Introduction

It is the government’s dream for every US citizen to own a home. This will see taking pride in property ownership and thus much engagement with the community around. The problem with the United States of America is that homes are expensive to own and thus most of the American citizens rely on taking loans when buying houses.

In the year 2000 the mortgages rates were at a record low and this allowed many people borrow loans at low monthly rates; at the same time the home prices rose dramatically and this acted as an incentive to many financial institutions allowing people to borrow loans and then use their mortgages as collateral. The rising home prices gave home owners the much needed equities and thus most home owners took second mortgages in the believe that the ever rising prices of their homes could refinance for their mortgages.

While some people used their money wisely others resorted to using the money to maintain their standards of living and thus when the crisis erupted they were among the worst hit. During this process most of the banks and other financial institutions failed to notice that though the home prices were increasing, individual incomes were not and thus resettling the debts could always be through borrowing and this was risky (Prichard 6).

In the year 2005 the worst began to happen, house prices stated declining and the cases of default rose to over 30% from a previous record of 6%. This crisis spilled over to other sectors of the economy and this provoked a public outcry and decisive measures had to be taken. Sometimes one feels like sympathizing with the people who are lost and continue to lose their assets but may be the mortgage crisis was after all the natural process of weeding out the fiscally irresponsible as Charles Darwin would say in his creation theory.

What Triggered the Mortgage Crisis?

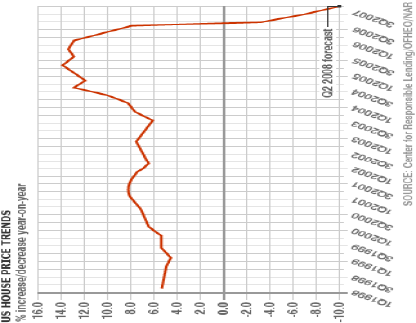

The housing bubble began to burst in 2005 and as shown in the graph below house prices can be said to have been increasing. In the year 2006, the home prices however started to decline and by the end of year 2007 the rates had declined up to negative levels, those who had borrowed loans with their houses as collaterals could no longer afford and thus stopped paying for the mortgages monthly payments and the rates on mortgages kept going higher and higher. The homeowners could no longer afford paying for their mortgages and the choices that remained were few.

They could either renegotiate with the financial institutions which had led them the mortgages or just wait for the foreclosures and while many others tried to reduce their spending to increase the income there was nothing much left that they could do to save themselves and thus they subdued. The banks were also faced with a major challenge in recovering their money after foreclosure. With the house prices having declined to such negative rates (as shown below) there was no way the banks could recover their money fully.

Another issue which took the crisis further was that the companies that had been issuing the mortgage sub prime loans had invested their money in hedge funds which after becoming worthless forced many to file for bankruptcy this resulted in further enormous losses in the economy. The Americans had done one big mistake they were spending more than they could earn trusting that their mortgages could help them repay and when the worst happened they had themselves to blame, (Tricia, pg 1).

The graph below shows the rate of price increases from 1998-2007:

How Did The Crisis Develop?

The rates of defaulting rose; banks and investors could not recover their money and thus in their bid to reduce more exposure they resulted in tightening their lending because they were not sure they would get paid back.

One of the main factors that could have helped the crisis grow even bigger was the issue that due to the increased liquidity in the market, the banks never considered that though the house prices went up, the individuals income was not thus despite all the incentives that people could afford those high prices in case of change in the prevailing market environment. Most people would be unable to settle their leverages and thus the problem could arise.

The unexpected then happened when the market environment changed and the prices of their houses fell. Many people could not afford to pay and thus they defaulted on their very first mortgage payment.

The number of houses in the market increased due to the defaults. This led to an oversupply of the houses in the market and the lack of home buyers forced the law of demand and supply to come into play; when the supply is high and the demand is low in order for a market equilibrium to be reached the price falls and those the house prices fell even further leading to more foreclosures.

This is what happened in the year 2006 and 2007 while the houses to be bought were many no one was willing to buy. A wave of panic swept through out Wall Street and even to the mortgage companies nobody wanted to engage in the risky mortgage business

Did the Crisis have to occur?

Whenever there is an economic crisis in the United States somebody has to be blamed! some people argue that the crisis could have been stopped had the mortgage brokers been regulated or controlled on using too much leverage others argue that the government with all the mechanisms it has in place after discovering the likelihood of a crisis they could have controlled the market or they could still have bought the bad loans (bail out) preventing the adverse and spread of the mortgage crisis.

No matter what one thinks, no one would have supported the regulation and I don’t think also the interference could have prevented the creation of new products.

