Wal-Mart Stores Incorporation

Wal-Mart stores Incorporation is among the largest retail stores in the world. It commands a large chunk of the retail market in the United States and some parts of the world. The company deals in a wide range fast goods and general retail consumer goods including the groceries.

Based on the range or type of goods that this company deals with, it can be readily affected by a slight change in the consumer behavior emanating from economic trends; economic trends affect the consumer buying behavior. The world has undergone some economic trends that have had an impact on its business. As a result, Wal-Mart has readjusted and redesigned its business strategies to fit the situation to remain in the market.

Recent Economic Trends on the U.S. Market

Food forms part of the basic human needs. In the United States, there are some household items purchased together with food on regular basis and are also essential for the satisfaction of the physiological needs of human beings. They include items such as tissue papers, soap, and toothpaste among many.

These items constitute the grocery. These items will always be on demand in the market because people need them on regular basis. The grocery market can therefore be said to be a safe market because the products range delved in are on demand on regular basis. The United States and the entire world have had some economic trends that impacted the grocery market. This trends have been brought by the major financial crisis of the world that begun in 2008.

2008-2009 Economic Downturns

The global financial crisis of 2008 was a resulted of a burst of the U.S. housing bubble. Since 2005, the banks were giving out mortgage loans to potential home owners leading to the increase in the housing prices. As the result, many people sought for loans from the bank whereas the banks continued dishing out loans to the customers.

The lending rate of the banks reached large scales to the point that some banks lacked the funds to lend out and had to be bailed out in the process. Even the largest insurance company in the United States called AIG was on the brink of collapse because it had bailed out many banks (Hank, 2010).

Commodities Boom

During the financial crisis period, the market was presumed to be floated with too much money obtained from loans. Also, because the market had dwelt more on housing, it was expected that money would flow from the housing projects to the commodity market. As a result, the prices of commodity started to rise. Some commodities such as, oil tripled in prices. As a result, the living cost rose up and the buying power of the consumer was affected (Hank, 2010).

Joblessness and Unemployment Rate

The financial crises of 2008 resulted into loss of jobs. When banks collapsed, employees started to lose jobs drastically and affected up to 25% of the United States labor force. By 2009, the rate of unemployment in the United States had risen to 8.5% (Hank, 2010).

How the Economic Trends on the US Market Affected Wal-Mart

From the start of 2008, the economic recession invaded the US market. This greatly affected the consumer buying behavior, which in turn affected the grocery market of the United States. First the increased prices of oil and other raw materials led to increased production cost of majority of the consumer products, leading to increased prices. At the same time, scores of people had lost their jobs, especially from the banking sector.

This meant that few people could afford to buy the needed groceries from leading stores like Wal-Mart. According to the survey done by the Food Processing Organization (2010), consumers with an annual income of bellow $75,000 became worried with the economic crisis and had to change their spending behaviors. As a result, 90% of the consumers earning bellow $75,000 per annual cut their spending behaviors on the groceries (Toops, 2011).

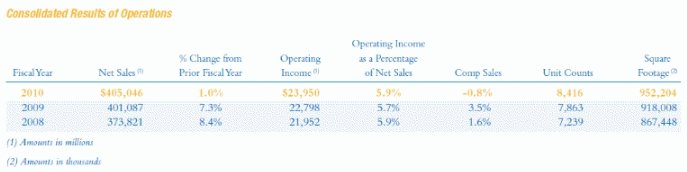

The economic crises further led to a reduction in the sales as a result of low turnover of stock. On top of that, increased prices of fuel led to the increased cost of acquisition for the same leading to the increased expenditure on fuel. The wage expenditure also increased the rate of turnover had decreased as a result of the decrease in the buying power of the consumers. The financial performance of Wal-Mart was grossly affected as shown bellow (Wal-Mart Stores, 2010).

From the table above, it can be seen that net sales from 2008 to 2010 increased gradually. However, the increase does not justify the growth because the percentage net change from each previous year dropped significantly.

The figures indicate that from 2007 to 2008, the percentage change was 8.4%. In 2009, the percentage change from 2008 was 7.3% whereas the percentage change in 2010 from 2009 was 1.0%. It can be noted that the financial crisis was at its worst in 2009 and 2010 and as a consequence the percentage change was the least.

Strategies That Wal-Mart Used To Adapt To the Changing Market Conditions Resulting From Global Economic Downtown

Following the economic downtown, Wal-Mart staged some strategies in 2009 to rectify the situation at hand. Three main strategies were formulated and implemented. The strategies taken by the company are discussed bellow.

Save Money, Live Better

This was the first strategy formulated by Wal-Mart. The strategy aimed at making Wal-Mart store a leader in low pricing. The company as a consequence embarked on a low price strategy campaign. A slogan ‘every day low pricing’ was adopted. In order to guard against suspicion of low quality, the company further ensured that the everyday low pricing strategy goes with greater value. The low pricing strategy targeted the consumable groceries.

