Wal-Mart has been revamping its stores. This has been through increase in the comfort with which consumers can reach goods (Kumar, 2012, par. 1-3). This capital project has been implemented in order to attract more customers in addition to improving sales. Additionally, the firm has been increasing the space of its stores. For instance, it has been expanding its drugstore capacity. This is likely to improve the sales and revenue of Wal-Mart in the near future. However, this project is likely to face various challenges:

Risks involved: The expansion of its stores might not meet the expected sales. This is considering the fact that Wal-Mart has been facing a lot of competition from its competitors such as Target. Additionally, there are high costs involved. For instance, this initiative will involve adding upper shelves and thinning of the wide corridors (Kumar, 2012, par. 7). Considering that there are very many stores worldwide, it is uncertain if these costs will be recovered in the near future. There are also risks of high interest, tax and inflation rates, decline in the housing sector and high debt levels faced by consumers. The purchasing capacity of consumers has been reducing as a result of these factors. Additionally, there will be a problem of getting dependable suppliers of raw materials used in production. With introduction of new products, it is very important to have reliable and efficient suppliers that can deliver timely raw materials.

Costs incurred: There are high costs involved in this project. For example, production, transport, advertising, marketing and labour costs. Additionally, there are costs associated with inflation, interest and tax rates. As a result, there might be reduction in profits within the first months of implementation of the expansion strategy. However, given the strength of the company, it will recover quickly.

Politics (getting it through committees): It might be a big challenge for Wal-Mart to completely implement the new expansion strategy. This is because the company faces opposition from the New US Government. For instance, Wal-Mart has been resisting attempts by its labour force to form unions. With Obama in power, it can prove be more difficult because he advocates for Employee Free Choice Act. The act allows employees to freely form unions. However, a union would make the employees to demand for their rights and healthier living standards (Ajmani, 2010, p. 15). This poses as a big threat to the existing and upcoming businesses.

Public Relations: Wal-Mart is facing opposition from the communities in the countries where it is opening new stores. For instance, in India, there have been protests from shopkeepers. They have been assembling outside Chandi Chowk to oppose Wal-Mart’s access in to the Indian retail market (Ajmani, 2010, p. 15).

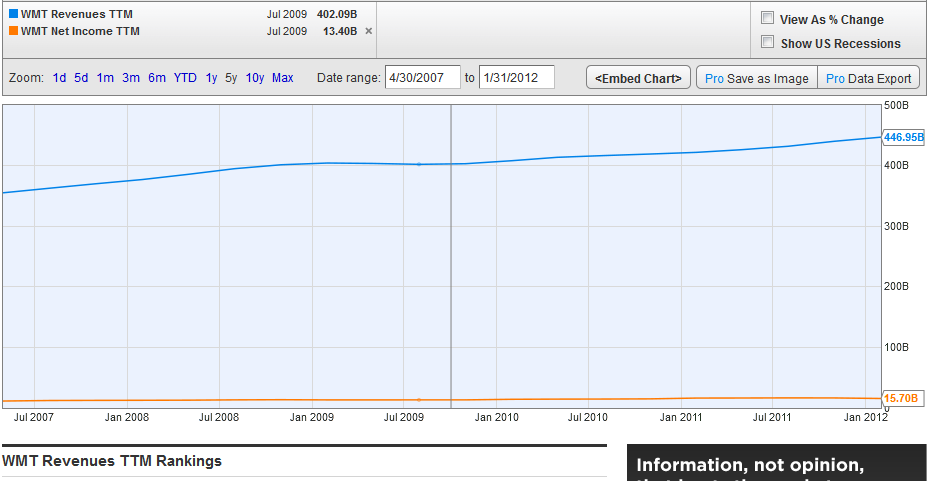

Initial Investments: If the initial investment between April 2007 and April 2012 is approximated to cost $50 per product then the total cost of investing 1 million products would be $50 million. The expected income from this project may be as follows: Based on Wal-Mart’s Efficient Use of Assets graph (Figure 1), it is evident that in January 2012, for every dollar invested as asset, there was a return of $2.356 (Wal-Mart Stores Price, 2012). Therefore, if there were 1 million products on sale, the total return on their sales would be (1m* 2.256) = $2,256,000m.

Annual incremental after-tax cash flow: In January 2012, Walmart’s net income was 15.70 billion. This has been an increase from a net income of 16.39 billion in January 2011. As a result, the net cash inflow increased by (15.70b-16.39b) = 0.69b. This is an equivalent of a 4.21% increase. This could have been as a result of the new re-strategizing that saw introduction of more products into the shelves.

References

Ajmani, A. (2010). Investment Management: Report on Walmart. Web.

Kumar, K. (2012). Walmart adding 8,500 products to try to lure customers back. Web.

Wal-Mart Stores Price. (2012). Web.