The global financial crisis hit the UAE economy when it was enjoying above average growth rate. The market in the UAE was in boom due to the easy and cheap accessibility of capital that resulted in high degree of lending and borrowing and high level of investment and consumption. Commodity prices, such as that of crude oil were high, leading to increased level of capital accumulation. This boom time in UAE coincided with the US sub-prime recession that began in 2005.

The financial market was crippled completely when in 2008 Lehman Brothers filed for bankruptcy. 2008 marked a turbulent year for the Arab countries, even though they began the year with high oil prices, buoyant real estate sector, and thriving banking sector (Ravichandran & Maloain, 2010). The only problem that was imminent during the period was increasing inflation due to the depreciation of the US dollars. Therefore the banks that earlier had easy access to international market, were now grappling for finances.

This crisis has led to dramatic changes in the growth process of the Arab world and GCC countries (Brach & Loewe, 2010; Ravichandran & Maloain, 2010). Therefore, the pertinent question that arises is that the degree to which the global financial crisis has affected the economy of UAE, especially its business sector, and the effect it will continue to have on businesses. The aim of the paper is to discuss the global financial crisis and the impact it had on the UAE economy and businesses.

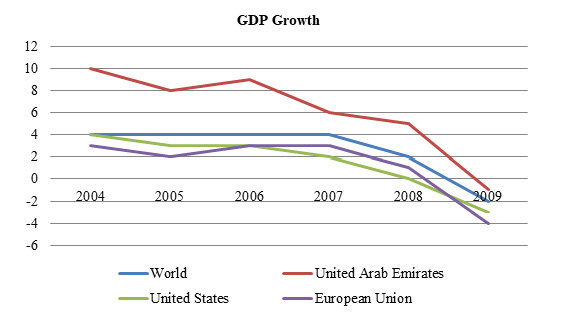

The economy of UAE was in boom until 2008, with positive conditions in its financial market, investments, capital accumulation, and growth. The economic growth of UAE when compared with other regions like European Union, the world economy, and the US economy from 2004 through 2009 (see figure 1), it can be observed the UAE economy had a higher growth rate than the other regions through 2004 to 2009.

However, the growth rate followed a similar pattern of declining growth rate since 2006. UAE has been one of the fastest growing economies of the world and its GDP had crossed $270 billion mark, even when the construction industry has been in recession but the growth rate of the economy fell to -0.7 percent in 2009 (World Bank, 2010).

The economy had a very high growth rate, and the per capita income of the country since 2005 had been higher than European Union countries. The service sector of the economy has been the highest contributor to the GDO with its share at 44 percent in 2009 (World Bank, 2010).

The economy was doing very well until the real estate industry showed signs of downfall in mid 2008. The boom market had created excess supply of realty. However, property prices crashed by 15 to 25 percent in 2008 (Hartley, 2009) and fell further by 43 percent in 2009 (Global Property Guide, 2010). This resulted in further crash of the business with profit margin shrinking, and sales declining. The financial market crumbled with the share market crashing (Ravichandran & Maloain, 2010).

The question that arose according to many is that the financial crisis that arose in UAE was due to the “mistakes in decisions taken prior to the crisis rather than the global financial crisis itself.” (Brach & Loewe, 2010, p. 46) Was the crisis in the UAE really related to the problem associated with the mistakes in financial decision making prior to the setting of the global recession? This question requires further deliberations.

With the UAE financial market tumbling down, the Central Bank of UAE and the government of Abu Dhabi came to the rescue with a bailout of $10 billion to the state run enterprise, Dubai World that had found it stuck in the crisis. 41 percent of the bailout was meant to take care of the debt obligations of the company related to Islamic bonds (sukuk) of the property related sect of the company. Therefore, the bailout was an imminent measure in order to help the UAE economy hold its position.

Though Dubai World had abruptly asked its creditors to repay back their loans, it had created uncertainty among the UAE financial market, and had crashed the stock market. However, the government bailout helped in stabilizing the financial market anxiety both in UAE and globally. The reason for the global shock to the fall of Dubai World was due to the heavy investment of western companies in UAE businesses. Therefore, a recession in the UAE market would affect their already depleting bottom line.

Many believe that Islamic bonds were the main reason for the UAE recession and not consider it as an after effect of the global recession. Actually, the reason for such an apparent belief is probably due to the bond’s central presence in the negotiations for the bail out.

Therefore, many started believing it was the Islamic bonds that were the root cause of the recession. However, sukuk was not the main reason for the recession in the UAE. Therefore were other factors that helped in the recession to set in. in the following paragraphs, these reasons are discussed.

