Overview of the Sport Organisation

USA Hockey is a sports organization that serves as a base for international and domestic ice hockey teams in the United States. AHAUS was founded on the 29th of October 1937 and rebranded to its current name in 1991 (USA Hockey, 2022b, Smolianov et al., 2021). The current location is in Colorado Springs, Colorado. The company’s field of interest and activities revolves around mass hockey programs’ development and support, focusing on national hockey teams and representing the country in competition.

The organization is the main governing body of USA Hockey. USA Hockey is structured in 12 districts and has 34 affiliated units (USA Hockey, 2022b). Furthermore, the association has a non-profit wing called the USA Hockey Foundation, which raises funds through donations. In addition, the company is involved in training and certifying coaches, including through online training, defining and approving standards, and developing the industry as a whole.

The organization’s most recent achievements have been steady development and attracting new sponsors. Interest in the sport is driven by sustained support, and growth rates are better than before the pandemic (USA Hockey, 2022a). Growth in membership and retention of existing members has shown considerable expansion, as has the organization’s finances. New board members have ensured that the sport and sports education and involvement of young people have flourished at a reasonably high level. Further consideration of the momentum will be given to the organization’s official financial statements for the three annual periods beginning in 2019.

Concept of Financial Performance: Definition and Critical Discussion

The financial performance demonstrates an organization’s ability to use its assets to sustain operations successfully and generate income. In addition, the profitability and effectiveness of actions and decisions taken are taken into account to determine the company’s overall financial health (Danso et al., 2019). In the context of financial performance study, the percentage of achievement of desired financial goals, which is defined as high by management, is of great importance (Omondi-Ochieng, 2019). Such goals include, for example, increasing the additional revenue from memberships, events, and internal programs and increasing their proportion relative to corporate sponsorships or government subsidies.

Financial efficiency also involves minimizing financial losses by allocating limited resources optimally. In this format, savings are made on time, costs, and other company resources while increasing productivity per unit of resources expended (Omondi-Ochieng, 2019). In the context of official information, it is worth noting that USA Hockey has had some problems with asset efficiency in generating revenue but has demonstrated success in stabilizing the revenue and the total amount of assets accumulated. Despite the blow caused to the company and the industry by the COVID-19 pandemic, the company is already in a normalized condition. It is reaching better numbers than before the international lockdown.

