Description of Problem

The company aims to increase revenue by diversifying its business opportunities through a new sales division that will sell its engines to a different industry. To do this, the sales department manager must research a new industry with growth and profitability potential and persuade stakeholders to support this initiative. The manager needs to analyze the U.S. automotive manufacturing industry, as well as a new one, using both qualitative and quantitative data to understand trends and changes in customer demands, new technologies, and regulations (Cole, 2020). Finally, the manager will compare the findings of Porter’s Five Forces analysis for the new and automotive industries to make an informed recommendation and present a strategic plan for the company’s diversification initiative.

Description of the Current U.S. Automotive Industry

The U.S. automotive industry is valued at $1.1 trillion and produces a range of vehicles, including cars, buses, and other types of vehicles. It is highly competitive with both domestic and foreign manufacturers. The industry faces challenges from trade policies, environmental regulations, and technological advancements, as well as economic conditions, consumer preferences, and the impact of COVID-19, which influence demand. Despite these challenges, the industry provides jobs and drives innovation. Regulatory compliance is complex, including safety, emissions standards, and trade policies (Jacobs, 2020).

Since its founding, the automotive industry has been concentrated in a few regional hubs. Previously, factories were located on both the East and West Coasts of the United States. However, now the industry has begun to move to the Midwest and areas of southern Ontario, where most sales are concentrated. According to the plant location map, the production and sales of automobiles are heavily concentrated along the southern axis of Detroit. However, the industry was once concentrated along the Chicago-to-New York route. Despite the growing importance of foreign factories, Detroit remains the hub of the industry.

The electric vehicle market is experiencing growth compared to last year, which is impacting the automotive industry’s expansion. Although sales of electric vehicles are still in their early stages, long-term projections indicate rapid growth worldwide. According to the International Energy Agency (IEA), the number of electric vehicles (EVs) is expected to grow to 125 million by 2030, up from 3.1 million in 2017 (LaMonaca & Ryan, 2022). China has the most electrified vehicles today, with the United States in third place with about 2.8 million units (LaMonaca & Ryan, 2022). The IEA report shows that sales of hybrid cars have doubled in 2021.

Current Automotive Market Trends

Due to increased environmental consciousness, the automotive industry is shifting towards electric and hybrid vehicles. Automakers are investing heavily in these vehicles to meet demand. Autonomous driving and connected cars are also transforming the industry, offering potential benefits such as improved safety, reduced traffic congestion, and a more enjoyable driving experience.

While the COVID-19 pandemic led to a decline in sales and production, the industry is expected to rebound as the economy recovers. Governments worldwide are introducing stricter emissions standards and fuel efficiency requirements, forcing automakers to invest in new technologies. The industry faces challenges and opportunities as it navigates these changes, with successful companies being those that adapt to these trends and stay ahead.

The 6.1 million-car American fleet was examined by iSeeCars experts. As a result, 25.8% of buyers chose to paint their cars white, accounting for more than a quarter of all vehicles (LaMonaca & Ryan, 2022). Silver, gray, and black hues are less popular among Americans. SUVs and trucks are gaining popularity as they are perceived as safer and more comfortable, leading automakers to introduce new models and phase out sedans (Winkelhake, 2021). In the U.S., the large size is the most preferred feature when choosing a car.

Description of the New Industry

The company is considering entering the electric vehicle (EV) industry, which is expected to grow rapidly due to declining battery costs and government incentives. Major automakers, such as Tesla, General Motors, and Ford, are investing in the production of electric cars, trucks, buses, and other vehicles to meet this demand. Electric vehicles produce zero emissions and are environmentally friendly.

This industry also sees innovation in battery technology, charging infrastructure, and vehicle design, which drives down costs and improves performance. However, challenges remain, such as high upfront costs, limited charging infrastructure, range anxiety, and regulatory hurdles (Suwa & Iguchi, 2020). Although facing these challenges, the EV industry presents the company with a valuable opportunity to expand its business and benefit from the growing demand for electric vehicles.

Current Market Trends in the New Industry

The electric vehicle industry is growing due to increased consumer interest in environmentally friendly transportation. Automakers invest in electric and hybrid vehicles, autonomous driving, and connected car technology. Governments worldwide are imposing stricter emissions standards, leading to increased investments in new technology and adjustments to product portfolios. While the EV industry presents a significant opportunity for companies to diversify and capitalize on growing demand, challenges such as high upfront costs for consumers, limited charging infrastructure, and range anxiety remain (Suwa & Iguchi, 2020). Companies must navigate these challenges while developing innovative products and services to meet the evolving demands of consumers.

