Taiwan and the United States have had a strong business relationship that is founded on trust and cooperation. The two countries developed their close relations during and after World War II when they signed an agreement, the so-called Sino-American mutual defense treaty in 1954 (Chang, & Clark 2008). This was meant to strengthen their military alliance, being a factor that enhanced Taiwan’s military muscles. Consequently, with the improved security in Taiwan, its economy began to grow rapidly, of course, with the American economic aid playing a major role in its growth.

In the year 1972, the United States changed its policies towards the Republic of China by switching recognition of the ROC to Peoples Republic of China PRC (Chang, & Clark 2008). However, only diplomatic relations changed between the ROC and the United States. The friendship between the people of the two states remained unchanged as well as the business ties (Chang, & Clark 2008).

Baisen International Co., Ltd is an American MNC that deals mainly with compact fluorescent Energy-saving Desk Lamps, Clip-On Lamps, as well floor Lamps (Martin, 2012). The management is interested in exploring the growing electronics market in Taiwan. The market in Taiwan is rapidly growing and the economy has been on an upward scale since World War II, owing to the military treaties signed by the two countries. With the prevailing peace and military strength, Taiwan has been able to stabilize its economy and, consequently, has attracted a number of MNC s including Baisen International Co. Ltd.

International business involves a number of methods. These include international trade, licensing, franchising, joint ventures, acquisitions of existing operations, and establishing new foreign subsidiaries (Rugman et al., 2011). The most appropriate method in the case of Baisen International Co. Ltd is, however, licensing. Licensing involves giving patent rights to another trading party at a fee. This means that the company will sell its rights to Taiwan allowing them to produce their products. The advantage of such an agreement is that the mother company evades the risk of investing capital.

Exchange rate

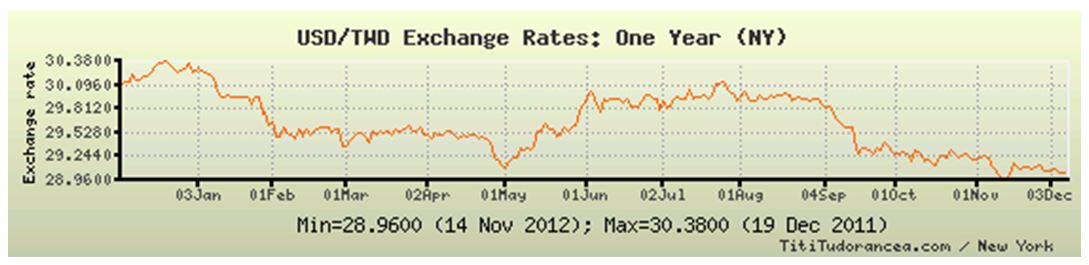

Taiwan has fully embraced its new Taiwan dollar, and in the last ten years, there has been remarkable progress in the economy. The trend in the exchange rate of the US dollar against the Taiwanese dollar has been characterized by major fluctuations as shown in the graph below (FRED, 2012).

In the year 2002, the exchange rate stood at 35.2100 against the US dollar and in the middle of the same year, it dropped to 32.5260. Major fluctuations were evident from 2005 going down until it increased in 2009 to 35.2100 again. However, since the year 2009, the market seems to have been doing very well as the rate has been on a downward fall, and currently, in December 2012 the exchange rate stands at 29.8420 being a clear indication that Taiwan is becoming a profitable market niche, and the investor should consider attractive market therein (FRED, 2012).

Looking at the exchange rate within this year alone, January was the month with the highest rate, which stood at 30.3800 against the US dollar. This rate steadily dropped through the months of February, March, April, and May to a level of 29.2 against the US dollar. However, the rate shot up again and in late August the Taiwan dollar could be exchanged at a rate of 30.1 against the US dollar. As shown in the graph below, from September till December the US dollar has weakened, hence the Taiwan dollar has gained its value (FRED, 2012).

Below is a brief historical account of the exchange rate in summary (FRED, 2012).