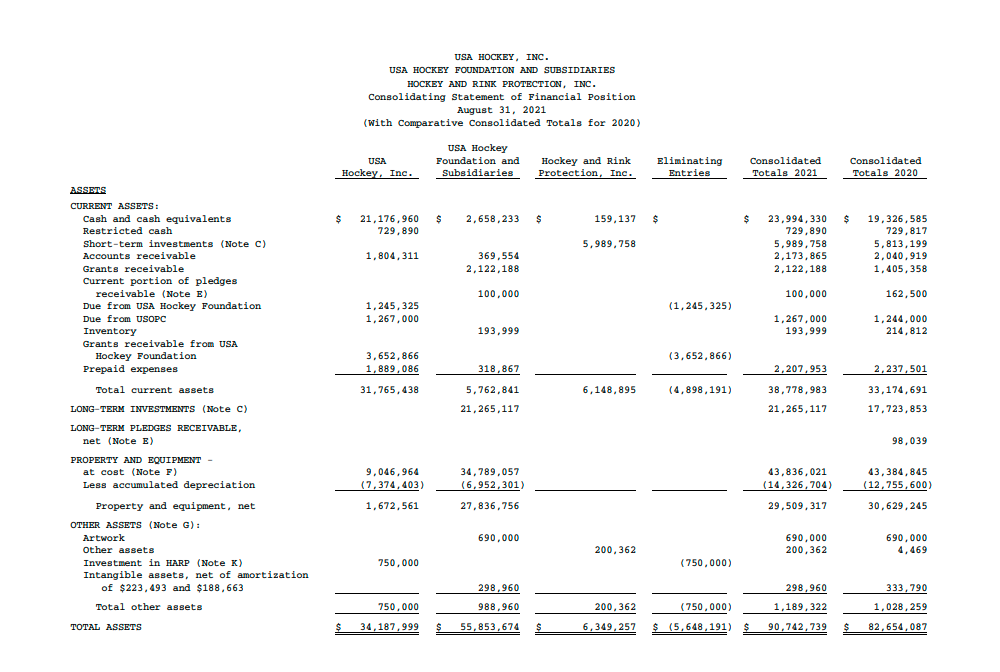

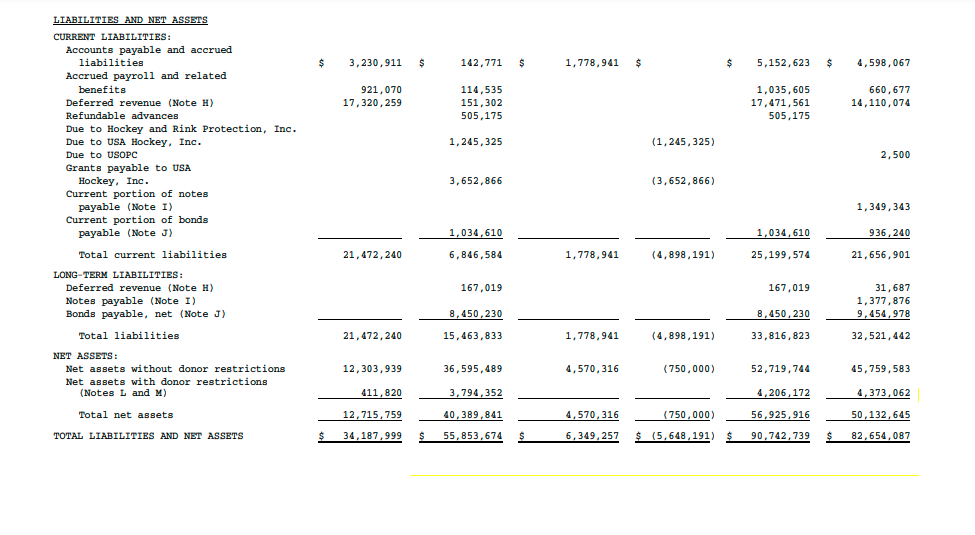

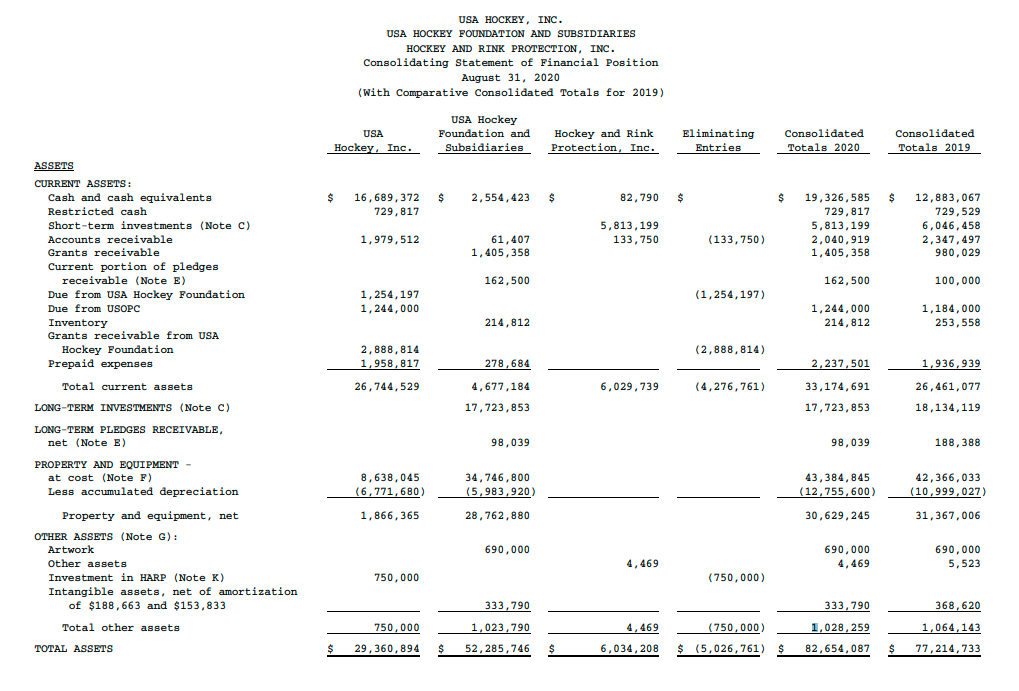

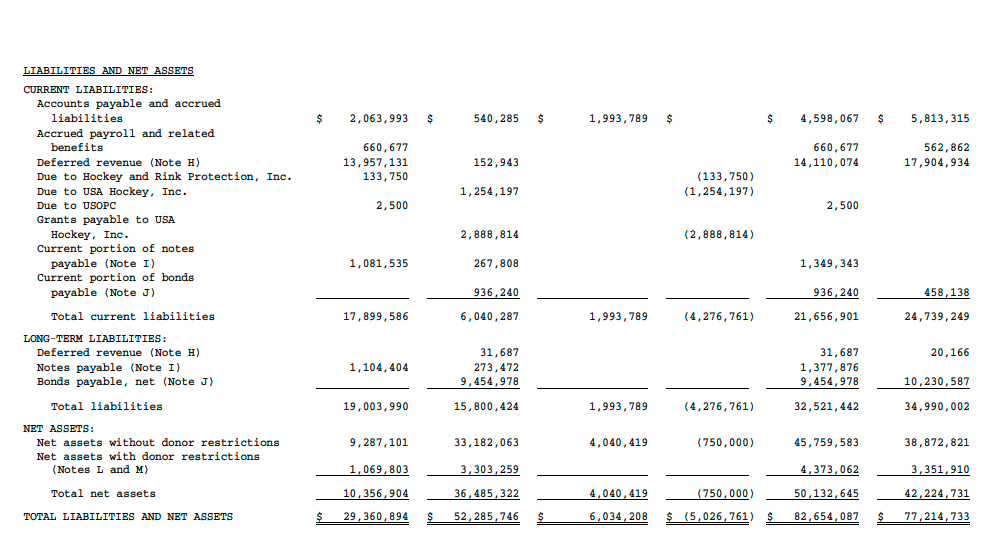

To determine more accurately the state of the organization’s finances and performance, an analysis of standardized financial indicators is carried out. The periods chosen for comparison include 2019, 2020, and 2021 as the most recent years available. All data taken into account in the calculations are taken from the company’s official website and confirmed by an independent audit before publication (USA Hockey, 2022a). USA Hockey’s ability to acquire the necessary financial resources, prioritize goals, and overall development trends and survival opportunities are assessed.

Analysis of Financial Statements

Performance Ratios

Growth, productivity, and profit are measured by various metrics, each covering a different area of responsibility and evaluated from a task-specific perspective.

USA Hockey looks at operating profit and net profit as a measure of profit, as gross profit is more designed to measure the performance of services or products (Kadim et al., 2020). Based on the specifics of the organization, it can be assumed that cost control, provided by the convenience of gross profit analysis by regulating the cost of goods sold, is not at the forefront of the company’s strategic planning.

Net Income

