Best Strategy

The case presents two windows of opportunity for the company: the kid-friendly path or the up-scale path. Arguably, the company would profit more from the first variant due to a number of reasons. Firstly, the radical change proposed in the second option requires too much investment. As the market research in the appendix suggests, there are already a number of upscale lounge bowling clubs, and this niche is occupied at the moment (Hamermesh & Zalosh, 2012). On the other hand, there seems to be no record of the bowling facilities that target young audiences which might become advantageous, at least for the short term. Secondly, the kid-friendly path correlates with the customer study that indicated families with kids as their primary audience.

In addition to the abovementioned points, it should be noted that the company’s board is likely to have a limited budget to spare. As it was indicated in the case, a large part of the last investment was taken from the personal savings of the board members and mostly out of sentiment. This behavior demonstrates that the approval of a costly venture is unlikely due to their own shortage of money. In addition, the turning of the bowling facility into an upscale one will make it compete with others like it while losing its primary audience.

The kid-friendly variant could provide a retreat for families with kids that will be in demand due to the fact the mean age of the people in the town is above 30. In addition, a relatively small change could be less financially damaging in case of its failure while large-scale investments may bring the company to the verge of bankruptcy. Finally, the first variant does not require any major changes to the style which can appeal to the vintage look seekers among the audience.

VRIO Analysis

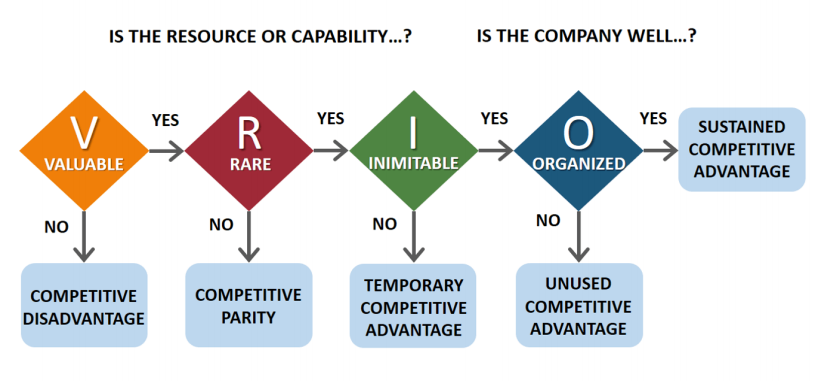

VRIO analysis can be considered the best instrument to apply in this particular case for a number of reasons. Firstly, it is versatile and can be used for diagnosing, decision-making, and delivery. In order to define what the company is best at, there is a need for an analysis of its ability to fully utilize the advantages of the change. This model provides such an opportunity through applying the fourth step. The question of the company’s preparedness to embrace one or the other decision is the critical moment in the evaluation of the viability of the whole venture. SWOT analysis could have been more useful in this endeavor, but it lacks the decision-making component which VRIO conveniently presents.

Essentially, Givens’ proposition is an introduction of a new service to the market which needs to be evaluated from the standpoint of its viability to the company. It also requires an analysis of whether it can be profitable enough to carry the firm forward and return the investment with profit. VRIO model provides an answer to both questions. It can make clear references to profitability and long-term viability by guiding the decision-maker through the first three steps. Determining the value, rarity, and imitability could help the company decide if their new set of services and products could provide an adequate return and became a new distinctive feature for the brand.

Conclusion

In addition to that, the model lets the decision-makers assess their options and compare them to the actual market situation which is rather important relative to this case. It was mentioned that there are two more bowling alleys in the vicinity, and it is vital to conduct an assessment of the options with fierce competition in mind. Despite the fact that the VRIO model unlikely could indicate a hundred-percent-viable option, it can bring the board members and Givens’ as close to objective choice as possible.

The reason for that is the nature of the posed questions, answering which a person could deduce the actual quality of a decision. In this case, one of the most persistent problems VRIO can help with is determining whether an organization as a whole could make it work. It is the basis of Givens’ concerns, and the model could likely clarify that question. Therefore, VRIO can become a solid tool choice for the Westlake Lanes case.

Reference

Hamermesh, R. G., & Zalosh, A. (2012). Westlake lanes: How can this business be saved? Web.