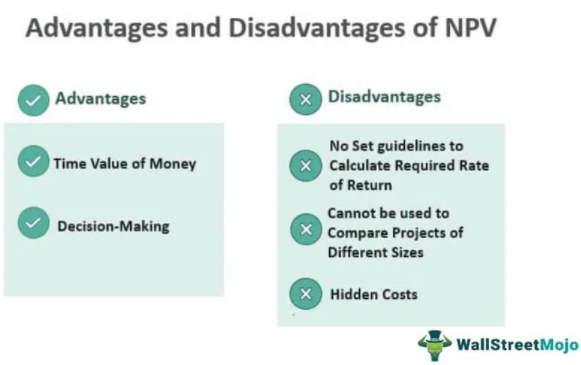

In finance, the net present value (NPV), also known as the net present worth, is one of the methods used to calculate the return on investment (ROI) for certain expenditures or projects. Compared to other ROI calculation methods, for instance, payback period, NPV possesses specific advantages. As figure 1 indicates, the method’s strong points include consideration given to the time value of money (TVM) (“Capital budgets & NPV,” n.d.). In simple terms, TVM is the idea that money possesses interest-earning potential, which explains changes in its value with time (Weber, 2021). Another essential advantage is the degree to which NPV facilitates corporate decision-making by enabling the classification of investments based on the size of their profit-making capacity. Being relatively easy to calculate, NPV is indicative of a project’s profitability if it is positive (Thakur, n.d.). Companies can implement it into their financial analysis activities by using the pre-filled NPV spreadsheets from Harvard Business Review or the NPV function in Excel (Basher & Raboy, 2018). The discussed method could simplify profitability measurement, thus supporting the right decisions in selecting investment options.

The method’s disadvantages also require consideration when selecting the optimal ROI calculation strategy for a company. In figure 1, Thakur (n.d.) mentions the lack of standardization in calculating the required rate of return as a factor limiting NPV’s applicability. Businesses are free to set this value independently, which could result in unrealistic NPV calculations (Thakur, n.d.). Next, being measured in dollar amounts rather than percent values, NPV will inevitably depend on the analyzed project’s size, limiting the opportunity for comparing larger and smaller projects (Thakur, n.d.). NPV’s accuracy in measuring profitability is another area of concern since the method ignores unforeseen expenses. Also, when evaluating investments with specific characteristics, including uncertainty and irreversibility, it is not appropriate to apply the universally accepted NPV rules, and relevant modifications are required (Basher & Raboy, 2018). These factors motivate financial professionals to decide between NPV and alternative analytical tools only after a thorough analysis.

References

Basher, S. A., & Raboy, D. G. (2018). The misuse of net present value in energy efficiency standards.Renewable and Sustainable Energy Reviews, 96, 218-225.

Capital budgets & NPV [PowerPoint slides]. (n.d.).

Thakur, M. (n.d.). Advantages and disadvantages of NPV. WallStreetMojo.

Weber, R. (2021). Embedding futurity in urban governance: Redevelopment schemes and the time value of money. Environment and Planning: Economy and Space, 53(3), 503-524.