The United States dollar has acted as the world’s reserve currency for more than sixty years. According to Carbaugh (2009, p. 519), the US dollar emerged as the world reserve currency after World War II. The United States was not adversely affected by war. In addition, the US experienced an increment in the inflow of gold and during 1930s and 1940s. The resultant effect is that the dollar became the reserve currency.

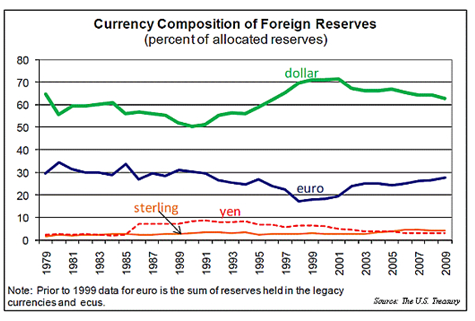

Over the past decades, the dollar has been considered to be the ‘almighty’ (Robinson, 2009, p.148). Most governments have over the years considered the US dollar to be an efficient mode of holding currency as illustrated in figure 1. One of the reasons which explain why the dollar has continued to be the world’s reserve currency relates to trade.

Today, most governments reserve the dollar in their central banks so as to purchase goods in the foreign market. The US dollar was generally accepted as the reserve currency because the US firms produced high quality goods at low cost.

As a world reserve currency, the US dollar’s role was to enhance the level of confidence in trade and investment. In addition, the US dollar has over the years been used by most countries which do not have a gold standard to back their currencies.

As a result, the dollar enhances the level of confidence in investors. In most cases, emerging economies have discretion with regard to the reserves they wish to hold. However, they have to hold a currency which instills a high level of confidence on their local currency. This explains why China has liked its Yuan on the dollar.

Secondly, the US dollar cautioned countries against balance of payment deficits. Over the past few decades, the US dollar has been relatively stable compared to other currencies. According to Epstein and Graham (1993, p.74), a reserve currency must have a relatively high and stable value.

These characteristics make the reserve currency to be an attractive asset and also instill confidence amongst investors. As a world reserve currency, the dollar ensured that countries do not experience balance of payment deficits.

From figure 1, it is evident that there was an increment in the volume of dollars accumulated by governments from 1997. One of the reasons for this relates to the occurrence of the 1997 Asian financial crisis. The crisis led to countries such as Indonesia, Thailand and South Korea experiencing balance of payment deficits. As a result, there was an increment in demand for dollars.

The first reason for the increased calls for a new reserve currency is the existence of increased global financial instability. For a period of 13 years, the US dollar was considered as the world reserve currency. However, there was a decline in the degree at which the dollar is considered as the reserve currency from 2000 onwards.

A report by Peterson Institute for International Economics (PIIE) revealed a decline in the dollar’s share with regard to foreign exchange reserve with a margin of 4.3%. By 2009, the US dollar comprised approximately 60% of the total world reserves. The euro, the yen and pound followed as accounting for less than 30% as illustrated by the graph (Chu, 2010, para. 2).

One of the reasons which explain the decline in the prominence of the dollar is the fact that the US is experiencing a budget deficit. The resultant effect is that US has increased its dependence on borrowing to finance its economic. The occurrence of the 2008/2009 global financial crisis illustrates the weakness inherent in the existing international monetary system.

Those arguing for introduction of a new reserve currency system cite the need to develop financial stability. The instability of the dollar has led to increased calls for a new international monetary system to be introduced especially by emerging economies such as China and Brazil.

According to Hill (2009, p.54), emerging economies mainly depend on the international trade in order to stimulate their economic growth and development. However, the current reserve system does not offer efficient international liquidity. The resultant effect is that most of these economies were affected by spillovers of global shocks.

The emerging economies were adversely affected by the intensity and severity of the resulting financial shock spillovers. Despite the fact that these economies had accumulated a substantial amount of foreign reserves, the shortage of the dollar was a test on the effectiveness of the financial system.

The crisis also limited these countries from accessing the international interbank markets in addition to increasing the cost of borrowing foreign currency (dollar). This culminated into a significant decline in these countries rate of economic growth.

The second main reason for calls of a new reserve system relates to the Triffin dilemma. Most of the proponents for a new reserve system argue that dependence of a currency of a dominant country as the world’s reserve currency can lead to emergence of the Triffin dilemma (Lee, 2010, p.1).

According to Reinert, Rajan, Glass and Davis (2008, p.1143), the most successful developing countries are achieving their success by borrowing financial capital from the international market. The resultant effect is that the lending country experiences a balance of payment deficit. The debt may rise to high levels.

This may culminate into a decline in the level of confidence on the value of their reserved assets. Katz and Holmes (2008, p.69), are of the opinion that decline in level of confidence means that individuals would not consider the dollar the world’s reserve currency.

On the other hand, the borrowing country continues to accumulate foreign reserves. Currently, there is no system to force the reserve-issuer or the supply country to undertake adjustments so as to fix the imbalance. In turn, this would negatively affect the fixed exchange system culminating into global economic instability (Lee, 2010, p.1).

In order to deal with these issues, the International Monetary Fund resolved to introduce a new reserve asset referred to as the Special Drawing Rights (SDRs) in 1969. The main objective was to enhance the fixed exchange regime. ActionAid (2009, p.4), defines SDR to include a form of money which the IMF can develop by crediting accounts of the members.

This is done at an exchange rate which is determined by a number of major currencies. The main currencies considered in the SDR include the US dollar, Japanese yen, the euro and the pound sterling.

SDR is determined b y calculating the average of the four major currencies using a weighted formula which is re-evaluated after 5 years to ensure relevance of the currencies (ActionAid, 2009, p.4). The aim of the SDRs is to improve international liquidity.

In November 2010, the IMF decided to review the SDR by adjusting the weights of the respective currencies on the bases f the volume of exports and amount of reserves which are denominated by the currency held by member countries (International Monetary Fund, 2011, para. 7).

According to Reinert Rajan, Glass and Davis (2008, p.1020), this new international currency system will enable countries to attain diversification in their reserve holdings. In addition, it is possible to hold SDR at a relatively low cost compared to holding major currencies.

Reference List

ActionAid. 2009. Special Drawing Rights (SDRs) and the global reserve system. Web.

Carbaugh, R., 2009. International economics. Mason, Ohio: South-Western Cengage Learning.

Chu, D., 2010. Chinese Yuan versus the US dollar : in the case of global reserve currency. Web.

Epstein, G., 1993. Creating a new world economy: forces of change and plans for action. Philadelphia: Temple University.

Hill, C., 2009. Global business today. New York: McGraw-Hill.

International Monetary Fund. 1996. Annual report. New York: International Monetary Fund.

International Monetary Fund. 2011. Poverty reduction and growth facility. Web.

Katz, J. & Holmes, F., 2008. The goldwatcher: demystifying gold investing. Hoboken, NJ: John Wiley.

Lee, J.W., 2010. Will the renminbi emerge as an international reserve currency? Web.

Reinert, K., Rajan, R., Glass, A. & Davis, L., 2008. The Princeton encyclopedia of the world economy. New York: Princeton.

Robinson, J., 2009. Bankruptcy of our nation: 12 key strategies for protecting your finances in these uncertain times. Green Forest, AR: New Leaf Press.