The strategy further aimed at increasing the private label of the company’s products to save the customer’s money. Through private branding, some suppliers and lines of products not in need by the customers would be reduced. However, the company planned to increase the branding strategy by linking with the suppliers or producers of the products on shelf. This would see the company increase its integrated branding communication (Murray, 2012).

Win Play Show

The win play strategy was introduced to ensure that there was product optimization in all its stores. In this strategy, suppliers were influenced to reduce prices and the number of products. The general number of suppliers was reduced also. The move was also to enhance the private label products with subsequent increase in revenue. The general aim was to optimize products by placing them into three groups; win, play, or show.

For the win category, the company was to consider the top priority products. Top priority products in this case were the products on demand by the customer during economic downtown. The general aim was to have an assortment of the product that would win the market and therefore increase the market share.

For play categories, it was upon the suppliers to aggressively market the product if they wanted them on the shelves of Wal-Mart. Manufacturers and suppliers of these products were supposed to convince the customer in possible ways like aggressive advertising campaigns for them to buy (Murray, 2012). This implies that they required more advertising, a cost Wal-Mart was not willing to meet.

The last category was the show category of products. This was category of the products not on high demand but was necessary during economic downturn; their turnover was extremely low. Wal-Mart was in consequence forced to stock them in limited number that would show the customer that they are there.

Fast, Friendly and Clean

The purpose of this strategy was to improve the in-store experience of the customer on top of ensuring increased efficiency in and out of the store. This was to be accomplished through several ways. The first one was efficient merchandise flow.

Through this strategy, efficient practices such as cross docking and merchandise replenishment circle of less than two days were adopted. Through cross-docking, operation cost was reduced, throughput increased, inventory levels reduced, unnecessary handling eliminated, and unnecessary storage reduced.

The second way of implementing the fast, friendly, and clean strategy was through installation of the zero waste facilities. Zero waste programs were implemented through the company’s green policies. The policy outlined efficiency in the company’s products from the raw material phase to the final consumption phase.

Also, Wal-Mart Fast, Friendly, and Clean strategy was to be implemented through transformation of the supply chain. The strategy has been achieved through improvement in the cost of the supply chain. The fuel efficiency has been increased by 21% by maximizing on the transportation space whereby the numbers of pallets per track have been increased by 5.5%. Consequently, the empty truck per mile has been reduced by 6.5% whereas the cases shipped reduced by 7.8% in mileage (Murray, 2012).

The Market Side Store Strategy

In 2010, Wal-Mart rolled out another strategy that would see the sales increase as the company reaches out to expanded market. The company planned to build small stores rather than its ordinary gigantic buildings to penetrate the heart of congested cities such as New York. The building of 20,000 square feet was ideal for stocking the win category of the products and would save on the space because penetrating the city is not easy as a result of congestion.

Tactics Wal-Mart Has Implemented To Achieve Its Strategic Goals

Wal-Mart strategy has been achieved through several ways as discussed bellow.

Linking With Manufacturers

The company links with the manufacturers of its supplied products to ensure efficiency and reduction on cost. Although that kind of communication is rarely applied in business, Wal-Mart has been able to gain the influence. It teaches the manufacturers on how to improve efficiency and cut on its labor cost so as to supply low priced commodities (Wal-Mart Stores, 2010).

A Strong Strategic Committee

The company has put in place a strategic committee that looks into the strategies of the company and supervises their implementation process. The committee has been empowered to utilize the resources of the company to gain efficiency in the overall process.

Low Wages

To accomplish its low price strategy, Wal-Mart is paying relatively low wages to its workers. To guard against industrial action over the same, the workers union has been given limited powers.

Location

To reach an array of customers, Wal-Mart has expanded its coverage area. Currently Wal-Mart stores are within 15-mile distance. Given its low price strategy, consumers opt for the 15-mile drive to shop in these stores.

Funds

The company has floated its shares on the stock market and thus it is easy to raise capital for its activities.

The Role Human Resources Management Plays in Helping the Company Achieve Its Business Goals

Wal-Mart stores are among the biggest retail stores in the world. According to the information on its site (2012), the company had 8970 stores locations with 2.2 million employees in 2012. Wal-Mart stores have a strong management team that helps the management realize the vision of the company. Through the human resources management department, planning, organization, staffing, and control of workforce of the company is done.

One of the roles of the Human resource management (HRM) at Wal-Mart is job analysis. Since 2010, the company embarked on expansion program of small stores in the heart of the city. The vacancies arising from the same positions were filled through job analysis and subsequent recruitment of the reliable candidates.

