Balance of payment (BoP) describes the trade and transactions of a country with the rest of the countries. The main components of BoP are current account and capital account; current account deals with trade in goods and services, transfers and investment incomes. On the other hand, capital account provides the information of net investment, portfolio investment and capital flows. Moreover, error and emission express that it is not possible to collect and scrutinize all the data.

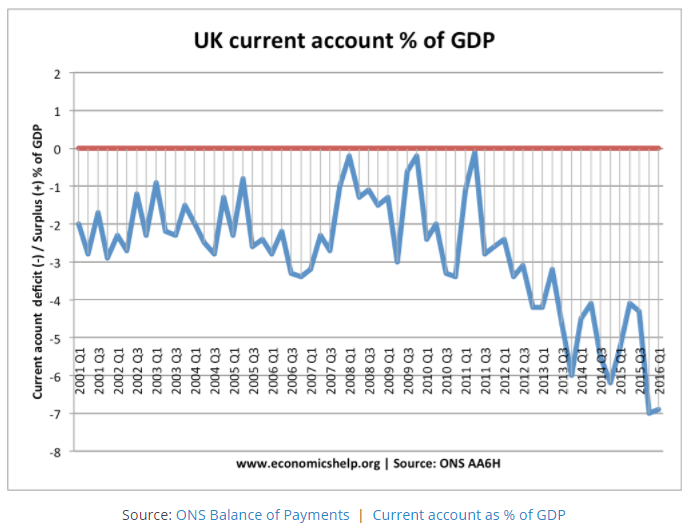

Since last few years, United Kingdom (UK) has been facing current account deficits. This drastic deficit is mainly caused by the deterioration in trade in goods, and declining in investment income. In 2015, UK has recorded its worst current account deficit at £96 billion (Taylor, Balance of Payments: Oct to Dec and annual 2016). The shortfall on secondary income raised by £2 billion and recorder £7.4 billion in the last quarter of 2015. Whereas, the primary income deficit recorder £13.1 billion in the last quarter. The net borrowing increased at level of £4.4 billion. The portfolio investment income deficit also rose to £5.2 billion in 2015, as compared to £3.5 billion in 2014.

The trade account deficit was due to the decline in exports by £1.9 billion and upsurge in imports by £0.4 billion. The deficit in primary income account was due to receipts declining by £10.8 billion. This drastic decline in receipts was caused by the shrinking the foreign direct investment in the UK and reducing the earnings of direct investors.

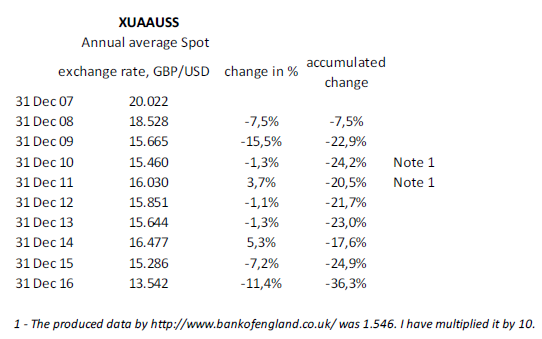

Overall, the above information about BoP deficit provides the evidence of dwindlea lot of UK economy. This indicated that the net export of goods, services and profit are less that the imports of goods, services and profits. Furthermore, to pay this extra burden, UK government should sell the British pound to take the dollar or euro. The increase in the foreign currency demand will depreciate the UK pound (Strata). Figure 1 indicates the decline in the British pound over the last 10 years. In 2015, the GBP was depreciated by 7.2 percent against US dollar (Pettinger). The increasing deficit in BoP forced British government to pay the debts by converting pound and buy the US dollar.For that reason, in 2015, the British pound was further depreciated by 11.4 percent.

Exchange rate is the integral part to trade with rest of the world. The decrease in exchange rate helps the country to promote its exports. Previously, in Bretton Woods era, the exchange rate was fixed with US dollar that created hurdles for economic growth. However, now a day, the governments are able to adjust its exchange rates. Moreover, the market forces also fluctuates the exchange rates. The exchange rate of highly demanded currency appreciates gradually. On the contrary, the selling currency loses it worth over time. In the above example, the British pound has lost its worth by 7.2 percent in 2015 and 11.4 percent in 2016.

This decline in exchange rate can help to boost the local industry; the imports become costly that reduces the dependence on foreign products. In addition, the local products become cheaper for the foreign buyers which in turn help to increases the exports. This strategy can help to decrease the current account deficit. Besides, this depreciation in currency has a significant impact on foreign earnings (Taylor). For example, the UK subsidiary is performing its operations outside the country. The foreign remittances send by that subsidiary also increases due to the depreciation in GBP ( Melvin and Norrbin; Ahmad, Nasir and Ahmad; Dávila, et al.). However, the long run impact can be varies according to the fiscal and monetary policies.For that purpose, the British should wisely form its long run plans and strategies to counter these issues.

References

Ahmad, Fercan, Nasir, Muhammad and Mushtaq Ahmad. Foreign Direct Investment, Aggregate Demand Conditions and Exchange Rate Nexus: A Panel Data Analysis of BRICS Economies. Research in International Business and Finance , 20.

Dávila Gonzales, Stithou Marva, Pescaroli Gianlucha, Pietrantoni Luca, Koundouri Phoebe, Díaz-Simal Pedro, et al. Promoting resilient economies by exploring insurance potential for facing coastal flooding and erosion: Evidence from Italy, Spain, France and United Kingdom. Coastal Engineering , vol. 87, p. 183–192.

Melvin Michael International Money and Finance (Ninth Edition). In The Balance of Payments (p. 74). Academic Press.

Pettinger Tejvan (2016). UK Balance of Payments. Web.

Strata Insight (2016). Why sterling is vulnerable post-Brexit. Retrieved from Bespoke Consultants to the Eastern Mediterranean hydrocarbons sector. Web.

Taylor Craig. (2016). Balance of Payments: July to Sept 2016. Office of National Statistics , p. 3.

Taylor Craig. (2016). Balance of Payments: Oct to Dec and annual. Office of National Statistics , p. 2.