Historical Exchange Rate Summary: Twd/USD

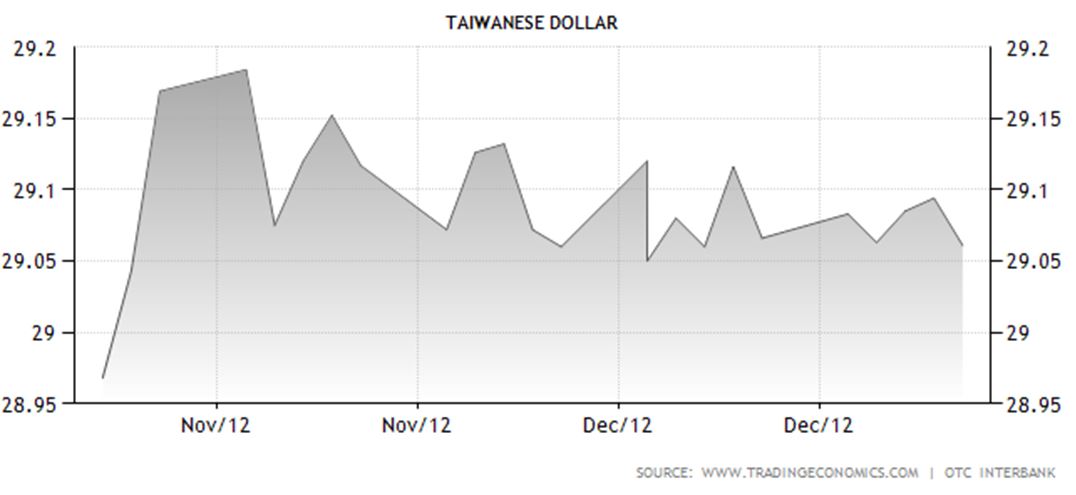

Expanding business in the developing world may be risky; but if the right approach is applied, there are lucrative benefits to be realized. In the Taiwan market, the fluctuating exchange rates are a threat to new investors, who intend to import their products to that market niche. However, using the licensing method of international trade may help the MNC avoid the risks of trade as presented by the fluctuating currency (Martin, 2012).

These fluctuations bring about some economic implications, such as transaction, economic, translation, and contingent exposure to a firm (Martin, 2012). Economic exposure influences the market value, therefore, affecting the MNC’s ability to project profitability. Financial reporting is, on the other hand, affected by the translation exposure effect of exchange rates. It becomes a bit difficult for a firm to bid and negotiate foreign projects and direct investment; hence, there is contingent exposure. All these are the risks associated with exchange rate fluctuations.

The graph below shows the fluctuations in the exchange rate from November to December this year (FRED, 2012).

Conclusion

The dramatic fluctuation of the Taiwan dollar against the US dollar has affected the import-export market greatly. However, the bottom line is the fact that the US dollar is losing against Taiwan’s dollar being a good sign of great opportunities in Taiwan’s market. The entry of the US-based MNC, Baisen International Co. Ltd will be profitable to both the investor and the country. The benefit accrued by the company’s investment plan is lucrative. Other than getting exposure by displaying their products in a larger market, the company will avoid the investment risks as discussed above.

The company by using the licensing method of international business will be in a position to influence a bigger market and hence influence the industry. This method also would help the investors to avoid such costs as transportation costs, as well as investment costs if they export their products all the way to Taiwan themselves. In addition, this would help the company to save their importation cost in terms of import tax and other foreign policies that may hamper importation.

With the weakening US dollar, the Taiwan economy is growing and, therefore, attracting investors all over the world. The MNCs in this case will have a great opportunity if it sets a business deal with Taiwan to seize the opportunity in the growing market especially with the demand for electronics. This also gives the company a greater scope of the trade along with other economic benefits. Therefore, the decision to establish a licensing trade plan with Taiwan is a well-informed and timely decision if the managers at Baisen International Co. Ltd would consider doing this.

References

Chang, S.K.C., & Clark C. (2008) American MNC’s and the Local Business Environment in Taiwan: Chinese Managers and Foreign Training Programs as Underutilized Resources, Inha Journal of International Studies, 8 (1), 135-163.

FRED. Taiwan / U.S. Foreign Exchange Rate. (2012). Web.

Martin, M. F. (2012). East Asia’s Foreign Exchange Rate Policies. Web.

Rugman, A. M., Chang Hoon Oh, & Dominik S. K. Lim. (2011). Regional and Global Strategies of Multinational Enterprises, Discussion Paper Series. Web.