Introduction

Financial statements are a reflection of the performance of a certain hospital. International financial reporting standards (IFRS) require hospitals to make financial statement like any other companies. The only differences are on the king of goods that it has to report. Ratios are used to analyse the financial strength of a business. Generally there are two categories of ratios; they are balance sheet ratios and income statement ratios (Cleverly & Cameron, 2007). This paper will analyse financial statements of Valley Medical centre.

General information of the hospital

Valley medical centre is a hospital located in Washington, Kingsland. The hospitals auditors are Everett, Washington. The group of auditors are responsible for making the hospitals financial statements. The hospital’s financial year end on 31st of each December. This paper will give financial ratios for the hospital. It will consider 2008 and 2009 financial statements (Valley Medical center, 2010). (the statements will be attached).

Balance sheet ratios

Current ratio; this is the ratio that determines how well a company can finance its short term financial obligations when they fall due. A healthy company will have other ratio of current ratio: current liability as 2:1.

The formulae for calculating the ratio is

Current Ratio = Total Current Assets/Total Current Liabilities

In the case of Valley centre;

Meaning of the ratio

The hospital has a good current ratio which shows that it can meet its short term financial obligations as they fall due (Finkler & Ward, 2006).

Quick ratio

This is also called acid test ratio. The ratio is a modification of current ratio which it does not consider the value of stock. It concentrates on more predictable assets (stocks decrease in value).

The formulae for calculating it is

Quick Ratio = Cash + Government Securities + Receivables / Total Current Liabilities

Meaning of the ratio

In 2008, the hospital was almost at break even in meeting its short term liabilities. However in 2009, it recovered from the slight difference and this can be more certain of meeting their financial obligation better.

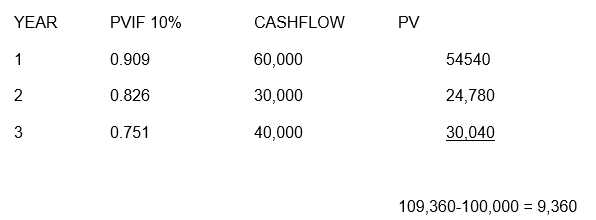

Net profit margin

This is a ratio that analysis the proportion of net profit available in a volume of sales. It interpolates the profitability of a firm. Although hospitals are taken as non profit making organisations, they make profits out of fees charged for medical purposes. To have a predictable future the ratio should never be a negative. It is calculated as follows;

Net Profit Margin Ratio = Net Profit before Tax / Net Sales

Meaning of the ratio

The above ratios although small for the case of a business; they are adequate for a hospital since its main aim is the welfare of the society. On the other hand, the ratio is adequate to keep the business running. The hospital is having an increased profit which is a show of a financially stable hospital in the predictable future if it goes with the same trend (Michael, 2006).

Return on assets ratio

The ratio shows the rate of return that is derived from utilizing the available assets (fixed assets). The higher the value the better, it’s calculated as;

Return on Assets = Net Profit before Tax / Total Assets

Meaning of the ratio

The ratio means that in 2008, the assets employed in the company lead to an income of 0.086%, the assets employed for 2008 yielded an income of 0.036%. The general observation is that the hospital is utilizing its assets better is 2009 than 2008. On the other hand, the marginal increase in assets has brought a significant change. This is a show of a business that is increasing its efficiency to have a better financial standing (McCartney, 2004).

Explain the factors that affect the results

Ratios are a reflection of a business working conditions. This makes them affected by the dame reason that affects the operation of a business. They can be divided into;

Operating factors

The operation of a business is affected by the economic condition of the country. When the economy is performing poorly then the ratios will reflect decreased profitability ratios. In the case of hospital, if the general welfare of the country has increased, then the people requiring medical attention will be reduced. This results to decreased revenue.

Investing factors

Ratios are subjected to the level of assets that business have. If a business has increased its assets, they are going to affect the balance sheet ratios. When assets have been increased in an organisation, return on assets ratio will decrease in the short term but when the assets have started earning revenue the arte will be improve (Weygand, Kimmel & Kieso, 2010).

Conclusion

Hospitals are required to make financial statements like, income statement, balance sheet and cash flow statements. Ratios are used to evaluate the financial health of the hospitals and help in making future decisions relying on the analysis. Ratios are affected by economic situation of a country (external factors) and investing factors (internal factors).

References

Cleverly, W. O., & Cameron, A. E. (2007). Essentials of health care finance (6th ed.). Sudbury, MA: Jones and Bartlett.

Finkler, S. A., & Ward, D. M. (2006). Accounting fundamentals for health care management. Sudbury, MA: Jones and Bartlett.

McCartney, J. (2004). Accounting: A Framework for Decision Making (Book). Pacific Accounting Review (Pacific Accounting Review Trust), 16(1), 77-80.

Michael P S. (2006). Advanced Accounting: Concepts & Practice. Issues in Accounting Education, 21(1), 69.

Valley Medical center. (2010). Financial statements. Web.

Weygand, J., Kimmel, P. and Kieso, A. (2010). Financial Accounting: IFRS, 1st edition. Illinois: Northern Illinois University.