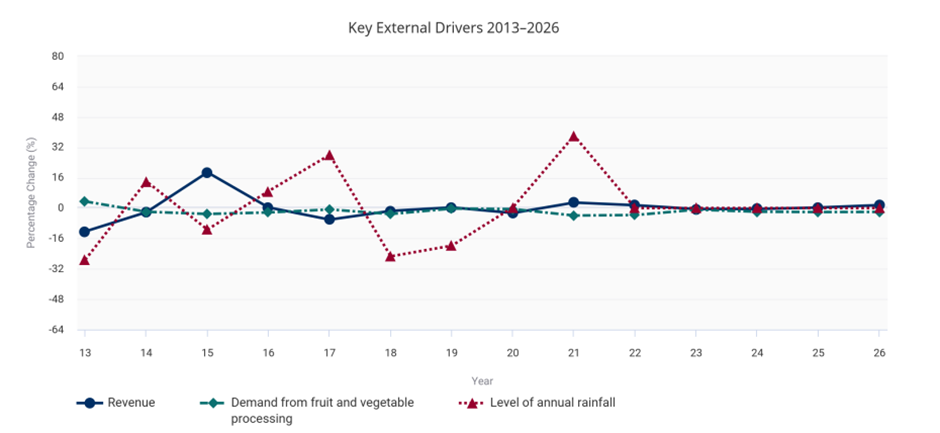

Supply and demand in this market depend on external factors, particularly the amount of precipitation and climatic conditions. In some cases, the effect is long-term (ABS, 2022). At the same time, the elasticity of demand for apples is flexible: with an increase in yield and a decrease in prices, sales increase commensurately (ABS, 2022).

The Royal Gala variety features rapid softening during long-term storage after harvest (Thewes et al., 2021). Accordingly, the elasticity of demand may depend on the price, which in turn is dictated by the time of harvesting apples: moreover, the demand will be both for more expensive, high-quality, and fresh, and for softening but cheaper ones (IBISWorld, 2022). The increasing sales of this variety confirm this fact.

Dependence on climatic indicators is supplied volatility’s first and obvious determinant over the past five years. The second determinant of supply is the availability of distribution channels: the emergence of significant new food chains in Australia promotes more choice, competition, and low prices for these products (IBISWorld, 2022).

At the same time, producers or farmers also rely on legislation and related export tariffs as potential factors in the possibility of developing their production (Robertson and Eather, 2020). Here, the determinants are macroeconomic indicators of the exchange rate or interest rates. The increase in supply and income in the future depends on the strength of the Australian dollar.

Demand for fruits can be driven by opening local or more extensive production facilities that require this product as a raw material. Juice production, confectionery, and recycling firms’ in-house developments can contribute to optimal resource consumption and industry development opportunities (de Waal, Tiwari, and McMurray, 2018). At the same time, new industries positively affect the country’s GDP and are supported by government agencies through grants and subsidies. Climate conditions are tricky to predict, but the positive dynamics of demand growth may continue in the future due to ever-increasing competition and keeping prices at the same level, despite inflation.

In this figure 1, annual rainfall has a deferred effect on the amount of fruit sold for the following year, and supply increases accordingly. Demand for products is relatively stable, so it has little effect on pricing policy.

Welfare Analysis

Firstly, state structures associated with educational functions, such as schools and universities, can place state orders for such products at the expense of government support. Loyal terms or creating economic ground in the form of more favorable taxation can make these processes more efficient for these entities and beneficial for local producers. As a result, more apples, pears, and other fruits will enter the market, and certain groups of the population will be able to include them in their diet more often.

Secondly, it is possible to create an incentive for the export of products through such economic mechanisms. Presence in the international market increases the budget, GDP, and other macroeconomic indicators that contribute to the well-being of the country’s citizens. Consequently, creating local solid brands recognized internationally will contribute to the population’s sale and consumption of healthy fruits.

