The state of the economy of a country can be categorized based on a number of economic theories. The most prominent models are business cycle and aggregate expenditure. The business cycle refers to the contraction and expansion of aggregate economic activities for several years.

The phenomenon is measured through total employment, real income, and real expenditure. On the other hand, aggregate expenditures refer to the amount of domestic income. The model indicates the present value of the total commodities and services. In the article below, the present state of the US economy with respect to the business cycle and aggregate expenditure models is highlighted.

Business cycles comprise of five stages. The stages are expansion, peak, expansion, recession, and trough (U.S. Bureau of Labor Statistics 1). Massive investments and economic prosperity characterize the expansion period. On the other hand, the peak period indicates the end of the expansion period and the onset of the contraction period. During the peak period, GDPs stop rising and stagnate marking the height of the economic booms.

The end of the peak period marks the onset of the recession period. During the recession period, several economies experience reduced wages, business profits, productions, GDP growth rates, and increased unemployment rates. As such, between the year 2007 and 2009, the USA experienced an economic recession (Heinrichs 4). From the year 2009, the American economy has been under the recovery period. The period marks the final phase of the business cycle. At this stage, GDPs stop falling and stagnate.

Based on the business cycle and aggregate expenditure models, it is apparent that the present state of the country’s economy is far from fully recovering. The incomplete recovery experienced in the past few years has been uneven. As such, the recovery has favored the progress of corporate returns and stock values at the expense of job creation and wage growth (Heinrichs 4).

It should be noted that extensive inconsistencies carry on in local economic health. In early 2008, with the onset of global economic crises plunged the US economy into a state of depression (U.S. Bureau of Labor Statistics 1). To counteract its effects, economic policymakers recommended appropriate guidelines using both fiscal and monetary policies. However, these mitigation measures worsened the business cycles excesses.

Employment

Based on the National Bureau of Economic Research’s data, six years after the recession the US economy ranges from one third to half of being fully recovered (U.S. Bureau of Labor Statistics 1). According to the data, the 2007-2009 recession was the slowest ever since the occurrence of the Great Depression. During the recession, the employment dropped by 6.3% (U.S. Bureau of Labor Statistics 1). The figures were higher than the figures from 1981, 2001, and 1990 recessions.

After the recession, it was estimated that the country needed to create more than eleven million jobs. To date, 4 million jobs have been created. The above implies that 7 million more jobs are supposed to be created to return the joblessness rate to pre-recession levels (U.S. Bureau of Labor Statistics 1).

Similarly, the data indicate that less than forty percent of the employment deficit triggered by the 2007-2009 recession has been addressed. The figures indicate that the economy is creating an estimate of 199, 0000 jobs every month (U.S. Bureau of Labor Statistics 1). With this rate, it will take more than five years to return the joblessness rate to pre-recession levels in the future.

Another indicator that shows the US economy is yet to recover is the national employment rate. Before the recession, the country’s employment rate was approximated at 4.6% (U.S. Bureau of Labor Statistics 1). During the recession, the rate increased to 10%. After measures were put in place to control the recession, the unemployment rate reduced to 6.3%. The above figures suggest that approximately two-thirds of the job market downturn has decreased.

GDP, Inflation, and investment data

After the recession, the US economy has been rising sluggishly. For the first three years after the crisis, the country’s economy was estimated to have risen slowly as compared to the first three years after the Great Depression in the 1940s (Council of Economic Advisers 1). In the year 2009, the country’s GDP growth rate was -2.8%.

The following year, the rate increased to 2.5% after the recession ended. During the year 2013, the GDP growth rate was estimated at 2.4%. The estimates indicate that the growth has been slow as the economy tries to recover from the effects of the recession. Equally, the figures indicate that the US economy is yet to recover fully from the recession.

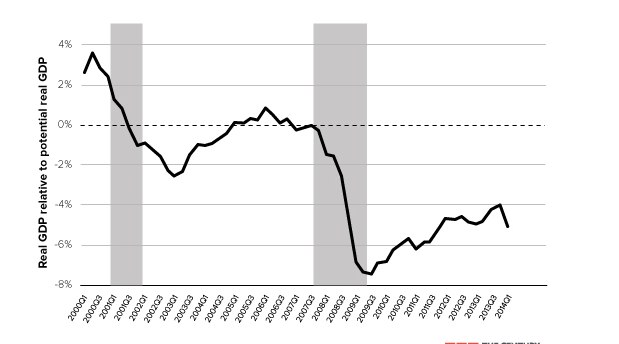

An analysis of the GDP can also indicate the current economic status of the US. During the 2007-2009 recession, the country’s GDP reduced by 4.3% despite the increase in the country’s output and population (Council of Economic Advisers 1). Currently, the country’s GDP is still 5% below its potential. The above implies that the country has not yet recovered fully from the effects of the recession. The figure below indicates the country’s economic output with respect to its output.