It seemed good and profitable to many though no one thought of the impacts (Amadeo 5). The American citizens can as well bear the blame for their own predicaments this is due to the reason that mortgages are ”no alternative” loans. Thus, for a home owner with a mortgage that exceeds the value of his house can be encouraged to default even if monthly contributions are affordable to him (Feldstein 3).

Impacts of the Mortgage Crisis

The impacts of the mortgage crisis were well spread across the American economy from the investors to those who had mutual funds backed by mortgages.

The increased number of foreclosures has left most of the Americans very poor and with the more black Americans being affected by the closures evidence state that some of them have been left poor than they were during the struggle of equal rights in the 1960s. America has also experienced increased number of loan defaults and bankruptcies which has brought an emergence of concerns about the risks involved in financial markets in the recent days.

An increased demand for liquidity from the companies caught up in the issue has forced the government of the united states to provide sizeable amounts of money bailing them out thus bringing out the question whether America is a real capitalist or could turn socialistic if it meant saving its economy.

The mortgage crisis has also resulted in many investors fleeing towards the less risky securities especially after the federal bond rates dropped (US mortgage crisis 2). Financial institutions have also enacted several borrowing guidelines that previously were in place but during the housing boom were overlooked. Not a while a go, attaining a (home) loan or even an auto loan was the easiest thing to do in the United States of America.

However, the currently issued loans have always been at a higher risk of default from the borrower; this has made banks to be extra careful while lending out and thus is has become very hard for an individual to acquire such loans if his credit worthiness is doubtful. The reduced lending frequency has affected profitability in banks thus reduced revenue.

Not only did the mortgage crisis affect the grown up in the US but the kids were not spared either. After the closure of their homes, these children had to move with their parents and thus their learning process was affected by this since it always takes sometime before one can settle in a new environment. As the authority tries to solve the economic problems, efforts should also be put in ensuring the education of all American children is not affected (Lovell & Isaacs 2).

Outside the US the crisis is said to have spread to other parts of the world with a European report showing the costs of homes dipped as a result of the tense atmosphere created. Many claims that the impact of the crisis may be felt through out the world though not at the same magnitude as was felt in the US with cases of sluggish growth as the unemployment rates continue to rise.

What the Government is doing

The federal and state mortgage regulators have been reviewing the rules under which the new Subprime mortgages can be issued and also they are negotiating how previously issued mortgages can be defaulted or be repaid. The office of the president has directed the Federal Housing Administration to expand its insurance to mortgages in order to improve the credit worthiness and the borrowers to secure adequate loans.

On the other hand, financial institutions have increased their exposure to mortgage assets in efforts to bring some life to the housing market. The supposition is that the defaults result from short-term failures of the markets and that the government involvement was much needed to check the market breakdowns. Since the mortgage crisis affected both the lower income families who used to rent houses as well as the families who owned homes.

The House of Representatives passed an act which promised to create an estimated 15 million affordable housing to Americans over the next 10 years particularly targeting the low income renters. If passed the senate and combined with controlled mortgage lending history chances of history repeating itself will be hard (Lovell & Isaacs 2).

Conclusion and Recommendations

While in the past mortgages were held by banks, whose real intent was to ensure the borrowed funds were recovered in the ensuing period, the mortgages were sold and resold.

Others pooled them together into securities and this made it difficult to know who the mortgage owner was and thus the losses made by the Americans could be more than even the estimated statistics were spread across many American citizens (Sub prime Mortgage 4). To reduce cases of defaults, the rising unemployment among the Americans could have been checked.

Solutions to the mortgage crisis would have been to let every bank that got itself into the crisis struggle and try to recover, then the authorities could have allowed every American with a mortgage be absolved allowing them to own their homes and then the money used to bail the banks out should have been used in enacting and implementing new financial policies and start up new capital for banks in order to prevent these crisis from reoccurring. While interference with the market structures is not advisable the measures which the US government has taken can be applauded and hope there won’t be a repeat of another crisis.

Works Cited

Amadeo, Kimberly. Could the Mortgage Crisis and Bank Bailout Have Been Prevented? Web.

Corcino, Christian. The U.S. Subprime Mortgage Crisis & its Impact in Latin America. 2008. Web.

Feldstein, Martin. How to Stop the Mortgage Crisis? 2008. Web.

Lovell, Phillip and Isaacs Julia. The Impact of Mortgage Crisis on Children First Focus. 2008. Web.

Prichard, Justin. Mortgage Crisis Overview: What Caused the Mortgage Crisis? Web.

Sub prime Mortgage. The Subprime Mortgage Crisis Explained. Web.

Tricia, Ellis-Christensen. Edited by O. Wallace. What caused the Subprime mortgage crisis? Web.

US mortgage crisis. Impacts of the US mortgage crisis. 2007. Web.