Producer surplus should be addressed by export support and sustainable business development programs, while consumer surplus should be leveled by diversifying fruit varieties, which will create choice and the opportunity to increase sales – material level; as well as the health of the population through proper nutrition – an intangible level.

Further Market Analysis

An obvious external factor that significantly affects this industry is the amount of annual precipitation. This indicator may vary depending on many other determinants dictated by global climate change. The more rainfall, the better the harvest, but abnormal rainfall at the same time can be detrimental to production. Therefore, a downward-branching parabola graph can describe the factor’s influence. A dry year leads to increased consumption of water resources, while excessive rainfall requires restoration work in the gardens. A change in the number of products created can affect the market, creating a shortage or surplus, thus determining the price.

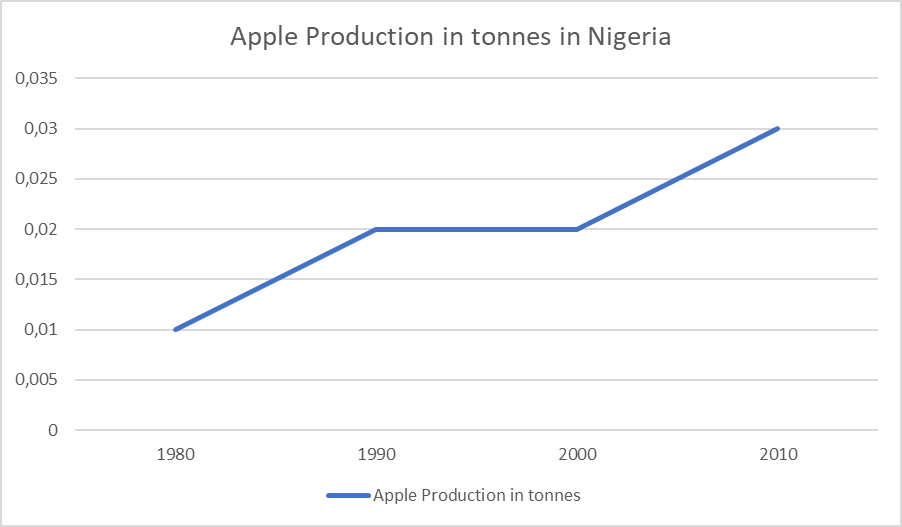

The African region is a striking example of climate inconsistency and the almost complete absence of a market. In particular, Nigeria has not produced even one tonne of apples for many years, with a total world production of about 87 tons as of 2021 (Knoema, 2021). Therefore, Figure 2 reflects a permanent stagnation due to market failure for a reason described above.

State authorities should always have mechanisms for increasing imports in certain seasons in case of an abnormal climatic situation in the country. Imports will make it possible to partially satisfy demand with a reduced supply, albeit at higher prices Figure 3 presents a hypothetical situation of falling growth and a potential demand return due to this season’s imports. Without seasonal factors, market equilibrium is at points in Q1 and Q4.

Reference List

ABS (2022) ‘Agricultural Commodities, Australia’. Web.

de Waal, G., Tiwari, R., and McMurray, A. (2018) ‘Resource-constrained innovation: A viable strategy for firms in the Australian food processing industry’ in Governance and Sustainability Conference, Melbourne, Australia.

IBISWorld (2022) ‘Apple, Pear and Stone Fruit Growing in Australia – Market Research Report’. Web.

Knoema (2021) ‘Nigeria Apples production, 1960-2020’. Web.

Robertson, A., and Eather, J. (2020) ‘Market access improvements: A case study of stone fruit exports to China’, Agricultural Commodities, 10(1), pp. 60-67. Web.

Thewes, F. R., et al. (2021) ‘Static dynamic controlled atmosphere: Impacts of aerobic and anaerobic metabolism on physiological disorders and overall quality of ‘Royal Gala’ apples’, LWT, 141, p. 110922. Web.