From the year 2009 to the year 2013, real business investment has grown rapidly compared to other past recession1940s (Council of Economic Advisers 1). During the period, investment has added 0.25% point more to the progressive rise in the proportion of ideal GDP to probable GDP as compared with the estimated cycle. Based on this, it is apparent that business investment is steadily rising.

Consumption

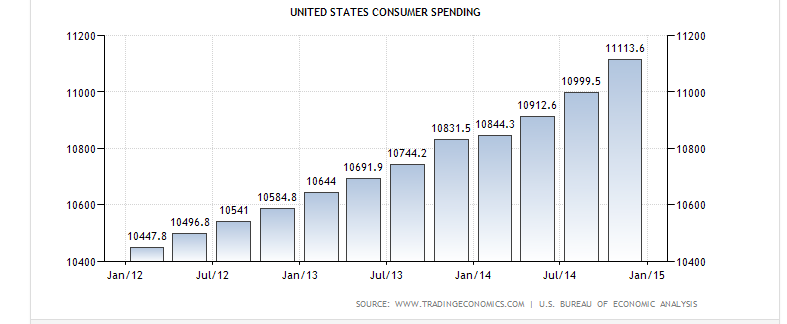

With respect to aggregate expenditures, it is apparent that the US economy is yet to recover. Faced with dwindling returns and financial uncertainty, many individuals decreased their expenditures between the years 2007 and 2009. The reduction in aggregate expenditure by American households during the period represented major inflation-adjusted fall in the last 30 years.

In the year 2010, after the recession aggregate expenditure slowly recovered (U.S. Bureau of Economic Analysis 1). By the year 2014, consumer spending had significantly increased. According to the Bureau of Economic Analysis, the spending had reached 11113.59 USD in the year 2014. The figure below illustrates the consumer spending for the last two years. From the figure, it is clear that the US economy is recovering steadily.

Recommendations

To address the damages brought about by the great recession, the Obama administration and the Federal Reserve should implement appropriate policies. In early 2008, the housing bubble’s collapse plunged the world economies into a state of depression (U.S. Bureau of Economic Analysis 1). To counteract its effects, economic policymakers recommended appropriate guidelines using both fiscal and monetary policies.

However, these mitigation measures worsened the business cycles excesses. The Federal Reserve alone cannot address the damage caused by the recession. Therefore, the organization must collaborate with the relevant policymakers and the government in coming up with appropriate measures that will ensure that the country recovers fully.

The US economy could be better if financial makers could have collaborated with other stakeholders after the recession. Instead, they formulated ill bent policies that were politically biased frustrating other strategies that were meant to revive the economy.

The Obama administration should woo the opposition to desist from being a hindrance to the endorsement of policies believed by a number of economists to be the solutions to the decelerated economic recovery. Similarly, the government should decrease its expenditure.

It should allocate more money towards the creation of more job opportunities, increase business investments, and woo investors. Through this, unemployment rates would be decreased. An increase in business investments signifies a boost in aggregate demand leading to an expansion in an economy.

Similarly, the relevant authorities can amend the country’s interest and credit rates to spur the economy. It is a fact that when interest and credit rates are lowered companies, organizations and individuals borrow more money from money lending institutions leading to the creation of more jobs (U.S. Bureau of Economic Analysis 1). On the other hand, when the interest rates are high few people have access to loans and credits leading to a reduction in the creation of jobs in an economy.

Equally, the Obama administration and the Federal Reserve should fund researches aimed at identifying the cause of past recessions. An analysis of past recessions offers an opportunity to revive economic theories in order to identify their flaws, to compare different economic paradigms, and to find the one that provides a more plausible explanation and a more credible cure.

By doing so, economic experts are expected to investigate the events that led to the current economic crises. Through their studies and researches, economists should comprehensively investigate the features and causes of the recession. By doing so, they should remain watchful to identify the developments and policies that led to the current global economic crises. Similarly, researchers should recommend acceptable pathways to economic prosperity in the future.

Conclusion

In conclusion, it should be noted that the present state of the US economy could be analyzed with the help of the business cycle and the aggregate expenditure model. Based on the business cycle and aggregate expenditure models, it is apparent that the present state of the country’s economy is far from recovering fully. The incomplete recovery experienced in the past few years has been uneven.

Other indicators that show that the US economy is yet to recover is the national employment rate, GDP, investment data, inflation rate, and consumption rates. After the recession, the US economy has been rising sluggishly. For the first three years after the crisis, the country’s economy was estimated to have risen sluggishly as compared to the first three years after the Great Depression in the 1940s.

Before the 2007-2009 recessions, the country’s employment rate was approximated at 4.6%. During inflation, the employment rate was 10%. Presently, the rate is estimated at 6.3%. The above figures suggest that approximately two-thirds of the job market downturn has decreased and the economy is yet to recover.

Works Cited

Council of Economic Advisers. 2015. Web.

Heinrichs, Ann. The Great Recession. New York: Children’s, 2012. Print.

U.S. Bureau of Labor Statistics. 2015. Web.

U.S. Bureau of Economic Analysis. 2015. Web.