The internet revolution is changing many facets of human existence. It is one of the key enablers of globalization. The last decade saw the rise of eCommerce as an alternative to traditional brick-and-mortar businesses. The internet brought many advantages such as online marketing, online ordering and online tracking of cargo. These developments led to an increase in the demand for online payment solutions. In response, companies such as PayPal, and eBay came into being.

The emergence of digital currencies is an extension of this phenomenon. The situation now is that vendors must support multiple payment platforms to participate effectively in eCommerce. As eCommerce goes into maturity, the electronic payments market will mature and one or two digital currencies will emerge as the standard for online transactions.

This paper examines the issues surrounding the use of Bitcoin based on this context. Bitcoin is a digital currency not supported by a specific merchant, and it is not a money transfer system. The currency has several unique features, and is controversial in some cases. This paper explores the issues surrounding the use of Bitcoins in eCommerce.

Evolution of Digital Currencies

Digital currencies are a natural offshoot of the development of eCommerce. ECommerce is riding on the internet wave that has revolutionized how people buy and sell goods. The internet has made it very easy for traders and customers to meet and transact regardless of constraints associated with distance and time. As the internet platform for eCommerce came into being, the need for a money transfer system became arose.

The history of the development of money can shed some light on the current state of development of digital currencies. Gold or some other form of valuable substances served as the measure of value before the development of paper and coin currencies. As time went on, it was not desirable to carry gold from place to place because of the obvious security risks. Therefore, traders opted to keep their gold in a bank reserve, and to use a note as a means of exchanging the gold.

These notes are what evolved into the paper currency used all over the world today. In theory, all the paper money in circulation should be backed by gold. However, over time the notes became a measure of value. No one went to the bank to check whether the notes he held were backed by gold reserves. This made the gold standard redundant.

When it comes to eCommerce, the first generation of digital currencies was cash transfer systems. These systems are what EBay, Amazon, and PayPal, among others use today. At one end, people use real currency to load their online account. These people then send the money to the intended recipients in any country in the world using the internet. The receivers on the other end go to a bank or a cash vendor and withdraw the money for use.

However, once the money is online, it can be used for online transactions. Theoretically speaking, some of the money uploaded into the online cash transfer system will never leave the internet. Some of the value will remain online as long as the system exists. Money held by PayPal is backed by real money in the bank.

People have confidence in digital currency. This means that it is only a matter of time before real money becomes irrelevant when it comes to online transactions. They will no longer bother to check whether there is any real money backing the online balance. This illustrates how digital currencies have come into existence and how they will evolve.

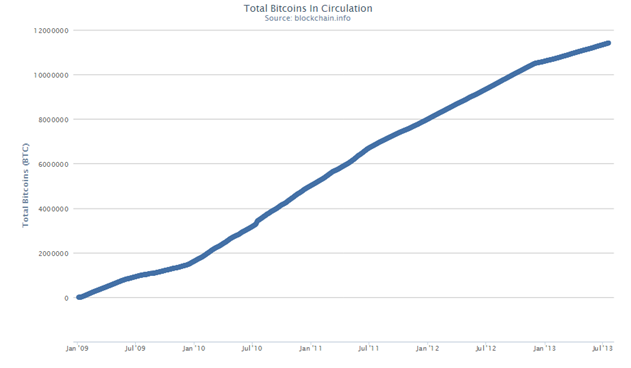

Bitcoin came into being in 2009. The currency was created by an anonymous programmer (or group of programmers) known as Satoshi Nakamoto. The currency has an upper limit of twenty one million units, though it can be broken down into smaller parts of up to eight decimal places . This currently gives the Bitcoin an absolute limit of 2.1 x 1017 units. It is however possible to divide it further. The number of Bitcoins in circulation has grown steadily since its introduction in 2009, as shown in Figure 1 Below.

Major Bitcoin Players

The major players in the Bitcoin market are Bitcoin miners, merchants, and enthusiasts. A specific authority such as a central bank does not issue Bitcoin. New Bitcoins come into circulation after the miners solve complex mathematical problems using very powerful computers. Solving these puzzles unlocks new Bitcoins. Some companies spend considerable resources mining Bitcoins in order to unlock them for use. As of July 2013, the total number of Bitcoins mined was almost 11.5 million.

This means that there are still 8.5 million Bitcoins not released into circulation. Miners include companies such as Ciphermine, and private programmers with the resources and skills to solve the complex mathematical problems needed to unlock new Bitcoins.

The second category of players involved in the development of Bitcoin is online merchants. The number of merchants that accept Bitcoins is on the increase. There is an increasing demand from consumers for merchants to allow them to pay for services using Bitcoins. Currently, the list includes online casinos, mining companies, and internet services companies, among others.

