Introduction

It is essential to recognize that significant shifts in the national economy are best understood by examining both domestic and external forces at play. Inflation is of prime interest since it is a key economic metric influenced by various factors. It reflects the overall rise in the economy’s cost of services and goods (Blink & Dorton, 2020). T

he following analysis will primarily focus on the key reasons why the United Kingdom faces a substantial reduction in its gross domestic product (GDP). GDP measures the total services and goods produced and purchased within a nation in a specific period (Mankiw, 2020). The answer will discuss the War in Ukraine, followed by an energy price increase globally, with a final section focused on connecting the dots. The most likely causes of high inflation and reduced GDP in the UK during the last 12 months include increased energy prices and the War in Ukraine.

Analysis of Economic Issues and Their Causes

The War in Ukraine

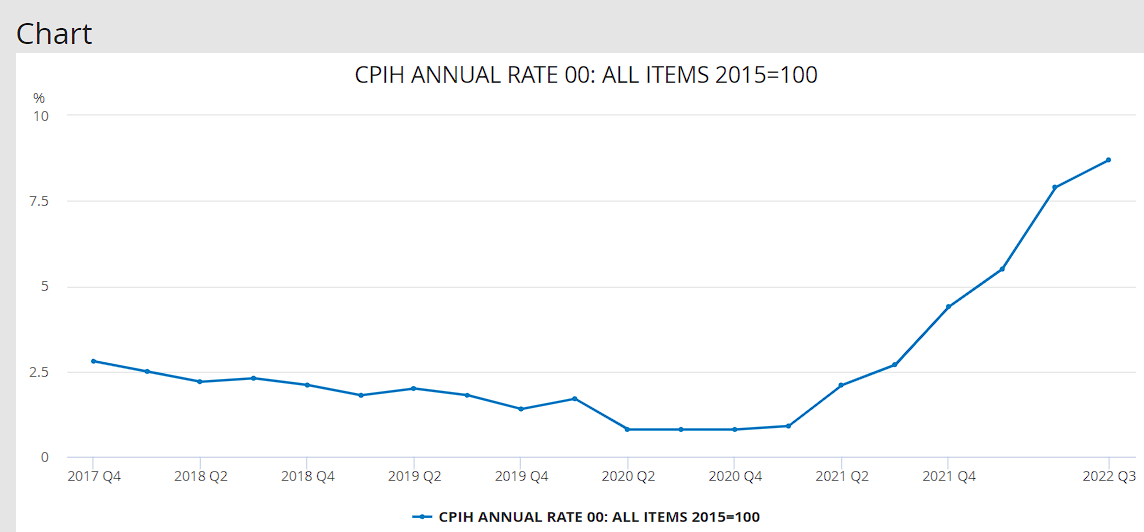

The primary causal factors of inflation over the last year are the War in Ukraine, the rise in energy prices, and sanctions against Russia. The current inflation rate in the previous 12 months is 9.3% (Office for National Statistics, 2022a). The most hit areas are housing, household energy expenditures, and food (Office for National Statistics, 2022b).

It is reported that “Britain’s inflation rate rose to the highest level in 40 years last month as Russia’s war in Ukraine fuelled further increases in food and fuel prices” (The Associated Press, 2022, para. 1). The highest spike in inflation can be observed between the fourth quarter of 2021 and the third quarter of 2022 in Figure 1 below. Other reports suggest that “inflation in food prices this month has climbed past the 9.3% reported in August, fuelled by the war in Ukraine” (Sweney, 2022, para. 3). Therefore, the role of the War in Ukraine cannot be overlooked when discussing the current inflation crisis in the UK.

The analysis of the previous paragraph reveals that the most critical and essential commodities affected by inflation are food and fuel prices. UK citizens find buying food products and fuel for their homes more expensive, which has become especially problematic since winter arrived (Romei, 2022). The geopolitical tensions on the world stage are manifested in sanctions, war, and the disruption of the global economy, resulting in a rise in energy prices.

