For a currently centralized organization that considers adopting a decentralized structure, multiple challenges may be associated in the area of budgeting and cost spread. This paper reviews the key concerns associated with transfer pricing involved in organizational restructuring. Furthermore, it comments on the purpose and functions of responsibility centers, internal changes appropriate for cost centers, and the role of business analytics in a decentralized growing organization.

Decentralized organizations are generally characterized by the ability of low-level managers to make impactful decisions that affect commercial tactics and strategies implemented by the firm. The main benefits of this approach include fast decision-making, a high level of motivation across low-level management, and greater responsiveness to local needs. Transfer pricing is often adopted by decentralized organizations, as a quick and effective tool to pay for goods and services they require for operation.

Transfer pricing is the value measure directed by the profit center to other responsibility centers within the company. It occurs in cases of internal exchange of goods and services between multiple divisions of a firm, which is significantly more common for decentralized organizations. The most common problem associated with them despite their relative inevitability lies in the fact that transfer prices are a source of revenue and costs at the same time depending on the perspective, leading to a conflict of interest.

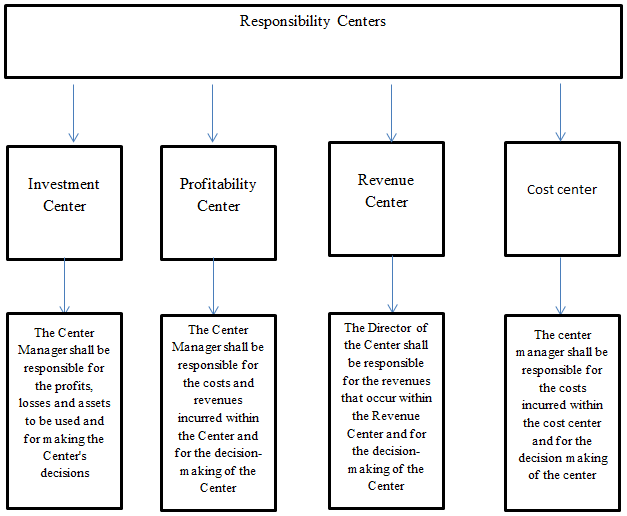

Responsibility centers in any organization may be divided into four categories: cost centers, revenue centers, profit centers, and investment centers. These centers are a key part of the responsibility accounting, which in turn allows for analyzing each manager’s financial decisions individually, to identify responsible employees quickly if the need arises. Cost centers in particular concern the responsibility accounting approach where the inputs, those being the resources used by a firm at large or by its division, are only measured in monetary terms. Cost centers assess the financial performance in terms of the costs it entailed.

To specify, they comment on a financial operation’s efficiency by analyzing the number of inputs needed to generate the desired output. Thus, their analysis is frequently somewhat surface level, as it lacks the focus on the general profitability of an operation for the company. A firm might consider changing its direct functionality by combining cost centers with other KPI-measuring tools when assessing a financial operation.

Decentralization frequently increases the firm’s efficiency on multiple smaller scales simultaneously, particularly where an international organization is concerned. A decentralized decision-making process for a global company implies that decisions are made with the knowledge of local economic and social structures. Such decisions have the potential to be exceptionally informed, thus generating financial profits and long-term benefits for the company.

However, in order to realize the model’s full potential for customization and attention to detail, said decisions should be informed by business analytics and profound research. Business analytics enables a de-centralized firm to generate balanced, grounded solutions that correlate with the current market trends. It allows the leaders to exercise control over their areas of responsibility from the angle of managerial and financial expertise.

In conclusion, responsible accounting and efficient de-centralized organizational structure tend to go hand in hand. It allows a firm to organize its inputs and outputs, thus evaluating running costs from the point of their profitability. However, the current model of responsibility centers might be in need of greater flexibility to design a more adaptable and multi-layered cost evaluation tool.

References

Aljanabia, A. K., & Nourib, M. A. Responsible Accounting and Its Role in Achieving Competitive Advantage. International Journal of Innovation, Creativity and Change, 10 (11), 577-611. Web.

De Mooij, R., & Liu, L. (2020). At a cost: The real effects of transfer pricing regulations. IMF Economic Review, 68(1), 268-306. Web.