Net profit, on the other hand, allows us to assess the general efficiency of a company, which consists of various divisions, including non-profits. It provides an overview of profit trends and their correspondence to expenses (Danso et al., 2019). In addition to this indicator, a margin calculation is also carried out, showing the share of net profit in total revenue as a percentage. The corresponding figures for USA Hockey by year are 2019: – $ 3.50 m, 2020: $ 6.89 m, 2021: $ 6.95 m. Total losses in the first period are due to the pandemic, as the organization’s fiscal year ends on the 31st of August. Additional insurance costs and a lot of canceled activities caused these higher amounts.

Accordingly, the net profit margin is 2019: 7.11 %, 2020: 13.56 %, 2021: 13.63 %. Considering the same figure in 2018, when it was 10.31 %, so one can see a significant increase in the organization’s position and a rapid recovery in profitability after the lockdown crisis.

Return on Assets

By comparing resources with revenues, it is possible to demonstrate the efficiency of a company’s operations. Thus, Return on Assets is calculated as the ratio of net revenues to total assets. The higher the ratio, the higher the overall corporate performance – 2019: – 4.53 %, 2020: 8.34 %, 2021: 7.66 %. The data showed a decrease in FY 2021 due to growth in current assets and a sharp increase in long-term investments. In the next reporting period, it can be projected to grow to at least the 2020 level due to the pace of the organization’s development and financial health.