An increase in the number of merchants that accept Bitcoins will increase the stability of the currency and it will reduce the impact of losses, and fluctuation in exchange rates. This means that merchants play a vital role in the development of Bitcoins by accepting Bitcoin payments.

The third category of players in the Bitcoin economy is enthusiasts. Many people are very worried about the amount of personal information that they give to websites such as PayPal when they carry out online transactions. Most services leave a trail that anyone can follow. The Bitcoin does not expose its users to this risk. Its popularity comes from the anonymity associated with it. Just like cash, there is no trail left when someone uses Bitcoins.

Therefore, Bitcoins promise anonymous online transactions. The other group of enthusiasts is the Bitcoin miners. These people unlock new Bitcoins and make them available for circulation. The miners therefore play a vital role in ensuring that there is enough money in circulation.

Apart from these three groups of key stakeholders, Bitcoin exchanges are also becoming important in the development of the Bitcoin economy. Bitcoin exchanges provide currency exchange services for Bitcoin users. Therefore, users can exchange their Bitcoins for other currencies when they need the hard currency for other purposes.

Economic and Mathematical Valuation of Digital Currencies

The basic laws of supply and demand determine the value of the Bitcoin, just like all other currencies. The value of the Bitcoin rises and falls in relation to other currencies, based on the forces of supply and demand. The Bitcoin mining process is responsible for bringing more Bitcoins into circulation. The pace of introduction of new Bitcoins is controlled by the complexity of problems that miners must solve.

The complexity of these problems doubles every four years. This means that the resources needed to unlock a Bitcoin double every four years. This will ensure that increasing computing power based on Moore’s Law will not increase the pace of the introduction of new Bitcoins to the open market.

The second factor that influences the financial valuation of the Bitcoin is the controlled supply of the currency. Everyone involved in the Bitcoin economy understands that there will be no upsurge in the supply of the currency. Therefore, the system implemented to control the rate of supply of new Bitcoins assures all players that the currency will not suffer from inflationary pressure. Its rate of growth is timed to match the increase in demand for the Bitcoin.

Thirdly, the Bitcoin uses a deflationary economic model to retain value. Bitcoins are held in electronic wallets found in the computers of the users. These wallets are vulnerable to loss in case something happens to the computer. Such occurrences will lead to the loss of Bitcoins.

When a Bitcoin is lost, the deflationary economic model anticipates that the remaining Bitcoins will increase in value to compensate for the lost coin. The number of coins needed to purchase the same product or service will reduce. Therefore, lost coins will not lead to a loss of value.

Finally, the currency derives its value from user confidence. Provided all the users of the Bitcoin have confidence in the currency, it will survive any economic shock. However, any situation that may lead to mass dumping of Bitcoins is detrimental to the development of the currency.

The currency is still vulnerable to shock because it has not found wide acceptance in all industries. The number of people who are willing to receive payments made in Bitcoins is increasing. However, the number must attain critical mass for the currency to achieve long-term stability.

The Success of Digital Currencies

The best use of Bitcoins is for online transactions. The Bitcoin acts as a form of online cash because of the features it shares with cash. It is very suited for international cash transfer because it can give an intermediary measure of value that will enable traders on both ends to use their local currencies. The Bitcoin is also ideal for making payments for services rendered on the internet such as the purchase of eBooks, software, music, and products delivered in digital formats.

The currency is risky to use for product-based commerce because Bitcoin transactions are irreversible. This can complicate guarantees that customers expect when trading online. Many online companies offer money-back-guarantees as a way of gaining the confidence of their customers. Using Bitcoins to offer such guarantees will be difficult.

Bitcoins offers three main advantages to its users. The first benefit of Bitcoin is that it allows users to remain anonymous. This is a major departure from the existing online money transfer services where it is necessary to give the merchant private information that they later use for marketing purposes. The Bitcoin system does not leave a trail. This makes it impossible for anyone to find out the purchasing habits of a consumer. This feature is very attractive to internet users who have privacy concerns.

The second benefit of the currency is that it allows for international cash transfer devoid of regulation and usually with lower transaction costs. The global economy is becoming integrated with time. Many traders and governments are feeling the need for a currency that supports this growth. An increased circulation on Bitcoins will make international trade more convenient for businesses.

The third benefit is that Bitcoins increases the rate of circulation of currency. This arises from the ease of use associated with Bitcoins and the increasing acceptance of the currency by merchants. This means that the currency can increase the rate of economic activity, which is the basis for rapid economic growth. Therefore, the increased uptake of the Bitcoin can lead to an increase in the economic growth of all the countries that supports its use.