Job analysis entails development of ideas on the type of training, selection, compensation, and performance appraisal for the given job category. In connection with this information on job analysis, the HRM at Wal-Mart have actively in the collection of vital information on the same so as to provide important tools and equipments for every particular job.

The HRM has also actively involved in the recruitment and training of workforce at Wal-Mart to fit in the new strategy. According to the information on its site, the HRM was receiving more than five times the number of applicants for a particular position advertised. The HRM therefore scrutinized the application and recruited the right kind of candidates to fit in the strategic mission of the company.

The HRM further organized periodic training to employees to fit into the company’s strategy. Workers were trained on the energy efficiency scheme and the general cost cutting scheme of the company (Wal-Mart Stores, 2010).

Overall Business Analysis for Investment Opportunities by Mutual Fund Manager

Wal-Mart seems basically the company of choice for investment. However, several considerations must be analyzed before making such judgment. In the first place, Wal-Mart is one of the fortune 500 companies. Since its inception, it has taken the retail industry by a storm with no sign of ceasing. Wal-Mart has been the number one company on the fortune 500 list for two years in a row but currently dropped to number two in 2012. The SWOT analysis of the company is shown bellow.

Strength of Wal-Mart

Wal-Mart is the biggest retail with low prices compared to its competition like Target and K-Mart. Convenience is the biggest strength; everything is under one roof. Instead of going to three different locations one can find everything under one roof. The large scale of operation gives this company a say so as to what manufacturers sell and how much they sell it for.

Essentially this is not good news for the manufacturer, but is good news for the customer. Wal-Mart realized a 27% increase in profit for the fiscal year of 2011 and according to Woods (2011), the key to its success was international operations. Wal-Mart is leading in international sales. This is a major strength.

Weakness

There have been many lawsuits in place to get rid of Wal-Mart. Complaints that Wal-Mart does not treat its employees fairly and spend less money on their employees’ well-being have been its undoing. The international sales seem to be okay to customers because they are unaware of the low labor costs that Wal-Mart is trying to cover up.

Another weakness would be the performance in the U.S.; Wal-Mart gets nearly three-quarters of its operating profits from the US. This should be avoided because any change in the economy of the US can impact negatively on the profit of the company.

Opportunities

With the downfall of the economy all companies must keep prices low at a level that can be maintained. The fact that Wal-Mart has been able to navigate through the economic downturn period means that it can navigate through hard economic period without losses.

Potential Threats

Potential threats includes: competitors using similar low price strategy, decline in customer satisfaction that could create a decline in sales, and the act of dishing out money for lawsuits could put the company in debt. Also, extending to the heart of the city where land is expensive could affect the profits the company when the plans rolls out.

Stakeholders’ Analysis

The stakeholders in Wal-Mart include the customers, employees, shareholders, the communities, the suppliers, the gas companies, politicians, and investors. All stakeholders hold an important position but each stakeholder receives different types of compensation. The customers want honest ethical products, fairness, customer satisfaction, value, and quality products and service, which the company is providing.

Employees need job security, fair compensation for their time, respect, and ethical fairness from management, which the company has failed in some instances. The community is a stakeholder who plays a major role in the wellbeing of the company. A new company like Wal-Mart could mean more jobs, but it could also mean big trouble for small businesses that are already in the community.

Financial Analysis

Based on the financial statement of 2011, cash flow statement shows that Wal-Mart ends with more money than the beginning.. The cash on hand increased at the end of the period. The amount at the beginning of the period was 6,550,000 by the end of the period it was 8,117,000.

Improved merchandising capabilities have helped increase handling costs. Twenty four percent of the company’s revenue is derived from its international sales. Investing in international sales has created more opportunities for not only shareholders of Wal-Mart but for the employees and people who use Wal-Mart stores daily. A potential problem could be the constant outreach for more international accommodations. Trying to appeal to the international sector Wal-Mart may be out of contact with its initial customer base.

Conclusion

Being a fund manager, it is will not be possible to invest in Wal-Mart because the Cons outweigh the pros. Wal-Mart is not all about the customer but after money; this is why they are always involved in lawsuits. It seems as if they feel they can pay their way out of serious trouble because it is beneficial to the person who is suing at that moment.

Wal-Mart has great leaders behind them and they have the potential to grow even larger but, it is ultimately up to the customers to make that decision because they would not be as successful as they are without the customers. That they have succeeded in low price strategy means that someone else with good employee treatment can succeed and throw Wal-Mart out of the market. Therefore, investing in this company will not be a wise decision.

References

Hank, P. (2010). On the Brink. London: Headline.

Murray, M. (2012). Wal-Mart’s Strategic Initiatives. Web.

Toops, D. (2011). Grocery Buying in the Current Economy. Web.

Wal-Mart Stores. (2010). 2010 annual report. Web.

Woods, J. (2011). Investor place. Web.