Russia and Ukraine are major food producers and exporters, including grains and fertilizers, which means they are either unable or unwilling to sell their commodities to the UK and other countries (Polityuk, 2022). This leads to a shortage of food products, and the demand for such essential goods is inelastic, resulting in ever-increasing costs (Banerjee & Duflo, 2019). Russia is also a significant oil and gas exporter, and the sanctions and trade barriers between the UK and the Russian Federation create a fuel deficit (Horton & Palumbo, 2022). Thus, it is evident that the War in Ukraine is a fight between two key players in the food supply chain, and Russia is a major fuel exporter.

Increase in Energy Prices

From a macroeconomic perspective, the UK does not need to rely heavily on Russian oil and gas to experience fuel price increases, as the global shortage will lead to higher prices. Other fuel exporters, such as the Organization of the Petroleum Exporting Countries (OPEC), will cut their supply to capitalise and profit from higher prices (Cai et al., 2022). It is reported that “soaring energy bills were the biggest inflation driver, reflecting last month’s increase in regulated energy tariffs” (Al Jazeera Media Network, 2022, para. 8). Therefore, one can see how inflation is a direct by-product of the War in Ukraine and the global fuel price increase.

Inflation Increase and GDP Reduction: Comprehensive Analysis

Based on the evidence provided, it is critical to emphasise that the root causes of inflation are the war and the energy crisis. The global shortage of food and fuel also affects the UK, where UK citizens are finding it increasingly expensive to purchase food and fuel for their households. In other words, inflation results from a shortage in the supply of goods and services, especially food products and fuel.

The GDP requires an increase in consumption and production of goods and services (World Bank Group, 2021). On the consumption front, UK citizens have no extra income to spend besides energy and food, which is why they are not stimulating the economy to induce domestic growth. On the production front, businesses and industries require reasonably priced fuel to produce, manufacture, and create goods and services, thereby positively impacting the GDP value. Thus, inflation is characterized by a shortage of essential goods and services. In contrast, GDP reduction is marked by lowered consumption and production due to the lower purchasing power of UK consumers.

Conclusion

In conclusion, the most probable causal factors of high inflation and the reduction in GDP in the UK over the last twelve months are the war in Ukraine and higher energy prices. The geopolitical tensions in the global arena are manifested in disruptions, wars, and global economic instability, which have driven up energy and food prices. Russia and Ukraine are leading producers and suppliers of food, and Russia is a major international exporter of oil and gas. Industries and businesses need adequately priced fuel to produce goods and services, thereby contributing to GDP growth.

In addition, the income of UK residents is primarily absorbed by energy and food costs, leaving little for discretionary spending and thereby hindering economic stimulation and domestic growth. Therefore, the reduction in GDP stems from decreased consumption and production, driven by the declining buying power of UK consumers. In contrast, inflation is driven by scarcity in key goods and services.

Reference List

Al Jazeera Media Network. (2022) ‘UK inflation hits 9%, highest since 1982, amid Russia-Ukraine war’, Al Jazeera, Web.

Banerjee, A. V., and Duflo, E. (2019) Good economics for hard times. New York: Public Affairs.

Blink, J., and Dorton, I. (2020) NEW economics course book 2020 edition. Oxford: Oxford University Press.

Cai, Y. et al. (2022) ‘Macroeconomic outcomes of OPEC and non-OPEC oil supply shocks in the euro area’, Energy Economics, 109, p. 105975. Web.

Horton, J., and Palumbo, D. (2022) ‘Russia sanctions: How can the world cope without its oil and gas?’, BBC News, Web.

Mankiw, G. N. (2020) Principles of economics. Boston: Cengage Learning.

Office for National Statistics. (2022a) Main figures. Web.

Office for National Statistics. (2022b) Consumer price inflation, UK: November 2022. Web.

Polityuk, P. (2022) ‘Ukraine’s key food exports have fallen by almost half since Russian war’, Reuters, Web.

Romei, V. (2022) ‘UK consumers face ‘bleak’ winter as food inflation hits new high’, Financial Times, Web.

Sweney, M. (2022) ‘UK inflation hits 40-year high amid Russia’s war in Ukraine’, The Guardian, Web.

The Associated Press. (2022) ‘UK inflation hits 40-year high amid Russia’s war in Ukraine’, AP News, Web.

World Bank Group. (2021) Global economic prospects. Washington, D.C.: World Bank Publications.