The first effect that UAE faced may be characterized as the wealth effect of the global recession. In this case the state and the private business players lost a lot of their accumulated savings as they had heavily invested in the industrialized western world where they lost their wealth as the recession hit the western world.

In case of UAE, it is believed that the country’s “sovereign funds were by far the largest worldwide with a total sum that was more almost 400 percent of the country’s GDP” and it is believed that 30 percent of these accumulated savings of were lost during the global recession (Brach & Loewe, 2010, p. 49).

UAE had its sovereign funds savings invested in emerging market stocks and bonds that crashed with the global recession, in which they too faced heavy losses. Therefore, the main problem of the UAE financial crisis was that the accumulated savings of the country was not invested in the domestic production, but rather was diverted in western countries that were worst affected due to the recent global recession.

The financial affect that was faced by the country was related to the stock market of UAE. On an average the stock market indices of the UAE crashed by 50 percent from middle of 2008 through early 2009. This caused a loss of around 40 percent of GDP during the crisis in UAE. UAE was hit the worst, as it was a major oil producing country. The reason for the effect was the direct exposure of the country to the western economy.

Further, the country was facing a high level of inflation, much higher than the western world, with price for consumer goods and necessities rising. Other research has shown that the global financial crisis has made the economy of UAE for vulnerable to external shocks thus, the global financial market affected the domestic market by crashing the stock market in 2008 (Ravichandran & Maloain, 2010).

Further, UAE had many help of external financial support that made it more vulnerable to the financial crisis. For instance, many foreign companies invested in development projects in Dubai and therefore the bond market in the whole Arab world was affected due to the west dependent development investments.

Further the increased dependency of the UAE on its oild exports also affected it during the financial crisis. The growth of the UAE economy has been due to the steady increase in the oil prices, however, once the recession hit, the oil prices underwent a correction, and this resulted in decline of the prices by almost 60 percent:

The decline of oil prices was no good news for the UAE, for the oil sector accounted for about 35.9 percent of the country’s GDP in 2007. Local newspaper Gulf News estimated in July that the oil revenue of Abu Dhabi whose production accounts for nearly 94 percent of the UAE’s crude oil output, would reach 100 billion dollars if the price remained on high level. But the figure seems impossible now. (Jian, 2008)

Further there was a bust in the property market, with the property prices declining sharply. However, the boom in the property market reversed as the property prices fell by almost 40 to 50 percent of their previous rent in UAE (Brach & Loewe, 2010). The property prices in UAE dropped by 25 percent in 2008 and further by 43 percent in 2009 (Global Property Guide, 2010).

The main reason for the crash in the property prices in UAE has been a rise in foreign buyers of property in Dubai that had led to the drastic increase in property prices in the country. However, with the recession, foreign investors in the property market vanished, leading to a high price, and no buyers, therefore, crashing the market miserably.

Further, there was a rise of short-term speculative buying of property and it crashed as the property market went bust. This led to a recession of the construction industry as “half of all the construction projects in the UAE, worth … US$582 billion … have been … cancelled in response to falling demand and deteriorating market conditions” (Global Property Guide, 2010).

However, certain domestic problem in case of UAE cannot be overlooked. The Dubai World and its fall due to the increased debt in form of Islamic bonds is supposed to be one of the major reasons for the crisis in UAE.

With the vision of making Dubai the hub of tourism for the region, there were grand plans for the city that were thwarted due to the drying up of the foreign investments in development projects of the city. Therefore, with the stagnation in property prices in Dubai, the investors became suspicion, and with the global recession, the property market declined heavily, leading to the financial crisis in UAE.

The financial crisis in the UAE was caused due to two fold reasons – global financial crisis and the internal development plans that heavily dependent on foreign investment.

This made the development project, and thereby the economy vulnerable to external shocks. Thus, with the global financial crisis, there was an instant affect on the stock and real estate market in UAE, and thereby hampering development of the businesses in the economy. However, presently, the economy is slowly recovering from the crisis, and is expected to regain its past galore.

References

Brach, J., & Loewe, M. (2010). The global financial crisis and the Arab world: Impact, reactions, and consequences. Mediteranean Policies, 15(1) , 45-71.

Global Property Guide. (2010). UAE house prices go up, but more price falls forecast. Web.

Hartley, J. (2009). Abu Dhabi property prices fall by up to 25%. Web.

Jian, P. (2008). Global financial crisis takes toll on UAE. Web.

Ravichandran, K., & Maloain, A. M. (2010). The Global Financial Crisis and Stock Market Linkages: Further Evidence on GCC Market. Journal of Money, Investment and Banking, 16 , 46-56.

World Bank. (2010). World Bank Databank. Web.