Introduction

Since Michael Porter published the book titled The Competitive Advantage of Nations in 1990, it has received criticism and praise in what would be considered equal measure. On one side of the divide is a group of critics who think the book (and the arguments therein) are “fatuous” (Congdon 1990, p. 41) and “devoid of originality” (Miller 1990, p. 104).

Supporters of Porter and his thoughts and concepts as expressed in the 1990 publication argue that the book fills a gap in knowledge, which existed between international economic and strategic management (Grant 1991, p. 535). This critical essay will start by exploring Porter’s Diamond Model.

The paper will review the Diamond Model’s applicability in strategic choice that firms make when operating in home or host locations, thus deducing whether the model is useful or not.

The essay concludes by noting that although the Diamond Model made an attempt to explain how nations can obtain competitive advantage both at home and elsewhere, its greatest contribution in theory is relevant to international businesses and the strategies they choose when operating either in domestic or host locations.

The essay therefore finds Porter’s Diamond Model as offering useful explanations of home and host location strategies by international businesses.

Discussion

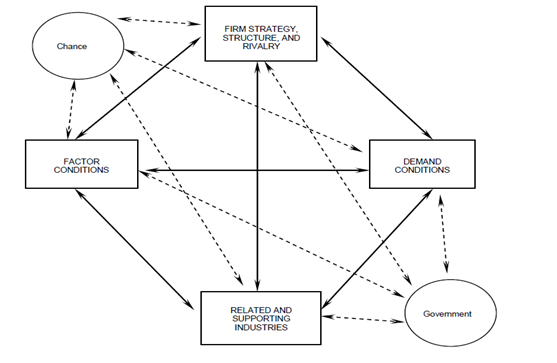

Porter’s Diamond Model (see figure 1 below) suggests that the competitive advantage of a nation is affected by four determinants namely: “Firm’s strategy and rivalry”, “related and supporting industries”, “demand conditions” and “factor conditions” (Porter 1990, p. 71).

Chance and government are two other factors that Porter (1990) indicate are supportive and complementary to national competitiveness. He however argues that the two (government and chance) do not create durable competitive advantages.

Figure 1: Porter’s Diamond Model

Source: Porter (1990).

The factor conditions Porter (1990) refers to include human resources, knowledge resources, infrastructure, capital resources and physical resources. He categorizes these factors into two categories namely basic and advanced factors.

Basic factors include the resources that a country naturally has (e.g. human resources, climate, land and water). Advanced factors on the other hand require effort by the country, and are according to Porter (1990) a potential source of sustainable competitive advantage.

Demand conditions according to Porter (1990) are a source of competitive advantage because they can anticipate and lead to international demand. Porter argues that sophisticated demand shapes how manufacturers of goods distinguish, understand and react to market needs.

He also observes that where demand is sophisticated, producers are innovative since they are continually seeking for ways to meet the high standards of demand.

The ‘firm strategy, structure and rivalry’ determinant as indicated by Porter (1990) suggests that competitiveness is affected by strategies and structures in the national environment. Additionally, Porter (1990) cites rivalry as a critical factor in competitiveness since it forces firms within nations to be innovative and emphasize the need for quality productions.

Linking firms to their parent-nations, Porter (1990) argues that although individual firms compete on the international market, it is a nation’s competitiveness on the international scene that shapes how firms (from the country) will compete therein.

The ‘related and support industries’ determinant refers external factors related to an industry (e.g. networks and/or institutions in an industry) (Porter 1990). According to Porter, industry clusters “represents an environment in which learning, innovation and operating productivity can flourish” (Smit 2010, p.118).

He argues that the reason why developing countries lag behind in development is because they lack the ‘related and support industry clusters’.

Arguably, and as noted by Davies and Ellis (2000), the Diamond Model offers insights into country-specific comparative advantages that nations have. Notably, by offering country-specific advantages, the Diamond Model highlights the importance of location as a source of competitive advantage for business.

Home and host location strategies of international business

The home and location strategies of international business are basically guided by the profit possibilities in distinct locations, and the political, economic, social and technological factors therein (Alcer & Chung 2007). The environmental and legal considerations also affect the attractiveness (or lack thereof) of a home or host location (Alcer & Chung 2007).

Acquisitions, alliances, and direct investments where a firm establishes its presence in the home or host nation are some of the common strategies that international businesses use.

