A salary matrix, also known as the salary schedule, is a standardized table reflecting the level of pay and compensation progression within an organization. It serves the general purpose of transparency, making the salary policy of an organization known to the public. In addition, employee candidates see an objective picture in terms of the projected income that may be able to receive as they enhance their competencies and meet the criteria for subsequent levels. This way, clearer prospects of personal earnings serve as an additional incentive for the people who consider engaging in the affairs of a specific organization. This idea is particularly important for the governmental and non-profit entities. In fact, in the minds of many people, they are associated with poorer income opportunities, as compared to the private sector and its businesses. Therefore, the analysis of salary matrix of major governmental and non-profit organizations will provide insight into the actual state of the situation.

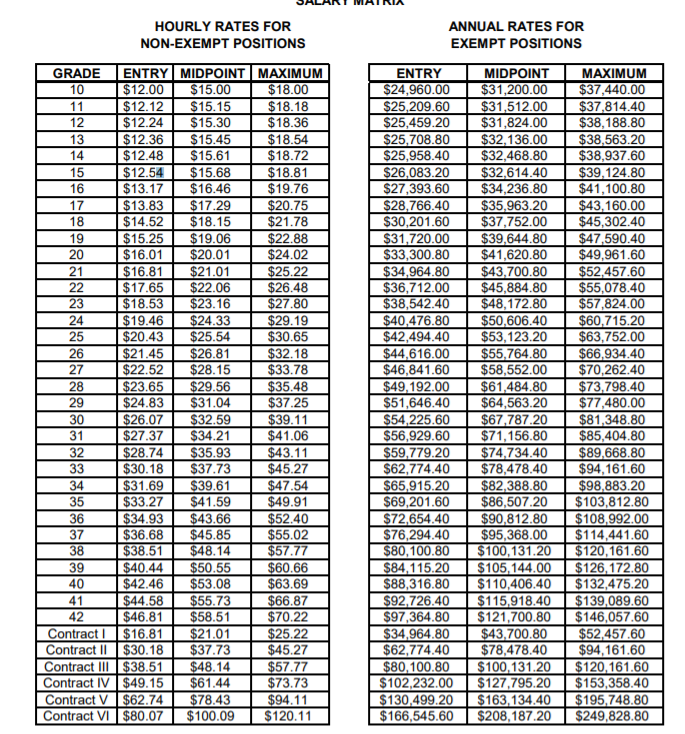

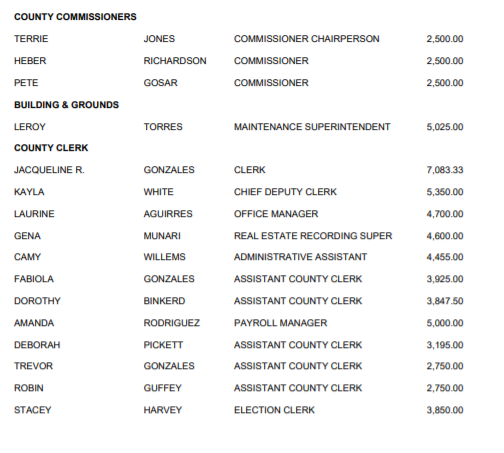

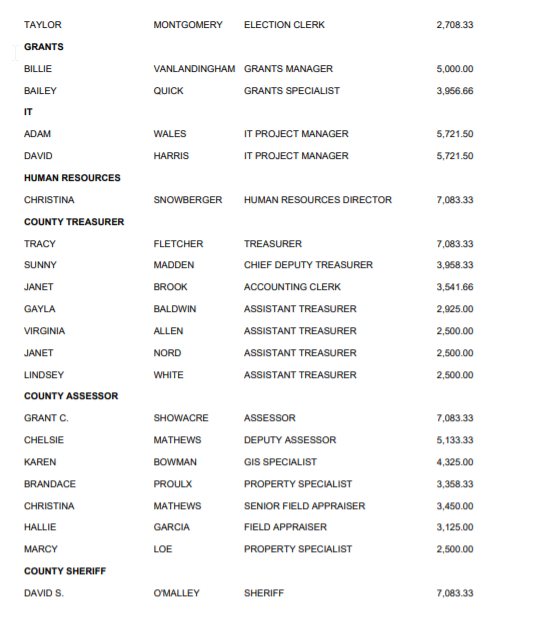

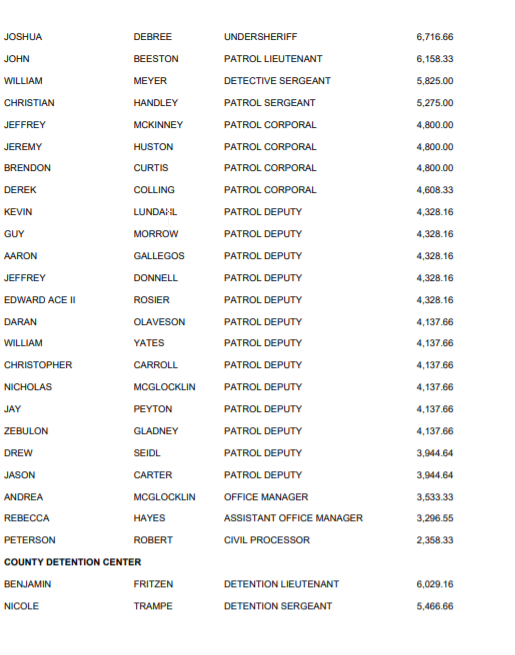

The first entity under review represents one of the local governments within the state of New York. More specifically, Appendix A introduces the salary matrix of the Columbia Country government. This particular document comprises two separate tables for non-exempt and exempt positions. For the former, the income progression is presented in terms of hourly rates, reflecting the entry, midpoint, and maximum earning per grade. A similar format is applied to the exempt positions, but, in this case, annual rates are presented. The lowest entry point is below $25,000, which is not much, but the progression clearly shows a path to earning over $100,000 per year, working for the Columbia Country government. Another entity of the local government does not follow the pattern of a salary matrix. Instead, Albany County presents a comprehensive list of wages and salaries per specific positions, including the names of the people who currently occupy them, if any (Appendix B). Such a format is also viable, as it adds a personalized dimension to the information and serves an element of checks and balances. Governmental employees have their salaries divulged, which contributes to the sense of responsibility.

