The UK jewellery market consists of precious jewellery made of gold, platinum, silver or other precious metals and costume jewellery. The jewellery market grew 1 percent in 2003-07 (CBI, 2008). The jewellery industry in the UK has seen a consumer spending of € 68.7 per capita in 2007, which is much higher than the EU average of € 48.3 (CBI, 2008). The jewellery industry in the UK is very attractive and demand in the market has been increasing constantly (GFMS, 27th January 2005). Only half of the jewellery demand of the country is met by domestic jewellers while the rest are imported and are branded products. Thus understanding the UK jewellery industry and the market structure which shapes the competition in the market is essential.

The UK jewellery market is highly fragmented (CBI, 2008). The industry is comprised of mostly small companies and workshops which specialise in different types of jewellery or on stages of production. Most of the production occurs abroad and is imported in the domestic market for consumption. The UK domestic industry has been segregated by the CBI into four categories viz. manufacturers, modern jewellery manufacturers, design manufacturers and international luxury brands.

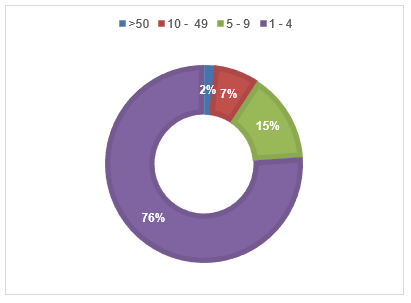

Figure 1 shows that the number of small firms with less than 5 employees comprises the maximum market, indicating that there are many small companies operating in the jewellery industry in the UK. As there are a large number of firms operating in the industry, the market can be termed as competitive in nature.

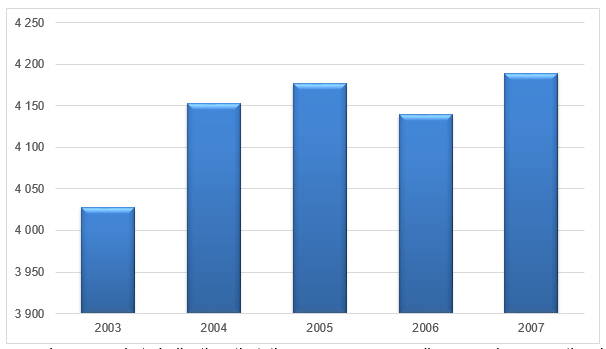

The demand for jewellery in the UK is high, with retail demand of jewellery being very high. Figure 2 shows that the demand for jewellery is high with demand being as high as 4189 in 2007. The target market for the retailers is a UK population which stood at 61 million in 2007. So the number of buyers is also large. As the number of buyers and sellers are large the market is competitive in nature. Here if we assume that the information regarding jewelleries are perfectly available to the buyers as well as sellers, the jewellery market in UK can be dubbed as perfectly competitive in nature. But perfect flow of information in the market is utopia and there are only a few large sellers who have a strong hold over the market like Abbeycrest, Alfred Terry, Kestrel, Signet, etc. but the market is competitive as there are expected to be independent 7000 retail stores in the UK.

Signet management has identified that even thought the market is fragmented there are very few large operators in the UK with number of stores exceeding 100 (Signet Group, 2008). The demand for a brand can be increased through increased brand awareness and loyalty (Penfold, 2007). Further, there is a higher demand for branded jewelry which shows that the brand element has a great effect on the market. The competition is faced through a collusion between small traders into forming a cartel like trading center wherein all the manufacturers together trade jewelry, thus reaching equilibrium in the market.

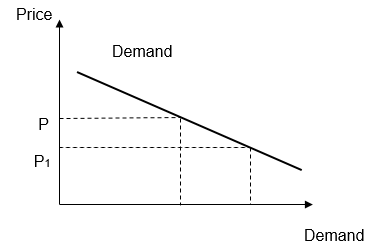

Gerald Ratner is a successful jeweller who has brought about a unique concept of selling jewellery through internet (BBC, 27 May, 2002). Online sales in the UK for jewellery have been increasing which has driven the business model to success. The main idea of Ratner was to get price advantage. Gartner through online sale could reduce the price of jewellery to a great extent where the demand of jewellery is elastic. Let us exemplify the situation. As jewellery is a luxury good, by economic theory its demand must be a highly elastic in nature which indicates a flatter demand curve for jewellery in the UK.

Figure 3 shows the demand curve for jewellery in the UK. Assuming P is the price for jewellery in the UK retail market. But Ratner through only sales has the advantage of providing a lower price which is at P1. Given the price advantage and an elastic demand, Ratner can sell a much higher quantity of jewellery as compared to other retailers. Thus, Ratner took advantage of the price elasticity of demand which states that when the demand for a good is elastic, a one unit decrease in price increases demand by more than one unit. Thus elasticity of demand has been manipulated by Ratner to increase the demand for the good with low price.

Ratner was able to reduce price as he banked on online sale. Prices can be brought down in internet sale. Further the cetirus paribus assumption of demand definition states that all thing reaming constant the demand for a good will increase by a certain quantity with reduction in price. But if technological factors change in favour of a price reduction, the demand for the good will further increase with the same amount of price reduction, thus increasing the elasticity of the good. Ratner took this advantage when he embarked on jewellery sale through the internet.

Reference

BBC, 2002. Ratner hopes to sparkle again. Web.

CBI, 2008. The Jewellery Market in the United Kingdom. CBI Market Survey. CBI Market Information Database.

GFMS, 2005. Real World Analysis of the UK Gold Jewellery Market. PRESS RELEASE. GFMS.

Penfold, G., 2007. Diversification, Design, Strategic Planning and New Product Development: A Jewellery Industry Knowledge Transfer Partnership., The Design Journal vol. 10 no. 1, p. 3-12.

Signet Group, 2008. UK operating review. Annual Report & Accounts. Signet Group plc.