However, and as Smit (2010) indicates, the entire concept of competitive advantage indicates that a firm will prefer producing products in which it has the greatest competitive advantage, and in a location that offer the most support and no or lowest risks.

Similarly, firms chose different strategies in the home and host location strategies guided by which of the competitive advantage potential in each of the available strategies.

Having established that the Diamond Model identifies country-specific advantages that would provide competitive advantage for businesses, one could argue that an international business’ home and host location can be explained using the same model.

Specifically, the strategy that international businesses chooses for use in either the home or host locations depends on the comparative advantage that they get. For example, firms consider a strategy will afford it human resources, knowledge resources, infrastructure, capital resources and physical resources needed to achieve factor conditions as indicted by Porter.

Next, an international business would consider how well a strategy fairs in Porter’s dimension of strategy, structures and rivalry. Ideally, strong structures and weaker rivals would make one location more desirable than others. An international business will also ideally review the demand conditions against its own abilities to deliver products and/or services that can satisfy those demands.

Examples: Samsung Inc. and Apple Inc. in Africa

Samsung has directly invested in Africa (through well-established distribution channels) and with time, has developed the capacity to meet the nature of demands in the continent (Okuruwa 2013). Other phone (and electronic) manufacturers do not find establishing manufacturing firms in Africa a viable option considering the low economic situations of the continent.

Further, the Korean electronics manufacturer has the ability to produce cheap phones (including smart phones) and other electronics which it is successfully marketing and selling in the African continent. In contrast, Apple Inc. does not even have distribution channels in Africa.

Arguably, the company does not find all (or some) of dimensions in the Diamond Model being strong enough to warrant its investment in distribution channels in Africa.

Arguably, the African continent meets all four critical dimensions in the Diamond Model for Samsung, since it has factor conditions (resources of different kind); demand conditions (demand for sophisticated, functional yet affordable electronics); firm strategy, structure and rivalry (it manufactures in Korea and imports to Africa, has established distribution channels, and has more market penetration compared to other foreign electronic manufacturers); and related and support industries (universities have technology hubs, it is working with mobile service providers in the country, and other players such as Google).

Additionally, governments are generally supportive of Foreign Direct Investment (FDI) in Africa especially when such investments are technology related.

Moreover, the chance dimension (exogenous factors) seems to support Samsung’s entry into Africa because it did so at a time when functional and cheap mobile phones were in high demand in the continent. The same however may not be true for Apple Inc., hence its conspicuous absence as Okuruwa (2013) notes.

Conclusion

Evidently, the Diamond Model may be a weak explanation for the competitive advantage of nations, but if applied on individual international businesses, the model can be useful.

Linking national competitiveness with the performance of individual firms also seems to be a theoretical mistake on Porter’s part because although this has considered the usefulness of the Diamond Model in explaining how Samsung has obtained competitive in Africa, this does not necessarily mean that Korea has competitive advantage over the USA, which is the home location to Apple Inc., in relation to marketing electronics in Africa.

Ideally, Apple Inc. is not in competition with Samsung in Africa and as such, none has a competitive advantage over the other.

Overall, it is worth noting that although the Diamond Model makes an attempt to explain how nations can obtain competitive advantage both at home and elsewhere, its greatest contribution in theory is relevant to international businesses and the strategies they chose when operating either in domestic or host locations.

This essay therefore finds Porter’s Diamond Model as offering useful explanations of home and host location strategies by international businesses.

References

Congdon, T 1990, ‘Autumn books should be made of sterner stuff: the competitive advantage of nations,’ Spectator, vol. 265, no.8463, pp. 41-42.

Davies, H & Ellis, P 2000, ‘Porter’s ‘competitive advantage of nations’: time for the final judgment?’Journal of Management Studies, vol. 37, no.8, pp. 1189-1213.

Grant, R. M 1991, ‘Porter’s “competitive advantage of nations”: an assessment,’ Strategic Management Journal, vol.12, pp. 535-548.

Miller, M 1990, ‘Of pushcart vendors and management consultants,’ The Public Interest, vol.101, pp. 103-106.

Okuruwa, C 2013, ‘Apple’s snob marketing and the declining fortunes of the iPhone,’ This Day Live. Web.

Porter, M.E 1990, The competitive advantage of nations, Free Press Macmillan, New York.

Smit, A. J 2010, ‘The competitive advantage of nations: is Porter’s Diamond Framework a new theory that explains the international competitiveness of countries?’ Southern African Business Review, vol.14, no.1, pp. 105-130.