The growth in sales of electric vehicles is driven by subsidies and benefits for purchasing and maintaining such vehicles, as well as the increasing cost of combustible fuels and tightening environmental standards. The popularity of electric vehicle sales is directly related to fuel prices in the regions. The highest prices are observed in California, at $6.39 per gallon. In Hawaii, a gallon of diesel costs $5.74, while in Pennsylvania, it costs $5.68 (Alola et al., 2023). Therefore, in these states, there will be a high level of sales. Diesel costs the least in Georgia, at $4.83 per gallon, which is likely to result in lower sales.

Legislation and automakers’ commitments to convert their fleets to electric vehicles drive growth in EV sales. In the United States, 4.7 million cars, or 35% of all sales, are anticipated to be electric vehicles by 2030 (LaMonaca & Ryan, 2022).

References

Alola, A. A., Özkan, O., & Usman, O. (2023). Examining crude oil price outlook amidst substitute energy price and household energy expenditure in the USA: A novel nonparametric multivariate QQR approach. Energy Economics, 120. Web.

Cole, R. (2020). The Japanese Automotive Industry: Model and challenge for the future? University of Michigan Press.

LaMonaca, S., & Ryan, L. (2022). The state of play in Electric Vehicle Charging Services – a review of infrastructure provision, players, and policies. Renewable and Sustainable Energy Reviews, 154, 111733. Web.

Jacobs, A. J. (2020). The Automotive Industry and European Integration: The divergent paths of Belgium and Spain. Palgrave Macmillan.

Suwa, A., & Iguchi, M. (2020). Sustainability and the Automobile Industry in Asia: Policy and governance. Routledge.

Winkelhake, U. (2021). The digital transformation of the automotive industry: Catalysts, roadmap, practice. Springer Nature.

Appendix A

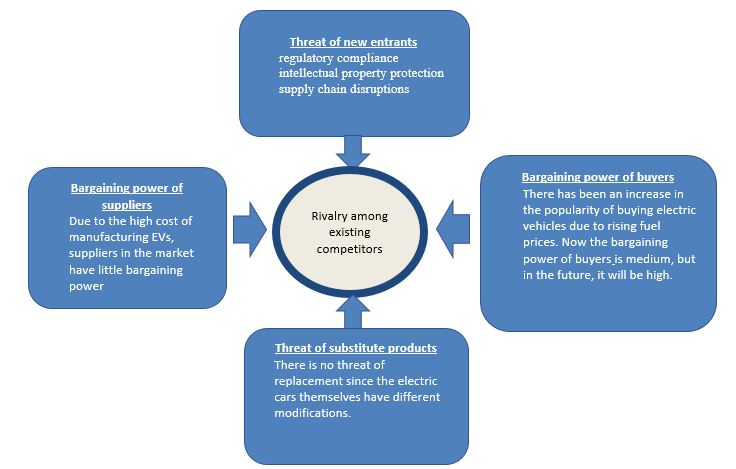

Explanation from Porter’s Five Forces Analysis of the New Industry

Porter’s Five Forces Analysis shows that the new industry has low barriers to entry and a high risk of new entrants. There is high and low buyer bargaining power due to the many suppliers and buyers. The threat of substitutes is high due to many alternative products. Finally, intense competitive rivalry is present due to the high number of competitors.

To succeed, the company must focus on innovative products like high-performance electric motors or advanced battery technology (Winkelhake, 2021). It should also build strong relationships with suppliers and customers to secure essential resources. However, it must consider potential threats and risks like regulatory compliance, intellectual property protection, or supply chain disruptions. To mitigate these risks, it needs a comprehensive risk management strategy.

Porter’s Five Forces Analysis highlights the opportunities and challenges of entering the electric vehicle industry. By adopting a differentiation strategy and carefully managing risks, the company can succeed and capitalize on the growing demand for electric vehicles. Electric vehicles currently sell at a slightly lower rate than fuel-powered ones. However, the growth rate of EV sales is increasing due to global green trends and U.S. government policies. It also helps fuel price increases, negatively affecting traditional auto sales.

Appendix B

Summary of Findings from Porter’s Five Forces Analysis Comparing Both Industries

After analyzing both industries using Porter’s Five Forces, we discovered they have similar levels of competitive rivalry, supplier bargaining power, and the threat of new entrants. However, the industry is more susceptible to substitutes due to lower pricing alternatives, while the new industry has more bargaining power due to buyers being more price sensitive. To succeed, the company should adopt different strategies for each industry.

For the traditional industry, focus on strong supplier and customer relationships and unique product features. For this situation, it is mainly essential to prioritize cost-effective and reliable engines (Winkelhake, 2021). The company must also address regulatory compliance, intellectual property protection, and supply chain disruptions.

The sales department manager must conduct thorough research and analysis to present a strategic plan. This report provides an overview of the U.S. automotive and electric vehicle industries, highlights opportunities and risks, and suggests practical strategies (Suwa & Iguchi, 2020). The report emphasizes the importance of considering both qualitative and quantitative data and stresses the need for the company to be adaptable to remain competitive.