Operating Profit

Operating profit refers to the total profit from the company’s principal activities during the accounting period, excluding interest and taxes, which are deducted. Ancillary investments or income from shares in other enterprises are also not taken into account. In this format, the calculation is Operating profit = Revenue – Cost of sold goods – Operating expenses – Depreciation – Depreciation. USA Hockey figures then show that in 2019, it was $ 44.88 m; in 2020, it was $ 46.95 m; and in 2021, it was $ 47.44 m. Only the costs necessary to sustain the business are considered by excluding volatility factors from the calculation. The corresponding margin is determined similarly and can show the same trend for USA Hockey: 2019: 91.29 %, 2020: 92.40 %, 2021: 93.04 %.

Liquidity Ratios

Liquidity ratios are an equally important class of measures of an organization’s ability as a debtor to manage its debt obligations. A sufficient liquidity ratio takes into account a company’s ability to manage its debt without raising external capital and demonstrates its margin of safety and attractiveness to investors (Kadim et al., 2020). USA Hockey tends to strengthen its position, given the greater relevance of comparing these ratios over time.

Current Ratio

The current ratio is responsible for a company’s ability to repay specifically its current liabilities, sometimes referred to as annual liabilities. Usually, the period taken into account and accounting for such liabilities is equal to one financial year, as in USA Hockey. It is calculated by dividing existing assets by the same liabilities and is in 2019: $26.46m / $24.74m = 1.069, 2020: $33.17m / $21.66m = 1.531, 2021: $38.78m / $25.20m = 1.539.

If it is less than one, the relevant indicator represents the company’s insufficient assets to manage its current debt. Over two demonstrates the company’s inefficiency in asset management, often a lack of growth or development. Therefore, the most recent figure of 1.539 demonstrates the company’s decent financial condition and adequate asset management. Even in the most challenging year, the company could cover its liabilities, and this ratio is optimal at the current time.

Quick Ratio (Acid Test)

This ratio focuses on a company’s short-term liabilities, given its ability to use its most liquid assets for potential term repayment. This implies the exclusion of an inventory of their assets from the calculation (Omondi-Ochieng, 2019). It is calculated by dividing the liquid assets by the current liabilities and is in 2019: ($26.46m – $0.25m – $1.94m) / $24.74m = 0.981, 2020: ($33.17m – $0.21m – $2.24m) / $21.66m = 1.418, 2021: ($38.78m – $0.19m – $2.21m) / $25.20m = 1.444. Thus, only in the year of the pandemic did the acid test show that USA Hockey had an incomplete ability to pay off its short-term liabilities. In the following periods, the situation equilibrated, and the indicator showed an increase, demonstrating the organization’s financial health.

Capital Structure Ratios

Capital structure ratios demonstrate the reliability of a company’s balance sheet and are most significant to investors when considering the attractiveness of USA Hockey. They help analyze the balance between equity and debt in capital. The lower the level of debt and the higher the equity, the higher the quality of the potential investment up to a certain point. However, a too high equity ratio, as in the case of liquidity, can mean no growth of the organization, lack of money management, or ineffective financial management.

Debt Ratio

In the case of USA Hockey, two equity ratios are calculated and analyzed. The first of them allows one to measure the financial leverage of an organization, but one has to keep in mind the specificity of the industry when evaluating it. The calculation is determined by the ratio of total debt to total assets and is in 2019: $34.99m / $77.21m = 0.453, 2020: $32.52m / $82.65m = 0.393, 2021: $33.82m / $90.74m = 0.373. The figure is typical for the industry, given the reduced cash flow density in the enterprise (Kadim et al., 2020). However, it also shows a positive trend after a loss-making year of the global pandemic.

Recommendations and Conclusion

Evaluating the financial results of any organization is of prime importance not only for management planning and control purposes but also for evaluating the company’s overall finances and development indicators. The results of several comparisons of USA Hockey’s financial results have been calculated in three years. As a result, it is possible to form a view of the company’s improved financial management, profitability, and rapid recovery from a loss-making year in many sectors after the start of the COVID-19 pandemic.

Despite the overall improvement in the company’s business efficiency, several observations, recommendations, and conclusions are worth noting. Firstly, the return on assets declined significantly in 2021 compared to 2020, which showed a jump. It could be due to an increase in investment and total current assets, as earnings did not show a downward trend. Thus, to maintain the return on assets and raise it, management is advised to be more cautious with funding and avoid such significant changes in the balance sheet after a major economic crisis. The company’s ability to stay afloat will depend on this, and despite investment and charitable contributions, overall financial development may stall or reverse.

