The Opportunity

An opportunity of interest exists in the techfin sector. It involves the use of technology to disrupt the traditional banking model, specifically to enhance lending and create value for consumers (Ries 1). The model represents banks of the future in which not so much attention would dwell on the credit history but rather on customer behaviors, analyzed from data obtained from various sources, both online and offline. The model is predictive and not definitive, but every piece of information shows the willingness of the customer to repay the loan borrowed. The basic principle is based on ‘know your customer’ applied in a digital era. The idea represents the new lending model and consumer bank of the future.

The Competencies and Skills

The venture requires competencies and skills in finance, microfinancing and data mining and development of complex algorithms to make reliable lending decisions. The team possesses abilities to analyze thousands of digital data about a potential customer’s behaviors and attributes.

Data crunching skills developed over time will ensure that the team can analyze thousands of variables to develop a reliable risk profile for every potential customer. The outcome exceeds by far the traditional credit score system. Once the team has determined the risks of default more accurately, the company can then price its loan appropriately. The model will eliminate the use of traditional income minus expense approach to determine and predict possibilities of loan repayment, but rely on a more accurate evaluation of creditworthiness and reduce cost of lending.

Important Stakeholders

Internal stakeholders, who are also employees, are important stakeholders because they will be required to drive the business. Employees are expected to execute the strategy and develop long-term vision, identify early adopters and continue to improve the products to meet the needs of the target market.

Customers are also vital for the business. The business model targets individuals who are unable to borrow from banks or payday lenders because of poor credit history and high interest rates respectively, but show willingness to repay short-term loans.

Venture capitalists are also required to invest in the company to ensure that it has adequate capital to finance software and lending.

Finally, regulators will also be invited to evaluate business practices.

Passion and Commitment for the Opportunity

The rich are just fine. The new opportunity focuses on the poor who require cheaper loans to meet unexpected expenses within the month. The so-called subprime borrowers are disadvantaged because they face discrimination based on their credit worthiness yet they need money to meet some unexpected needs.

The company would spend much time to design effective experiences for borrowers, better create values, and ensure a dignified alternative for subprime borrowers.

The company will focus on driving down the cost of lending to ensure that marginalized, underbanked individuals can meet their financial responsibilities by ease.

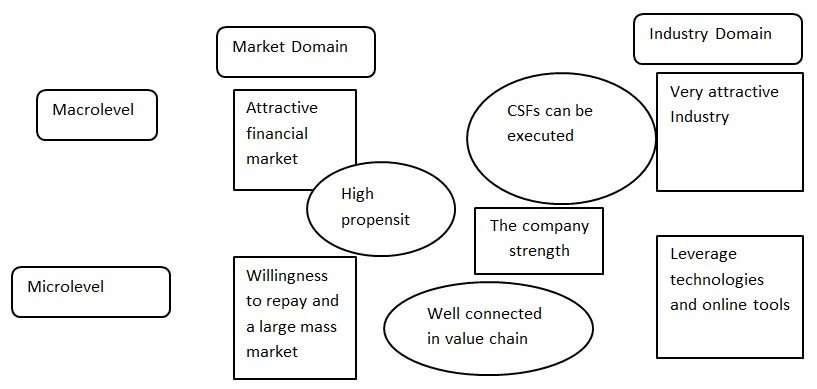

A Good Opportunity

The business presents a good opportunity for investment because of the driving knowledge, technology and ethics (Byers, Dorf and Nelson 3-134). The focus is to enhance the economics of underwriting and borrowing practices through non-banking practices. The model would create more opportunities for millions of consumers to access loans at relatively lower costs.

The Category of the Type of Opportunity

Increasing the value of a product or service

For several centuries, traditional banks have offered lending services to consumers. However, they have also equally restricted financial reach to the rich and other clients regarded as creditworthy. Consequently, many would-be borrowers are locked out of the mainstream banking system with no alternative except exploitative payday lenders.

The techfin model focuses on transforming the borrowing industry but creating better values for subprime borrowers who are normally charged high interest rates at the banks and largely exploited by payday lenders. By relying on data mining techniques, the company would ensure that it could lend to this segment of the market based on their willingness to pay rather than creditworthiness. For many centuries, banks have not been able to introduce such values to their customers.

Developing the Customer and Service Simultaneously

Technologies and financial systems have converged to create value for customers. Innovation is driving the modern financial industry as startups focus on mining data about consumers to meet the needs of underbanked, underserved subprime borrowers.

Generally, these new, non-bank financial firms locate small signals about consumers across a wide variety of sources, including social networks and prepaid cell phone usages among others to determine willingness to repay loans.