The Controversial Issues Regarding Digital Currencies

The Bitcoin is subject to two main sources of controversy. First, the currency does not have a regulator similar to a central bank. In many countries, the central bank is the only entity legally mandated to issue currency. In such jurisdictions, the Bitcoin can run into legal problems. Other issues associated with regulation include control of the monetary policy of the country. When the central banks have no role in the issuance of currency, their role in controlling inflation or deflation becomes complicated.

Another scenario is where the Bitcoin ends up generating an inordinate amount of economic activity that is difficult or impossible to document. The absence of regulation can lead to the development of a virtual economy, which governments cannot access for tax purposes.

A company can sell or pay for goods and services using Bitcoins, without leaving a paper trail that a tax official can assess. Since Bitcoins are not banked, there may be no way of knowing whether the company has more money than what it declares in its books. Therefore, the Bitcoin can be a disruptive force in modern economies because of the extreme difficulty of exerting control over the currency.

The second source of controversy in the use of the Bitcoin arises from its high level of compatibility with conventional crimes and economic crimes. The Bitcoin is an ideal way of paying for items where the buyer does not want any form of evidence that the transaction took place. For instance, the Bitcoin is ideal for making payments for the supply of illegal drugs. There is no way for law enforcement officers to follow the money trail to know who pays drug suppliers.

The system is also ideal for the payment of ransoms because no one can trace where the money goes after the payment is made. Similarly, the Bitcoin is ideal for money laundering operations. Anyone with illegally acquired cash can use the system to store the illegal money and spend it without detection. The same advantages that the Bitcoin offers to its users make it ideal for criminals because it makes it easy to collect and use the money acquired criminally.

Expected Regulations

The current approach to the regulation of currencies will play a major role in the nature of regulations that governments across the world will develop to govern the operations of the Bitcoin. However, this will not be an easy matter because Bitcoin has so far survived without government intervention.

The first question that regulators need to answer is how to control the supply of the Bitcoin. Supply and demand of currency are a major regulatory endeavor because of the role these forces play in the economic stability of nations. The Bitcoin is running on autopilot in regards to its supply to the markets. Regulators will need to develop models to simulate the impacts of the current supply plan. This will help them to determine how best to deal with the supply side of the currency.

The second concern that regulators need to address is the conduct of the Bitcoin exchanges. The financial crisis of 2009 is a good reference point in relation to the impacts of unregulated activities of money markets.

Regulators will need to find ways of regulating and possibly licensing Bitcoin exchanges. Imposing certain limits on the volumes of transactions at the exchanges will make it possible for regulators to mitigate negative impacts on the Bitcoin economy on the overall economic profile of the country.

The third main regulatory issue is how to monitor criminal activity and how to detect economic crimes committed using Bitcoin. This requires careful thought on how to unearth such crimes and how to handle the people caught using the currency to facilitate and to benefit from the crimes. The main issue in this regard would be the international nature of the Bitcoin economy, and how to handle crimes committed in different jurisdictions.

The fourth issue that regulators will need to think about is the currency conversion. This is a short-term problem because the currency is still gaining traction. As it stands, the currency is currently very volatile and it is susceptible to price fluctuations. The currency needs regulatory support to reduce the risks that users are taking. The high volatility associated with it can lead to the emergence of speculative markets, which in turn will lead to further instability of the value of Bitcoin.

The Future of Digital Currencies

All indications are that digital currencies will become part of eCommerce, and eventually may replace all other forms of currency. In fact, the correct position is that digital currencies are already an important part of eCommerce. Their impact on eCommerce is still minimal, but as soon as the merchants accepting digital currencies reach critical mass, the currencies will become a dominant force.

There is debate regarding whether Bitcoin will become the default digital currency, and opinion is divided regarding its future. Its model may eventually stand out because of the self-policing system that runs it, or it may fall out with regulators who may demand for more control over its development.

The attention that Bitcoin has received from regulators has led to the development of a rival currency called Litecoin. Litecoin seeks to address some of the regulatory challenges associated with the use of Bitcoin. In conclusion, there is no certainty about the future of Bitcoin, but there is little doubt that digital currencies are here to stay.

Works Cited

Bitcoin. How it Works. 2019. Web.

Blockchain. Total Bitcoins in Circulation. 2013. Web.

Irrera, Anna. Are Litecoins The Next Big Thing?. 2013. Web.

Nakamoto, Satoshi. “Bitcoin: A Peer-to-Peer Electronic Cash System.” 2008. Bitcoin.org. Web.

The Economist. A New Specie: Regulators Should Keep their Hands Off New Forms of Digital Money such as Bitcoin. 2013. Web.

—. How Does Bitcoin Wook. 2013. Web.

—. Mining Digital Gold. 2013. Web.

Whippman, Ruth. The Hacker Currency that’s Taking Over the Web. 2011. Web.