Secondly, the sharp bounce in virtually all metrics in the year following the pandemic suggests that the organization has been very successful in accumulating assets and stabilizing overall earnings. However, given the ratio, there remains space for significant growth and more efficient use of assets in generating profits (Omondi-Ochieng, 2019). Even considering the specifics of the organization, profits aimed at company growth and development strengthen the position of such a company, increasing its attractiveness.

Thirdly, this study, in its general existence, should draw more attention to the industry and improve the financial performance of its representatives. Further developments in the form of recommendations or strategic planning can contribute to the development of the sports industry itself, as the financial basis underpins every business regardless of its focus (George et al., 2019). Unfortunately, there is not enough relevant literature currently exploring the sector’s activities. The popularisation of the topic could be an impetus for further academic development on the issue.

References

Danso, A., Adomako, S., Amankwah-Amoah, J., Owusu-Agyei, S., & Konadu, R. (2019). Environmental sustainability orientation, competitive strategy, and financial performance. Business Strategy and the Environment, 28(5), 885–895. Web.

George, B., Walker, R. M., & Monster, J. (2019). Does strategic planning improve organizational performance? A meta‐analysis. Public Administration Review, 79(6), 810–819. Web.

Kadim, A., Sunardi, N., & Husain, T. (2020). The modeling firm’s value is based on financial ratios, intellectual capital, and dividend policy. Accounting, 859–870. Web.

Omondi-Ochieng, P. (2019). Financial performance trends of United States Hockey Inc: A resource-dependency approach. Journal of Economics, Finance, and Administrative Science, 24(48), 327–344. Web.

Smolianov, P., Grønkjær, A. B., Ridpath, B. D., & Dolmatova, T. (2021). USA and leadership in elite ice hockey. In Embedded Multi-Level Leadership in Elite Sport (1st Edition, pp. 184–204). Routledge.

USA Hockey. (2022a). Financials. Usahockey.com. Web.

USA Hockey. (2022b). Team USA. Usahockey.com. Web.

Appendices

Performance Ratios

Net Income

- 2019: $49.16m – $52.66m = -$3.50m,

- 2020: $50.81m – $43.92m = $6.89m,

- 2021: $50.99m – $44.04m = $6.95m.

Accordingly, the net profit margin:

- 2019: ($3.50m/$49.16m) * 100% = 7.11%,

- 2020: ($6.89m/$50.81m) * 100% = 13.56%,

- 2021: ($6.95m/$50.99m) * 100% = 13.63%.

Return on Assets

- 2019: -$3.50m / $77.21m = -4.53%,

- 2020: $6.89m / $82.65m = 8.34%,

- 2021: $6.95m / $90.74m = 7.66%.

Operating Profit

- 2019: $49.16m – $1.13m – $0.86m – $1.67m – $0.33m – $0.29m = $44.88m,

- 2020: $50.81m – $0.67m – $1.79m – $0.78m – $0.32m – $0.30m = $46.95m,

- 2021: $50.99m – $0.54m – $1.60m – $0.81m – $0.30m – $0.30m = $47.44m.

The corresponding margin is:

- 2019: ($44.88m/$49.16m) * 100% = 91.29%,

- 2020: ($46.95m/$50.81m) * 100% = 92.40%,

- 2021: ($47.44m/$50.99m) * 100% = 93.04%.

Liquidity Ratios

Current Ratio

2019: $26.46m / $24.74m = 1.069,

2020: $33.17m / $21.66m = 1.531,

2021: $38.78m / $25.20m = 1.539.

Quick Ratio (Acid Test)

2019: ($26.46m – $0.25m – $1.94m) / $24.74m = 0.981,

2020: ($33.17m – $0.21m – $2.24m) / $21.66m = 1.418,

2021: ($38.78m – $0.19m – $2.21m) / $25.20m = 1.444

Capital Structure Ratios

Debt Ratio

- 2019: $34.99m / $77.21m = 0.453,

- 2020: $32.52m / $82.65m = 0.393,

- 2021: $33.82m / $90.74m = 0.373.

Financial Statements 2019-2020

Financial Statements 2020-2021