The firm leverages technologies to ensure effective risk management compared to traditional banks. Consequently, it is able to create value through delivering credit facilities at lower rate and create a broader market to subprime borrowers who banks have neglected and at the same time, help them escape predatory lending from payday lenders.

Opportunities and Processes

Capabilities: the venture opportunity is consistent with the capabilities, knowledge, and experience of the team members. However, constant training on new software solutions is necessary.

Novelty: the financial service would assist subprime borrowers and help them to escape predatory debt models. The target is the ‘the poor masses’ and, therefore, no premium charges are intended but relatively affordable services.

Resources: given the robust nature of the technology and financial sector industries, it is expected that the synergy between these two industries can delivery meaningful change that will also be responsible for attracting the necessary talent and investment (Lohr 1).

Return: the venture will take huge risks by targeting individuals who are considered not creditworthy. However, by minimizing risks, limiting amount, and repayment period to one month, it would realize returns within the first few months after operations.

Commitment: only individuals who are committed to their venture can take such a risky market segment (Mathis and Jackson 201).

The problem or need and the customer: gaining access to finances to meet short-term, unexpected needs has been a challenge to individuals with poor credit history. This segment of the market is ideal for a new lending model or financial services that meet immediate needs.

The proposed solution and the uniqueness of the solution: affordable financial services to marginalized would-be borrowers present unique business opportunities while meeting the needs of individuals who require financial services but are unable to meet them because of traditional modes of evaluating customers.

Industry Domain Why the customer will pay for the solution: the target customers are in dire need of dignified alternative financial solutions and, they therefore will pay for the business solution.

Vision Statement for the Venture

The company will continue to define the future of banking as it ferrets out underserved consumers and serve them to meet their everyday financial challenges.

The company envisions a financial model driven by easily accessible consumer data analyzed by innovative tools rather than relying on old models of determining creditworthiness of consumers.

Value Proposition for the Venture

It will enhance the economics of underwriting, create value through low cost loans, improve borrowers’ experiences and nurture strong relationships.

Many more subprime borrowers will have access to relatively affordable loans.

Business Model for the Venture

Evolving customer priorities

The company will focus on consumers who require quick money to fix immediate problems. In addition, it will reach such would-be borrowers through various online platforms.

New technologies

It will continuously leverage new analytical tools for deeper data mining while relying on highly qualified individuals to achieve its vision.

Economic conditions

The financial market is extremely volatile. The past economic recessions have left behind consumers who are no longer considered as creditworthy within the mainstream financial system.

Select the customer

The company targets individuals who are aged 18 years and over, are completely employed, have checking accounts and show willingness to repay loans. The market is wide.

The key values of the customer

The mass market will drive the growth of the company.

A value proposition

The company shall delivery affordable consumer finance to underserved consumers.

Testing the model

The company will adapt its services incrementally and gradually to meet market needs.

Implement the business model

Once the approach is proven effective, the company will implement the model to a broader market.

Reevaluation of the model

Notable changes in lending practices and technologies will be included to strengthen the model and meet dynamic needs of clients (Wohlsen 1).

A SWOT Analysis

Strategic Approach

The company will use differentiation-cost as a strategic approach to distinguish itself from competitors. This mode of approach would ensure that processes are effective, services are relatively low cost while technologies are adopted to drive customer experiences.

A Partnership Strategy

The company will seek for mutual relationships with technology companies and financial institutions to enhance the delivery of value to its target customers. Only successful partnership may progress to long-term ones or merger.

Strategy Description

The company continuously seeks for strategic partnership to enhance product development and knowledge sharing for ultimate growth. It is expected that such a partnership would lead both firms forward effectively and attain sustainable growth.

Social Responsibility

The company would be socially responsible because it will be based on strong ethical standards (Wheelen and Hunger 70). It will take initiatives to train customers on sound financial issues with the aim of getting them out of debt circles. It aims to promote financial literacy so that customers can have some money management skills.

Further, it will promote environmental conservation by being paperless and restricting most transactions to electronic forms.

Works Cited

Byers, Thomas H, Richard C. Dorf and Andrew J Nelson. Technology Ventures: From Idea to Enterprise. New York, NY: McGraw-Hill, 2008. Print.

Lohr, Steve. “Banking Start-Ups Adopt New Tools for Lending.” New York Times. 2015.

Mathis, L. Robert and H. John Jackson. Human Resource Management, 13th ed. Mason, OH: South-Western Cengage Learning, 2011. Print.

Ries, Eric. The Lean Startup Methodology. n.d. Web. 2015.

Wheelen, Thomas and David Hunger. Strategic Management and Business Policy: Toward Global Sustainability, 13th ed. New York: Pearson Education, 2012. Print.

Wohlsen, Marcus. Tech’s Hot New Market: The Poor. 2013. Web.