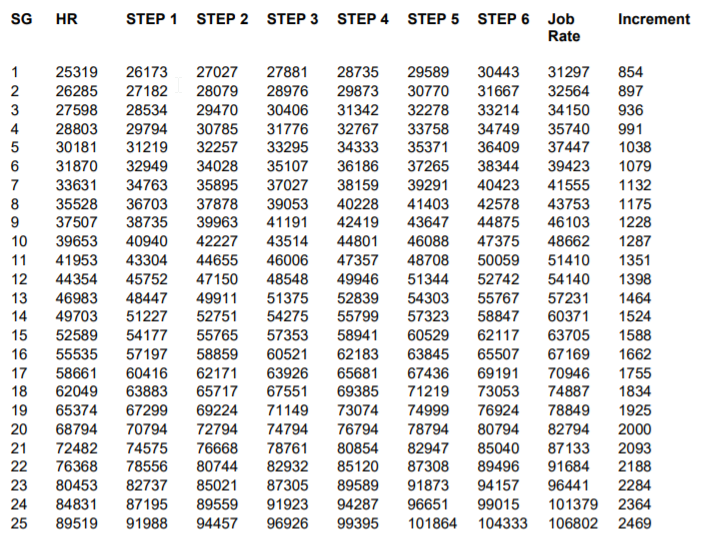

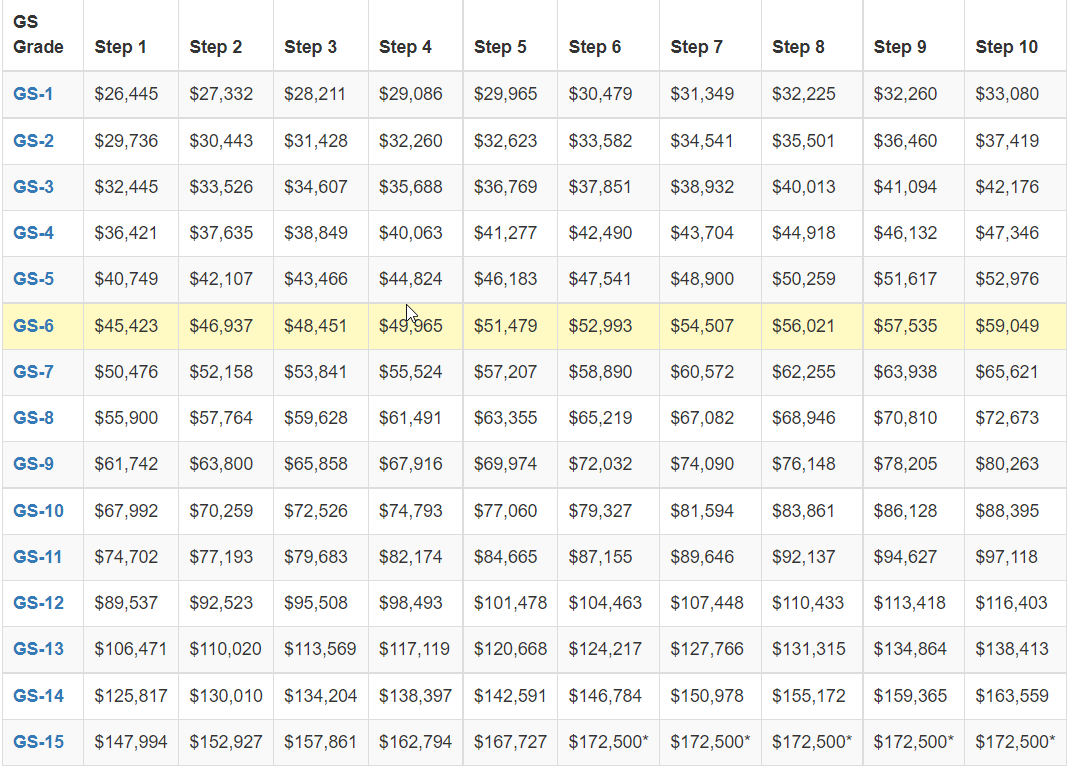

The salary situation on a statewide level equally deserves additional exploration. The first entity of the state government in New York is the Civil Service Employees Association (CSEA). This organization represents the labor union of the state government’s employees. Thus, it aims to protect their rights and ensure better work conditions. The nature of its mission is highly demanding in terms of the integrity of the organization, making it highly interesting to examine its compensation rates. The CSEA presents this information in the form of a salary matrix available in Appendix C. The data shows that entry-level compensations at the state level are often lower than the figures shown by local authorities. At the same time, the figures provided by the New York General Schedule Payscale for the year 2021 are generally higher. As such, the minimal entry compensation amounts to $26,445 with the higher end of the scale being over $170,000 (Appendix D). In addition, the locality pay adjustments are applied on the statewide level, providing better opportunities for dedicated workers.

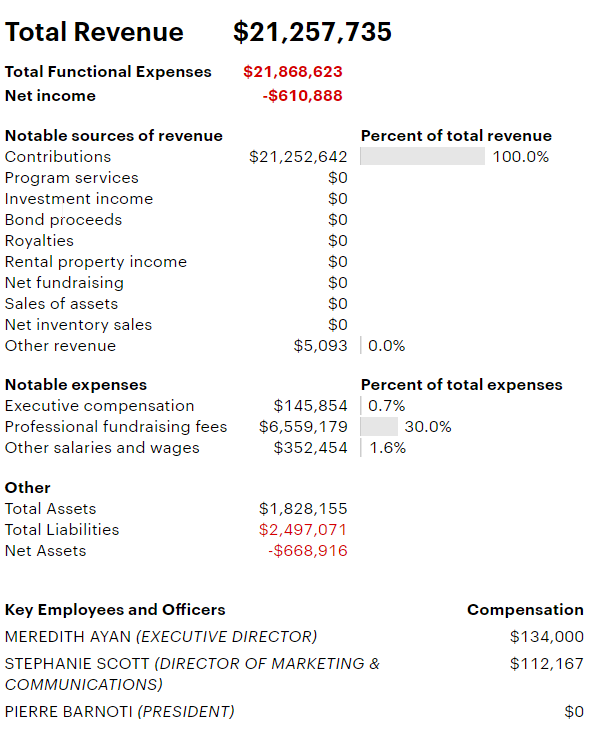

Finally, another point of interest is represented by non-profit organizations operating within the state of New York. Based on the examination of range of such entities, it has become evident that most of them do not rely on standardized salary schedules. This tendency may be conditioned by the nature of the organizations, in which few employees are paid directly, while most operations rely on donations and volunteering. Therefore, most non-profit organizations limit their salary reports to general financial statements, in which the income of the few full-time members are indicated. Appendix E exhibits the case of SPCA International, a non-profit animal rescue charity that reports the annual incomes of its executive director and director of marketing and communications. Another case is presented in Appendix F, which includes the average salaries of Environmental Defense Fund’s employees categorized per position. Thus, the format of salary matrix is widely implemented in federal, state, and local governments, which show insignificant differences in income progression. However, non-profit organizations rely on a different approach, which is justified by the particular nature of their work.

References

Payscale. (2021). Average salary for Environmental Defense Fund employees. Web.

Federal Pay. General Schedule (GS) payscale in New York for 2021. Web.

Columbia County. (2019). Columbia county government salary matrix. Web.

Pro Publica. (2020). SPAC International, Inc. Web.

CSEA. (2020). Salary Schedule. Web.

Albany County. (2019). Albany County, Wyoming. Web.

Appendix A

Appendix B

Appendix C

Appendix D

Appendix E

Appendix F