Debt vs. Equity Investments

Modern companies use one of the two investment approaches to increase their capital. Wild and Shaw (2021) state that these are debt and equity investments. The two differ in the methods of providing financial resources to the borrower and the mechanisms for generating a return on investment.

It can be said that the debt investor lends its funds directly to the borrower through a loan. The equity one provides money by acquiring some of the borrower’s ownership (What are equity investments? n.d.). As a result, the former receives loan payments, and potential dividends and income from the sale of shares serve as returns for the latter.

Making a debt investment requires some free cash from the investor, but it rewards one with stable returns with interest. Equity investing also requires free money from the investor to purchase shares in the borrowing company, whereby one becomes a shareholder capable of receiving capital gains and dividend payments.

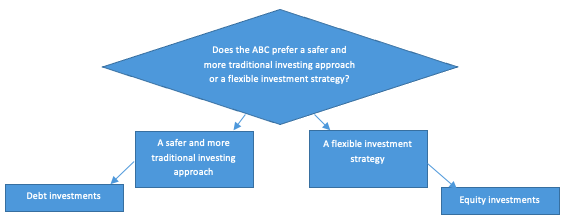

Moreover, “equities can strengthen a portfolio’s asset allocation by adding diversification” (What are equity investments? n.d., para. 1). To conclude, debt investments are for those who prefer a more traditional investment approach (Fig. 1). Equity is more suitable for those who follow a more flexible investment strategy.

Types of Debt and Equity Investments

Professional standards require accountants in organizations that practice investing to distinguish debt investments into three types of securities. These are how held-to-maturity (HTM) securities, held-for-trading (HFT) or just trading, and available-for-sale (AFS) securities (Tab. 1) (Wild & Shaw, 2021). These are categorized primarily based on how and when the organization intends to use them.

As seen from its name, HTM securities are those that a company acquires to sell when it reaches financial maturity. AFS ones have two potential uses; they are either sold until they reach their mature status or are kept if they do not have a maturity date. Trading securities are short-term investments purchased explicitly by an entity to be sold within an annual period.

Equity investments are categorized by accounting professionals into three categories, too. These include those with minor, significant, and controlling influence (Tab. 1) (Wild & Shaw, 2021). This classification is based on the percentage of shares from the borrower’s ownership the lending entity receives for the investment.

If an investment provides up to one-fifth of all shares to the lender, it is marked as insignificant. Accountants consider a significant investment to give the investor between 20% and half of the ownership of those who received their money during the transaction. An investment acquires controlling influence status when it provides the investing agent with more than half the borrower’s equity or the control stock.

Table 1: Subtypes of Debt and Equity Investments

Accounting Rules for Debt and Equity Investments

There are some professional standards and rules for accounting for the discussed types of investments that any financial agent must follow. One is the temporal classification of securities into short-term and long-term. HFT and AFS securities and those with insignificant influence can be put in both categories (Wild & Shaw, 2021). One should remember that HFT securities can only be listed as short-term and those with significant and controlling influence only as long-term ones (Wild & Shaw, 2021).

HTM ones are always reported at cost; the rule here is that they are equivalent to the price they were bought for. AFS ones are counted according to the principle of ‘fair value adjustment to equity’ because these are explicitly purchased for short-term sale (Wild & Shaw, 2021). Trading and insignificant securities are also reported according to the accounting standard ‘fair value adjustment to income’ (Wild & Shaw, 2021). Accountants report significant investments following the equity methodology, and those with controlling influence by the consolidation rule or, simply put, fair value adjustment are not needed.

References

What are equity investments? (n.d.). BlackRock. Web.

Wild, J., & Shaw, K. (2021). Fundamental accounting principles (25th ed.). McGraw Hill.